Get the free Ptax-340

Get, Create, Make and Sign ptax-340

Editing ptax-340 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ptax-340

How to fill out ptax-340

Who needs ptax-340?

PTAX-340 Form: A Comprehensive Guide

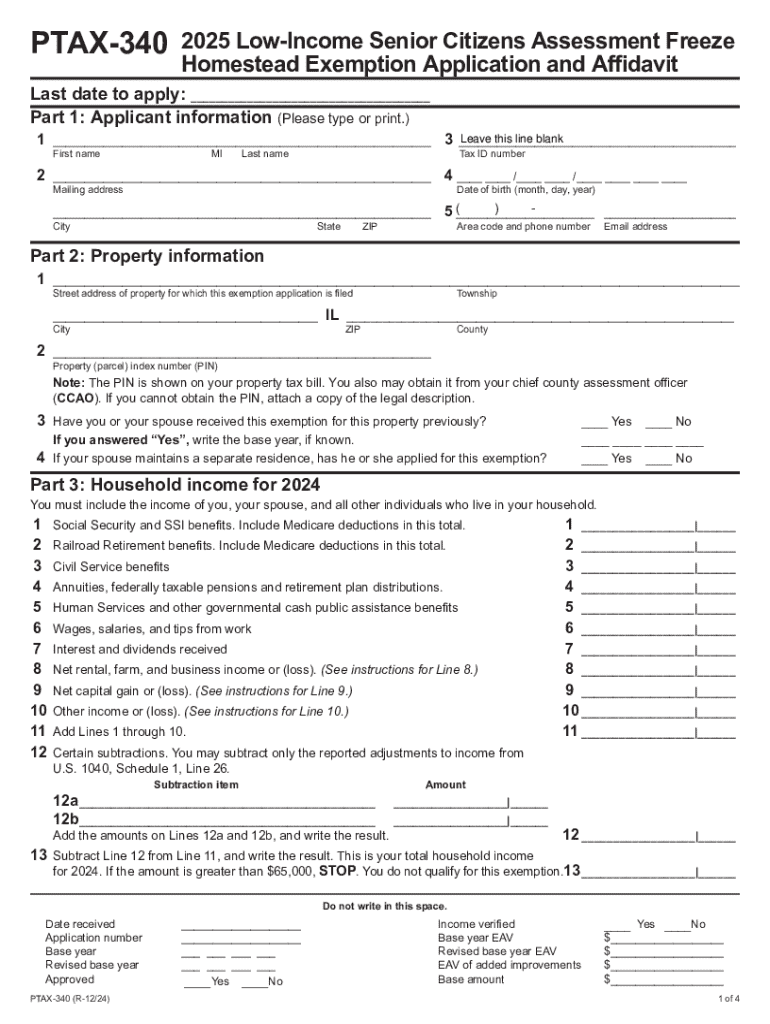

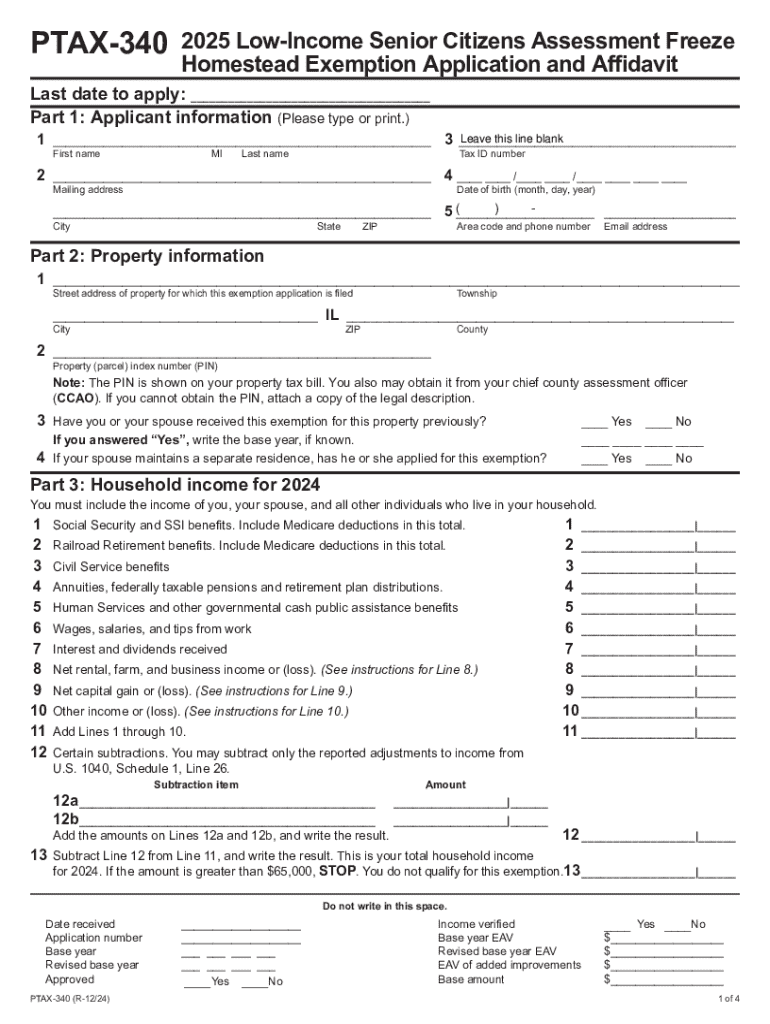

Understanding the PTAX-340 Form

The PTAX-340 Form serves as an essential document for property tax exemption claims, designed specifically for individuals and organizations seeking relief from property taxes on qualifying properties. Its primary purpose is to facilitate the process of claiming exemptions which can lead to significant financial savings for eligible homeowners and entities. This form reflects a commitment to ensuring that residents who meet certain criteria can receive appropriate tax benefits.

Filing the PTAX-340 form is important as it helps property owners communicate their exemption claims effectively to local tax authorities. The accurate completion of this form is critical to ensure claims are processed without unnecessary delays, paving the way for timely benefits. An understanding of who needs to file this form is vital for ensuring that potential exemptions are not overlooked.

Who needs to file the PTAX-340?

Eligibility to file the PTAX-340 form typically extends to homeowners, organizations, and some special cases defined by state law. These may include individuals who qualify for various exemptions due to disability, veteran status, or senior citizen status. Each state may set specific criteria, so it is crucial for applicants to check local regulations to confirm their eligibility.

Key features of the PTAX-340 Form

The layout of the PTAX-340 form has been designed for clarity and ease of use, allowing applicants to navigate through various segments with ease. Each section serves a specific purpose, contributing valuable information required for the exemption review process. Icons and color-coding can often be found within the form to signify different areas, helping users to distinguish between sections quickly.

Each PTAX-340 form requires a specific set of information to process the exemption claim effectively. Users should be prepared to supply both personal and property information, ensuring all details are accurate and up-to-date. This includes property addresses, the nature of the exemption sought, and any necessary supporting documentation like proof of eligibility.

How to fill out the PTAX-340 form effectively

Filling out the PTAX-340 form need not be a daunting task if approached methodically. Here are step-by-step instructions to guide users through the process, ensuring compliance and accuracy at each stage.

Common mistakes can lead to delays in processing. Simple errors such as incorrect personal details or missing documentation can result in a denial or processing delays. Applicants should utilize a checklist before submission to confirm that all entries are correct.

Additionally, it can be beneficial to have another set of eyes review the form to catch any errors that might have been overlooked. A meticulous approach will ensure the form is ready for submission without complications.

Tips for editing and signing the PTAX-340 form

When it comes to editing the PTAX-340 form, tools like pdfFiller provide a seamless platform for online editing. Users can access and modify the form, making it simple to ensure everything is correctly filled out. This online environment offers interactive tools that facilitate straightforward editing, reducing the chances of human error.

The eSignature process through pdfFiller is particularly user-friendly. Users can sign documents electronically, ensuring a quick and efficient submission process. Secure storage and management features offered by pdfFiller ensure that users' submitted information remains confidential and protected.

With a focus on security, pdfFiller ensures that your private information is not only secure during the editing process but is also adequately managed post-submission. Understanding these security measures allows users to submit forms with peace of mind.

Submitting the PTAX-340 form

Submitting the PTAX-340 form can be done through various methods, making it accessible based on the user’s preferences. For those who wish to utilize technology, online filing options via platforms like pdfFiller are available, streamlining the entire process from filling out to submission.

Alternatively, individuals can opt for traditional mail-in submission. For this route, printed forms should be sent to the appropriate tax authority, ensuring proper addresses are utilized to avoid delays.

After submitting the PTAX-340 form, tracking your application can provide peace of mind. Most tax authorities will provide a method for applicants to verify receipt of their forms. Should any delays occur or responses not be received, it’s advised to follow up with the respective tax office.

FAQs about the PTAX-340 form

Understanding the nuances and implications of the PTAX-340 form is vital for maximizing property tax benefits. Potential applicants frequently have questions that need addressing to ensure smooth processing.

Accessing further information is crucial for clarity and guidance. Many state tax authority websites offer resources that explain the exemptions process in further detail. Additionally, contacting local tax authorities can provide personalized assistance.

Additional tools and resources

Platforms like pdfFiller excel in offering interactive resources that aid in the completion of forms such as the PTAX-340. Tutorials and how-to videos are readily available, guiding users through the form filling and submission process.

Additionally, user forums can foster shared experiences where individuals can share tips and insights on navigating the exemptions process. This community-based approach can prove invaluable for those unfamiliar with property tax exemptions and the related paperwork.

Stay updated on property tax exemptions

Keeping abreast of updates and changes regarding property tax exemptions is vital for any applicant. Subscribing to newsletters can provide timely information about changes to tax forms, crucial for maintaining compliance and maximizing benefits.

Engaging with communities involved in discussions around document management can enhance knowledge and understanding. Moreover, sharing information and resources can help peers and colleagues ensure they also navigate the complexities of property tax exemptions effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send ptax-340 to be eSigned by others?

How do I execute ptax-340 online?

How do I edit ptax-340 on an Android device?

What is ptax-340?

Who is required to file ptax-340?

How to fill out ptax-340?

What is the purpose of ptax-340?

What information must be reported on ptax-340?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.