Get the free Pre-retirement Catch-up Form

Get, Create, Make and Sign pre-retirement catch-up form

Editing pre-retirement catch-up form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out pre-retirement catch-up form

How to fill out pre-retirement catch-up form

Who needs pre-retirement catch-up form?

Pre-Retirement Catch-Up Form: A Comprehensive Guide

Understanding pre-retirement catch-up contributions

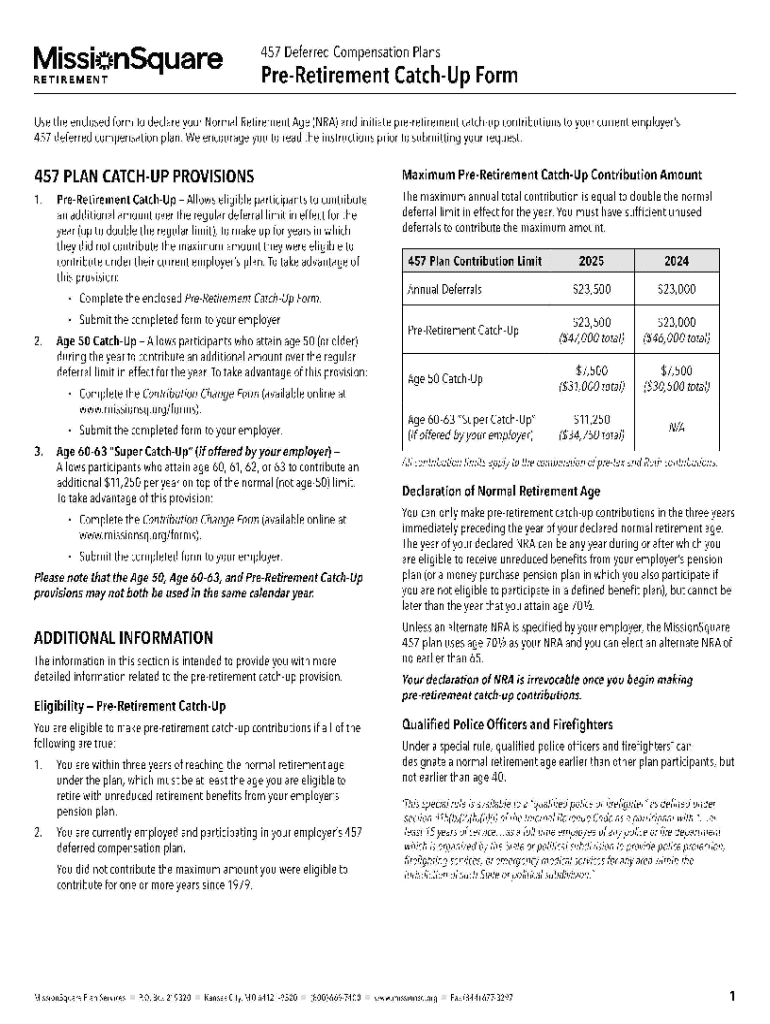

Pre-retirement catch-up contributions are additional contributions that individuals aged 50 or older can make to their retirement savings plans beyond the standard contribution limit. This provision is crucial for those nearing retirement who may find themselves behind on their savings targets. The primary aim of these contributions is to help individuals bolster their retirement savings as they draw closer to retirement age, thereby enhancing their financial security during their golden years.

Eligibility for pre-retirement catch-up contributions is determined by the specific retirement plan rules, but primarily, participants must be aged 50 or older at the end of the calendar year. Various plans like 401(k)s, 403(b)s, and some governmental 457 plans offer these options, allowing individuals to increase their contribution limits significantly, often by several thousand dollars each year.

Key features of the pre-retirement catch-up form

The pre-retirement catch-up form includes essential information needed to facilitate the extra contributions. At its core, the form requests standard participant details, the desired catch-up contribution amount, and information about the plan itself. By covering these critical areas, the form ensures that retirement plan providers can process requests efficiently and accurately.

Using the pre-retirement catch-up form comes with various benefits, including the potential for increased retirement income, streamlined processing by providers, and clearer tracking of one's financial progress toward retirement goals. By maintaining proper documentation, users can ensure they maximize their savings potential before reaching retirement.

How to complete the pre-retirement catch-up form

Completing the pre-retirement catch-up form can be straightforward if you follow a systematic approach. Here are detailed steps to guide you through the completion process:

To avoid delays in processing, ensure that all information is accurate and complete. Double-check the form for any common issues, such as misspellings or incorrect numbers, to streamline the processing additionally.

Editing your pre-retirement catch-up form

If you find the need to make changes after filling out your pre-retirement catch-up form, tools like pdfFiller allow for easy editing. With pdfFiller, users can return to their forms, make necessary updates, and save a new version seamlessly.

The platform includes various features aimed at facilitating straightforward updates, whether it involves changing numbers or revising personal information. Saving different versions aids in maintaining records of what was submitted and when, providing consistency in your planning process.

Signing the pre-retirement catch-up form

Before submitting your pre-retirement catch-up form, it's necessary to sign it to validate your intentions. Using pdfFiller offers convenient options for electronic signatures, which not only save time but also ensure that you can complete the process remotely.

Legal considerations regarding electronic signatures are crucial; ensure that your eSignature complies with the Electronic Signatures in Global and National Commerce (ESIGN) Act, ensuring that it has the same weight as a handwritten one. To sign securely, follow the step-by-step guide within pdfFiller to enhance the overall security of your documents.

Submitting your pre-retirement catch-up form

Submitting your completed pre-retirement catch-up form entails following best practices to ensure it reaches your retirement plan provider accurately and promptly. It's advisable to familiarize yourself with the submission procedures of your specific provider, as they may differ in terms.

Using pdfFiller, you can track your form submission status through the platform, providing peace of mind that your catch-up contributions are being processed and included in your retirement plan.

Understanding the rules and limitations

Navigating the rules and limitations of pre-retirement catch-up contributions is vital for planning. The IRS outlines specific regulations associated with catch-up contributions, including setting annual limits based on the type of retirement plan you participate in. For instance, as of 2023, individuals enrolled in a 401(k) plan can contribute an additional catch-up amount of $7,500 on top of the standard limit.

Other plans, such as 457(b) and 403(b) plans, also have provisions differing in annual limits. It's essential to consult your plan document or provider for specifics, ensuring you are maximizing the additional contributions permissible within your retirement strategy.

Resources for further education

Educating yourself on pre-retirement catch-up contributions can significantly influence your retirement outcomes. pdfFiller offers interactive worksheets and calculators that empower users to project their retirement savings more effectively, catering to individual financial situations.

Additionally, FAQs available on pdfFiller address common concerns, enabling users to navigate the complexities of retirement planning, while financial education portals provide deeper insights into strategies that can enhance overall financial literacy.

Managing your documents securely

In the landscape of financial planning, document management plays a crucial role. It’s essential to organize all retirement-related documents cohesively. Using pdfFiller, you can categorize files by topics—such as contributions, plans, and correspondence—with a robust system, enhancing both access and planning efficacy.

pdfFiller emphasizes security by offering features that protect your documents from unauthorized access, ensuring that your sensitive financial information remains confidential. Prioritizing document management is as critical as the contributions you make toward your retirement.

Frequently asked questions about pre-retirement catch-up contributions

Understanding the nuances of catch-up contributions can be challenging. It’s common to have questions regarding eligibility, the specific contributions allowed, and how they vary by plan type. Some frequently asked questions include the following:

Addressing these concerns via reputable sources or financial professionals can provide clarity, ensuring informed decision-making throughout your retirement planning journey.

Testimonials and case studies

Real-life scenarios often illuminate the benefits and processes surrounding the pre-retirement catch-up form. For many individuals, utilizing this form has proven advantageous in elevating their retirement funding effectively. Testimonials highlight cases where individuals successfully increased their savings substantially by leveraging these contributions at critical stages closer to retirement.

Insights from financial advisors reinforce the practice of integrating catch-up contributions into one’s savings strategy, showcasing practical applications and demonstrating the tangible benefits experienced by those who persistently engage with their retirement planning.

Contact support for personalized assistance

If you encounter challenges while filling out or submitting your pre-retirement catch-up form, reaching out to pdfFiller's dedicated customer support team can be immensely helpful. Their representatives offer guidance tailored to your specific needs, ensuring you receive prompt and accurate assistance on all aspects of using the form.

Consider taking advantage of their online resources and chat support features, which aim to facilitate user experience and provide you with a seamless journey in managing your retirement documentation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find pre-retirement catch-up form?

How do I edit pre-retirement catch-up form straight from my smartphone?

How do I fill out pre-retirement catch-up form using my mobile device?

What is pre-retirement catch-up form?

Who is required to file pre-retirement catch-up form?

How to fill out pre-retirement catch-up form?

What is the purpose of pre-retirement catch-up form?

What information must be reported on pre-retirement catch-up form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.