Get the free Cobra Open Enrollment Form

Get, Create, Make and Sign cobra open enrollment form

Editing cobra open enrollment form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out cobra open enrollment form

How to fill out cobra open enrollment form

Who needs cobra open enrollment form?

Your Essential Guide to the COBRA Open Enrollment Form

Understanding COBRA open enrollment

COBRA (Consolidated Omnibus Budget Reconciliation Act) open enrollment is a critical period that allows eligible individuals to continue their health insurance coverage after job loss, reduction in work hours, or other qualifying events. This legal framework provides a lifeline to those who might otherwise be left without health insurance. Timely enrollment is paramount; it ensures you do not lapse in coverage, particularly if you have ongoing health care needs.

Eligibility criteria for COBRA varies based on the employer's group health plan. Generally, to qualify, individuals must have been covered under the employer's plan at the time of a qualifying event and must be filling out the enrollment forms during the designated period. Understanding these criteria helps streamline the process and ensures you take advantage of your rights under this federal law.

Benefits of COBRA coverage

One of the primary advantages of COBRA coverage is that it allows for continuity of healthcare despite life changes. For many, switching health plans can be both challenging and risky, particularly for those undergoing regular treatments or managing chronic conditions. COBRA allows individuals to retain their existing coverage, which often includes negotiated rates and established relationships with providers.

Additionally, COBRA coverage extends to dependents, ensuring that spouses and children can also maintain their health insurance. This is particularly important for families who want to avoid the gaps in coverage that could arise during transitions between jobs. Moreover, flexibility in plan choices allows individuals to select their preferred coverage options, whether it's high-deductible plans or specific provider networks.

How to navigate the COBRA open enrollment process

Navigating the COBRA open enrollment process involves several critical steps to ensure you successfully secure your coverage.

Frequently asked questions about COBRA enrollment

One of the most pressing questions regarding COBRA enrollment is what happens if you miss the sign-up deadline. Unfortunately, missing this deadline could result in losing your right to COBRA coverage, making it vital to stay aware of your enrollment window.

Billing for COBRA insurance typically operates on a monthly basis and can vary based on the selected coverage. It's important to note that you will generally be responsible for the entire premium, including administrative fees. If you wish to change your coverage once enrolled, you may need to work with your previous plan administrator as changes can be limited and often occur only during designated times.

Special considerations for employers and advisers

Employers have specific responsibilities under COBRA, including notifying employees of their rights and providing accurate election notices. Failing to comply can result in significant penalties, making it crucial for employers to understand their duties regarding COBRA.

Advisers play a key role in helping employees navigate the complexities of COBRA enrollment and coverage options. This includes providing insights into choosing the right plans, clarifying the financial implications of maintaining coverage, and facilitating communication between employees and benefits providers.

Unique features and offers with pdfFiller

pdfFiller offers seamless document management, simplifying the COBRA enrollment process. You can access, fill out, and edit the necessary COBRA open enrollment form directly from a cloud-based platform, ensuring documents are available from anywhere at any time.

eSigning is straightforward with pdfFiller, enhancing the efficiency of your COBRA enrollment experience. By utilizing collaborative features, teams managing COBRA enrollments can work together effectively, ensuring all forms are completed and submitted on time.

Troubleshooting common issues

A common issue during the COBRA enrollment process is the missing election notice. If you haven’t received yours, contact your former employer’s HR department promptly. Keeping records of all communications can clarify any discrepancies or issues.

In some cases, employees may face non-compliance issues when it comes to documentation or deadlines. It’s essential to understand your rights and responsibilities under COBRA. Should significant challenges arise, reaching out for assistance from your employer's benefits administrator or seeking legal advice might be necessary.

Additional tips for a successful COBRA enrollment

To make the most of your COBRA enrollment experience, staying informed with regular plan updates is crucial. This enables you to fully understand any changes in coverage or associated costs.

Utilizing available decision resources when selecting a plan can simplify complex choices. Once enrolled, conducting a yearly review of your coverage options can help ensure that you're optimizing your benefits based on current health needs and changes in personal circumstances.

Overview of related documents

Understanding the summary of benefits for COBRA plans is essential for navigating your coverage options effectively. Familiarize yourself with important deadlines and dates for enrollment in upcoming years, as the timing can significantly impact your ability to secure coverage.

Interactive tools and resources

To further enhance your COBRA Open Enrollment experience, utilize online calculators to estimate COBRA costs based on your specific plan choices. Keeping track of relevant updates and notifications through reputable resources will also aid in informed decision-making.

Downloadable checklists can serve as a guide to ensure that each step in the enrollment process is completed efficiently, removing much of the guesswork and adding structure to your application efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in cobra open enrollment form without leaving Chrome?

How do I fill out cobra open enrollment form using my mobile device?

Can I edit cobra open enrollment form on an iOS device?

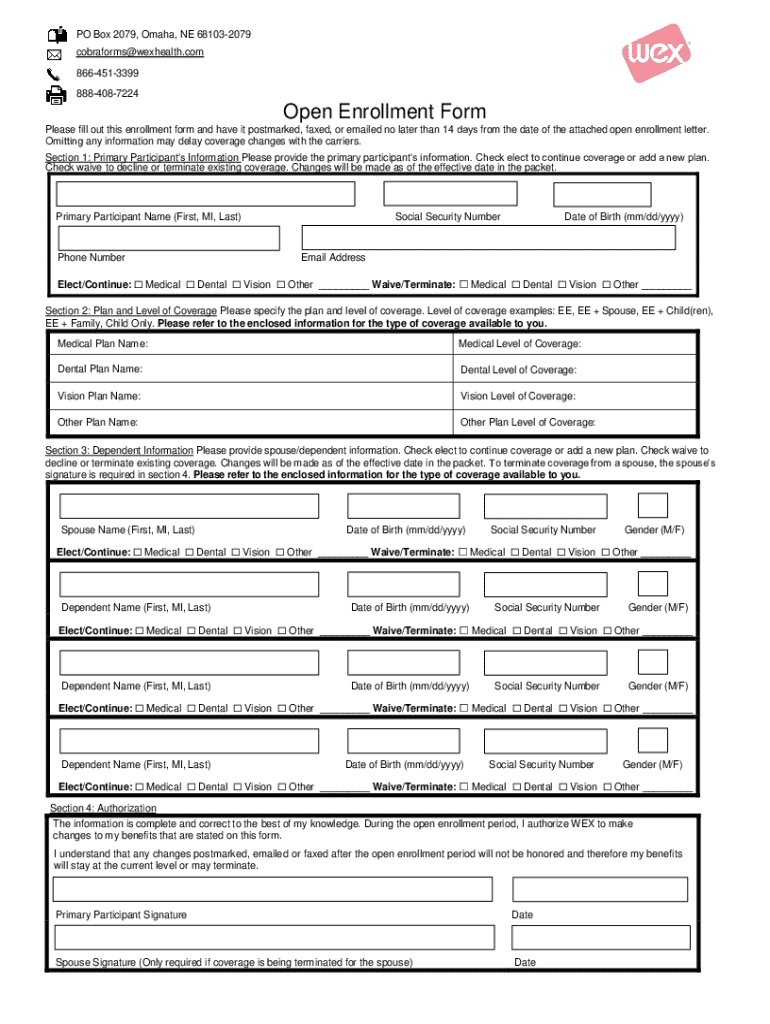

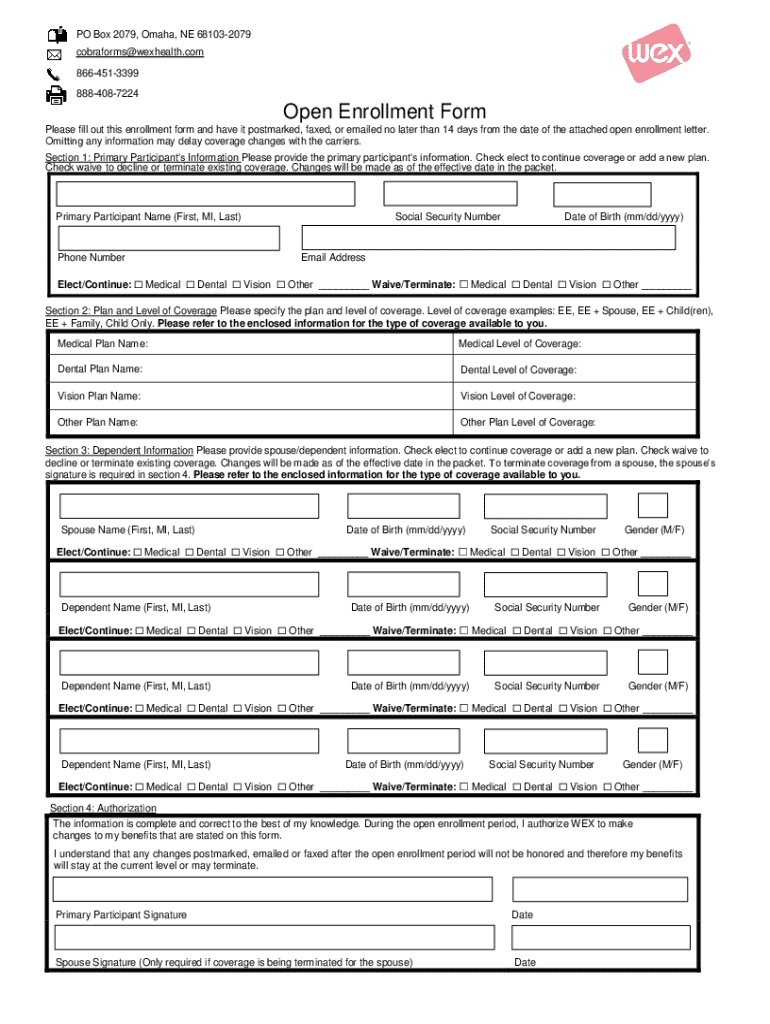

What is cobra open enrollment form?

Who is required to file cobra open enrollment form?

How to fill out cobra open enrollment form?

What is the purpose of cobra open enrollment form?

What information must be reported on cobra open enrollment form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.