Get the free Hmc Employee Gift Payroll Deduction

Get, Create, Make and Sign hmc employee gift payroll

Editing hmc employee gift payroll online

Uncompromising security for your PDF editing and eSignature needs

How to fill out hmc employee gift payroll

How to fill out hmc employee gift payroll

Who needs hmc employee gift payroll?

HMC Employee Gift Payroll Form: A Comprehensive Guide

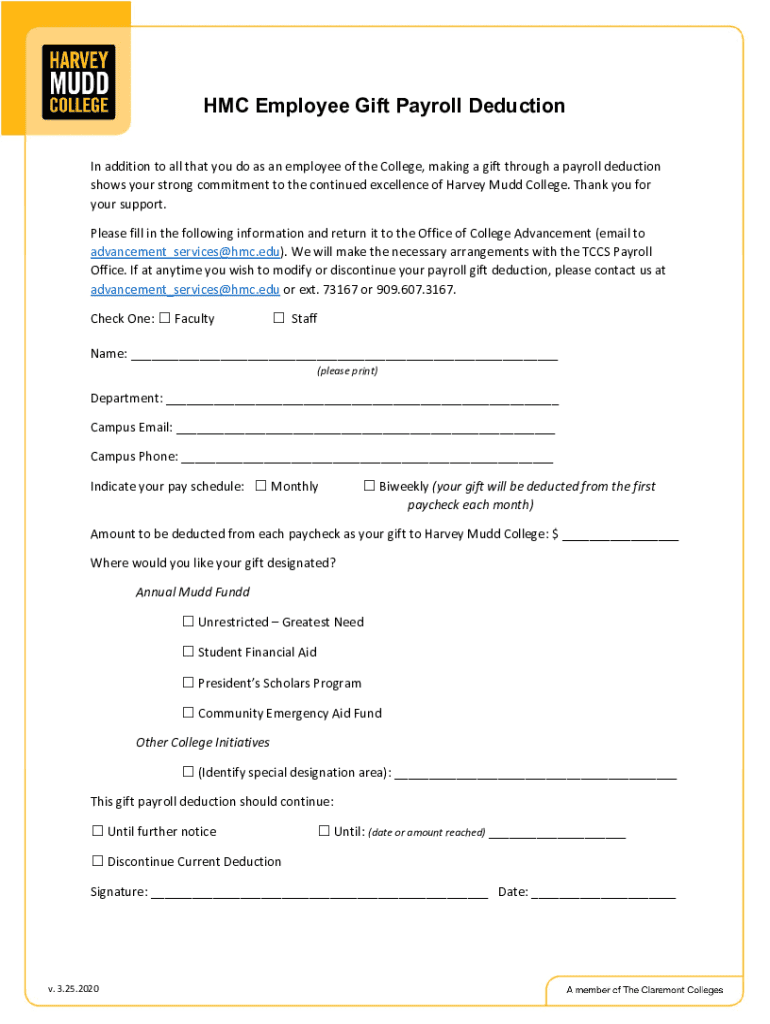

Understanding the HMC Employee Gift Payroll Form

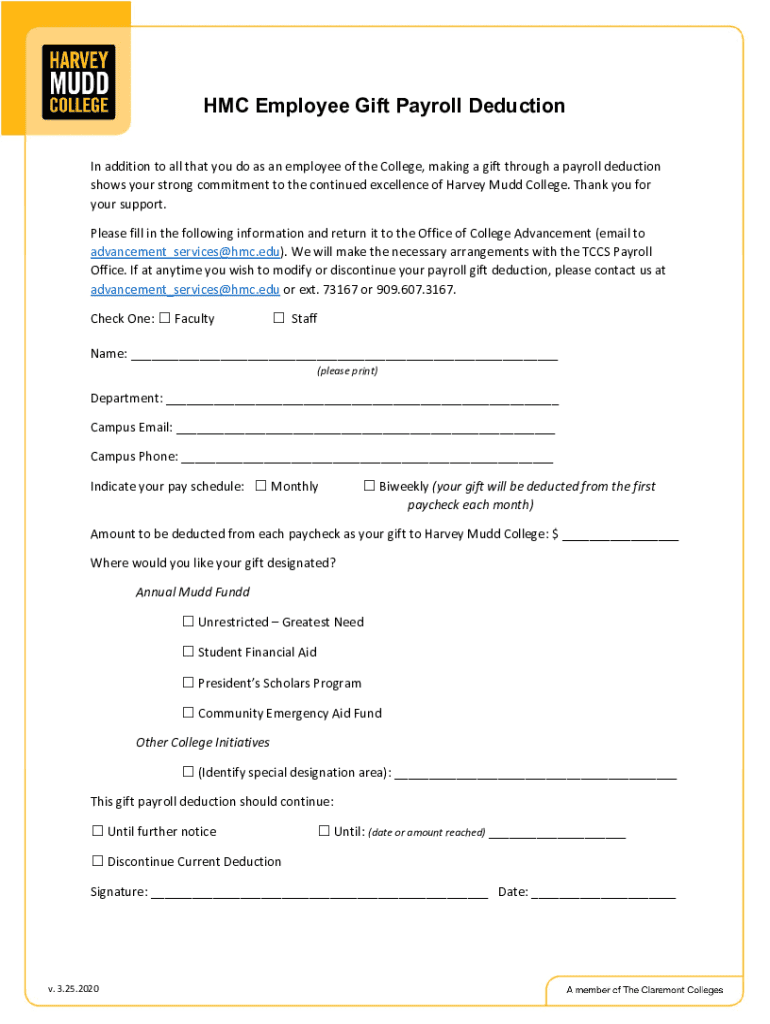

The HMC Employee Gift Payroll Form is an essential document utilized for employees wishing to contribute to gift programs or charitable donations directly from their payroll. This streamlined process ensures that monetary gifts or contributions can be made effortlessly through automatic deductions. The form is particularly valuable for organizations looking to facilitate employee participation in gift-giving initiatives while maintaining compliance with payroll regulations.

By using the HMC Employee Gift Payroll Form, employees can easily allocate a portion of their salary to specific causes or gifts, fostering a culture of philanthropy within the workplace. This not only enhances camaraderie among team members but also contributes to community welfare, reinforcing the organization's commitment to social responsibility.

Who can utilize the HMC Employee Gift Payroll Form?

Eligibility to use the HMC Employee Gift Payroll Form typically applies to all full-time or part-time employees within an organization that has adopted this method of supporting charitable initiatives. Depending on the specific policies of the organization, temporary staff or contractors may also be invited to participate, significantly broadening the impact of these gift-giving programs.

Within organizations, teams can leverage this form to collectively contribute toward shared goals or projects, enhancing unity and collaboration. Testimonials from users highlight the positive feedback this initiative receives, often noting increased engagement and satisfaction derived from participating in meaningful causes.

Step-by-step instructions for completing the form

Accessing and filling out the HMC Employee Gift Payroll Form is a straightforward process. Begin by visiting the pdfFiller platform, where the form can easily be located. Searching for 'HMC Employee Gift Payroll Form' in the provided search bar on pdfFiller will direct you to the document. Familiarize yourself with the layout, taking note of the various sections that need to be filled out.

Essential sections of the form include personal information, details regarding the gift or contribution, and payroll deduction options. Ensuring all information is accurate is crucial as it directly affects payroll processing. Once you’ve filled out the form, it’s important to review your entries carefully before submitting the form to avoid any discrepancies.

Editing and managing your form

After submission, users often find themselves needing to make adjustments or edits. Fortunately, pdfFiller offers robust editing tools that allow you to modify your form after it has been submitted. Whether it's correcting details or updating contribution amounts, the platform provides a seamless way to manage your document.

In addition to individual edits, collaborating with HR or finance teams becomes significantly easier through pdfFiller's functionality. Version control is essential for maintaining accurate records, and users can access previous versions of their form to track changes over time. This capability ensures that you maintain an organized approach to your contributions.

E-signing your employee gift payroll form

E-signatures are a vital component of the HMC Employee Gift Payroll Form as they ensure the authenticity and compliance of the document. The process of adding your signature is straightforward with pdfFiller. This feature not only expedites the submission process but also ensures that your form holds legal validity. Employees should follow the simple prompts within pdfFiller to affix their e-signature quickly.

It's critical to remember that the integrity of e-signatures serves as a safeguard against unauthorized changes, giving both employees and employers peace of mind. Full compliance with legal requirements is guaranteed when using pdfFiller for electronic document management.

Additional features of pdfFiller that enhance your experience

pdfFiller is designed to elevate the document management experience through various features. Document management capabilities allow users to organize, categorize, and retrieve their forms and documents easily. This means that users can find their HMC Employee Gift Payroll Form among other essential documents at a moment’s notice, enhancing productivity.

Moreover, pdfFiller’s cloud-based access means you can manage your documents from anywhere in the world. The mobile accessibility feature is a game changer, enabling users to edit or sign their forms on-the-go. This flexibility caters to today’s work environment where remote and flexible work arrangements are becoming the norm.

FAQs about the HMC Employee Gift Payroll Form

When creating the HMC Employee Gift Payroll Form or considering participation in gift programs, employees often have questions. Common concerns include how personal data will be handled, what happens if a contribution amount changes, or how payroll deductions are processed. Transparency is key, and organizations typically ensure robust measures are in place to protect employee privacy.

Additionally, understanding the processing of deductions is essential. Most payroll systems handle these transactions seamlessly, ensuring that contributions are deducted from paychecks in a timely manner. Employees can ease any uncertainties by reaching out to HR or reviewing company policies concerning payroll deductions.

Related forms and tools on pdfFiller

In addition to the HMC Employee Gift Payroll Form, pdfFiller offers a variety of other payroll deduction forms that can complement your charitable giving efforts. Exploring related forms provides users with a broader perspective on available employee contribution options, allowing individuals and teams to maximize their giving experiences.

Comparing different forms and tools, users can find the best fit for their needs. This exploration ultimately helps in maximizing contributions through various forms, encouraging a spirit of giving throughout the organization and making the most of available resources.

Case studies: successful employee gift programs

Numerous organizations have successfully implemented employee gift programs using the HMC Employee Gift Payroll Form, demonstrating the positive impact of collective giving. For instance, a nonprofit organization that encourages employee contributions for local charities has seen a significant increase in participation since adopting this form. The feedback indicates a stronger sense of community and enhanced workplace morale among employees.

These case studies reveal that employee gift programs can strengthen company culture and brand image. By investing in community initiatives, organizations not only support external causes but also foster loyalty and engagement within their teams, showcasing the transformative potential of structured giving programs.

Contacting support for further assistance

Should you encounter any challenges while using the HMC Employee Gift Payroll Form, reaching out to pdfFiller’s customer support is recommended. The support team can assist you with detailed queries regarding the form or any aspect of the pdfFiller platform. Whether you have questions about the filling process or require troubleshooting assistance, help is just a call or click away.

Knowing when to seek support is key. If you experience difficulty during the submission or editing processes, contacting customer support can save time and prevent frustration. Additionally, pdfFiller provides a range of online resources and help articles that can guide you through common issues and FAQs related to the payroll form.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send hmc employee gift payroll to be eSigned by others?

How do I edit hmc employee gift payroll straight from my smartphone?

How do I fill out hmc employee gift payroll using my mobile device?

What is hmc employee gift payroll?

Who is required to file hmc employee gift payroll?

How to fill out hmc employee gift payroll?

What is the purpose of hmc employee gift payroll?

What information must be reported on hmc employee gift payroll?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.