Get the free Maryland Form 500cr

Get, Create, Make and Sign maryland form 500cr

Editing maryland form 500cr online

Uncompromising security for your PDF editing and eSignature needs

How to fill out maryland form 500cr

How to fill out maryland form 500cr

Who needs maryland form 500cr?

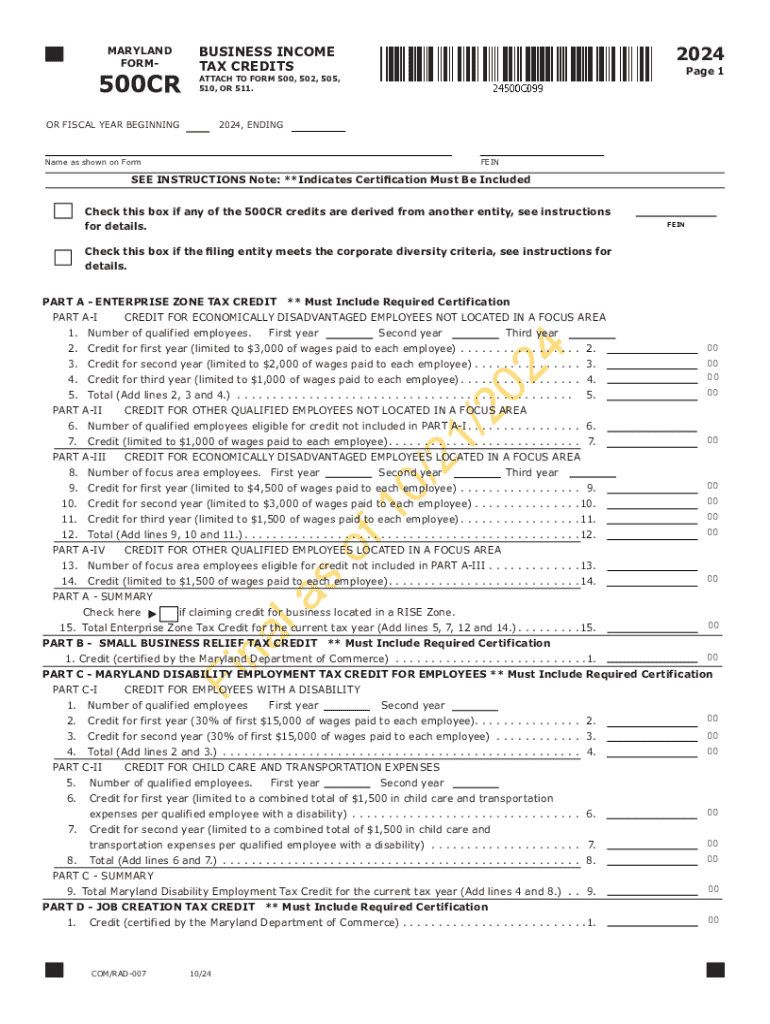

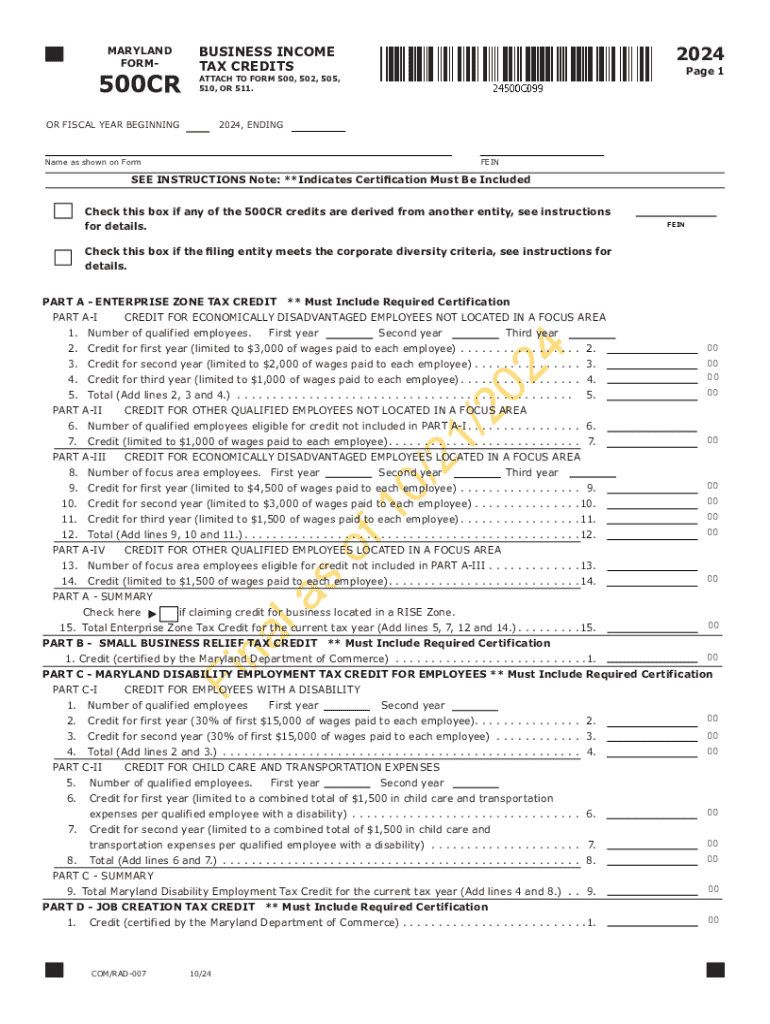

A Comprehensive Guide to Maryland Form 500CR

Understanding the Maryland Form 500CR

Maryland Form 500CR is a crucial document for individuals and businesses seeking to claim tax credits on their Maryland tax returns. This form is specifically designed for taxpayers who qualify for certain credits that can significantly reduce their overall tax liability, making it vital for financial planning and compliance.

Filing the Form 500CR is essential for Maryland taxpayers as it allows them to benefit from various state tax credits that can lead to substantial savings. Unlike the standard Form 500, which reports income and calculates tax owed, the 500CR focuses solely on available credits, illuminating opportunities for taxpayers to lower their tax burdens effectively.

Benefits of using PDFfiller for Form 500CR

Utilizing PDFfiller for completing and filing the Maryland Form 500CR brings numerous advantages to users. The platform allows for easy online editing, enabling taxpayers to make real-time changes without the hassle of printing, filling out by hand, and scanning. This streamlined approach not only saves time but also reduces the likelihood of errors.

PDFfiller also includes seamless electronic signing capabilities, allowing users to sign their completed forms digitally, thus complying with legal standards without needing a physical signature. Furthermore, its collaboration features empower both individuals and teams to work on forms simultaneously, making it especially useful for accountants and financial advisors helping multiple clients.

Eligibility criteria for filing Form 500CR

Determining whether you need to file Form 500CR is straightforward. Taxpayers who qualify for certain tax credits, such as the Earned Income Credit or the Child and Dependent Care Credit, should file this form to claim those benefits. Understanding eligibility criteria ensures that you maximize your potential refunds and credits.

Specific eligibility requirements may include having a valid Social Security Number, a taxable income that meets thresholds set by the Maryland Comptroller’s office, and qualification based on household size and dependencies. While numerous taxpayers will fall under these criteria, exceptions may apply, particularly if income levels change or if you have received certain tax benefits in the previous year.

How to obtain Maryland Form 500CR

Accessing Maryland Form 500CR is easy, thanks to online resources. You can find the form directly from the Maryland Comptroller's website, ensuring you are using the most current version. Alternatively, PDFfiller offers a quick download option that allows you to access and edit the form seamlessly.

If you prefer a physical copy, you can visit your local tax office or public library. Ensure that you are collecting the most recent form to avoid potential issues during filing. PDFfiller's platform also enables you to create a personal account, making it easier to save and retrieve your documents as needed.

Step-by-step guide to filling out Maryland Form 500CR

Filling out the Maryland Form 500CR can be broken down into manageable sections. The first section requires personal information, including name, address, and Social Security Number. It’s critical to ensure that all entries are accurate to avoid processing delays or potential audits.

In the second section, report your income. This involves detailing all sources of income that are taxable under Maryland law. Understanding what constitutes taxable income is essential for correctly completing this section. The third section focuses on available credits and deductions, where taxpayers can claim their eligible credits effectively.

Lastly, make sure to electronically sign your form using PDFfiller. This optional yet efficient method can expedite your submission. After signing, you can decide whether to submit your form online for a quicker process or print it out and mail it to the Maryland tax office.

Interactive tools for managing Form 500CR

PDFfiller provides interactive tools to enhance your experience when filling out the Maryland Form 500CR. Utilizing their editing tools, you can add text boxes, highlight sections, and even annotate your form, which is highly beneficial for collaborative purposes or when you need to remind yourself of certain entries.

The platform also offers features for securely sharing your completed forms with advisors or team members, ensuring everyone involved can review the document. Additionally, saving options let you keep multiple versions of your form, facilitating easier tracking of changes made over time.

Common mistakes to avoid when filing Form 500CR

When completing the Maryland Form 500CR, several common pitfalls may lead to errors. One significant mistake is neglecting to double-check your personal and financial information, as inaccuracies could delay processing or even result in penalties.

Another frequent issue occurs when taxpayers fail to claim all eligible credits or mistakenly claim ineligible ones. It’s wise to familiarize yourself with available tax credits according to current Maryland tax laws to maximize your potential savings. Lastly, overlooking the filing deadline can lead to missed opportunities; set reminders to ensure timely submissions.

Tracking your form submission status

Once you have submitted your Maryland Form 500CR, it is important to track its submission status. You can verify your submission by contacting the Maryland tax office directly or checking their online portal. Keeping your submission confirmation handy will aid in verifying your status, especially if there are any delays or issues.

If you encounter issues after submission, remain proactive. Contact the Maryland Comptroller’s office to address any discrepancies or to inquire about the status of your application. They can provide guidance on the next steps to take if your form is missing or requires additional information.

FAQs about Maryland Form 500CR

One common question is, what happens if I miss the filing deadline? In such cases, late filing penalties may apply, and it's advisable to file as soon as possible to mitigate potential fines. Can I amend my Form 500CR after submission? Yes, you can file an amended form if you discover an error; just ensure you follow the specific instructions for amendments provided by the Maryland tax office.

Another question often posed is how tax credits impact my overall tax liability. Reducing your tax liability through credits can lower the amount owed or increase your refund, making understanding these credits imperative for effective tax planning. Ensure you're well-versed in the credits applicable to your situation.

Resources for further assistance

For additional help, it's beneficial to reach out directly to the Maryland Comptroller’s office, where staff can provide up-to-date information on tax regulations and filing. They offer various communication channels, including phone support and online resources.

Not only can PDFfiller’s website serve as a great resource for document management and filing, but their customer support is also readily available to assist users facing any challenges while completing forms. They can provide guidance on using the platform effectively and ensure you get your documents in order.

Staying updated on Maryland tax regulations

Tax regulations can change frequently, making it essential for taxpayers to stay informed on any developments that may affect Form 500CR. This can involve subscribing to newsletters from the Maryland Comptroller's office, following their official website for updates, or even joining tax forums to exchange information with fellow taxpayers.

Implementing best practices for document management throughout the year can contribute to a smoother filing experience. Keeping all tax-related documents organized and easily accessible will minimize stress when preparing to file your taxes. Regularly reviewing your financial situation and potential tax credits can also optimize your tax preparation efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my maryland form 500cr in Gmail?

How can I edit maryland form 500cr from Google Drive?

Where do I find maryland form 500cr?

What is maryland form 500cr?

Who is required to file maryland form 500cr?

How to fill out maryland form 500cr?

What is the purpose of maryland form 500cr?

What information must be reported on maryland form 500cr?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.