Get the free Mortgage Application Change Form (pcv)

Get, Create, Make and Sign mortgage application change form

Editing mortgage application change form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage application change form

How to fill out mortgage application change form

Who needs mortgage application change form?

Comprehensive Guide to the Mortgage Application Change Form

Understanding the mortgage application change form

A mortgage application change form is a critical document that allows borrowers to update their existing mortgage applications with changes in personal or financial information. This form plays an essential role in maintaining the accuracy of loan processing and ensuring that the lender has the most current information when reviewing the application. A completed mortgage application clearly reflects a borrower’s current status, which is vital for approval decisions.

Common reasons for modifying a mortgage application include changes in income, the addition or removal of co-borrowers, or adjustments in loan terms. It's essential for borrowers to understand the implications of these changes fully, as they can significantly impact loan eligibility and conditions.

Types of changes you can make

Understanding the types of changes available on the mortgage application change form is crucial for borrowers. Here's a breakdown of the most common modifications, each with specific eligibility criteria and documentation requirements.

Adding a borrower

When adding a borrower to an existing mortgage application, eligibility criteria typically include both parties' creditworthiness and income verification. Required documentation usually involves income statements, credit reports, and identification details.

Removing a borrower

Removing a borrower is often necessary in cases of divorce or financial changes. The process generally begins by submitting a request to the lender, and the impacts on loan terms could include changes to interest rates or repayment plans depending on the remaining borrower’s financial situation.

Replacing a borrower

Replacing a borrower involves substituting one borrower for another on the loan. Specific conditions must be met, such as loan-to-value ratio and credit scores. Necessary forms and processes will include the original application and possibly new credit checks.

Releasing collateral

Releasing collateral means that a portion of the property tied to the mortgage can be freed from the loan agreement. Borrowers must submit a request for a release to their lender, which often requires a re-evaluation of the property's value.

Amending loan terms

Borrowers can also modify their loan terms, including interest rates and repayment plans. Changes could be prompted by financial shifts or refinancing options. It is important to review how these amendments affect the overall financial obligations of the loan.

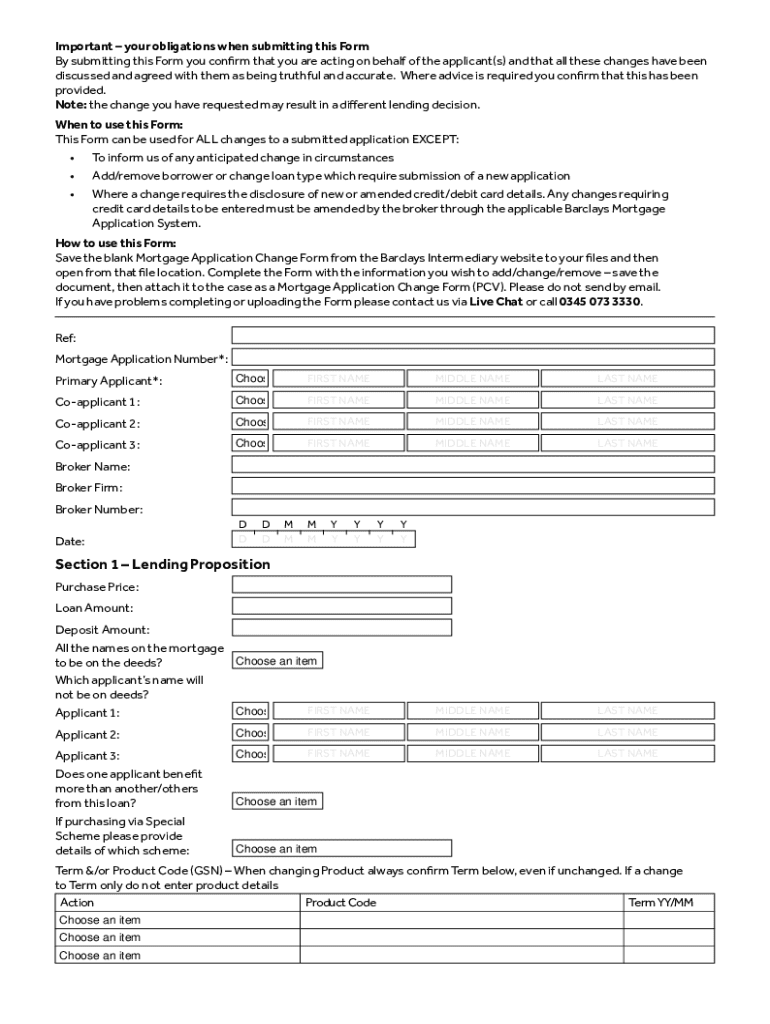

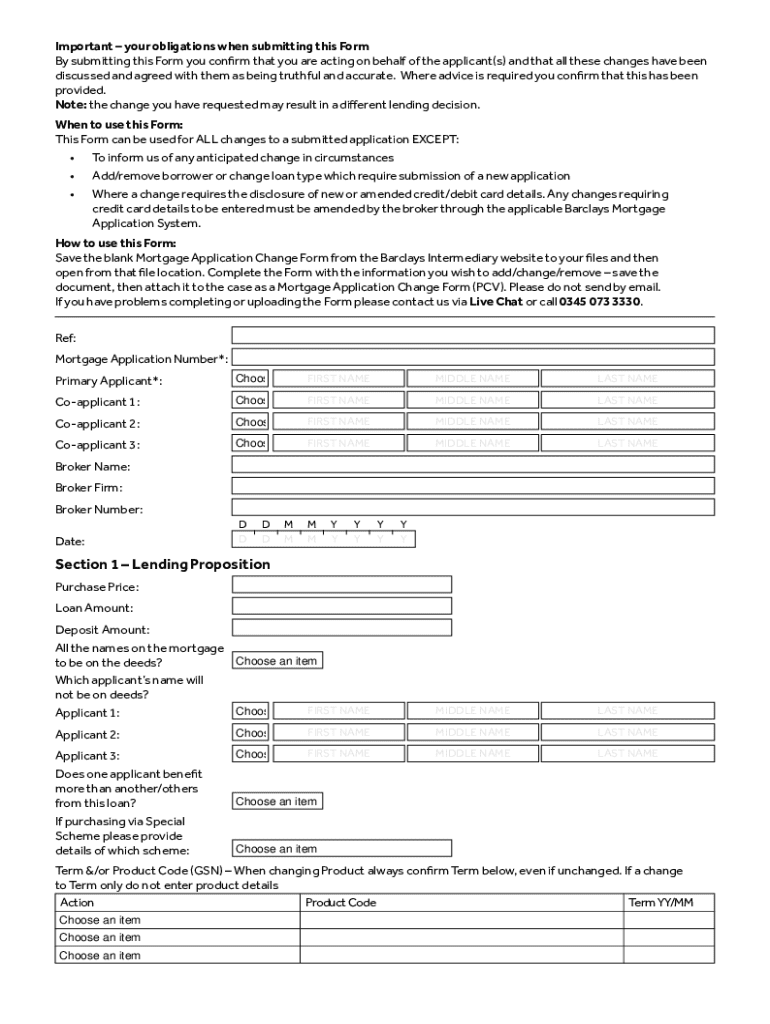

How to complete the mortgage application change form

Completing the mortgage application change form accurately is critical for smooth processing. Begin by gathering all necessary information, which typically includes personal identification, financial statements, and any relevant documentation pertaining to the changes you aim to make.

Step-by-step instructions for filling the form

As you begin filling out the form, pay attention to detailed fields that require specific information. Common pitfalls can include providing outdated documentation or missing key signatures, which can delay the processing of your request. To avoid these errors, double-check each section before submission.

Interactive tools for support

Utilizing online form fillers and video tutorials can help simplify the process of completing the mortgage application change form. Interactive tools can provide guided assistance, ensuring that users can navigate the form efficiently and reduce the likelihood of mistakes.

Submitting your change request

Once your mortgage application change form is completed, the next step is submission. There are multiple methods to submit your request, including via online portal or in-person at your lender's office. Each method has its advantages, but ensuring you have tracking for your application is crucial to monitor its progress.

What to expect post-submission

After submission, it's important to understand the estimated timelines for review and potential communication from your lender. Typically, you can expect a response within a few business days. Keeping an open line of communication with your lender is vital during this period.

Frequently asked questions

Navigating the mortgage application change form process can lead to a variety of questions. Here are some frequently asked questions that can help clarify potential concerns.

Best practices for managing your mortgage application

Managing your mortgage application effectively requires diligence and organization. Regularly reviewing application documents can help ensure that everything is up to date, especially if there are changes in your financial status or contact information. Keeping your contact information updated is also crucial for smooth communication.

One effective tool for document management is pdfFiller, which provides seamless editing and collaboration features. Its eSigning capabilities allow for quick approvals, giving users confidence that their documents are in order.

Additional considerations

When navigating the mortgage application change form, it's essential to consider various impacts, particularly on your credit score. Understanding the difference between hard and soft inquiries on your credit can influence your future borrowing ability.

Consulting financial advisors can provide additional guidance when making significant mortgage changes. They can offer insights tailored to your financial situation, particularly when considering any regulatory changes that could impact your mortgage.

The pdfFiller advantage

Using pdfFiller for managing your mortgage application change form presents numerous advantages. It allows for efficient document management through a cloud-based platform, making it easier to edit, eSign, and collaborate on documents no matter where you are.

Many users have experienced streamlined mortgage processes by leveraging pdfFiller's features. Whether it's ensuring that all necessary documents are completed promptly or enabling quick communication with lenders, the platform provides an invaluable resource for both individuals and teams managing their mortgage applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify mortgage application change form without leaving Google Drive?

How do I complete mortgage application change form online?

How do I fill out the mortgage application change form form on my smartphone?

What is mortgage application change form?

Who is required to file mortgage application change form?

How to fill out mortgage application change form?

What is the purpose of mortgage application change form?

What information must be reported on mortgage application change form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.