Direct Deposit Authorization Template Form: A Comprehensive Guide

Understanding direct deposit authorization

Direct deposit authorization is a financial agreement that allows for the automatic transfer of funds from an employer or an institution directly into an employee's bank account. This method has gained significant popularity due to its convenience and reliability, making it a cornerstone of payroll processes across industries. By securing authorization, employees ensure that their earnings, benefits, and reimbursements are deposited quickly without the hassle of paper checks.

The main components of a direct deposit authorization form include crucial information such as the account holder’s name, the account number, and the bank's routing number. Additionally, the form often requires the employer’s details, including their name and contact information, to facilitate seamless communication and processing between the two parties.

The name registered with the bank account.

The unique number assigned to the bank account.

The number used to identify the financial institution.

Information about the employer initiating the direct deposit.

When to use a direct deposit authorization form

Direct deposit authorization forms are required in various situations. For example, when starting a new job, employees typically need to submit this form to ensure their initial paycheck is deposited directly into their account. Additionally, employees may need to complete the form when changing bank accounts or setting up automatic deposits for benefits such as social security or tax refunds. These scenarios highlight the flexible nature of direct deposit, accommodating changes in an individual’s financial situation.

Understanding the legal considerations involved in direct deposit is essential. Employees should be aware of their rights concerning the information they provide. It is imperative to read the terms associated with direct deposit authorization to ensure they have clarity on the implications of the authorization, including the ease of withdrawing consent if needed.

Required for initial payroll setup.

Necessary when updating deposit details.

Essential for automatic government or insurance payments.

How to fill out a direct deposit authorization form

Filling out a direct deposit authorization form may seem straightforward, but attention to detail is critical. Start by gathering necessary information, such as recent bank statements and personal identification, which will make the process smoother. Ensuring you have these documents at hand streamlines the completion of the form.

Next, complete the employer and employee sections accurately. Your details should match the information in the bank records to prevent any discrepancies. Input your bank details meticulously, especially your routing and account numbers, as errors here can lead to payment delays. Once you've filled out all sections, review the form thoroughly. Check for completeness and accuracy based on a checklist, ensuring you've not omitted important information.

Collect documents like bank statements and ID.

Ensure accuracy in provided personal details.

Double-check routing and account numbers.

Use a checklist to confirm nothing is missing.

Common mistakes to avoid include misplacing banking details or omitting signatures and dates. These small errors can cause significant delays in processing, leading to frustration for both employees and employers.

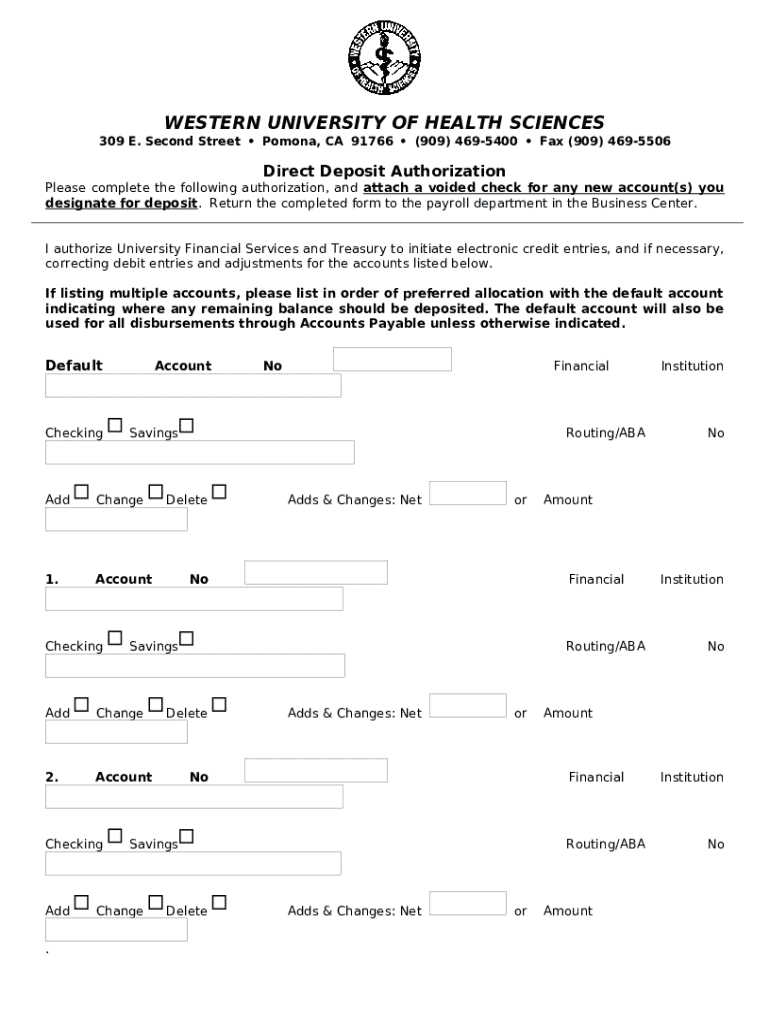

Sample direct deposit authorization templates

Having access to direct deposit authorization templates can facilitate the process. pdfFiller offers various downloadable template formats, including PDF and Word, that can be used for direct deposit authorization purposes. These templates are designed not only for ease of use but also to meet compliance standards.

To customize these templates to fit your personal needs, utilize user-friendly editing tools available through pdfFiller. This allows you to adjust fields, add personal notes, and format the document as required. You can use pdfFiller’s robust editing capabilities to ensure the template fits seamlessly into your workflow.

Downloadable format for quick setup.

Easily editable for personalized use.

Benefits of using direct deposit

Direct deposit creates a streamlined experience for both employees and employers. For employees, one of the primary advantages is the secure and timely receipt of funds. With direct deposit, there is no need to worry about lost or stolen checks, as payments are deposited directly into their accounts. This method also eliminates the delays associated with mail delivery, ensuring that employees have access to their funds as soon as they are available.

For employers, direct deposit is not only cost-effective but also enhances operational efficiency. By reducing the need for physical checks, companies can minimize administrative overhead, saving both time and resources. Furthermore, fewer check-processing errors and reduced fraud risk contribute to a positive return on investment for implementing direct deposit policies.

Funds are deposited directly, reducing theft risks.

Immediate availability of funds to employees.

Lower administrative costs for employers.

Minimized risks associated with processing checks.

Managing your direct deposit authorization

Submitting your completed direct deposit authorization form is just as important as filling it out correctly. Best practices for submission include sending the form directly to your HR department via email, delivering it in person, or utilizing a secure online portal if your employer offers one. Ensure you follow your company's preferred method to avoid delays.

If you ever need to change your banking information or cancel a direct deposit, it's crucial to communicate these changes promptly. Always notify your employer in writing, as this can protect you from any unwanted interruptions in the receipt of your payments. Keep copies of all correspondence regarding changes for your records.

Follow the preferred submission method of your employer.

Inform your employer of updates in a timely manner.

Retain copies of all communications for reference.

Tips for troubleshooting common issues

If you find that your payments are delayed, the best initial step is to check with your employer. Understanding their payroll schedule can clarify any issues. If the employer confirms that payments have been released, the next step is to reach out to your bank to investigate. Both sides can usually resolve most problems efficiently.

Common authorization problems may include missing documentation or discrepancies in account information. Keeping records organized and regularly verifying your direct deposit details can prevent many of these issues. If problems arise, addressing them as soon as possible with your employer and bank will lead to quicker resolutions.

Inquire about payment schedules and records.

Investigate further when necessary.

Ensure all documents are accessible for reference.

Additional features of using pdfFiller for direct deposit forms

pdfFiller offers a robust set of tools specifically designed for managing direct deposit authorization forms and other documents. With various features for editing, signing, and securely storing documents in the cloud, users can manage their documents from anywhere. This flexibility is particularly valuable for those who need to adapt to changes in financial circumstances quickly.

Additionally, collaboration tools available through pdfFiller enable seamless integration with HR departments or teams, facilitating efficient processing. Whether accessing forms on a desktop or mobile device, users can ensure that they are never far from their important documents, enhancing productivity in managing direct deposits.

Edit, sign, and store forms securely in the cloud.

Work efficiently with HR and teams.

Manage forms on-the-go for added convenience.

Frequently asked questions

Individuals often have questions regarding their direct deposit setups, especially when circumstances change. For instance, if you change jobs, you will typically need to complete a new direct deposit authorization form to reflect your new employer’s information.

Security is also a common concern. Rest assured that as long as you are using a reputable platform like pdfFiller to store and manage your forms, your personal information is secure. You may also wonder if it's possible to have multiple direct deposits; indeed, many people manage several, distributing their salary across different accounts as needed.

Complete a new authorization form for your new employer.

Use reputable platforms to manage your data safely.

Many individuals choose to split their payroll into several accounts.