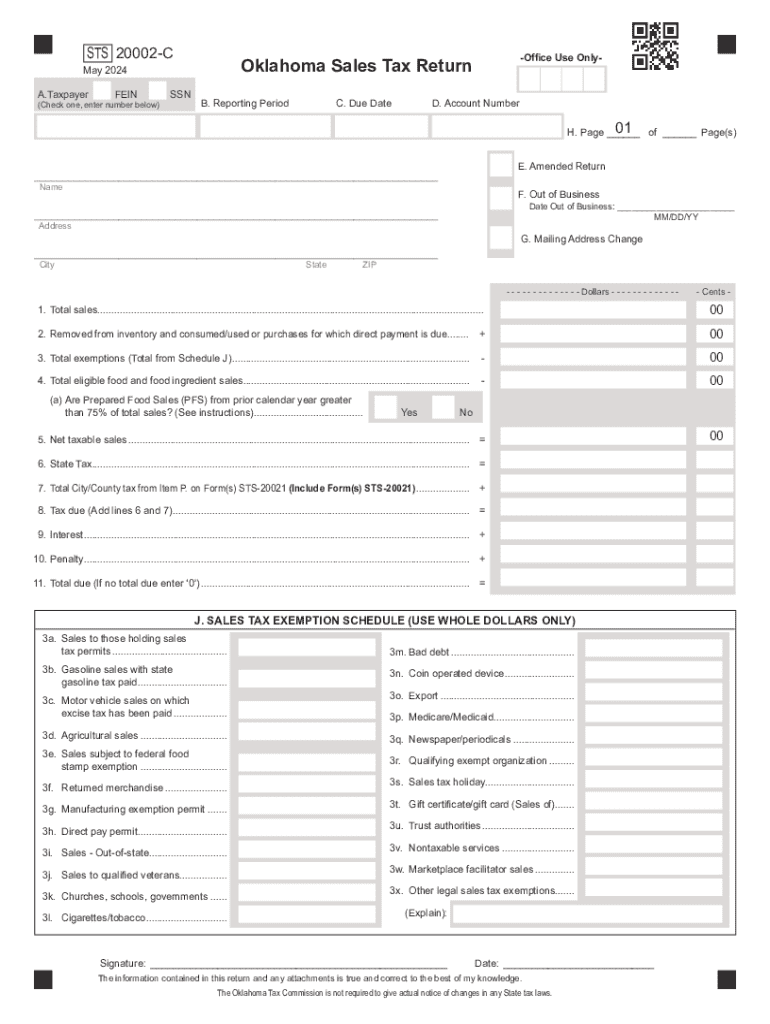

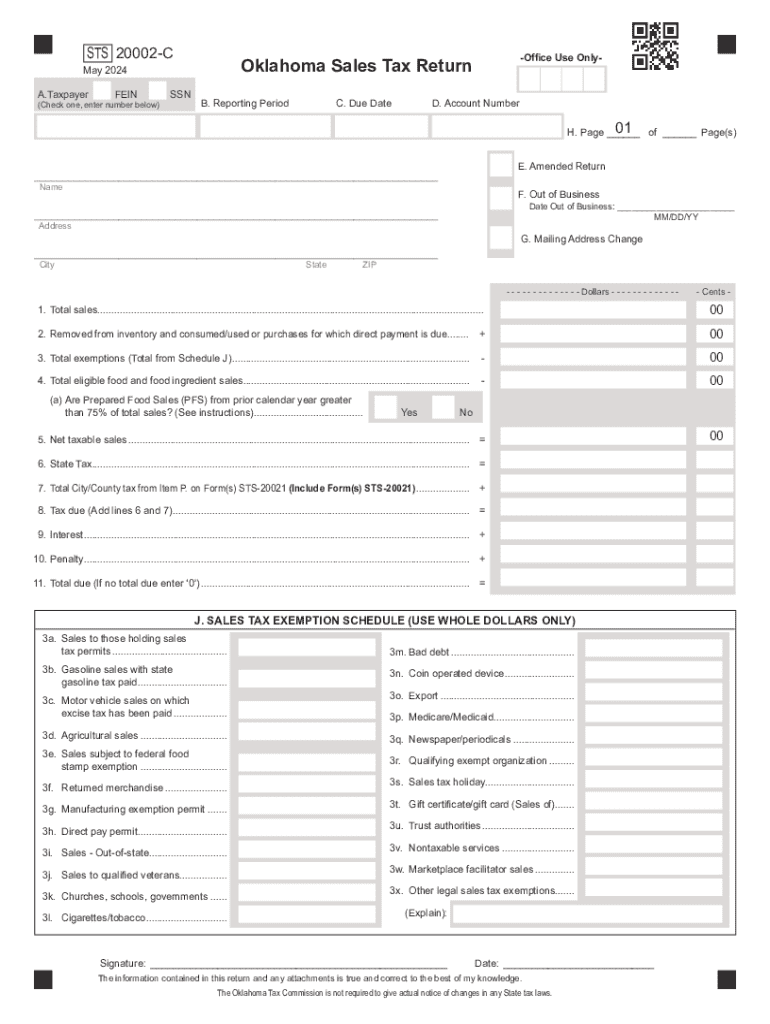

Get the free Oklahoma Sales Tax Return

Get, Create, Make and Sign oklahoma sales tax return

How to edit oklahoma sales tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out oklahoma sales tax return

How to fill out oklahoma sales tax return

Who needs oklahoma sales tax return?

Everything You Need to Know About the Oklahoma Sales Tax Return Form

Understanding the Oklahoma sales tax system

Oklahoma imposes a sales tax on the sale of tangible personal property and certain services. This tax is crucial for funding various state services, including education, infrastructure, and public safety. Compliance with sales tax regulations is essential for businesses to avoid penalties and ensure smooth operations.

In Oklahoma, the standard sales tax rate is currently set at 4.5%, but local municipalities can impose additional taxes, making the effective rate higher in certain areas. It is important for business owners to be aware of their specific location’s tax rates and regulations.

Any business that sells goods or services subject to sales tax must file a sales tax return. This applies to both in-state and out-of-state vendors selling to Oklahoma residents. Timely and accurate filings are essential for maintaining good standing with the Oklahoma Tax Commission.

Types of Oklahoma sales tax returns

Oklahoma offers different filing frequencies for businesses based on their sales volume. Businesses might need to file monthly, quarterly, or annually, depending on factors such as their taxable sales and previous compliance history.

Additionally, different forms are used based on the type of business: retailers will use Form STS-100, wholesalers might use Form STS-200, and service providers will have their specific forms as well.

Where to find the Oklahoma sales tax return form

The official Oklahoma sales tax return form can be easily accessed through the Oklahoma Tax Commission's website. A direct link to the form is often available in PDF format, allowing for convenient download and print.

Alternatively, you can find forms from various resources online, but it’s crucial to ensure they are the most current versions. For ease, pdfFiller provides a platform to access, edit, and download these forms efficiently.

Using pdfFiller, you can seamlessly access the sales tax return form along with additional tools that simplify the document management process.

Step-by-step guide to filling out the Oklahoma sales tax return form

Filling out the Oklahoma sales tax return form involves several essential sections that require accuracy and attention to detail.

Tips for editing and managing your sales tax return with pdfFiller

pdfFiller significantly simplifies the editing process of the sales tax return form, allowing users to make adjustments as needed without bulky paperwork. Features enable users to collaborate with other team members, which can be particularly helpful for ensuring accuracy and compliance.

The platform also provides options to save and store forms for easy access in the future, which adds another layer of convenience for busy business owners.

Frequently asked questions about the Oklahoma sales tax return

Filing taxes can often bring up numerous questions. Here are some of the most common inquiries regarding the Oklahoma sales tax return process.

Troubleshooting common issues

Despite best efforts, issues may still arise during the filing process. Common reasons for sales tax return rejections often include incomplete forms, incorrect calculations, or mismatched data with existing records.

If you encounter a discrepancy, the best course of action is to gather relevant documents, review your submission for errors, and consult the Oklahoma Tax Commission support for guidance.

Additional tools and resources for Oklahoma businesses

To assist Oklahoma businesses, various resources are available that include tax calculators, interactive tools, and additional forms outlined by the Oklahoma Tax Commission.

Engaging with tax professionals or local resources can also provide valuable insights into better managing sales tax and maintaining compliance with current regulations.

Staying compliant: Key deadlines and filing frequencies

Keeping track of filing frequencies and deadlines is essential. Monthly filings are generally due by the 20th of the following month, while quarterly and annual deadlines vary.

It is crucial to maintain awareness of any changes in sales tax regulations, as they can affect business operations and compliance requirements.

User experiences: Testimonials and case studies

Many users have found success in filing their Oklahoma sales tax return using platforms like pdfFiller. Testimonials highlight the ease of use, the simplicity of filling out the forms, and the efficiency gained during the entire process.

Customer stories emphasize how leveraging technology transformed their approach to tax filings, enabling smoother operations and reducing stress.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send oklahoma sales tax return to be eSigned by others?

Where do I find oklahoma sales tax return?

How do I edit oklahoma sales tax return on an iOS device?

What is oklahoma sales tax return?

Who is required to file oklahoma sales tax return?

How to fill out oklahoma sales tax return?

What is the purpose of oklahoma sales tax return?

What information must be reported on oklahoma sales tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.