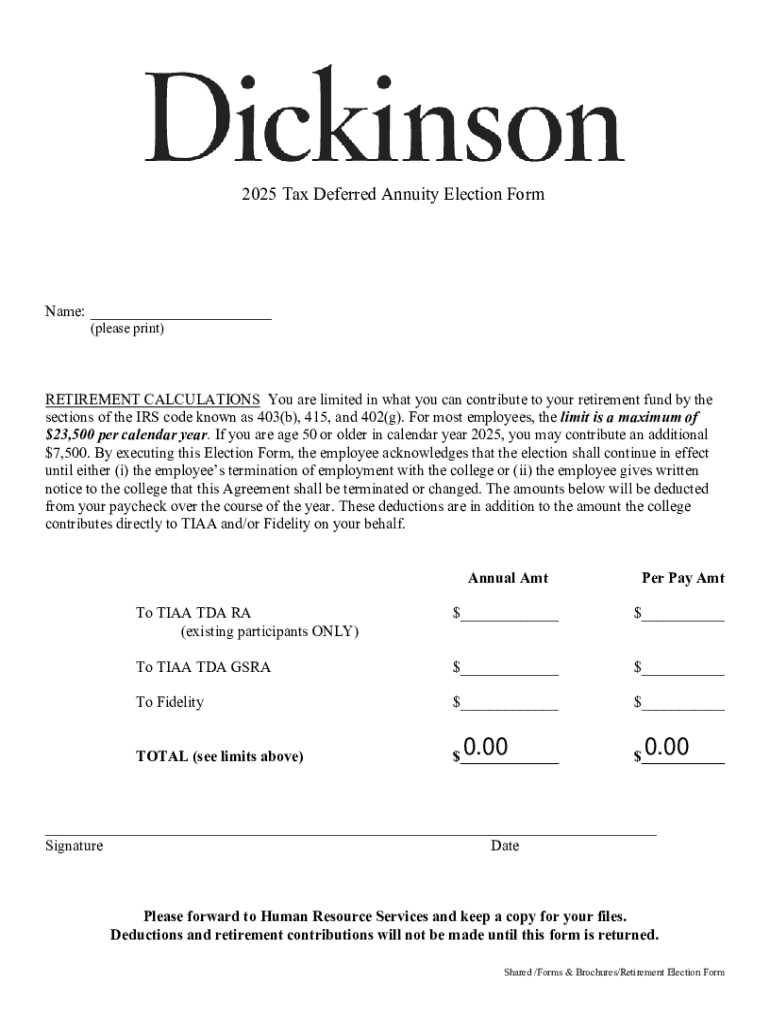

Get the free 2025 Tax Deferred Annuity Election Form

Get, Create, Make and Sign 2025 tax deferred annuity

Editing 2025 tax deferred annuity online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2025 tax deferred annuity

How to fill out 2025 tax deferred annuity

Who needs 2025 tax deferred annuity?

2025 Tax Deferred Annuity Form: A Comprehensive Guide

Understanding tax deferred annuities

Tax deferred annuities are financial products designed to help individuals save for retirement while deferring tax payments until funds are withdrawn. They operate by allowing investors to contribute funds without being taxed on the earnings, providing a unique opportunity for growth. This mechanism can significantly impact financial planning, particularly for those focused on retirement savings and long-term wealth accumulation.

The importance of tax deferred annuities in financial planning cannot be overstated, as they provide a structured approach to savings with built-in tax benefits. This strategy is particularly advantageous in the high-income years when individuals can benefit most from tax deferrals.

Key features

Tax deferred annuities come with several key features that make them attractive to investors. Firstly, the tax advantages allow earnings to grow without immediate tax implications, enhancing the potential for compound growth. Additionally, there are various types of tax deferred annuities available, including fixed, variable, and indexed annuities, each catering to different investor needs and risk appetites.

Significance of the 2025 tax deferred annuity form

The 2025 tax deferred annuity form serves as a critical piece of documentation for individuals looking to take advantage of these financial products. It captures essential information and ensures compliance with legal regulations regarding tax deferred annuities, making it a vital tool for effective financial management.

For 2025, there are several changes to be aware of regarding this form. Legislative adjustments have been made, reflecting current financial conditions and tax laws that could affect how individuals approach annuities.

Changes and updates for 2025

New regulations affecting tax deferred annuities in 2025 include revised contribution limits and updated provisions regarding withdrawals and penalties. These changes may differentiate this year’s form from previous versions, particularly regarding tax implications and the increased benefits aimed at encouraging retirement savings.

Comprehensive guide to completing the 2025 tax deferred annuity form

Getting started

Before diving into the details of completing the 2025 tax deferred annuity form, it's essential to gather all required documents and information. This preparation will streamline the filing process and ensure accuracy.

Step-by-step instructions

To access the 2025 tax deferred annuity form, utilize pdfFiller, where you can find the latest version readily available. Once you have the form, follow these specific steps for completion:

Common mistakes to avoid

Several common mistakes can derail your completion of the 2025 tax deferred annuity form. Misunderstanding terminologies or overlooking required sections can lead to delays or issues with your annuity. Furthermore, providing incomplete information can result in processing errors.

Interactive tools and features on pdfFiller

pdfFiller provides a suite of digital editing tools designed to simplify the process of completing and managing your 2025 tax deferred annuity form. With these features, users can customize their documents effortlessly.

Digital editing tools

On pdfFiller, editing the form is direct and user-friendly. The platform offers a variety of features such as customizable document fields that allow users to personalize their forms according to their specific needs, ensuring that no critical information is left out.

eSignature capabilities

Signing the 2025 tax deferred annuity form electronically on pdfFiller is both convenient and secure. The platform's eSignature capabilities ensure the validity and security of your digital signature, aligning with legal standards and providing peace of mind.

Collaboration options

Collaborating with financial advisors or team members is seamless on pdfFiller. The platform facilitates sharing documents, making real-time editing possible, which enhances communication and ensures everyone is on the same page regarding your financial planning.

Managing your 2025 tax deferred annuity form

Saving and storing documents

Effective document management is crucial in maintaining your financial records. On pdfFiller, best practices for saving and storing your 2025 tax deferred annuity form include organizing files systematically and using searchable tags for easy retrieval whenever necessary.

Accessing your document anywhere

The benefit of cloud-based storage is that you can access your documents from anywhere. Whether you are at home or on the go, having access to your 2025 tax deferred annuity form ensures you are always up-to-date and can manage your finances effectively.

Tracking and reviewing changes

Keeping records over time is essential not only for personal tracking but also for tax purposes. pdfFiller allows you to track changes and revisions made to your form, facilitating an efficient audit trail of your financial documentation.

Frequently asked questions (FAQs)

General questions about tax deferred annuities

A common concern for individuals considering a tax deferred annuity pertains to tax implications of withdrawals. Typically, earnings are subject to income tax at the time of withdrawal, and early withdrawals may incur additional penalties. Understanding these implications is crucial when planning your retirement strategy.

Questions specific to the 2025 form

Many users wonder where to locate the necessary documentation for the 2025 tax deferred annuity form. Fortunately, pdfFiller provides all the forms within its platform. If an error occurs after submission, it’s vital to know that corrections can often be made, depending on the nature of the mistake and the policies of the issuing company.

Final steps after submission

Following up on your submission

After submitting your 2025 tax deferred annuity form, it’s essential to follow up to ensure the documents were received and are being processed correctly. This can often be done through the customer service channels offered by your annuity provider.

Planning ahead

Retirement planning is an ongoing process that requires adjustments year after year. After submitting your 2025 form, reflect on your financial goals and expectations to adapt your strategy as needed, keeping in mind new tax laws and regulations that come into effect.

Unique benefits of using pdfFiller for your annuity needs

User-centric features

PdfFiller stands out for its ease of use and comprehensive support for users. The platform’s intuitive interface allows individuals and teams to navigate the form-filling process without hassle, ensuring that all information is accurately captured and securely stored.

Security and compliance

Ensuring the protection of financial documents is paramount. pdfFiller is committed to security and compliance, implementing robust measures to safeguard your sensitive information while providing a platform that meets legal requirements for electronic signatures and document handling, giving users confidence in managing their financial affairs.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send 2025 tax deferred annuity for eSignature?

How do I edit 2025 tax deferred annuity in Chrome?

Can I create an eSignature for the 2025 tax deferred annuity in Gmail?

What is tax deferred annuity?

Who is required to file tax deferred annuity?

How to fill out tax deferred annuity?

What is the purpose of tax deferred annuity?

What information must be reported on tax deferred annuity?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.