Get the free Ach Authorization Form

Get, Create, Make and Sign ach authorization form

How to edit ach authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ach authorization form

How to fill out ach authorization form

Who needs ach authorization form?

ACH Authorization Form: A Comprehensive How-to Guide

Understanding the ACH Authorization Form

An ACH (Automated Clearing House) authorization form is a document that allows an organization or individual to withdraw funds from a bank account electronically. This form is a crucial aspect of electronically transferring funds, ensuring both parties are on the same page regarding payment agreements. By formally documenting the authorization, parties can establish trust and clarity in their financial relationships.

The importance of ACH authorization in financial transactions cannot be overstated. It simplifies payment processes and reduces the chances of errors compared to traditional payment methods like checks. With ACH transactions growing in popularity, knowing the ins and outs of the authorization form can empower individuals and businesses to manage their finances more efficiently.

There are key differences between ACH debit and credit authorization forms. ACH debit allows a business to withdraw funds from a customer's account, while ACH credit enables a company or individual to deposit funds. Understanding these distinctions is essential for selecting the correct form for your specific transaction needs.

Types of ACH Authorization Forms

ACH authorization forms come in several formats to accommodate different preferences and scenarios. Each type has its own benefits and best use cases, making it essential to understand the options available.

1. Paper Forms: These are traditional printed forms that can be filled out by hand and submitted physically. They are often used by companies that prefer paper records and require signatures to be more formal.

2. Electronic Authorization Forms: Widely used in today's digital age, these forms can be filled out online and submitted with just a few clicks. They often incorporate e-signature technology and can streamline the payment process significantly.

3. Verbal Authorization: This is typically used for transactions where parties are known to each other, such as small businesses. However, verbal authorization lacks the formal documentation that paper and electronic forms provide.

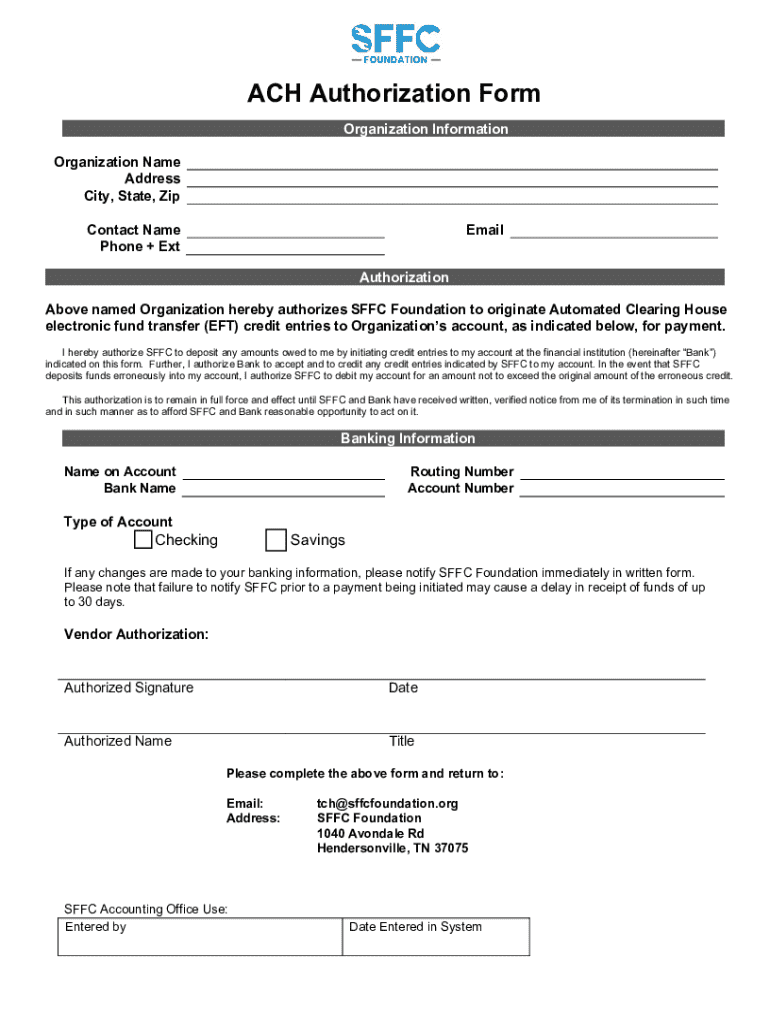

Essential Components of an ACH Authorization Form

Completing an ACH authorization form accurately is crucial to prevent any payment issues. Here are the essential components that need to be included for a successful transaction:

Steps to Fill Out an ACH Authorization Form

Filling out an ACH authorization form doesn't have to be complicated. Follow these detailed instructions for a seamless experience:

1. Start with your account holder details. Fill in your full name, permanent address, and contact information accurately.

2. Next, provide your bank account details. Double-check the bank name and verify that the account number and routing number are correct.

3. Clearly articulate the transaction details. Specify if it is a one-time payment or a recurring transaction. Indicate the payment amount and its intended purpose.

4. Draft a clear authorization statement that aligns with legal standards. This will diminish misunderstandings and protect both parties.

5. Finally, provide your signature and date it appropriately. If using an electronic form, ensure you use secure e-signature methods for verifiability.

Creating a customized ACH authorization form with pdfFiller

Creating a customized ACH authorization form with pdfFiller is straightforward with its intuitive interface. You can start by selecting a template that fits your needs, or build one from scratch using the platform's editing tools.

pdfFiller offers a range of customization options, allowing you to add fields, change fonts, and incorporate logos for branding purposes. With its eSignature features, you can ensure that the form is securely signed, adding an extra layer of authenticity to your document.

Take advantage of the platform's features for seamless document workflows, from editing to signing. You can personalize your form to meet specific transaction requirements, significantly enhancing the process.

Canceling an ACH Authorization

Cancellation procedures for ACH authorizations can vary, but it's crucial to follow specific guidelines to avoid unauthorized transactions. Generally, cancellation requires that the account holder contacts the organization to halt future transactions.

1. Understand the time frame for canceling authorization, which can depend on the transaction type or company policies.

2. Collect necessary information for the cancellation request, including account details, the type of transaction, and your contact information.

Best practices include getting written confirmation of the cancellation and keeping a record of all communication regarding the cancellation process to protect your interests.

Compliance and best practices

Compliance with legal standards is vital when managing ACH transactions. Staying informed about relevant regulations, such as NACHA rules and GDPR, ensures that organizations uphold consumer rights and protect sensitive information.

Some essential best practices involve periodically reviewing your transaction security protocols, ensuring that personal information is encrypted, and maintaining transparent communication with parties involved in the transactions.

Frequently Asked Questions (FAQs)

1. What to do if payment doesn’t go through? If a payment fails, double-check the provided bank details and contact your bank for assistance. It’s crucial to rectify any errors quickly.

2. How to update bank account information? To update, communicate with the organization holding the authorization and provide them with the new details using an updated ACH authorization form.

3. Troubleshooting common issues with ACH transactions often involves reviewing transaction history and ensuring both parties fulfill their responsibilities as outlined in the authorization form.

Using pdfFiller to manage your ACH authorizations

pdfFiller's cloud-based platform allows users to manage ACH authorizations with ease. You can create, edit, and store all documents securely from anywhere with internet access. This flexibility is particularly beneficial for teams that need to collaborate on financial documents.

The collaborative features enable team members to give feedback, add their input, and approve the documents in real-time, streamlining the authorization process. Additionally, access is hassle-free, allowing users to continually stay updated on their document statuses and manage changes on the go.

Additional considerations

Understanding the role of ACH authorizations in modern banking is essential as more consumers turn to electronic payment methods. With the increasing reliance on digital transactions, it's important to remain informed about compliance, security threats, and customer experience.

Looking ahead, future trends in ACH transactions are likely to involve greater integration with blockchain technology, potentially enhancing security and transaction verification. Keeping an eye on these developments will be crucial for individuals and companies alike as they navigate the evolving digital payment landscape.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit ach authorization form from Google Drive?

How can I edit ach authorization form on a smartphone?

How do I complete ach authorization form on an Android device?

What is ach authorization form?

Who is required to file ach authorization form?

How to fill out ach authorization form?

What is the purpose of ach authorization form?

What information must be reported on ach authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.