Get the free Direct Deposit Bank Authorization Form

Get, Create, Make and Sign direct deposit bank authorization

Editing direct deposit bank authorization online

Uncompromising security for your PDF editing and eSignature needs

How to fill out direct deposit bank authorization

How to fill out direct deposit bank authorization

Who needs direct deposit bank authorization?

Understanding the Direct Deposit Bank Authorization Form

Understanding the direct deposit bank authorization form

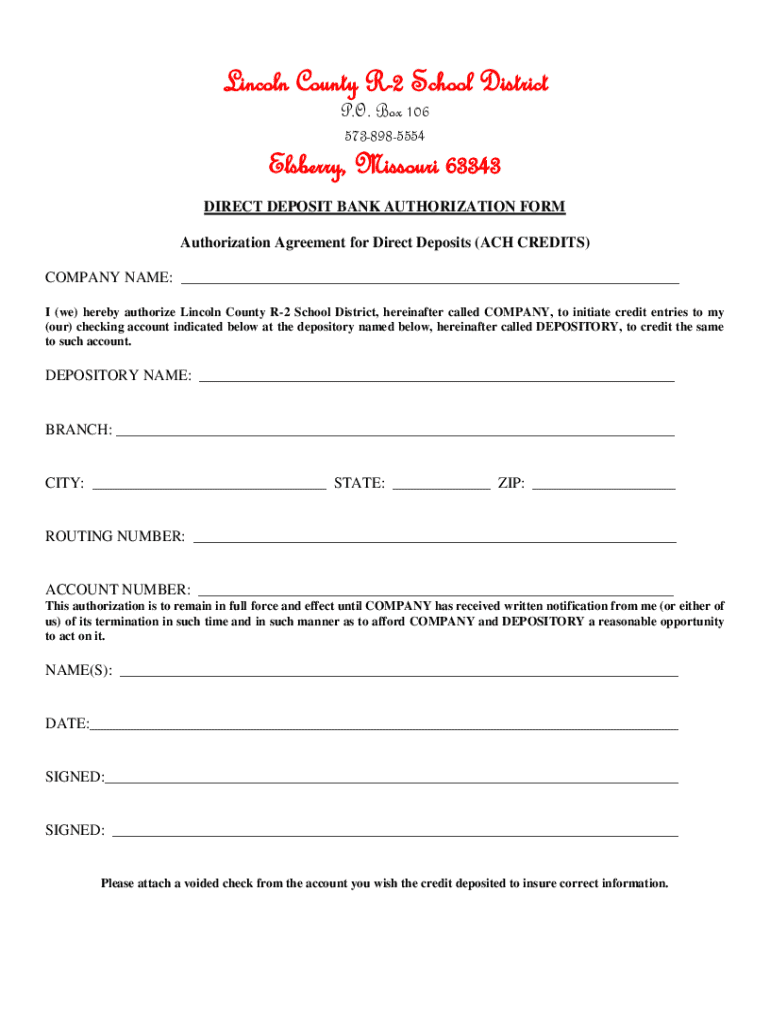

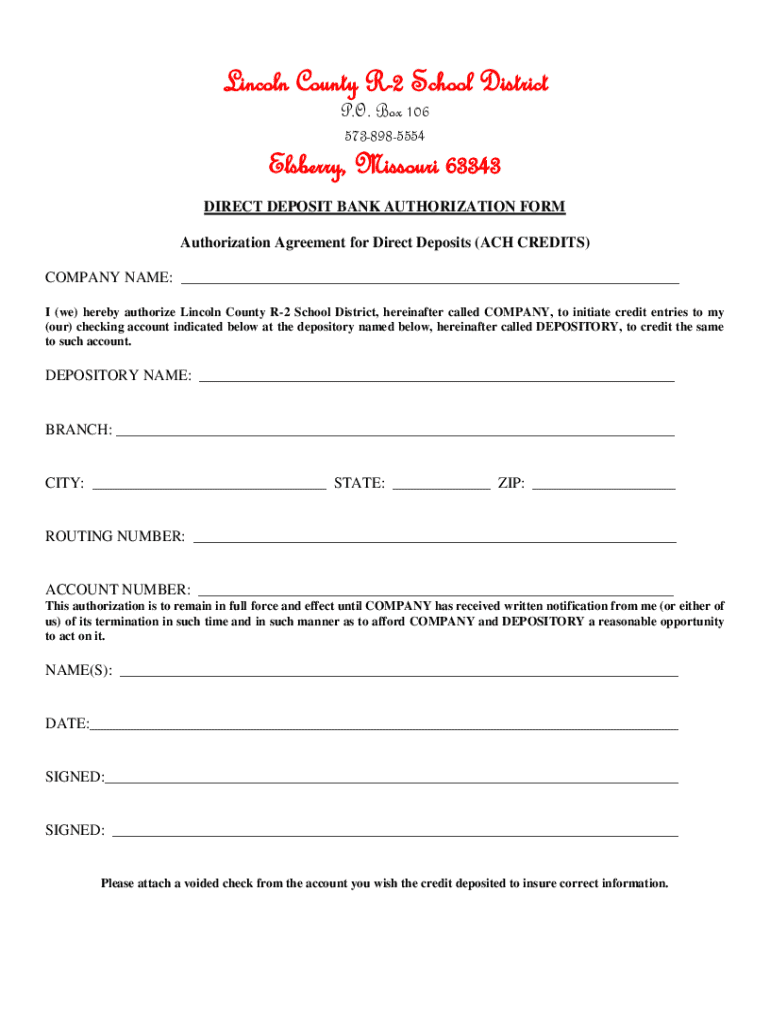

The direct deposit bank authorization form is a crucial document used by employees to authorize their employers to deposit payroll and other payments directly into their bank accounts. This form serves as a consent mechanism, ensuring that funds are transferred safely and securely without the need for physical checks.

Direct deposit has become the preferred method of payment for a variety of reasons. It eliminates the hassles associated with paper checks, such as delays in receiving payments or the risk of checks getting lost. According to a recent survey, approximately 80% of employees prefer direct deposit over traditional paychecks because of its convenience.

Common use cases for the direct deposit bank authorization form include payroll processing, where companies pay their employees; benefits disbursement, such as government aid or pensions; and tax refunds, providing a faster method for individuals to receive their credits from the IRS.

Necessary components of the form

To effectively authorize direct deposit, specific personal and bank information is essential. The completeness and accuracy of this information can streamline the payment process and ensure there are no delays.

Personal information typically required includes your full name, current address, and Social Security number. This information verifies your identity and links your payments to your tax records.

The bank information needed includes the bank's name, bank address, type of account (checking or savings), account number, and routing number. Each piece is vital for ensuring that funds are deposited correctly.

Finally, the signature and authorization section validates your consent. Be mindful that your signature represents a legal agreement. Along with your signature, the date of authorization is crucial to ensure the form reflects the most current authorization.

Step-by-step instructions for filling out the form

Filling out the direct deposit bank authorization form can be straightforward if you prepare appropriately. Start by gathering all necessary documents such as identification and bank statements to ensure accuracy.

Once your documents are in order, begin filling out the form by entering your personal information thoroughly. Pay special attention to spelling and numerical accuracy to prevent any discrepancies later.

After finishing the form, ensure that you sign it in the designated area, as your signature is legally binding. Next, submit the form to your employer or directly to your bank, following the specific submission guidelines provided.

Editing and managing the form with pdfFiller

Using pdfFiller to manage your direct deposit bank authorization form enhances your experience. First, access the form directly on the pdfFiller platform, where you can perform various edits and customizations.

The document's editing features allow you to modify any pre-filled information and ensure complete accuracy. You can also take advantage of digital signature options, which enable you to sign the document electronically, streamlining the submission process.

After editing, saving and storing your form is a breeze on pdfFiller. You benefit from cloud storage, allowing you to access your documents from anywhere at any time amidst growing remote work. Also, pdfFiller features version control, letting you track changes over time.

Common errors and how to avoid them

When filling out the direct deposit bank authorization form, it's essential to understand the common errors that can hinder the process. Missing information is a frequent pitfall; double-checking each section helps to mitigate this risk.

Incorrect banking details can result in funds being deposited into the wrong account, creating unnecessary issues that can be time-consuming to resolve. Ensure that your routing and account numbers are entered accurately.

Frequently asked questions (FAQs)

After submitting your direct deposit bank authorization form, the next steps may seem unclear. Typically, your employer will process the form and set up your payments within one or two pay cycles. Always follow up to ensure everything is set up correctly.

Tips for a smooth direct deposit experience

To ensure a seamless direct deposit experience, confirming processing times with your employer is vital. Some employers might require different timelines for setting up direct deposit, so being informed can prevent any cash flow issues.

Additionally, keeping track of your deposits can assist you in budgeting effectively. You can use online banking tools or apps to monitor when direct deposits are made, which adds to your financial management practices.

Exploring alternatives to direct deposit

While direct deposit is widely preferred, exploring alternatives can provide additional flexibility based on your needs. Other methods include paper checks and pay cards, each carrying different benefits and drawbacks.

For instance, checks can offer a tangible method of receiving money, while pay cards function similarly to debit cards but are often prepaid by your employer. Evaluate the pros and cons of each option to determine what best suits your financial situation.

Ultimately, assessing which payment method aligns with your financial habits and needs enhances your overall cash flow management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete direct deposit bank authorization on an iOS device?

How do I edit direct deposit bank authorization on an Android device?

How do I fill out direct deposit bank authorization on an Android device?

What is direct deposit bank authorization?

Who is required to file direct deposit bank authorization?

How to fill out direct deposit bank authorization?

What is the purpose of direct deposit bank authorization?

What information must be reported on direct deposit bank authorization?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.