Get the free Beneficiary Designation Form

Get, Create, Make and Sign beneficiary designation form

How to edit beneficiary designation form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out beneficiary designation form

How to fill out beneficiary designation form

Who needs beneficiary designation form?

A comprehensive guide to the beneficiary designation form

Understanding the beneficiary designation form

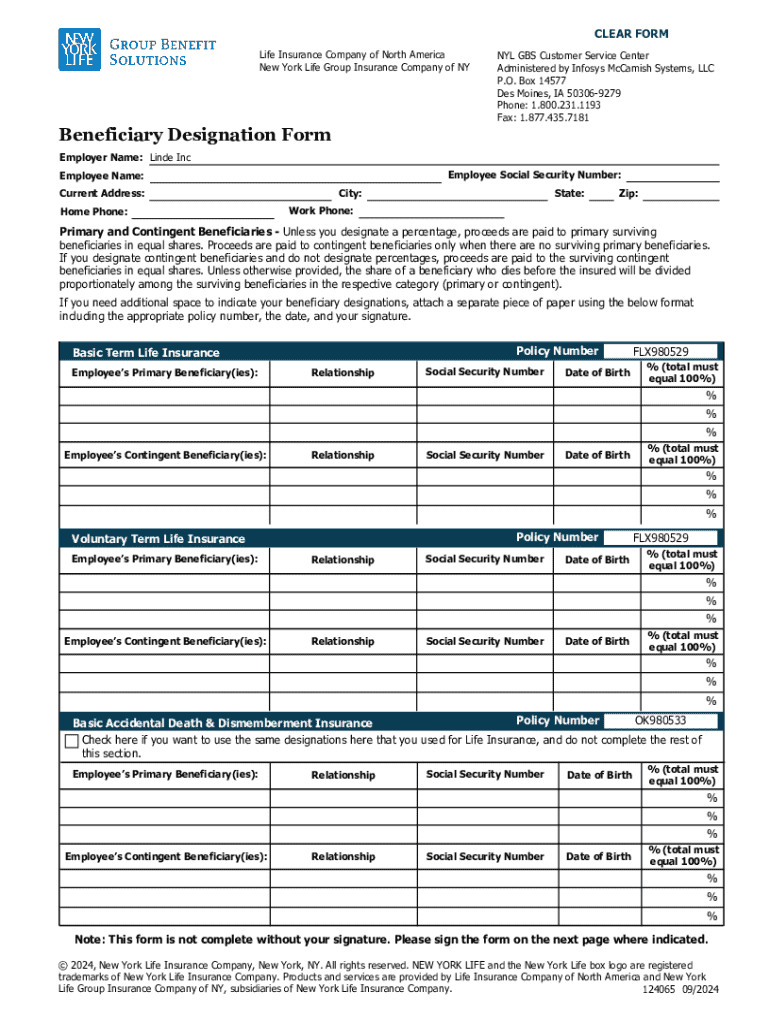

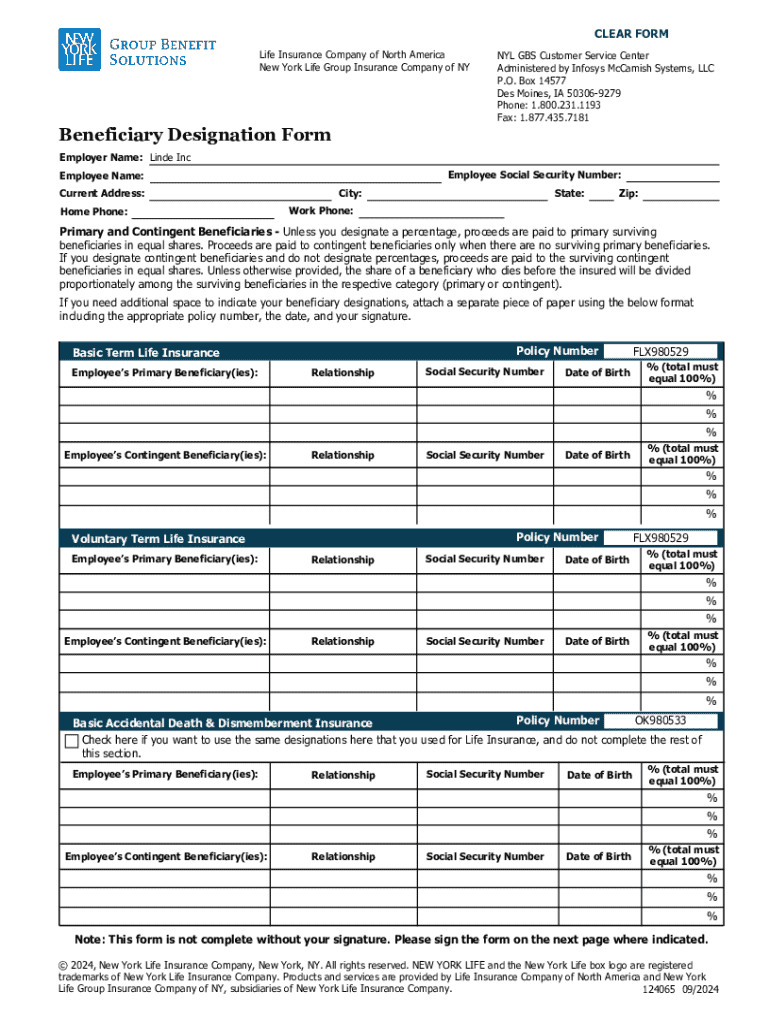

A beneficiary designation form is a legal document that specifies who will receive assets or benefits upon the death of an individual. This form is crucial in estate planning as it overrides instructions stated in a will, ensuring that the designated beneficiaries receive their intended benefits directly, without going through lengthy probate processes. By establishing clear beneficiaries in financial instruments like life insurance policies and retirement accounts, individuals can provide for their loved ones effectively.

The importance of this form extends beyond merely ensuring assets are distributed as intended; it is an essential tool for reducing potential conflicts among heirs, ultimately promoting clarity and peace within families during critical times of grief.

Key terminology

To navigate the intricacies of beneficiary designation forms effectively, understanding key terms is important. A 'beneficiary' is the individual or entity designated to receive assets. The 'designator' is the person filling out the form, usually the policyholder or account owner. 'Contingent beneficiaries' come into play as backup recipients, slated to inherit assets should the primary beneficiaries be unable to fulfill their role due to various reasons, such as predeceasing the designator.

When to use a beneficiary designation form

Several situations necessitate the use of a beneficiary designation form. Primarily, these include life insurance policies, where the insurer will pay the designated beneficiary directly upon the policyholder's death. Retirement accounts such as IRAs and 401(k)s similarly require a beneficiary designation; failing to specify a beneficiary may result in assets being distributed according to the default rules under state law, which may not align with the individual’s wishes.

In addition to life insurance and retirement accounts, trusts and wills can utilize beneficiary designation forms to clarify who inherits specific assets. Nevertheless, it’s essential to distinguish between legal scenarios that demand formal documentation and informal situations, where many individuals mistakenly believe a verbal agreement suffices. A lack of written instruction can lead to confusion and disputes, reinforcing the necessity of formalizing designations in writing.

How to fill out the beneficiary designation form

Filling out a beneficiary designation form correctly is vital for ensuring one’s wishes are honored. Start by collecting necessary information, including full names, birth dates, and Social Security numbers of all beneficiaries. Identify your primary beneficiaries first, and then list any contingent beneficiaries to ensure a backup plan in case the primary ones cannot inherit.

Next, provide complete contact information for each beneficiary and clearly articulate your designation instructions. It’s equally important to avoid common mistakes, including omitting vital information, creating naming conflicts (e.g., using nicknames instead of legal names), or neglecting to update the form after significant life changes such as marriage, divorce, or the birth of a child.

Editing and managing your beneficiary designation

Changes to your beneficiary designation should be considered whenever life circumstances evolve. These changes can arise from marriage, divorce, the birth of children, or the passing of a beneficiary. It’s advisable to revisit your designation at least annually, especially if there have been significant events that could impact your decisions.

Making changes involves requesting a new beneficiary designation form from your provider, filling it out with the updated information, and following any submission procedures outlined by the institution. Keeping accurate records of your beneficiary information is crucial, and leveraging tools like pdfFiller can help you manage these forms digitally, keeping your documents organized and readily accessible.

The role of digital solutions in managing forms

As individuals increasingly rely on digital tools for managing important documents, cloud-based platforms offer unmatched benefits. They provide accessibility to documents from any location, making it easier to manage beneficiary designations when away from home. This convenience extends to streamlined collaboration features that allow multiple parties to review and sign documents, significantly improving the efficiency of the process.

pdfFiller enhances this experience by offering robust features for editing and signing documents. With secure document storage, users can ensure their beneficiary designations are protected while remaining easy to update whenever necessary.

Special considerations for different types of beneficiaries

Understanding the distinction between primary and contingent beneficiaries is crucial. Primary beneficiaries are first in line to receive assets, while contingent beneficiaries step in only if primary beneficiaries cannot be fulfilled. This contingency planning ensures that assets are distributed as desired regardless of unforeseen circumstances.

Special situations may involve designating minor children as beneficiaries. In these cases, it is advisable to establish a trust to manage assets until they reach adulthood. Other situations include naming trusts or non-individual entities, such as charities, as beneficiaries. Each scenario requires careful consideration to align beneficiaries and the related strategies with one’s overall estate planning goals.

FAQs about beneficiary designation forms

Individuals frequently have questions regarding beneficiary designation forms. One common query is, 'How often should I update my form?' It’s recommended to review designations at least annually or after any major life event. Another pertinent question involves revocability: yes, beneficiary designations are typically revocable, allowing designators to change their minds.

A common concern involves what happens if a beneficiary predeceases the designator. In such an event, should there be no contingent beneficiary named, the policy or accounts may default to the estate, which can lead to unnecessary complications. Thus, naming contingent beneficiaries is crucial.

Interactive tools for beneficiary planning

Utilizing tools like pdfFiller’s interactive features can significantly simplify the process of managing beneficiary designations. Fillable forms and templates make it easy to customize documents according to individual needs, while collaboration tools enable teamwork when multiple individuals are needed to oversee planning.

Additionally, employing estate planning calculators and resource links can enrich your understanding and effectiveness in beneficiary planning. These tools offer a comprehensive view, helping users analyze their estate structures and the implications of their designations.

Legal framework surrounding beneficiary designation

Understanding the legal framework surrounding beneficiary designations is paramount. Various states have differing laws governing the designation of beneficiaries, influencing how assets are distributed. Being aware of state variations ensures compliance and reinforces educated decision-making in planning.

Moreover, the rights of beneficiaries can vary significantly; thus, consulting with professionals like legal advisors or financial planners is beneficial. They can provide valuable guidance, helping individuals align their beneficiary designations with larger estate planning strategies.

Best practices for beneficiary designation management

To maintain an effective beneficiary designation, strong communication is vital. Informing beneficiaries about their designation helps set clear expectations and provides them with necessary context. Engaging in discussions regarding your plans with family can eliminate misunderstandings and assure everyone is aligned.

Regularly reviewing and reassessing your designations is equally important. Scheduling annual check-ups can ensure that beneficiary designations reflect your current wishes. Responding to life changes — such as marriage, divorce, or the passing of a beneficiary — is crucial to maintaining accuracy and keeping your estate planning consistent.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send beneficiary designation form for eSignature?

How do I make changes in beneficiary designation form?

How do I complete beneficiary designation form on an iOS device?

What is beneficiary designation form?

Who is required to file beneficiary designation form?

How to fill out beneficiary designation form?

What is the purpose of beneficiary designation form?

What information must be reported on beneficiary designation form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.