Get the free Financial Disclosure Statement for Public Employees

Get, Create, Make and Sign financial disclosure statement for

How to edit financial disclosure statement for online

Uncompromising security for your PDF editing and eSignature needs

How to fill out financial disclosure statement for

How to fill out financial disclosure statement for

Who needs financial disclosure statement for?

Understanding Financial Disclosure Statements for Form

Understanding financial disclosure statements

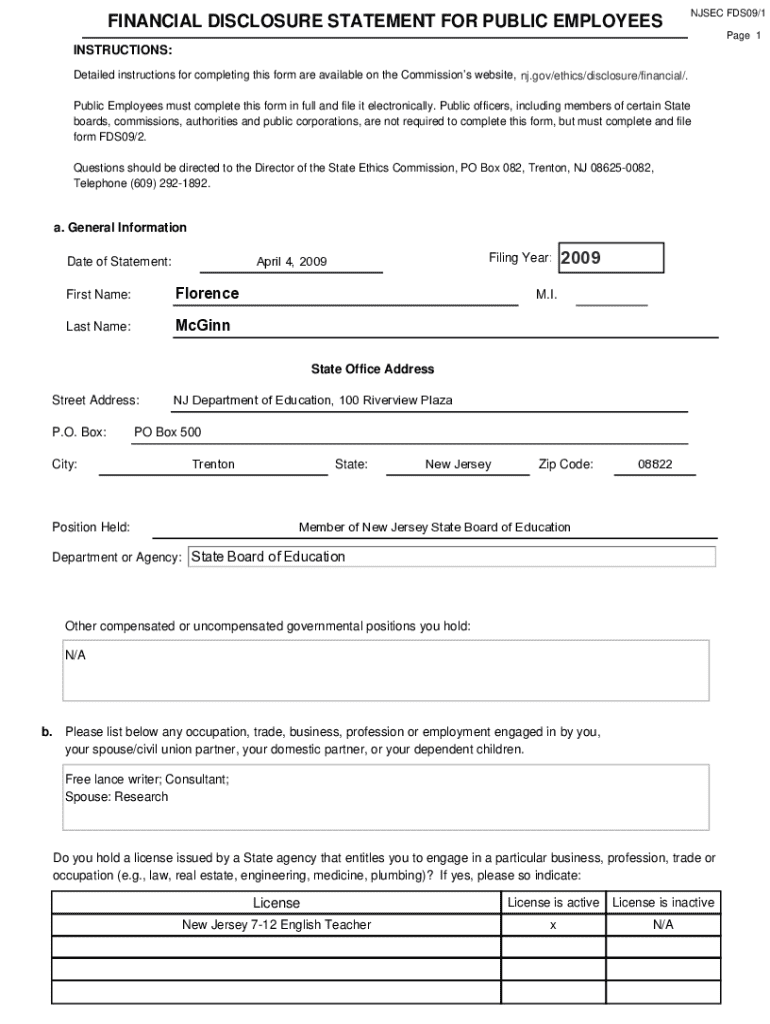

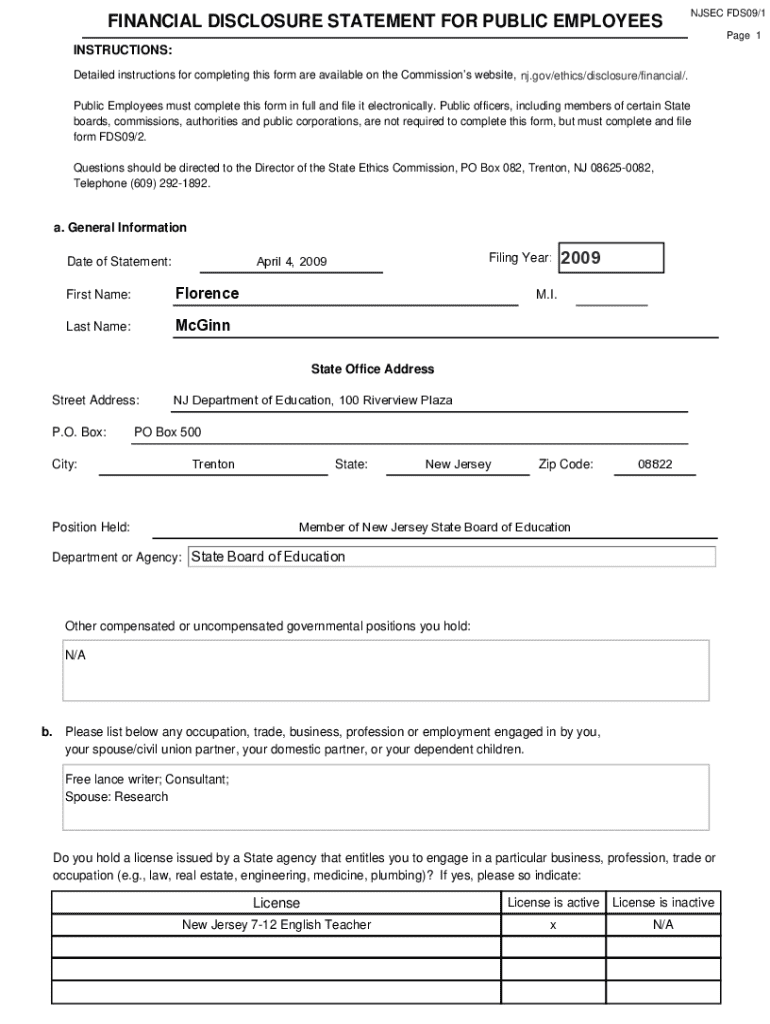

A financial disclosure statement for form serves as a transparent account of an individual's or organization’s financial activities. It outlines assets, liabilities, income, and other financial interests. The primary purpose of these statements is to promote ethical behavior and accountability among individuals in public office and corporations.

These statements play a crucial role in maintaining integrity in public office and corporate governance, ensuring stakeholders are informed of potential conflicts of interest. Legally, many public officials and corporate executives are required to submit these forms periodically, providing a clear view of their financial status.

Types of financial disclosure forms

Financial disclosure forms vary across jurisdictions and contexts. Generally, they fall into two main categories: federal and state forms. Federal forms are often more comprehensive, requiring detailed disclosures, while state forms may differ significantly in requirements and transparency levels.

Understanding the specific form required for your situation is vital for compliance and effectiveness.

Who needs to file a financial disclosure statement?

Various individuals are mandated to file financial disclosure statements based on their positions and responsibilities. Public officials and elected representatives typically must disclose their financial status to ensure accountability and transparency.

Additionally, employees in regulatory bodies and non-profit organizations’ directors or key employees are also required to submit these statements. This requirement ensures that those in influential or regulatory positions remain free from conflicts of interest and maintain ethical standards in their respective roles.

Steps to fill out your financial disclosure statement

Filling out a financial disclosure statement accurately is key to compliance and transparency. Here are steps to ensure you complete your statement correctly:

Utilizing pdfFiller's editing tools can simplify this process, making it easier to manage your documents effectively.

Interactive tools for managing your financial disclosure statement

pdfFiller provides an innovative solution for individuals and teams managing financial disclosure statements. With its eSignature features, users can sign documents securely, while the platform allows for easy sharing and collaboration on necessary forms.

Furthermore, users can securely store and access their financial disclosure statements online, ensuring ease of retrieval and reference at any time, significantly enhancing your management capabilities.

Frequently asked questions (FAQs)

When dealing with financial disclosure statements, several common queries arise:

Best practices for maintaining financial transparency

To uphold integrity and transparency, staying updated on changes in legislation related to financial disclosure is essential. Regularly reviewing and updating your financial information can prevent discrepancies and potential conflicts of interest.

Additionally, it is wise to establish clear guidelines for ethical conflict of interest management, ensuring that all stakeholders understand the importance of transparency.

Troubleshooting common issues

In the process of submitting a financial disclosure statement, encountering issues is not uncommon. Some common problems may include:

Addressing these issues promptly is crucial for maintaining compliance and transparency.

Resources for further information

For those seeking more information regarding financial disclosure statements, many resources are available, including links to relevant legal guidelines and contact information for regulatory bodies. Utilizing platforms like pdfFiller can also streamline the management of these documents, ensuring that you remain compliant and organized.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my financial disclosure statement for directly from Gmail?

How do I fill out the financial disclosure statement for form on my smartphone?

Can I edit financial disclosure statement for on an Android device?

What is financial disclosure statement for?

Who is required to file financial disclosure statement for?

How to fill out financial disclosure statement for?

What is the purpose of financial disclosure statement for?

What information must be reported on financial disclosure statement for?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.