Chattel mortgage template form - How-to Guide

Understanding chattel mortgages

A chattel mortgage is a secured loan where the borrower provides movable property as collateral. Unlike traditional real estate mortgages, which secure land or buildings, chattel mortgages are specifically designed for financing movable assets, such as cars, machinery, or furniture. This financial structure helps both individuals and businesses acquire necessary equipment without the upfront costs, making cash flow management more efficient.

Chattel mortgages differ significantly from traditional mortgages in terms of legal implications and structures. For example, while traditional mortgages usually involve a lengthy approval process and apply to immovable properties, chattel mortgages often feature faster approval times and are subject to different regulations. These differences make chattel mortgages an appealing option for those in need of quick financing solutions for movable assets.

Vehicle financing - Cars, trucks, and boats.

Business equipment - Machinery, tools, and computers.

Furniture - Office or household furnishings.

Why you might need a chattel mortgage template

Using a chattel mortgage template can help streamline the document preparation process, ensuring that all essential details are included. This efficiency is critical, especially for entrepreneurs and small business owners who may not have legal expertise. With a chattel mortgage template, the often complicated task of creating legally binding documents becomes straightforward and manageable.

Moreover, templates promote compliance with relevant legal requirements, reducing the risk of disputes that might arise from missing or incorrect information. When both lenders and borrowers use an established framework, they can navigate the complexities of chattel mortgages with confidence, ensuring that their agreements meet all necessary regulatory standards.

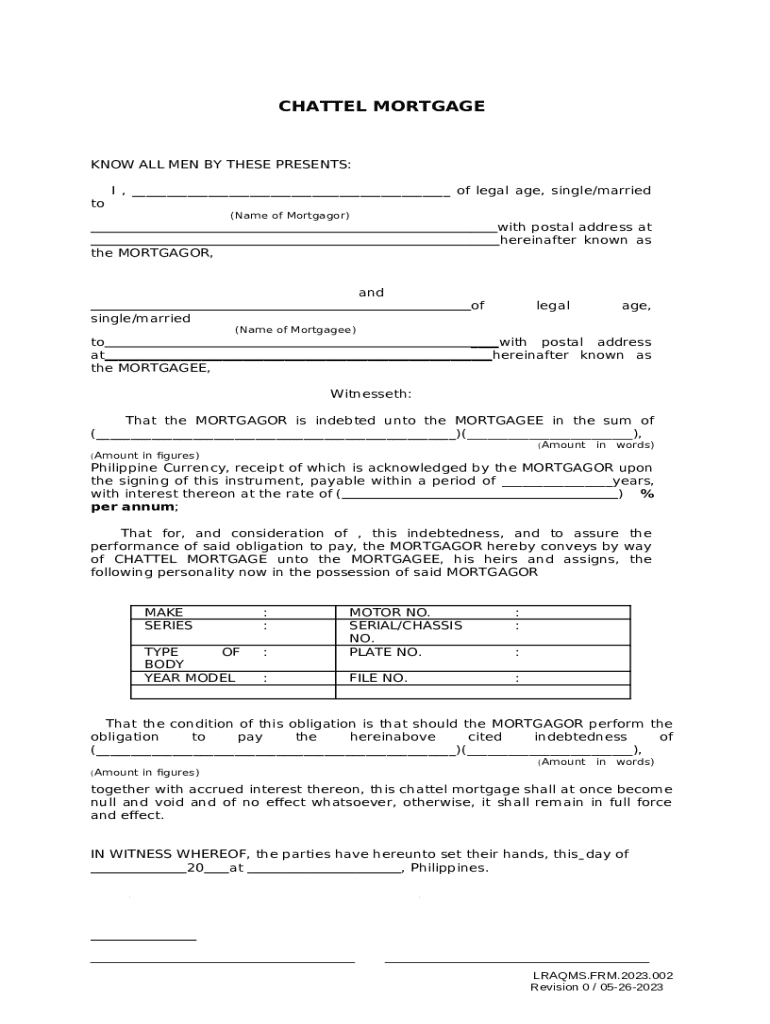

Key components of a chattel mortgage

A comprehensive chattel mortgage template consists of several critical components. Each section plays a vital role in formalizing the agreement between the borrower and lender, creating legally binding obligations that protect both parties involved in the transaction. Key components include the basic borrower and lender details, such as names, addresses, and contact information.

Additionally, a full description of the property being financed is essential, including details like make, model, and identification numbers, which eliminate any ambiguity. The loan terms — including the total amount borrowed, interest rate, and repayment schedule — must also be clearly defined. Further, legal clauses, such as default provisions, governing law, and jurisdiction, will safeguard against potential disputes.

Step-by-step guide to filling out a chattel mortgage template

Before filling out the chattel mortgage template, gather all necessary information and documentation. This preparation is crucial to ensure that no vital details are overlooked. Once you have your documents ready, you can begin completing the template. Start with the personal information section, where you'll input both the borrower’s and lender’s details accurately.

Next, clearly describe the property being financed, capturing all essential identifiers. Follow this by defining the loan terms, specifying the amount, interest rate, and repayment schedule. Ensure that all parties involved sign the document, often requiring witnesses, depending on local laws. It’s wise to double-check all information entered to confirm its accuracy and completeness, preventing any complications in the future.

Editing and customizing your chattel mortgage template

Leveraging pdfFiller’s editing tools can simplify the customization of your chattel mortgage template. Users can easily add or remove clauses as necessary to tailor the agreement to their specific situation. Whether you're financing a vintage car or the latest industrial equipment, customizing the fields in the template allows for flexibility and accuracy.

Maintaining legal integrity while customizing your template is crucial. Ensure any modifications made are compliant with local and national regulations. Following best practices in document creation will help preserve the enforceability of the agreement, mitigating any risks associated with poorly drafted contracts.

eSigning your chattel mortgage

Electronic signatures offer numerous benefits for completing a chattel mortgage. They enhance convenience, security, and compliance, escaping the need for physical presence to sign a document. With advancements in digital signature technology, electronic signatures are now considered legally binding in many jurisdictions.

To eSign using pdfFiller, follow these steps: upload your chattel mortgage template, use the eSigning tool to place signatures where needed, and invite other parties to sign as well. Be sure to confirm that all involved have completed the signing process, ensuring that your document is fully executed and valid.

Managing and storing your chattel mortgage

Proper management and secure storage of your chattel mortgage documents are crucial for future reference. Using cloud-based solutions like pdfFiller allows you to securely save and organize your documents, ensuring they are protected yet easily accessible from anywhere. This accessibility is especially beneficial for business owners who need to reference agreements during financing discussions or audits.

Collaboration features also facilitate sharing and reviewing documents with stakeholders. These features not only streamline communication but can also reduce the time spent on back-and-forth emails, as all parties can provide feedback in real-time.

Common mistakes to avoid with chattel mortgages

When filling out a chattel mortgage, several common pitfalls can arise that should be avoided. Missing key information is one of the most frequent mistakes, leading to complications during enforcement. Incomplete property descriptions can also create challenges when identifying the collateral tied to the loan, particularly if disputes arise.

Legal ramifications of inaccuracies can be severe, potentially leading to costly mistakes or failed financing arrangements. To minimize these risks, double-check your completed document against your preliminary notes, ensuring that every detail is accurate and matches the supporting documentation.

FAQs about chattel mortgages and templates

Understanding the intricacies of chattel mortgages can be daunting, leading many to have similar questions. Common inquiries include the essentials of what a chattel mortgage entails and how it differs from other forms of secured loans. Borrowers often seek clarification on what rights and obligations they hold throughout the loan period.

It’s also essential to understand the legal implications and the expectations that lenders have during the process. By addressing these frequently asked questions, you can equip yourself with the knowledge needed to navigate your chattel mortgage with confidence.

Case studies: Successful use of chattel mortgages

Real-world examples can illustrate the effectiveness of chattel mortgages. Many individuals and businesses have successfully leveraged finances through chattel mortgages, allowing them to attain essential equipment without depleting cash reserves. For instance, a local contracting firm used a chattel mortgage to finance new excavation equipment, which enabled them to expand their service offerings and significantly increase revenues.

In these scenarios, a chattel mortgage template played an integral role in structuring agreements efficiently and correctly, leading to prompt funding and smoother transactions. Understanding how to effectively utilize a chattel mortgage template not only empowers users to make informed decisions but also facilitates successful financing ventures.