Get the free Direct Deposit Authorization Form

Get, Create, Make and Sign direct deposit authorization form

How to edit direct deposit authorization form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct deposit authorization form

How to fill out direct deposit authorization form

Who needs direct deposit authorization form?

Direct deposit authorization form: A comprehensive how-to guide

Understanding direct deposit

Direct deposit is a banking feature that enables funds to be transferred electronically into your bank account without the need for paper checks. This method has gained widespread popularity due to its convenience and efficiency.

The benefits of using direct deposit over traditional methods are numerous. For one, it allows for faster access to your funds, often on the same day they are released. This means no more waiting for checks to clear. Those who rely on regular payments, such as salaries, appreciate the enhanced security this method provides, reducing the risk of lost or stolen checks.

Another advantage is the consistency in payment scheduling; funds are automatically deposited on predetermined dates, making financial planning simpler. Common use cases of direct deposits include payroll payments, government benefits (like Social Security), and the quick distribution of tax refunds.

Overview of the direct deposit authorization form

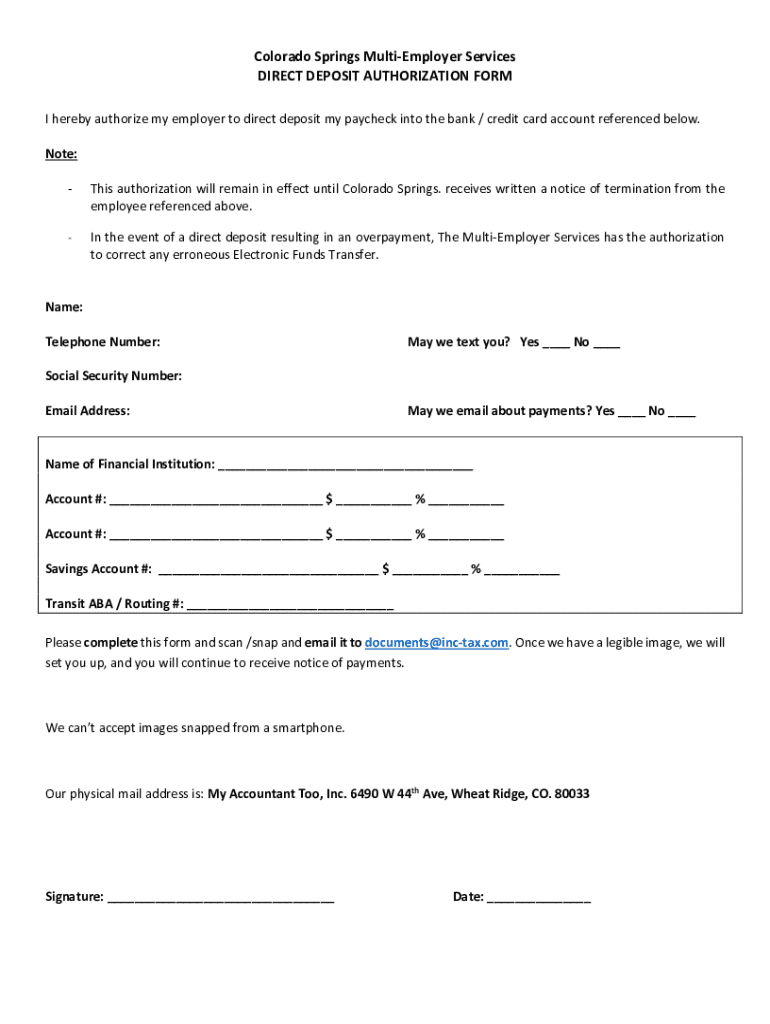

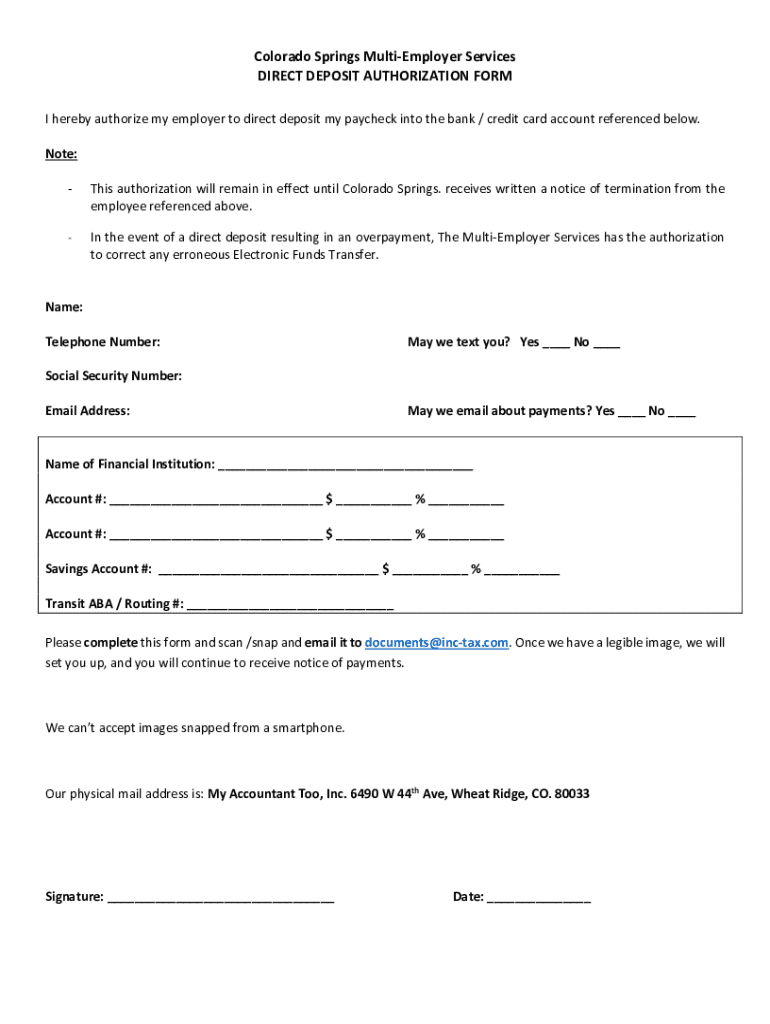

The direct deposit authorization form serves a critical purpose: it grants the organization or financial institution permission to deposit funds directly into your bank account. This form is essential as it lays out the terms under which payments will be made and ensures that your sensitive banking information is handled securely.

Key elements included in the form typically encompass a personal information section, detailing your name, address, and other identifying details; bank account specifics such as the routing and account numbers; and an authorization signature to confirm that you permit the deposit. Accuracy is paramount; mistakes in your information can lead to significant delays or complications with your funds.

How to obtain the direct deposit authorization form

You can easily obtain the direct deposit authorization form by downloading it from pdfFiller. Simply navigate to their website, search for the form template, and follow the prompts to access it. An in-depth guide on this process makes it simple for anyone new to the platform.

Alternative sources for this form include your employer’s website or the appropriate government agencies if you’re applying for benefits like Social Security. When choosing the form version, ensure you differentiate between forms required by various institutions, as they may have different requirements.

Filling out the direct deposit authorization form

Filling out the direct deposit authorization form requires careful attention to detail in several sections. Start with the personal information area. Here, you’ll need to provide your full name, address, and contact information.

The bank information section is crucial. It’s where you identify whether you are using a checking or savings account, and input your bank’s routing number along with your account number. In the authorization section, you'll be required to proudly sign and date to affirm your consent for direct deposits to occur. To avoid common mistakes, double-check your bank details and ensure you do not overlook filling in your signature.

Editing the direct deposit authorization form

If you need to make changes to the direct deposit authorization form after filling it out, pdfFiller’s editing tools simplify this process. Whether you need to adjust your account number or update your address, the platform allows users to make edits seamlessly while ensuring changes are tracked.

It's also important to ensure your editing complies with your bank's requirements. Always verify the specific guidelines that your financial institution mandates for form submission to avoid any mishaps.

Signing the direct deposit authorization form

Signing the direct deposit authorization form is a significant step, as it legally authorizes your chosen financial institution to process your deposits. It's essential to understand the nuances of eSignatures; they are legally binding in many jurisdictions, making them a secure alternative to traditional signing methods.

As you prepare to eSign using pdfFiller, take note of the easy-to-follow process involving electronic signatures. Options for securely sharing the signed form with HR or your financial institution are built into the platform, offering peace of mind when transmitting sensitive information.

Submitting the direct deposit authorization form

Once your direct deposit authorization form is filled out and signed, you have several submission methods available. You can submit it in person, via email, through a secure digital upload on your employer’s portal, or even via fax, depending on your organization's preferred process.

After submission, confirm receipt with your employer or bank to ensure that your application for direct deposit is being processed. Keeping an eye on the timing for activation is essential, as direct deposits typically take one to two full pay cycles to be set up.

Managing your direct deposit information

Managing your direct deposit information means keeping it current. It’s necessary to submit a new authorization form whenever there are changes, such as switching banks or accounts, to ensure continuity of services.

If you want to cancel or change your existing direct deposit setup, it’s crucial to understand your rights and responsibilities. Each bank or employer might have their own processes regarding how to stop direct deposits or make changes, along with relevant legal and financial considerations, which should be consulted.

Common issues faced by individuals include delays in payments or incorrect deposits. Having a mechanism to report or track these problems can be beneficial to resolve them swiftly.

Frequently asked questions about direct deposit authorization forms

Many individuals have questions surrounding direct deposit. What should you do if you encounter problems with your direct deposit? The best first step is to contact your employer or bank immediately to address any issues.

Security concerns are common, especially regarding personal information on the authorization form. To safeguard your data, only provide it through secure portals and to trusted institutions. Lastly, new employees often have queries about setting up direct deposit, so familiarizing yourself with the process can ease this transition.

Utilizing pdfFiller for enhanced document management

pdfFiller offers a robust platform for users wishing to manage their documents effectively, providing features tailored to both individuals and teams. Collaborative tools enable team members to work together seamlessly on forms, while cloud storage ensures that documents are readily accessible and updated.

Case studies from satisfied users illustrate how pdfFiller has transformed workflows, particularly regarding managing direct deposit authorization forms, optimizing both efficiency and accuracy.

Best practices for efficient document handling

Maintaining an organized system for your financial documents, particularly around direct deposit information, plays a crucial role in overall financial health. Schedule regular reviews to keep track of submission deadlines and any changes needed for your accounts.

Utilizing pdfFiller’s reminders and alerts can provide additional assistance to ensure you never miss an important deadline. This proactive approach helps in managing your direct deposit setup and ensures funds are properly directed to your financial resources.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find direct deposit authorization form?

How can I edit direct deposit authorization form on a smartphone?

How do I fill out the direct deposit authorization form form on my smartphone?

What is direct deposit authorization form?

Who is required to file direct deposit authorization form?

How to fill out direct deposit authorization form?

What is the purpose of direct deposit authorization form?

What information must be reported on direct deposit authorization form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.