A Comprehensive Guide to the Illinois Independent Contractor Agreement Form

Understanding the Illinois Independent Contractor Agreement

An Illinois independent contractor agreement is a crucial document that outlines the rights and responsibilities of both the contractor and the client for project work. Independent contractors operate as self-employed individuals offering their services to clients under specific conditions. In Illinois, distinguishing between independent contractors and employees is vital, as it influences tax obligations, benefits, and legal protections.

The importance of a formal agreement cannot be overstated. It not only sets clear expectations but also minimizes disputes and provides a legal framework should issues arise. Unlike employees, independent contractors retain control over their work process, which underscores the necessity of clarity in contractual obligations.

Independent contractors work for multiple clients simultaneously and manage their own schedules.

Employees may be subject to company policies and have taxes withheld from their pay.

Understanding the distinctions is critical for compliance with employment laws and regulations.

Key components of an Illinois independent contractor agreement

When drafting an Illinois independent contractor agreement, several key components must be addressed to ensure clarity and comprehensiveness. The first essential element is the scope of work, which should include clearly defined project descriptions and timelines for completion. This clarity helps eliminate potential disagreements regarding deliverables.

Another vital component is the payment terms. This includes specifying compensation structures, such as flat fees or hourly rates, as well as invoicing and payment schedules. Furthermore, confidentiality and non-disclosure clauses are crucial for protecting sensitive information shared during the contract period. Lastly, termination conditions should be clearly outlined, including grounds for termination by either party and any notice periods required.

Scope of work: Detailed project description and expected deadlines.

Payment terms: Compensation structures along with invoicing protocols.

Confidentiality clauses: Protect sensitive information shared between parties.

Termination conditions: Clear definitions of termination grounds and notice periods.

Creating your Illinois independent contractor agreement

Creating an effective Illinois independent contractor agreement involves a systematic approach. Here’s how you can do it step-by-step: First, identify the parties involved in the agreement, including their addresses and contact information. Next, outline the scope of work with specific details regarding the deliverables and the timeline for completion.

Following this, specify payment terms that include the payment rate, invoicing procedures, and due dates. It is also important to include confidentiality agreements to protect proprietary information. Finally, define termination conditions, specifying how either party can terminate the agreement and the necessary procedures to follow.

Identify the parties: Name and details of both contractor and client.

Outline the scope of work: Clearly define what is expected.

Specify payment terms: Include details on rates and invoicing.

Include confidentiality agreements: Essential for protecting sensitive data.

Define termination conditions: Describe process and grounds for termination.

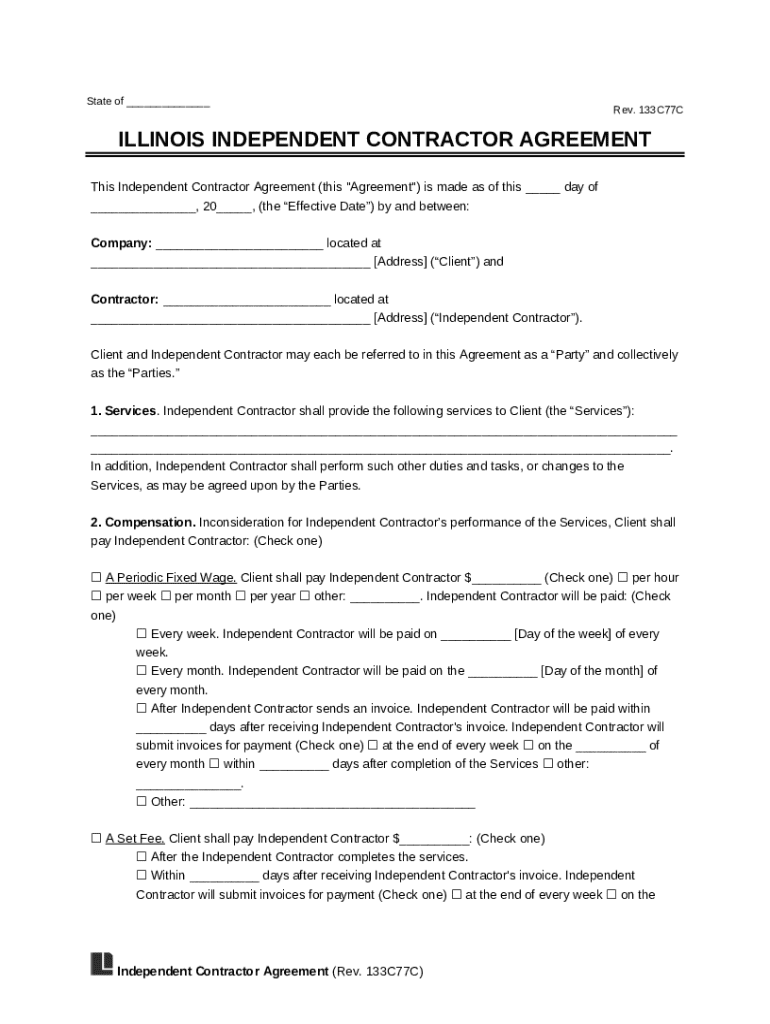

Filling out the Illinois independent contractor agreement form

To effectively fill out the Illinois independent contractor agreement form, you can utilize interactive tools available on platforms like pdfFiller. This can simplify the process by providing templates and guidance along the way. Key fields to complete include the names and contact information of the parties, the detailed description of the work, payment terms, and the duration of the agreement.

While filling out the form, it’s essential to avoid common mistakes such as leaving sections incomplete, using vague language, or neglecting to include important clauses. Ensure that every term is clearly articulated to prevent future misunderstandings.

Utilize tools: Platforms like pdfFiller can simplify form completion.

Complete key fields: Ensure all necessary sections are fully addressed.

Avoid common mistakes: Focus on clarity and completeness.

Editing and customizing your agreement

Once your Illinois independent contractor agreement is drafted, you might find the need to edit or customize it further. pdfFiller provides tools that allow you to make these edits smoothly. You can easily collaborate with team members by sharing the document for input, ensuring that all perspectives are considered before finalizing the agreement.

In addition, utilizing e-signature options can provide a seamless way for both parties to sign the document electronically, eliminating the hassle of printed copies and in-person meetings. Maintaining a digital copy of the signed agreement ensures easy access and document management.

Utilize editing tools: pdfFiller allows you to modify the agreement as needed.

Collaboration features: Engage team members for input and feedback.

E-signature options: Streamline the signing process with digital signatures.

Legal considerations and compliance in Illinois

Understanding worker classification in Illinois is essential when utilizing an independent contractor agreement. Misclassification can lead to significant legal implications, including penalties and back taxes. Illinois law outlines specific rights and responsibilities for independent contractors, including the requirement to report earnings accurately for tax purposes.

It's important for both parties to understand their obligations under the agreement and to comply with local labor laws. This includes knowing the implications of not following the terms set forth in the agreement, which can lead to disputes or legal challenges.

Understand worker classification: Key for compliance with labor laws.

Rights and responsibilities: Familiarize yourself with legal obligations.

Mitigate misclassification risks: Awareness can avoid penalties.

Related forms and templates

In addition to the Illinois independent contractor agreement form, there are several other related documents that individuals might need when operating as independent contractors. Other contractor agreements, W-9 forms for tax reporting, and non-compete agreements are critical to consider when setting up your business structure and contractual obligations.

Having access to templates for these documents can streamline the process of setting up your business and ensuring all legal bases are covered. Various platforms provide these templates, allowing you to customize them to your specific needs.

Other contractor agreements: Essential for different types of services.

W-9 tax forms: Important for reporting income as a contractor.

Non-compete agreements: Protect your business interests when hiring contractors.

Sample Illinois independent contractor agreement

Having a sample Illinois independent contractor agreement can serve as a valuable reference while drafting your own. A well-structured sample will provide insights into how each section should be formatted, from the introductory party identification to detailed clauses about the scope of work, payment terms, and more.

By reviewing a complete agreement, you can better understand the language used and how to articulate specific terms effectively. This can also assist you in identifying key elements you may want to include or adjust in your personalized agreement.

Preview of completed agreements: Understand how to structure your own.

Breakdown of each section: Learn what belongs where and why.

Utilize as a reference: Ensure that important elements are not overlooked.

Managing your documents post-agreement

After finalizing your Illinois independent contractor agreement, managing the document becomes crucial. Opting for reliable storage solutions is essential for maintaining access to your signed agreement. Platforms like pdfFiller offer cloud-based solutions that enable you to keep your documents secure and organized.

In addition to storage, tracking deadlines and renewals is vital. An organized system that alerts you prior to expiration dates or necessary renewals can help you maintain compliance and manage ongoing relationships effectively.

Storage solutions: Cloud-based platforms ensure secure access.

Collaboration on documents: Share and discuss adjustments with team members.

Deadline tracking: Essential for maintaining compliance and contract terms.

Frequently asked questions about Illinois independent contractor agreements

As you navigate the process of creating your Illinois independent contractor agreement, several common questions may arise. What makes a contract enforceable? Typically, a contract needs to have clear terms, mutual consent, and lawful objectives to be considered valid. Another common concern is how to handle disputes; including a mediation clause in your agreement can provide a pathway for resolution.

Many individuals also wonder if agreements can be modified. Yes, as long as both parties agree to the changes, modifications can be made to accommodate new circumstances or updates to project scope.

What makes a contract enforceable? Clear terms and mutual agreement are critical.

How to handle disputes? Consider including mediation clauses for resolution.

Can agreements be modified? Yes, with mutual consent from both parties.

Additional considerations for Illinois independent contractors

Independent contractors in Illinois should also be aware of state taxes and filing responsibilities. This includes understanding how to report income accurately and the implications of self-employment taxes. Being knowledgeable about your tax obligations helps in preventing surprises during tax season.

Additionally, navigating unemployment benefits for contractors can be complex. Understanding both state-specific and federal provisions can help you protect your financial interests in case of unexpected disruptions in work.

Understand state taxes: Essential for reporting income as an independent contractor.

Filing responsibilities: Be proactive to avoid penalties.

Navigating unemployment benefits: Know your eligibility under state and federal laws.