Get the free Schedule Cfr-iv

Get, Create, Make and Sign schedule cfr-iv

Editing schedule cfr-iv online

Uncompromising security for your PDF editing and eSignature needs

How to fill out schedule cfr-iv

How to fill out schedule cfr-iv

Who needs schedule cfr-iv?

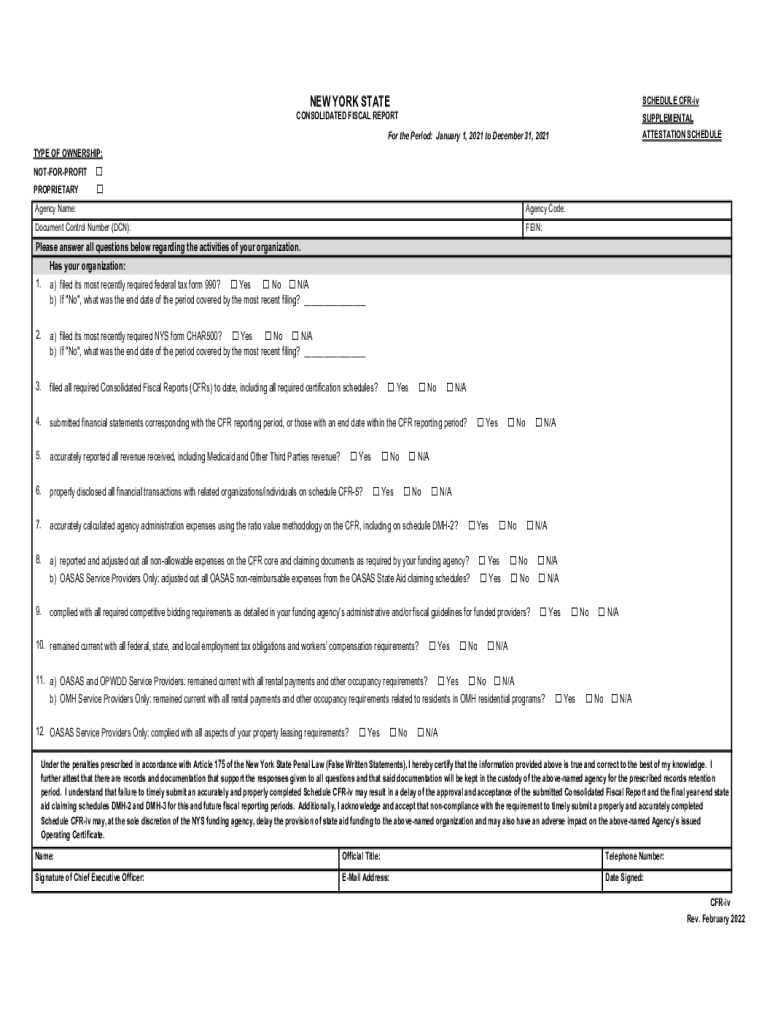

Understanding Schedule CFR- Form: A Comprehensive Guide

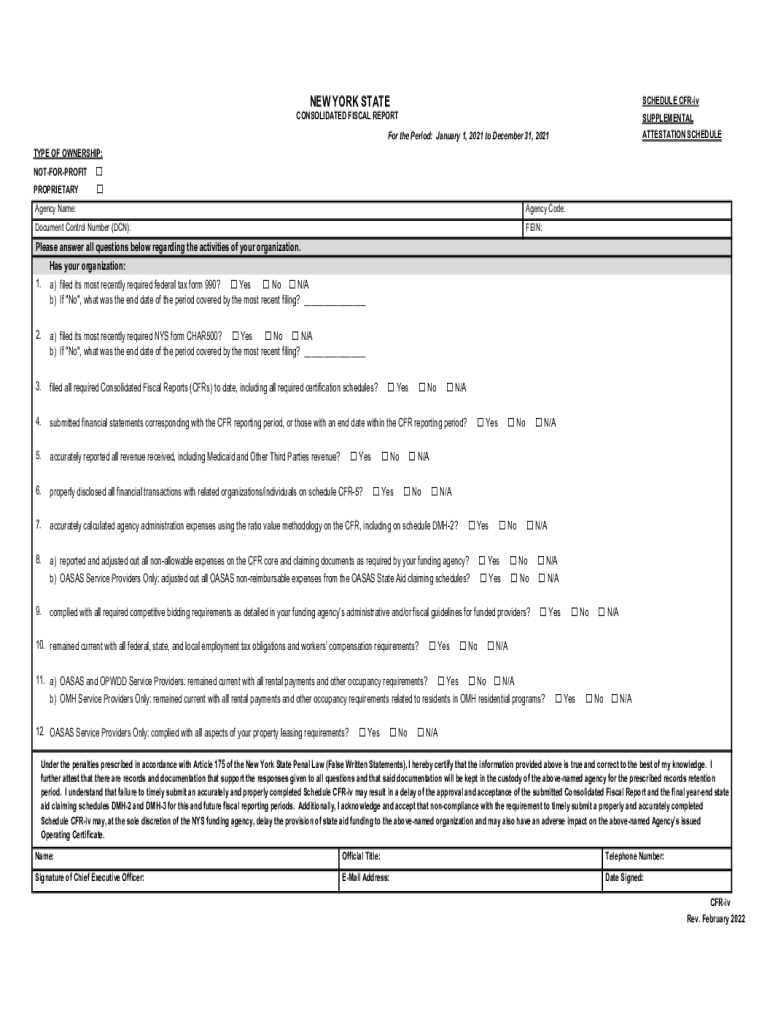

Understanding the Schedule CFR- Form

The Schedule CFR-IV Form is an essential document in the fiscal reporting landscape, specifically catering to organizations that are seeking compliance with federal and state regulations. This form is instrumental for reporting financial data and compliance metrics, contributing significantly to the transparency and credibility of financial reporting. Users of this form often include accountants, financial officers, and compliance managers who aim to provide accurate financial information while adhering to regulatory guidelines.

Historically, the Schedule CFR-IV Form has evolved to adapt to changes in regulatory requirements and organizational needs. With each update, the form has integrated more detailed reporting sections and compliance metrics to provide a comprehensive view of an organization’s financial health. Recent amendments have introduced stricter guidelines, highlighting the importance of accurate reporting and the consequences of non-compliance.

Key components of the Schedule CFR- Form

A thorough understanding of the Schedule CFR-IV Form’s structure is crucial for effective completion. The form consists of multiple sections, each focusing on different reporting areas. The key components include:

Familiarity with the terms used in the Schedule CFR-IV Form is also vital. A glossary of common terms may include items like 'net income,' 'current liabilities,' and 'regulatory compliance.' Understanding these definitions aids teams in accurately filling out the form and ensures clarity in communication.

Step-by-step instructions for completing the Schedule CFR- Form

To effectively complete the Schedule CFR-IV Form, you must follow a structured approach. First, prepare by gathering financial documents central to your reporting requirements. This may include tax returns, balance sheets, and preliminary financial statements.

Next, begin filling out the form. Here's a breakdown of how to navigate each section:

Common pitfalls while filling out the form include omissions of critical data and incorrect figures. To avoid these, thorough preparation and regular verifications against original documents are key. Once completed, adhere to submission timelines, with attention to whether electronic or paper submissions are most appropriate for your organization’s needs.

Editing, signing, and managing the Schedule CFR- Form with pdfFiller

pdfFiller offers an interactive platform for managing the Schedule CFR-IV Form, enhancing both usability and efficiency. Utilize pdfFiller's editing tools to make modifications easily. Users can annotate and edit directly within the PDF, streamlining the process of drafting and review.

Moreover, signing documents in pdfFiller is seamless. By following a simple step-by-step guide, teams can ensure all necessary signatures are obtained electronically, which also maintains compliance with regulatory standards.

For collaboration, pdfFiller allows multiple users to access the document concurrently, facilitating efficient teamwork. Teams can communicate effectively through the platform, which helps align their efforts when compiling information for the Schedule CFR-IV Form.

Troubleshooting common issues

Despite careful preparation, challenges may arise when completing the Schedule CFR-IV Form. Common issues include discrepancies in data, often due to math errors or misreported figures. Address discrepancies by cross-referencing calculations with original documents to ensure accuracy.

Another frequent obstacle can involve securing required signatures from stakeholders. To avoid delays, proactively communicate with all involved parties about the necessity for timely signatures.

For assistance during this process, consult regulatory bodies or industry associations that can provide guidance. They often offer resources tailored to navigating the complexities of the Schedule CFR-IV Form, helping ensure your submission is robust and compliant.

Best practices for managing CFR- documentation

Organizing documentation effectively is crucial for smooth audits and reporting processes related to the Schedule CFR-IV Form. Establish strategic approaches like categorizing documents by section or maintaining chronological records to enhance accessibility during audits.

Additionally, maintaining a secure storage solution is fundamental. Well-organized and securely stored records not only facilitate audits but also protect sensitive information. Leveraging pdfFiller's cloud-based platform can enhance your document management capabilities significantly, ensuring all documents are accessible whenever needed while maintaining regulatory compliance.

Case studies and real-life scenarios

Understanding practical applications can enhance comprehension of the Schedule CFR-IV Form. Successful submissions often come from organizations that prioritize thorough preparation and collaborative efforts, showcasing the effectiveness of utilizing tools like pdfFiller.

Conversely, numerous lessons can be gleaned from mistakes that occurred during submissions. For instance, cases highlighting the impacts of late submissions or inaccuracies serve as reminders of the importance of timely and correct reporting. Learning from these scenarios can help other organizations avoid similar pitfalls in the future.

Next steps after submission

Once the Schedule CFR-IV Form has been submitted, the review process begins. Organizations typically can expect a timeframe for feedback or additional requests for information; being prepared for follow-up actions is crucial to maintain compliance.

Planning for future reporting also requires awareness of potential updates to the Schedule CFR-IV Form. Staying informed about regulatory changes can ensure timely adaptations, better positioning organizations for subsequent submissions. Establishing a proactive approach to document updates can streamline future reporting efforts.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete schedule cfr-iv online?

Can I create an electronic signature for the schedule cfr-iv in Chrome?

How do I complete schedule cfr-iv on an iOS device?

What is schedule cfr-iv?

Who is required to file schedule cfr-iv?

How to fill out schedule cfr-iv?

What is the purpose of schedule cfr-iv?

What information must be reported on schedule cfr-iv?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.