Get the free Ach Application for Electronic Payments

Get, Create, Make and Sign ach application for electronic

Editing ach application for electronic online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ach application for electronic

How to fill out ach application for electronic

Who needs ach application for electronic?

ACH Application for Electronic Form: A Comprehensive Guide

Understanding ACH and its importance

The Automated Clearing House (ACH) is a crucial electronic payment network that facilitates the transfer of funds between bank accounts across the United States. This system is at the core of various financial transactions such as direct deposits, bill payments, and e-checks. Its importance lies in its ability to streamline payment processes, making them faster and more efficient compared to traditional paper-based methods.

For individuals and businesses alike, the benefits of ACH payments are significant. These payments are not only secure and reliable, but they also reduce transaction costs and minimize the risk of lost or stolen checks. With the rise of digital transactions, embracing ACH payments has become essential for businesses aiming to enhance their payment processing strategies.

The relevance of electronic forms in ACH transactions cannot be overstated. Electronic forms simplify the process of submitting applications for ACH transactions, allowing users to efficiently enter and manage their information while ensuring compliance with necessary regulations.

What is an ACH application for electronic form?

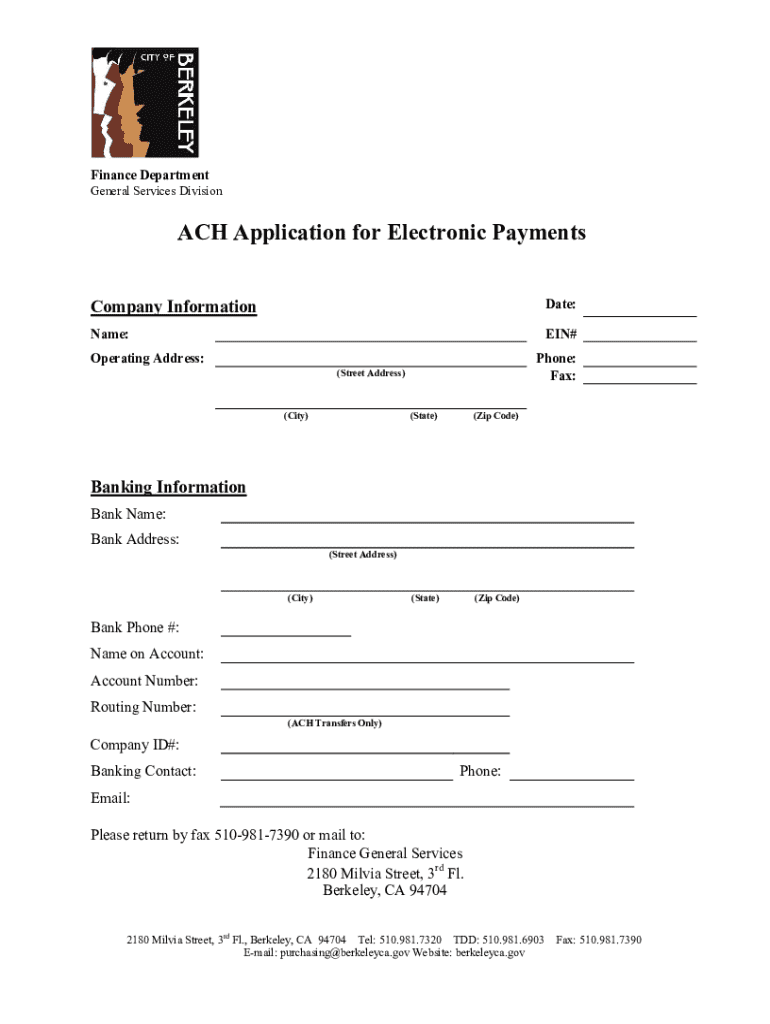

An ACH application form is a document used to authorize the transfer of funds electronically from one bank account to another. This form captures essential details about both the sender and recipient, along with specific transaction preferences. The adoption of electronic forms for ACH applications offers numerous advantages, including ease of use and reduced errors associated with manual entry.

There are two primary types of ACH applications: debit and credit. A debit ACH application allows for funds to be withdrawn from an account, often used for bill payments or subscriptions. In contrast, a credit ACH application deposits funds into an account, such as payroll or client payments. Understanding these types is essential for both individuals and businesses when selecting the appropriate application for their financial transactions.

Key components of an ACH application form

Completing an ACH application form requires specific information to ensure accurate processing. Here are the key components:

Steps to fill out an ACH application for electronic form

Filling out an ACH application using electronic forms is straightforward. Here’s a step-by-step guide to ensuring accuracy:

1. **Accessing the electronic form on pdfFiller**: Begin by logging into your pdfFiller account and navigating to the ACH application form.

2. **Inputting account holder and banking information**: Enter the required personal and banking details accurately to avoid processing delays.

3. **Specifying transaction details**: Indicate whether transactions are one-time or recurring, and specify the amounts to be transferred.

4. **Review and submit**: Double-check all information for accuracy before submitting the application. Ensure that you confirm compliance with any necessary regulations.

Common mistakes to avoid when filling out ACH applications

Many applicants make common errors that can delay processing. To avoid issues, here are mistakes to steer clear of:

Managing your ACH applications

Effective management of ACH applications can simplify your financial processes. With pdfFiller, users can easily save and edit forms, ensuring all information remains current and accurate.

You can also collaborate with team members on an application, which allows for shared input and suggestions before final submission. Utilizing pdfFiller’s eSignature features can expedite the approval process, helping you manage agreements digitally.

Cancellation and modifications of ACH authorizations

Understanding how to effectively cancel or modify ACH authorizations is critical. If you decide to cancel an ACH transaction, the first step is to notify your bank as soon as possible.

The cancellation process typically requires filling out a new ACH application form specifying the authorization to cancel. If you need to change details after submission, it’s advisable to communicate directly with your banking institution and follow their specific procedures for amendments.

Regulatory compliance and best practices

When dealing with ACH transactions, compliance is vital to protect both parties involved. These regulations, governed under 31 CFR Part 210, outline the procedures and requirements for electronic transactions.

It’s essential for users to remain aware of compliance considerations when utilizing electronic forms for ACH applications. Best practices include ensuring the security and privacy of sensitive information captured in electronic forms, protecting against data breaches.

Frequently asked questions about ACH applications

Here are some common queries related to ACH applications that users frequently ask:

Benefits of using pdfFiller for your ACH application needs

Utilizing pdfFiller for your ACH applications presents numerous benefits. The cloud-based platform allows for convenient document management, giving users the ability to access their forms from anywhere.

Interactive tools allow for efficient form filling and customization, ensuring that users can tailor their applications to meet specific needs. Additionally, pdfFiller enables seamless collaboration and sharing options, allowing teams to work together on ACH applications effortlessly.

Advanced features for ACH management on pdfFiller

pdfFiller offers advanced features for effective ACH management. Users can create templates for repetitive ACH applications, significantly reducing the time spent on forms.

Integration capabilities with other financial tools further streamline the ACH process, allowing for improved tracking and reporting of transactions. This sophistication in transaction management makes pdfFiller a robust solution for all your ACH application needs.

Conclusion: Simplifying ACH applications with pdfFiller

Navigating the world of ACH applications doesn't have to be complicated. By embracing electronic forms, users can streamline their payment workflows while maintaining compliance with regulatory requirements.

pdfFiller empowers users to manage their documents effortlessly, making it an ideal platform for anyone looking to simplify their ACH application process. Explore the pdfFiller platform today to experience efficient document handling first-hand.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit ach application for electronic online?

How do I fill out the ach application for electronic form on my smartphone?

Can I edit ach application for electronic on an Android device?

What is ach application for electronic?

Who is required to file ach application for electronic?

How to fill out ach application for electronic?

What is the purpose of ach application for electronic?

What information must be reported on ach application for electronic?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.