Get the free Risd Travel Expense Sheet

Get, Create, Make and Sign risd travel expense sheet

How to edit risd travel expense sheet online

Uncompromising security for your PDF editing and eSignature needs

How to fill out risd travel expense sheet

How to fill out risd travel expense sheet

Who needs risd travel expense sheet?

Comprehensive Guide to the RISD Travel Expense Sheet Form

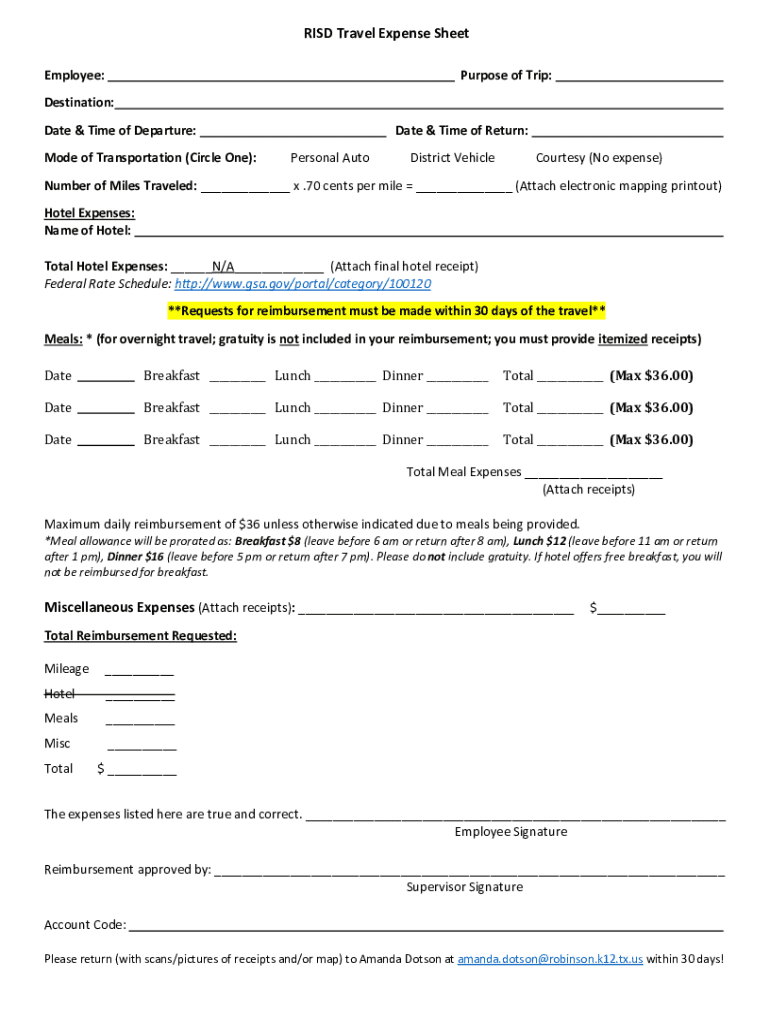

Overview of the RISD Travel Expense Sheet

The RISD Travel Expense Sheet is an essential tool for employees of the Rhode Island School of Design (RISD) to document and report their work-related travel expenses. This structured form ensures that all expenditures are recorded accurately and efficiently, providing a clear overview of costs incurred during business travel. For RISD employees and stakeholders, utilizing this expense sheet is not just a matter of compliance but also crucial for budget management and financial transparency.

The primary benefit of using a standardized travel expense sheet is that it simplifies the reimbursement process. Employees can clearly categorize their expenses, which expedites approval and reimbursement times. Moreover, it enhances organizational accuracy, reducing the chances of errors that could negatively impact budgeting decisions or lead to compliance issues with institutional financial policies.

Features of the RISD Travel Expense Sheet Form

The RISD Travel Expense Sheet Form is designed with user-friendliness and accessibility in mind. Its intuitive layout allows employees to navigate easily while ensuring that all required information is collected. The form operates entirely online, utilizing a cloud-based platform that allows users to access it from any device, at any time, which is particularly beneficial for those frequently on the go.

Interactive tools are integrated into the form, enabling users to calculate their expenses effortlessly. This real-time calculation minimizes the risk of mathematical errors that could delay processing. Additionally, it supports electronic signatures through pdfFiller, allowing for a seamless approval process without the need for printing or scanning documents.

Steps to access the RISD Travel Expense Sheet Form

Accessing the RISD Travel Expense Sheet Form is straightforward, allowing employees to focus on their reimbursement needs rather than navigating complex systems. Follow these simple steps:

Detailed instructions for filling out the form

When filling out the RISD Travel Expense Sheet, accuracy is paramount. Start by entering the required information, which includes essential personal details and specifics regarding your trip. These details typically encompass your name, department, travel dates, locations visited, and the purpose of your travel.

Next, you will need to document your expenses. This includes various categories, such as transportation costs—airfare, mileage, parking fees, etc.—alongside accommodation costs like hotel fees and taxes. Meal allowances also need attention; decide whether you'll report actual meal costs or opt for pre-defined per diem rates.

Documentation requirements are another crucial aspect. Be sure to include required receipts for all expenses, as the absence of proper substantiation may delay reimbursement. Each expense must be backed by valid proof to ensure that processing goes smoothly.

Editing and managing the RISD Travel Expense Sheet

Editing your RISD Travel Expense Sheet is simple, thanks to pdfFiller's robust set of editing tools. Users can add notes or comments directly to the form, which can be incredibly beneficial for clarifying specific expenses or providing additional context. If adjustments are necessary, the form allows for quick modifications to expense entries before final submission.

Once your form is complete, you have multiple saving and exporting options. You can save your expense report in PDF format, ensuring it maintains its professional appearance. Additionally, pdfFiller allows users to email the completed form directly from the platform, streamlining the process and keeping everything organized.

Electronic signature process

Signing the RISD Travel Expense Sheet electronically via pdfFiller is a crucial step in the submission process. To eSign, simply follow the guided prompts within the platform, making it straightforward and efficient. Electronic signatures not only expedite the approval process but also make it easier to track who has signed off on the document.

The benefits of electronic signatures extend beyond convenience; they also ensure compliance with legal standards that govern the validity of signed documents. This provides peace of mind for employees and organizations alike, knowing that their expense reports are processed reliably and efficiently.

Submitting the RISD Travel Expense Sheet

After completing and signing your RISD Travel Expense Sheet, the next step is to submit it correctly. The submission process for RISD typically involves emailing the completed form to the designated finance department, or it may have a specific online portal set up for easy uploads. It's crucial to familiarize yourself with these procedures to avoid any hiccups.

Along with submission processes, it's essential to be aware of deadlines for expense reporting to ensure timely reimbursement. Missing these deadlines can lead to delays or even the rejection of expense claims. Common pitfalls include not including all necessary documentation, submitting after the deadline, or failing to follow electronic submission protocols.

FAQs regarding the RISD Travel Expense Sheet

When using the RISD Travel Expense Sheet, employees often have questions about the intricacies of the process. Here are some frequently asked questions:

Support and resources

For users needing assistance with the RISD Travel Expense Sheet, pdfFiller offers customer support that can help address various issues. Whether you encounter technical difficulties or have questions about the form itself, their team is readily available to assist.

Additionally, pdfFiller provides valuable tutorials and webinars designed to enhance user understanding and efficiency when using the Travel Expense Sheet form. For RISD-specific inquiries, employees can contact their finance department for detailed guidance on policies and procedures related to expense reporting.

Tips for efficient expense reporting

To streamline your experience with the RISD Travel Expense Sheet, it is advisable to adopt several best practices for documenting travel expenses. Regularly update your receipts and keep them organized by category, which can save time and avoid last-minute scrambling before submission.

Stay informed about RISD’s travel policies and regulations, as these can change and may affect your allowable expenses. Utilizing digital tools such as expense tracking apps or the integrated features on pdfFiller can further enhance your ability to manage expenses effectively.

Testimonials from users

Many RISD employees have reported positive experiences using the RISD Travel Expense Sheet Form through pdfFiller. Users appreciate the convenience of being able to fill out forms online from anywhere and have noted that the interactive features make tracking expenses significantly easier compared to traditional methods.

Success stories highlight how employees have effectively managed their travel expenses without the usual headaches. By using the structured format offered by pdfFiller, users feel more confident submitting their reports, knowing they have a reliable process that adheres to institutional requirements.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete risd travel expense sheet online?

How do I edit risd travel expense sheet on an Android device?

How do I complete risd travel expense sheet on an Android device?

What is risd travel expense sheet?

Who is required to file risd travel expense sheet?

How to fill out risd travel expense sheet?

What is the purpose of risd travel expense sheet?

What information must be reported on risd travel expense sheet?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.