Get the free Mortgage Loan Account Instructions Form

Get, Create, Make and Sign mortgage loan account instructions

Editing mortgage loan account instructions online

Uncompromising security for your PDF editing and eSignature needs

How to fill out mortgage loan account instructions

How to fill out mortgage loan account instructions

Who needs mortgage loan account instructions?

Mortgage Loan Account Instructions Form: Your Comprehensive How-to Guide

Understanding the mortgage loan account instructions form

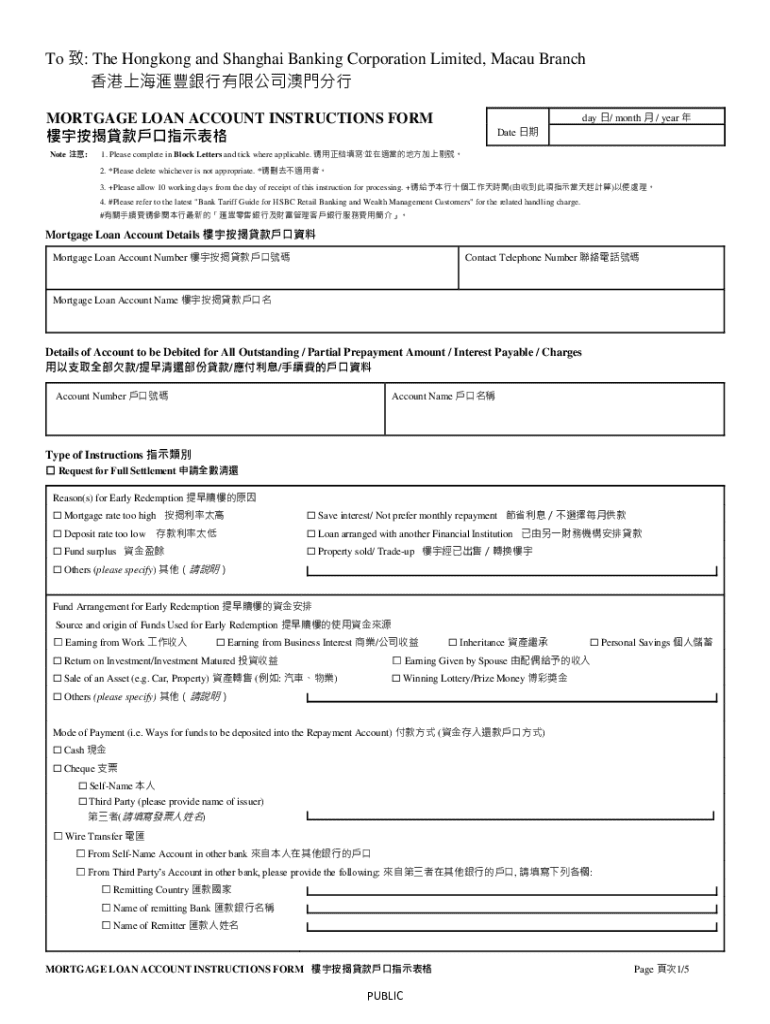

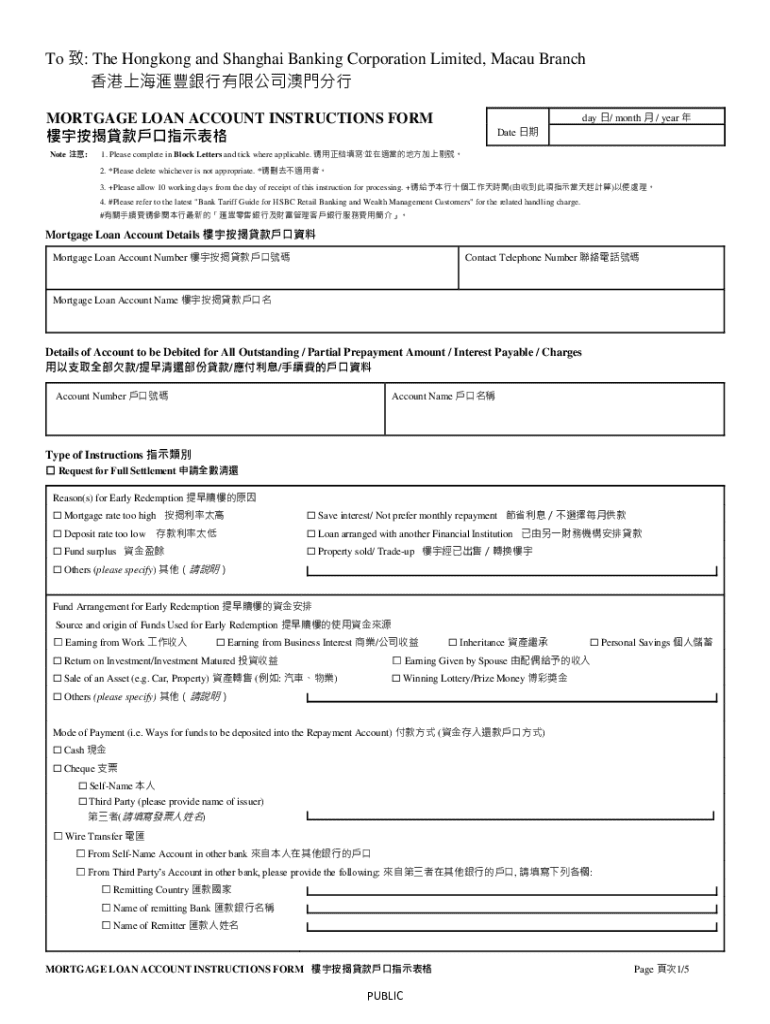

The mortgage loan account instructions form serves as a foundational document for individuals seeking to secure a mortgage. This form is essential for lenders to assess your eligibility for a loan, finalize lending agreements, and apply for a mortgage loan account. Understanding the nuances of this form is critical for a smooth borrowing process.

There are various types of mortgage loan accounts, including fixed-rate, adjustable-rate, and interest-only loans. Each type has its unique characteristics and is suited for different financial situations. Accurate submission of the account instructions form is vital as any discrepancies can delay the approval process or result in loan denial.

Preparing to fill out the form

Before diving into the filling out of the mortgage loan account instructions form, it’s imperative to gather the necessary documentation. A well-prepared applicant stands a better chance of a timely application process, and thorough preparation helps avert common mistakes.

Gather necessary documents

It's also vital to note the key information that will be needed to complete the form efficiently. This includes your personal details, the type of loan you’re seeking, and comprehensive property information.

Key information required

Step-by-step instructions for completing the form

Completing the mortgage loan account instructions form requires attention to detail and methodical filling out of each section. Here’s a straightforward breakdown to guide you.

Section 1: Personal Information

Section 2: Loan Information

Section 3: Property Information

Section 4: Income and Employment Details

Common mistakes to avoid when filling out the form

Even minor oversights can cause major delays. Here are common pitfalls to avoid for a smoother process.

Editing and reviewing the form

After completing the form, thoroughly review it to enhance the likelihood of its acceptance. Accurate documentation will expedite your loan processing time and mitigate any potential errors.

Utilizing pdfFiller tools for quick edits

pdfFiller provides user-friendly tools to make any necessary edits before submission. Tools such as digital editing and commenting capabilities allow you to streamline reviews and verification processes effectively. Don't underestimate the power of collaborative reviews; having another set of eyes can catch mistakes you might overlook.

Signing and submitting your form

Once your form is thoroughly filled out and reviewed, the next step is to sign it. Signing can be done electronically, which is both efficient and legally recognized.

Options for eSigning with pdfFiller

How to submit the form

Managing your mortgage loan account after submission

After submitting your mortgage loan account instructions form, managing the account efficiently becomes essential. Checking your application status and understanding the approval process can provide peace of mind and keep you informed.

Tracking the application status

Most lenders will follow up with communication regarding your application's status. You may also use pdfFiller to access your documents, track your loan information, and streamline any communications with your lender, enhancing your overall experience.

Frequently asked questions (FAQs)

As you navigate the complexities of the mortgage loan account instructions form, it’s helpful to address common concerns that many applicants face.

Conclusion: maximizing the use of pdfFiller

Utilizing pdfFiller enhances the document management experience, making your interactions with forms seamless and effective. By leveraging tools such as easy editing, eSigning, and collaboration, users gain the upper hand in managing their mortgage applications efficiently.

Embrace the convenience offered by pdfFiller to take control of your mortgage loan account instructions form and future document management, ensuring you can access, edit, and manage your files anytime, anywhere.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send mortgage loan account instructions for eSignature?

How do I make edits in mortgage loan account instructions without leaving Chrome?

How do I fill out mortgage loan account instructions on an Android device?

What is mortgage loan account instructions?

Who is required to file mortgage loan account instructions?

How to fill out mortgage loan account instructions?

What is the purpose of mortgage loan account instructions?

What information must be reported on mortgage loan account instructions?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.