Get the free Form 990-ez

Get, Create, Make and Sign form 990-ez

How to edit form 990-ez online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990-ez

How to fill out form 990-ez

Who needs form 990-ez?

Form 990-EZ Form: A Comprehensive How-To Guide

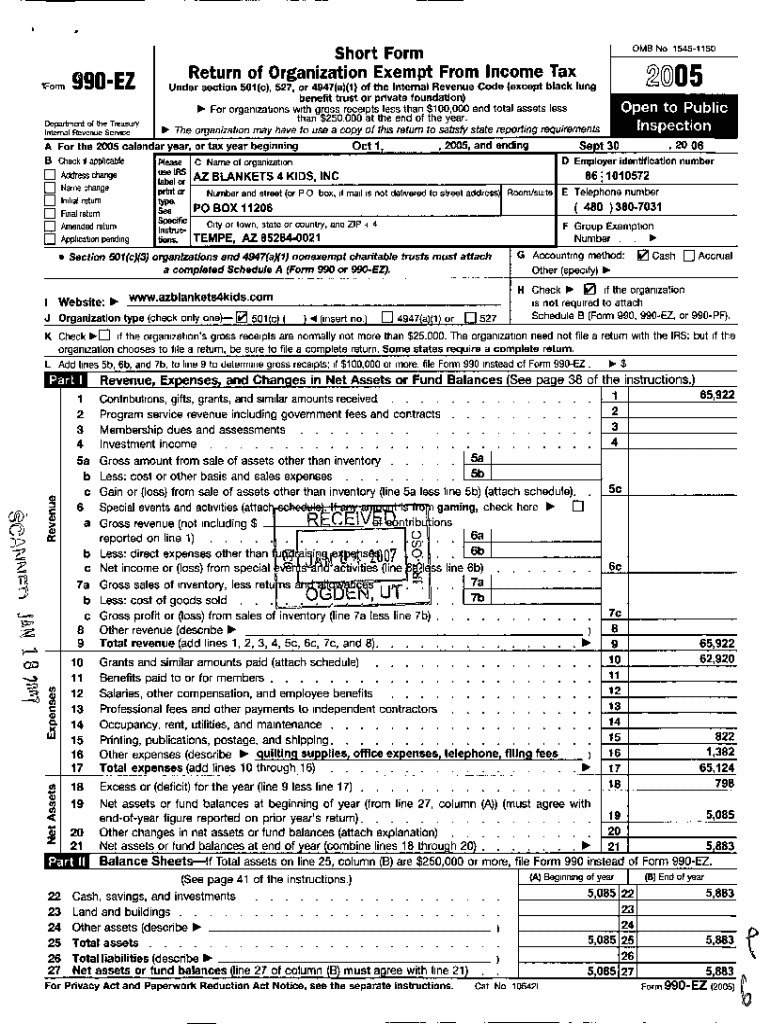

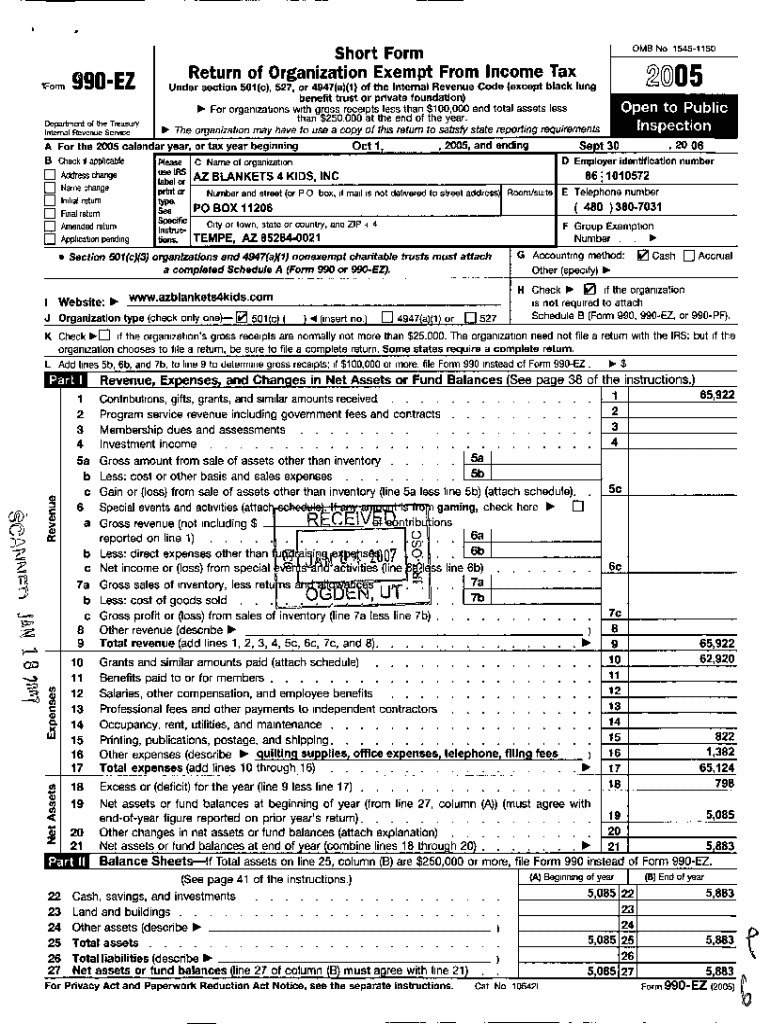

Understanding the Form 990-EZ

Form 990-EZ is a streamlined version of the more comprehensive Form 990, specifically designed for smaller nonprofit organizations. Its primary purpose is to provide the IRS and the public with an overview of an organization’s financial condition, including revenue, expenses, and activities undertaken during the fiscal year. Unlike Form 990, which is required for larger nonprofits with gross receipts above $200,000 or total assets over $500,000, Form 990-EZ can be filed by organizations with gross receipts of less than $200,000 and total assets under $500,000.

The differences between Form 990 and Form 990-EZ are primarily in the details required in reporting. While Form 990 mandates extensive disclosures, including detailed descriptions of program services, Form 990-EZ allows for a more concise summary, making it more manageable for smaller entities.

Who must file Form 990-EZ?

Eligibility to file Form 990-EZ is determined by several criteria. Organizations with gross receipts below $200,000 are eligible, as well as those with total assets under $500,000 at the end of their fiscal year. While many nonprofits fall into this category, certain organizations, such as churches or those eligible for the 501(c)(3) status but do not receive public funding, may be exempt from filing altogether. It’s essential for organizations to assess their financial standing accurately and stay informed about any changes in regulations concerning the filing process.

Key components of Form 990-EZ

Form 990-EZ is structured into several key parts, each serving a distinct purpose in detailing the organization’s financial operations. Part I addresses revenue and expenses while highlighting changes in net assets. This section requires a summary of the organization’s income sources, including contributions, grants, and program service revenue, alongside a breakdown of expenses incurred during the fiscal year.

Part II comprises the balance sheet, offering a snapshot of the organization’s financial position. It includes assets, liabilities, and net assets, providing crucial insights into the organization’s fiscal health. Part III focuses on program service accomplishments, requiring a narrative that illustrates the organization’s mission and the effect of its programs. In Part IV, organizations must list their officers, directors, trustees, and key employees, ensuring transparency and accountability. Lastly, Part V covers various other important information, providing additional context that might be relevant to stakeholders.

Understanding the schedules

Form 990-EZ also necessitates the inclusion of certain schedules, depending on the organization’s activities. Understanding which schedules you need to complete is critical for compliance. Required schedules include Schedule A, detailing public charity status and public support, and Schedule B, which lists substantial contributors. Additionally, optional schedules like Schedule O allow organizations to provide supplementary information that may clarify data presented in the body of the form.

Preparation steps for filling out Form 990-EZ

Filling out Form 990-EZ requires meticulous preparation to ensure accuracy and compliance. The first step is to gather all necessary documents. A thorough compilation should include financial statements, relevant supporting materials, and data from the previous year to enable smooth comparisons and accurate reporting.

Step 2 involves reviewing the IRS instructions for Form 990-EZ. This not only provides clarity on the requirements but also helps highlight potential pitfalls to avoid during the preparation process. Once you're familiar with the guidelines, proceed to Step 3, completing each part of the form. Ensure all figures are properly calculated and reflected accurately within each section as errors can lead to complications or penalties later on.

After filling out the form, Step 4 is to verify your information. Double-check all calculations, ensuring that everything is accurate and complete. Finally, in Step 5, prepare for submission. Consider whether you will file electronically or mail the form. Electronic filing can expedite the process and confirmation of receipt.

E-filing Form 990-EZ

Electronic filing of Form 990-EZ is becoming increasingly important due to IRS requirements and the advantages it brings. Organizations are encouraged to file electronically because it generally leads to faster processing and confirmation of submission. To file electronically, organizations can use services like pdfFiller, which simplifies the e-filing process with an intuitive interface.

To file Form 990-EZ electronically using pdfFiller, follow these steps: log in to your account, upload the completed form, and submit it following the on-screen instructions. The platform also provides valuable features such as e-signatures and collaborative tools for multi-user environments. Concerns regarding data security are necessary, and pdfFiller employs advanced encryption and security measures to ensure that your sensitive information is protected during the e-filing process.

Important deadlines

Filing deadlines for Form 990-EZ vary but typically align with the organization's tax year. Generally, organizations must submit their return by the 15th day of the 5th month following the end of their fiscal year. For many nonprofits operating on a calendar year, this means the due date is May 15. However, organizations can apply for an extension, allowing an additional six months to file, pushing the deadline to November 15.

It is essential for nonprofits to be aware of specific considerations related to deadlines. Organizations that have a fiscal year ending that does not coincide with the calendar year must keep careful records to avoid any omissions.

Common questions around Form 990-EZ

Can organizations request an extension for filing Form 990-EZ? Yes, nonprofits may use Form 8868 to apply for an additional six months of time to file their return. However, it is important to note that the extension applies only to the filing of the form, not the payment of any taxes owed. If an organization is late in filing, penalties can result, including monetary fines. It is crucial to stay ahead of deadlines to avoid any unnecessary issues.

If an organization realizes a mistake on a previously filed Form 990-EZ, it is possible to amend the return using Form 990-X. For assistance, many resources are available, including the IRS website and nonprofit support organizations that offer guidance on completing tax filings accurately.

Leveraging pdfFiller tools for form management

Utilizing a platform like pdfFiller can significantly enhance the experience of filling out Form 990-EZ. The interactive tools offered by pdfFiller allow users to complete forms efficiently, with features for e-signatures and collaborative functions designed for teams. As nonprofits often operate under tight deadlines, these features simplify the process, saving critical time.

Additionally, pdfFiller provides comprehensive support services, with customer assistance available for questions and guidance throughout the filing process. The resource center on pdfFiller grants access to webinars, tutorials, and specific guides tailored to Form 990-EZ, helping users stay informed and prepared.

Enhancing your filing experience

For a smooth filing process, organizations should implement organizational strategies, such as creating a timeline for collecting documentation and regularly reviewing IRS requirements. Implementation of a checklist can help streamline the preparation phase and minimize common pitfalls, such as missing information or incorrect calculations.

Feedback from users of pdfFiller highlights the platform's efficiency in managing Form 990-EZ filings. Many appreciate the ease of use and streamlined process that pdfFiller offers, contrasting it with the more cumbersome traditional filing methods. Users often share stories of reduced stress and time saved by utilizing pdfFiller’s tools.

Comparing pdfFiller with other filing methods reveals its standout advantages, including a more user-friendly interface and integrated management functionalities. Organizations looking to modernize their filing practices will find pdfFiller's capabilities to be a compelling option to enhance productivity and ease of access.

Conclusion with emphasis on pdfFiller's value proposition

Utilizing a cloud-based solution like pdfFiller not only simplifies the process of filing Form 990-EZ but also instills confidence in your compliance efforts. The seamless interaction and management capabilities that pdfFiller offers mitigate the stress commonly associated with tax filings. Organizations can focus more on their impactful missions and less on administrative burdens, capitalizing on a streamlined filing experience that fits today's operational demands.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get form 990-ez?

How do I make edits in form 990-ez without leaving Chrome?

How do I fill out form 990-ez using my mobile device?

What is form 990-ez?

Who is required to file form 990-ez?

How to fill out form 990-ez?

What is the purpose of form 990-ez?

What information must be reported on form 990-ez?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.