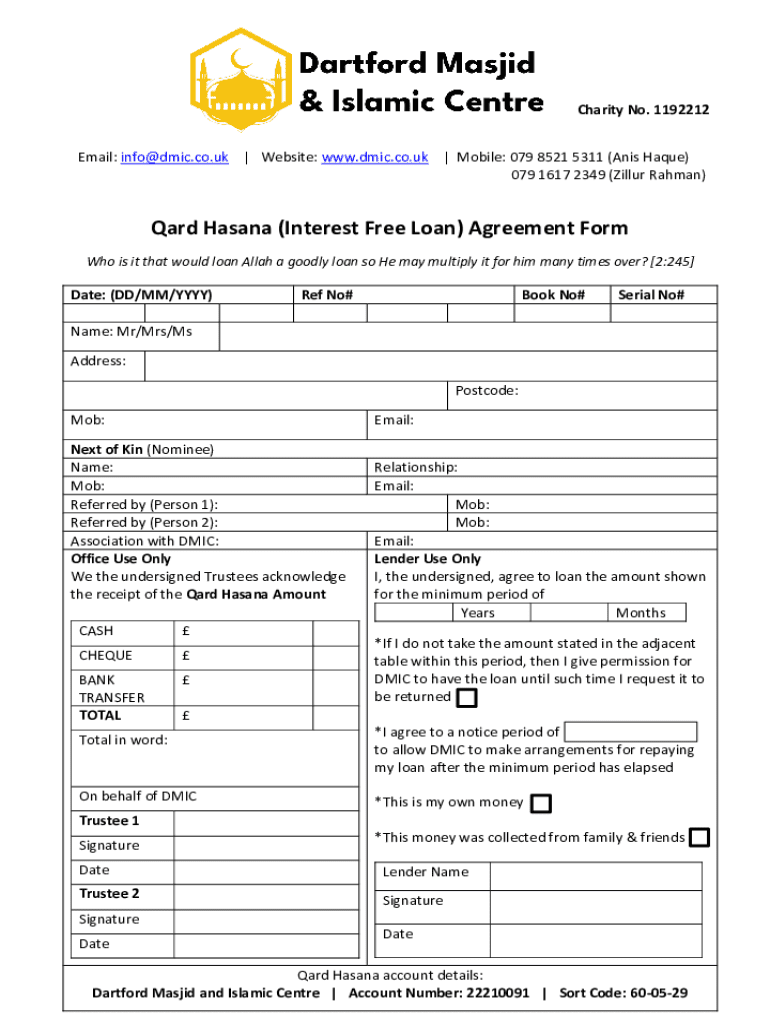

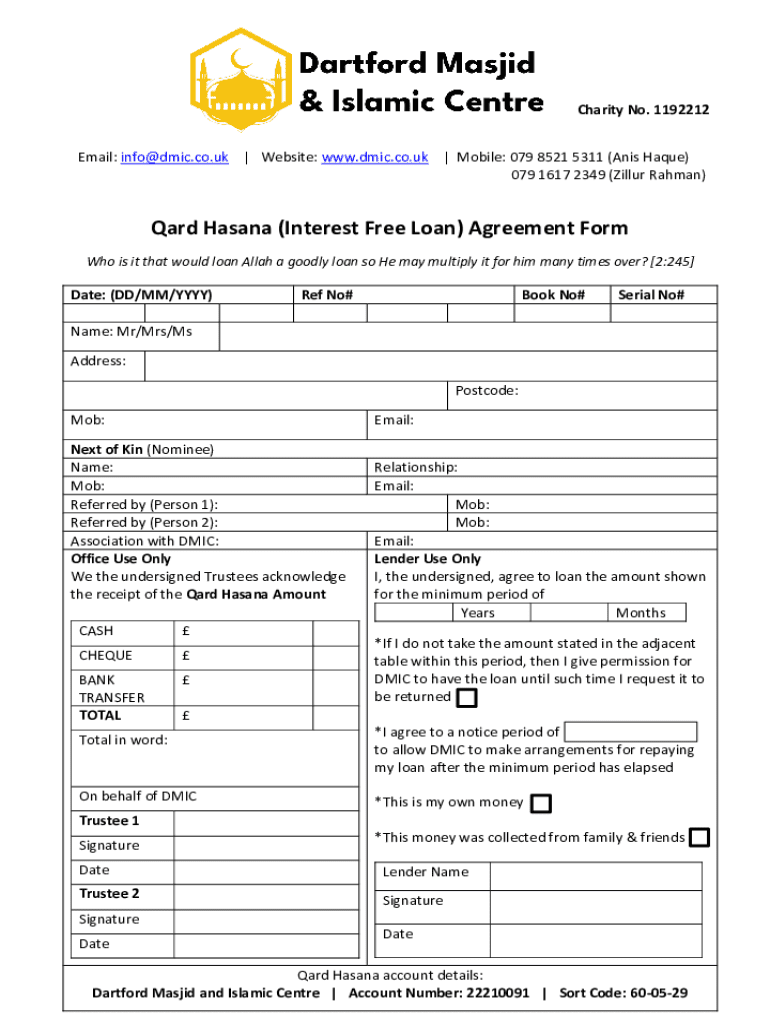

Get the Qard Hasana (interest Free Loan) Agreement Form

Get, Create, Make and Sign qard hasana interest loan

Editing qard hasana interest loan online

Uncompromising security for your PDF editing and eSignature needs

How to fill out qard hasana interest loan

How to fill out qard hasana interest loan

Who needs qard hasana interest loan?

Qard Hasana Interest Loan Form: A Comprehensive Guide

Understanding Qard Hasana

Qard Hasana, meaning 'good loan' in Arabic, represents an interest-free loan that is a vital component of Islamic finance. Unlike conventional loans, Qard Hasana embodies principles of benevolence and charity, focusing on helping those in need without any expectation of profit. This financing model not only supports individuals but also fosters community development by addressing social welfare.

In contrast to conventional loans, where lenders profit from interest charges, Qard Hasana operates entirely on goodwill. Borrowers are expected to repay only the principal amount, reinforcing the notion that financial systems can operate altruistically. This fundamental difference underscores the humanitarian focus inherent in Islamic finance.

Target audience for Qard Hasana loans

Qard Hasana loans are accessible to a diverse range of individuals and organizations. Potential borrowers often include individuals facing financial hardships, families in need of medical or educational assistance, or small business owners looking for initial funding without the burden of interest. Community organizations looking to support local initiatives can also apply for Qard Hasana, making it a versatile financial tool.

The common financing needs addressed by Qard Hasana encompass a variety of life circumstances. From covering unforeseen medical expenses and funding education for children to launching a fledgling business, these loans serve as a crucial lifeline for many in communities where traditional financing may be inaccessible due to stringent conditions or high-interest rates.

Benefits of Qard Hasana financing

The primary advantage of Qard Hasana financing is its interest-free nature. This allows borrowers to focus on repayment of the principal, alleviating financial pressure that comes with high-interest loans. This unique characteristic makes Qard Hasana an effective tool for promoting financial inclusivity and equality.

Additionally, Qard Hasana offers flexibility in repayment, allowing borrowers to negotiate terms that suit their financial situation. This is especially important for individuals experiencing temporary setbacks. Importantly, Qard Hasana plays a significant role in supporting underprivileged communities, as it channels funds into areas that require assistance, fostering overall social development.

Moreover, the application process for Qard Hasana loans is designed to be transparent and straightforward. Clear documentation and assessment procedures ensure that potential borrowers can navigate the system easily, reducing barriers to access.

Detailed Qard Hasana loan application process

To apply for a Qard Hasana loan, prospective borrowers should familiarize themselves with the application process, which typically begins with preparation. Essential documents such as identity proof and income statements are crucial to demonstrate eligibility. These documents provide lenders with the necessary information to assess the application.

Upon compiling the required documents, borrowers must fill out the Qard Hasana loan form accurately. Essential sections to complete may include personal information, purpose of the loan, and repayment plans. To avoid common mistakes, it's important to double-check entries for accuracy and completeness before submission.

The submission of the loan form can often be conducted in multiple ways. Many institutions offer both online submissions for convenience and in-person methods for those who prefer face-to-face interaction. Assessing which method aligns with personal comfort and access to technology can facilitate an easier application process.

Evaluation and approval process

Once the Qard Hasana loan application is submitted, it enters the evaluation stage. Shariah-compliant lenders will assess several criteria including the applicant’s financial stability, repayment capability, and the purpose stated for the loan. These factors are critical in determining eligibility.

Applicants can generally expect a response within a specified timeframe. While this can vary by lender, understanding the typical wait times for approval and disbursement helps manage expectations. In some instances, lenders may require additional information to support the application, which can further extend the process.

Application outcomes may differ; approvals will lead to disbursement of funds, while denials may arise due to insufficient documentation or ineligibility. Additionally, being requested for more information is common and reflects the thorough nature of the assessment process.

Managing Qard Hasana loans responsibly

Responsible management of Qard Hasana loans is essential for maintaining financial integrity and fostering good relationships with lenders. Borrowers should be aware of the repayment guidelines stipulated in the loan agreement, which typically include timelines and basic terms. Importantly, many lenders offer flexibility, adapting to individual circumstances that arise after borrowing.

In the event of late payments, it's crucial to communicate with the lender to explore accommodation options. Open communication can prevent misunderstandings and help devise a suitable repayment plan. For borrowers facing significant financial difficulties, many lenders provide resources and support systems designed to assist in navigating these challenges.

Ethical considerations and community impact

The benevolent nature of Qard Hasana instills significant ethical considerations within the finance realm. By promoting the essence of charity and altruism, Qard Hasana serves as a blueprint for ethical finance. This approach enriches both individual lives and community structures, emphasizing that lending should not merely be a transaction but a source of empowerment.

Moreover, Qard Hasana contributes meaningfully to societal development. By channeling funds into necessary domains such as education, healthcare, and entrepreneurship, these loans stimulate local economies and uplift communities. The broader impact of Qard Hasana reverberates through community initiatives, creating a cycle of support that fosters growth and resilience.

Frequently asked questions (FAQs)

Many inquiries arise when discussing Qard Hasana loans, leading to common questions about their nature and application. One frequent query is whether Qard Hasana is considered a donation or a loan; it is undoubtedly a loan since the borrower is required to repay the principal amount. Further questions arise about administrative fees; in general, while some lenders may charge nominal fees related to processing, these should never include interest.

Another important question is the procedure followed if a borrower cannot repay the loan. While each lender may have a slightly different policy, many emphasize understanding and flexibility, often working with the borrower to find a manageable solution. Additionally, comparing Qard Hasana with other Islamic financing methods such as Murabaha and Mudarabah can provide deeper insights into its unique position within Islamic finance.

pdfFiller’s role in the Qard Hasana process

pdfFiller plays a significant role in facilitating the management of Qard Hasana loan forms. Users can create, edit, and manage their Qard Hasana forms efficiently from a centralized, cloud-based platform. This seamless document management system ensures that all documentation requirements are met, streamlining the application process.

Additionally, pdfFiller offers convenient eSigning and collaboration tools that allow individuals and teams to work together on loan applications. This capability becomes particularly important in ensuring all relevant documents are completed accurately and efficiently. With access to interactive resources, including guides and templates tailored to Qard Hasana financing, pdfFiller remains committed to supporting users through their loan application journey.

Conclusion and next steps

Evaluating Qard Hasana against personal financial needs is crucial in making an informed decision about pursuing this financing method. Understanding the principles behind Qard Hasana can empower individuals and communities to utilize this interest-free loan effectively. For those considering applying, pdfFiller's comprehensive support and resources can simplify the documentation and application process.

By leveraging pdfFiller's capabilities, borrowers can ensure they navigate the complexities of Qard Hasana appropriately. This approach not only enhances the likelihood of securing the loan but also instills greater confidence in managing finances responsibly, ultimately fostering financial well-being within communities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete qard hasana interest loan online?

How do I make edits in qard hasana interest loan without leaving Chrome?

How do I fill out qard hasana interest loan on an Android device?

What is qard hasana interest loan?

Who is required to file qard hasana interest loan?

How to fill out qard hasana interest loan?

What is the purpose of qard hasana interest loan?

What information must be reported on qard hasana interest loan?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.