Get the free Cash Isa Application & Transfer Form 2025/2026

Get, Create, Make and Sign cash isa application transfer

How to edit cash isa application transfer online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cash isa application transfer

How to fill out cash isa application transfer

Who needs cash isa application transfer?

Cash ISA application transfer form: How-to guide

Understanding cash ISA transfer forms

A Cash ISA, or Individual Savings Account, is a tax-efficient savings account that allows individuals to save money without paying tax on interest earned. Transfers between Cash ISAs involve moving savings from one account to another, commonly to benefit from more attractive interest rates or better account features. The Cash ISA transfer form is crucial in this process, serving as the official request to your existing ISA provider to transfer your funds to your new provider.

Transferring your Cash ISA comes with several benefits. Primarily, it allows you to access higher interest rates that can increase your savings over time, align your investments with your changing financial goals, and consolidate your accounts for easier management.

Eligibility criteria for cash ISA transfers

Not everyone qualifies to transfer a Cash ISA. Generally, you must be over 16 or 18 years old, depending on local regulations. Besides age, ensure the account you wish to transfer allows transfers and meets conditions set forth by the new provider. You can move funds from a Cash ISA to another Cash ISA, Stocks and Shares ISA, or an Innovative Finance ISA; however, keep in mind that you must transfer the entire amount within the tax year.

Before initiating your transfer, consider whether any penalties or restrictions apply to your existing account. Some providers may impose fees for early withdrawal or restrict the amount that can be transferred in a single tax year.

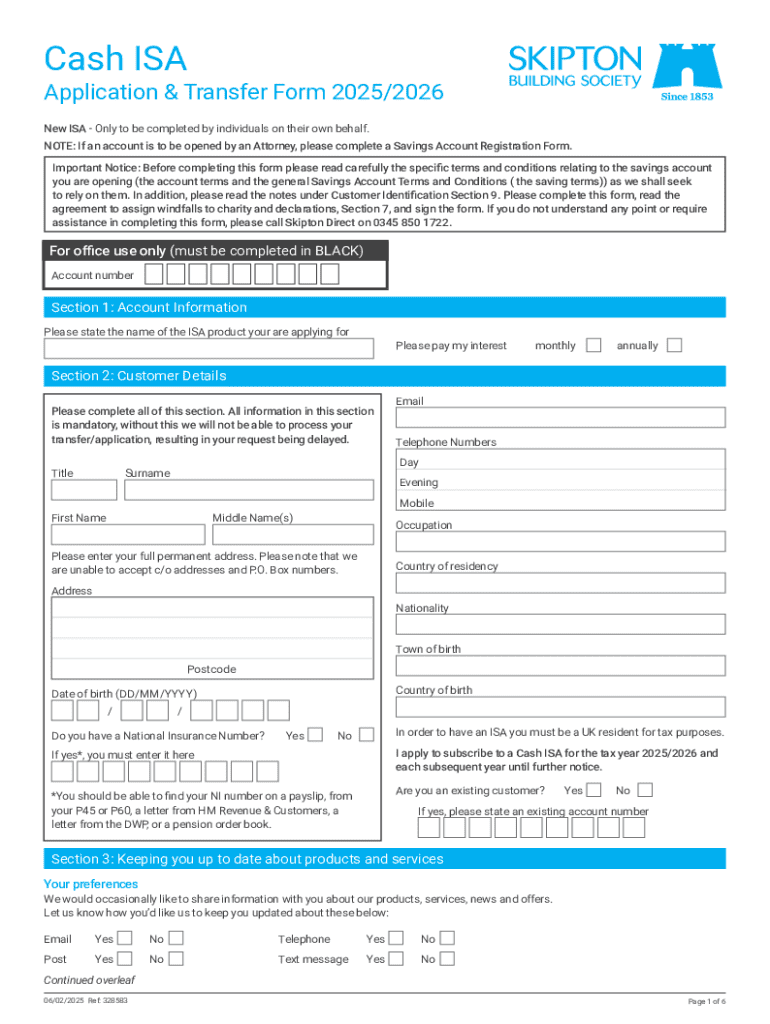

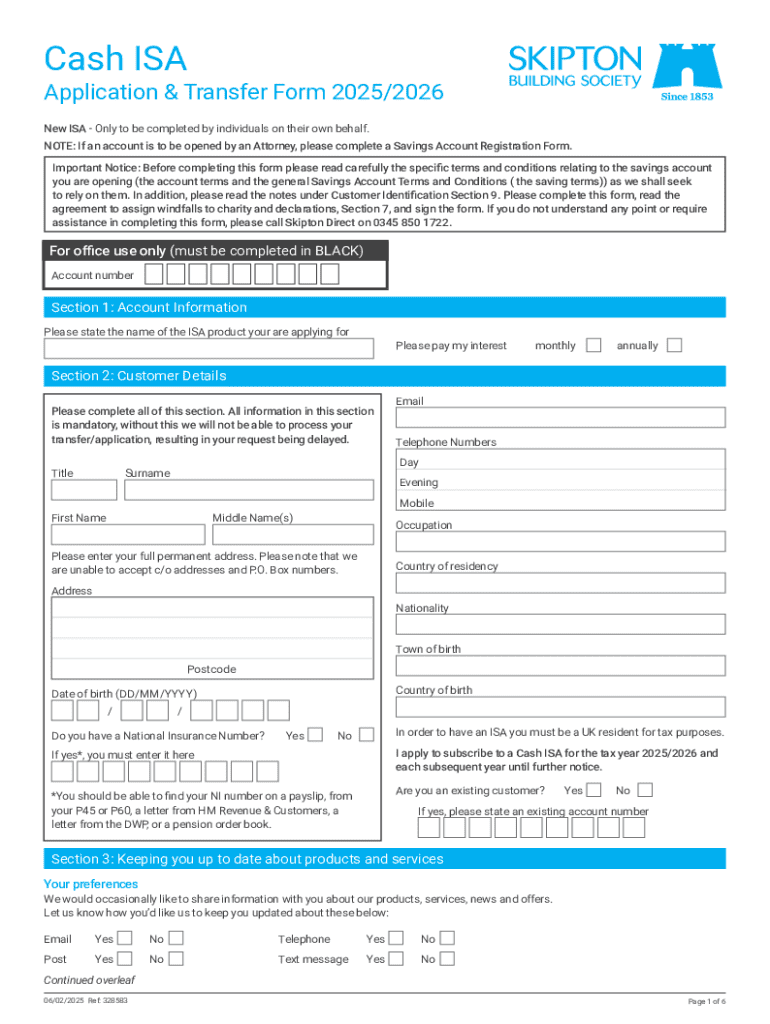

Preparing to complete the cash ISA transfer form

Before filling out the Cash ISA transfer form, gather necessary documents and information. You will need your personal information, including your full name, address, and National Insurance number. Additionally, you’ll need the account details of your existing ISA provider, such as the account number and any reference numbers they may require.

Other essential information includes the contact details of your new ISA provider. It's also a good idea to verify any particulars such as interest rates and terms offered by the new provider before completing the transfer form. Avoid common mistakes like leaving fields blank or providing incorrect account numbers, as these could delay your transfer process.

Step-by-step guide to filling out the cash ISA transfer form

Accessing the Cash ISA transfer form is often straightforward and can usually be completed online. Begin by visiting your new ISA provider's website and locating the Cash ISA transfer section. Most providers have downloadable forms or online submission options.

Review the completed form thoroughly before submission to avoid mistakes. Double-check all entered information for accuracy to facilitate a smooth transfer.

Submitting your cash ISA transfer form

Choosing how to submit your Cash ISA transfer form can depend largely on your provider. Electronic submission has become a popular option, providing faster processing times. If your new provider accepts online applications, follow their system prompts for submission. Alternatively, paper submissions typically involve mailing the completed form.

After submission, providers will typically process the transfer in a few working days to a few weeks. During this time, you can ask your new provider how to track your transfer progress to stay updated on its status.

Managing your cash ISA post-transfer

Once your Cash ISA transfer is complete, it's essential to familiarize yourself with the features of your new account. Ensure that you understand the interest rates, fees, and other features that come with your new ISA. Some accounts offer benefits such as bonus rates for a set period or flexible withdrawal options.

Maximizing your new ISA benefits requires regular monitoring of your savings and being proactive about maintaining a suitable balance. Given the dynamic nature of interest rates, ensure to stay informed about changes, rates, and new offers available from your provider.

Troubleshooting common issues with cash ISA transfers

Transfer delays can occur due to several reasons, including administrative errors or processing times at your previous provider. If you notice a delay, reach out to the customer service department of either your old or new provider for assistance. Providing documentation of your submission may help expedite their investigation.

In some cases, disputes may arise regarding amounts transferred or fees applied. Document all communications with your providers; this information can be vital if issues need to be escalated. Always keep records of your transfer requests and any confirmations posted by your providers.

Utilizing pdfFiller for a seamless transfer experience

Using pdfFiller simplifies the completion of your Cash ISA transfer form. With pdfFiller, you can easily upload your form, edit it, and eSign directly in the platform, eliminating the need for messy paperwork. Its collaborative features allow you to share your documents with financial advisors or partners for review before submission.

Moreover, with cloud-based management, you can access your Cash ISA transfer form anytime, anywhere, ensuring you stay organized throughout the transfer process. This flexibility reduces stress and enhances efficiency in managing your finances.

Interactive tools to simplify the cash ISA transfer process

Engaging with interactive tools can not only ease the completion of your Cash ISA transfer form but also enhance your overall understanding of the process. Many online providers, including pdfFiller, now offer interactive guides that break down each section of the form into simple steps.

Moreover, video tutorials are available that provide visual guidance on how to fill out the form correctly. These resources, along with an FAQ section addressing common queries, ensure you are well-equipped to navigate your Cash ISA transfer without hassle.

Future planning: maintaining your cash ISA

Maintaining an effective strategy for your Cash ISA is essential for long-term success. Please regularly check your account balances, inquire about any changes in interest rates, and perform comparisons among providers to make informed decisions. Adapt your approach to reflect personal financial goals and ever-changing market conditions.

Staying updated on ISA regulations and rates is just as crucial to maximizing your savings. Utilizing pdfFiller for ongoing document management needs enables you to access updated forms and information without hassle, ensuring you are always prepared to respond to any changes in your financial landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my cash isa application transfer directly from Gmail?

How do I make changes in cash isa application transfer?

How do I edit cash isa application transfer in Chrome?

What is cash isa application transfer?

Who is required to file cash isa application transfer?

How to fill out cash isa application transfer?

What is the purpose of cash isa application transfer?

What information must be reported on cash isa application transfer?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.