Get the free 14 to 31 January 2025 OPENING STATEMENT on behalf of THE

Get, Create, Make and Sign 14 to 31 january

How to edit 14 to 31 january online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 14 to 31 january

How to fill out 14 to 31 january

Who needs 14 to 31 january?

Comprehensive Guide to the 14 to 31 January Form

Overview of the 14 to 31 January Form

The 14 to 31 January Form serves a crucial function in the financial reporting landscape, especially for individuals and businesses in the United Kingdom. This form is primarily designed to reconcile financial activities from the previous year and submit necessary tax information to HM Revenue and Customs (HMRC). With specific deadlines set, understanding the importance and nuances of this form is essential for compliance and optimal financial management.

Individuals who are self-employed or have recently switched jobs, along with freelancers and contractors, are typically required to fill out this form. Accurate completion can significantly impact tax return assessments and overall tax liability. The deadlines for submission range from 14 January to 31 January each year, and it is essential to meet these timelines to avoid penalties.

Key components of the form

The 14 to 31 January Form consists of several key components that ensure all relevant data is captured. Understanding these sections allows for easier and more accurate completion of the form.

Each section has specific instructions to follow. When detailing personal information, ensure that the data matches official records to avoid discrepancies.

Equally important is the financial reporting section, where common mistakes include underreporting income or failing to adequately document allowable expenses. Double-check your numbers and uphold complete transparency.

Interactive tools for form completion

To streamline the completion of your 14 to 31 January Form, utilizing interactive tools can significantly enhance your experience. Step-by-step completion tools are available, guiding you through each section methodically.

Managing your form: Tips and tricks

Managing the 14 to 31 January Form efficiently can prevent unnecessary stress during the tax season. One major advantage is the ability to save your progress. You don’t need to complete the form in one sitting; save your progress and continue at your convenience.

Collaboration tools for teams

When multiple parties are involved in the completion of the 14 to 31 January Form, collaboration tools become invaluable. The ability to invite collaborators enhances teamwork, ensuring everyone is aligned and informed.

Troubleshooting common issues

Encountering issues while completing the 14 to 31 January Form is not uncommon. It's crucial to have solutions readily available to navigate these challenges effectively.

The importance of security in document management

Security in document management, especially concerning sensitive financial information is paramount. Users can rely on pdfFiller’s robust security features to keep their personal information safe.

Finalizing and submitting your form

Before submitting the 14 to 31 January Form, a thorough review is critical. Taking the time to confirm all information is accurate helps to avert any potential issues down the line.

Post-submission management

Once the form is submitted, staying organized is vital. Tracking any submissions and responses provides a clear view of deadlines and follow-up tasks.

Additional insights on document management

The completion of the 14 to 31 January Form should be viewed as a learning opportunity. Analyzing your previous submissions can provide insights for improvements in future reporting.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit 14 to 31 january on a smartphone?

Can I edit 14 to 31 january on an iOS device?

How can I fill out 14 to 31 january on an iOS device?

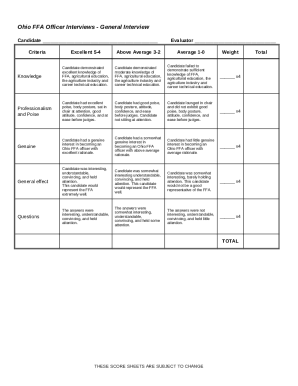

What is 14 to 31 january?

Who is required to file 14 to 31 january?

How to fill out 14 to 31 january?

What is the purpose of 14 to 31 january?

What information must be reported on 14 to 31 january?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.