Get the free Mortgage Insurance Programme Loan Application Form

Get, Create, Make and Sign mortgage insurance programme loan

How to edit mortgage insurance programme loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage insurance programme loan

How to fill out mortgage insurance programme loan

Who needs mortgage insurance programme loan?

Mortgage Insurance Programme Loan Form: A Comprehensive Guide

Overview of mortgage insurance

Mortgage insurance serves as a critical financial tool for homebuyers, designed to protect lenders against potential default. This insurance product is particularly valuable for those who cannot afford a substantial down payment. By mitigating the risk for lenders, mortgage insurance opens the door for more prospective homeowners, allowing them to secure a mortgage with lower equity.

Understanding the significance of mortgage insurance is vital in today's housing market. With many buyers aiming to secure a home, mortgage insurance plays a role in facilitating transactions by enabling loans even when down payments are minimal.

Understanding the mortgage insurance programme

The mortgage insurance programme provides financial security for lenders while making homeownership accessible to a broader audience. Key features of this programme include requirements for down payments, different types of insurance coverage, and specific eligibility criteria to ensure that borrowers are vetted appropriately.

The benefits of enrolling in the mortgage insurance programme can help buyers gain a competitive edge in the real estate market. With lower down payment requirements, individuals can finance their homes sooner and improve their purchasing power.

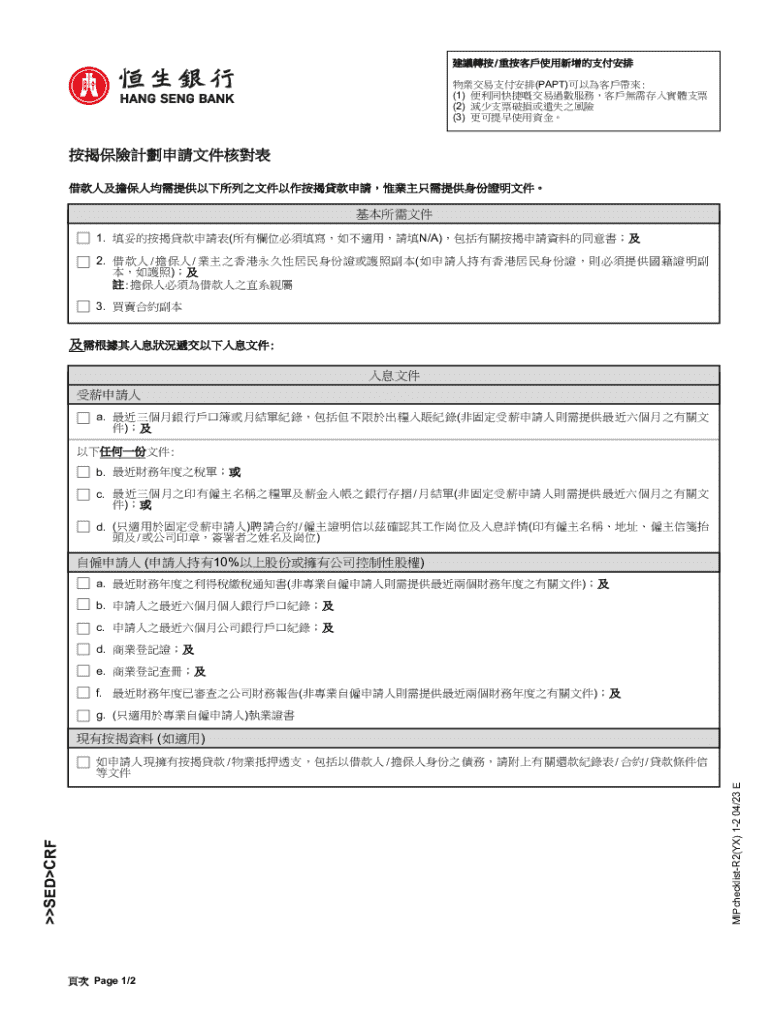

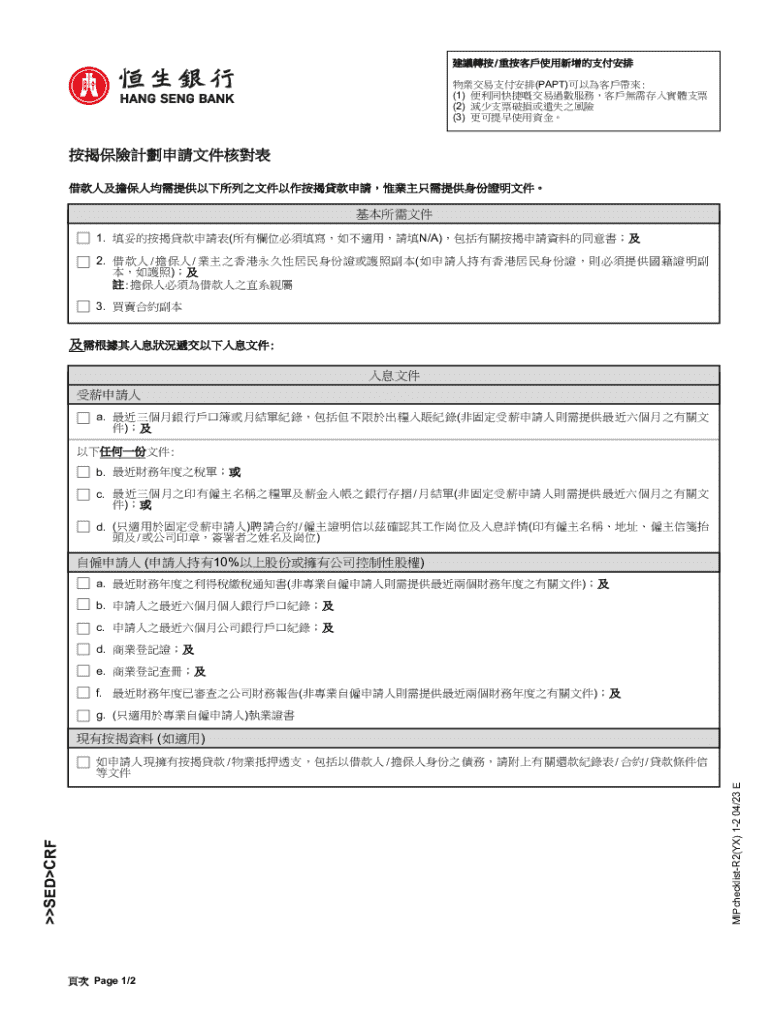

Introduction to the mortgage insurance programme loan form

Completing the mortgage insurance programme loan form is a crucial step in the home financing process. This form is designed to collect essential information from the borrower, enabling lenders to assess the eligibility and risk factors involved in granting a mortgage.

Accuracy is paramount when completing this form. Incomplete or incorrect details can lead to delays in processing or even denial of the application. Familiarizing oneself with the common pitfalls in filling out the form, such as providing outdated income information or skipping essential disclosures, can prevent complications down the line.

Step-by-step guide to completing the mortgage insurance programme loan form

Completing the mortgage insurance programme loan form involves several key steps that require attention to detail. Here’s a concise guide to ensure proper completion.

Editing and managing your mortgage insurance programme loan form

After submission, managing your mortgage insurance programme loan form can become necessary if adjustments are needed. It's critical to know that while some forms may allow editing after submission, others might have restrictions.

pdfFiller offers a range of tools for you to manage your mortgage insurance programme loan form efficiently. From eSigning options for instant approvals to collaborative features enabling team insights, you can easily ensure your document's accuracy and timeliness.

Frequently asked questions (FAQs)

Addressing common queries about the mortgage insurance programme loan form can help demystify the application process for first-time users.

Interactive tools for a smooth application process

Utilizing interactive tools can significantly ease the application journey for the mortgage insurance programme loan form. One useful feature is the mortgage calculator, which allows applicants to estimate monthly payments based on loan amounts and interest rates.

Another helpful tool is the eligibility checker, which assesses whether you qualify for the mortgage insurance programme based on your financial status and credit history.

Ensuring a successful application

While the mortgage insurance programme loan form simplifies the mortgage process, avoiding common mistakes is essential for ensuring a successful application. Being meticulous in verifying all entered data is crucial.

Before submitting your application, gather all necessary documentation and review it for accuracy. Keeping records organized and maintaining open communication with lenders can also aid in a smoother application experience.

Important notes

Understanding the financial implications of mortgage insurance is essential for all borrowers. Knowing the costs involved and how they can impact your monthly budget will help you make informed decisions.

Additionally, being aware of your legal rights and the responsibilities that come with a mortgage will empower you as a borrower. Resources provided by pdfFiller and other financial institutions can assist in further education and guidance in navigating mortgage insurance options and requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit mortgage insurance programme loan from Google Drive?

How do I execute mortgage insurance programme loan online?

Can I create an electronic signature for the mortgage insurance programme loan in Chrome?

What is mortgage insurance programme loan?

Who is required to file mortgage insurance programme loan?

How to fill out mortgage insurance programme loan?

What is the purpose of mortgage insurance programme loan?

What information must be reported on mortgage insurance programme loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.