Get the free Bequest Statement of Intent

Get, Create, Make and Sign bequest statement of intent

How to edit bequest statement of intent online

Uncompromising security for your PDF editing and eSignature needs

How to fill out bequest statement of intent

How to fill out bequest statement of intent

Who needs bequest statement of intent?

Bequest statement of intent form - How-to guide

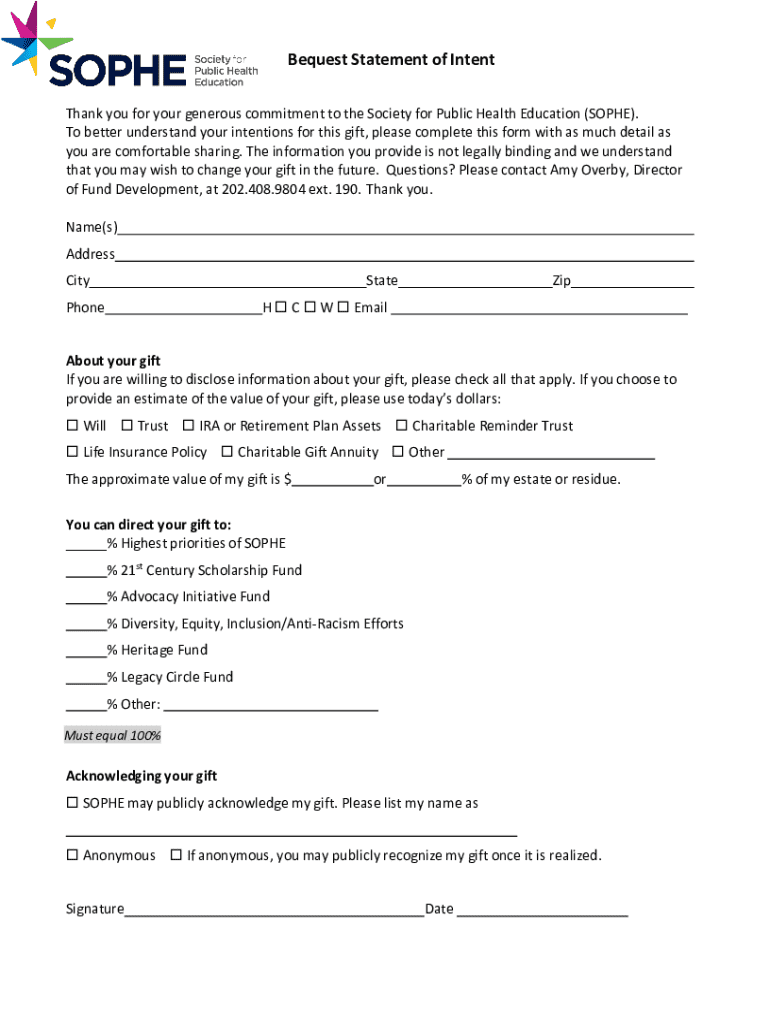

Understanding the bequest statement of intent form

A bequest statement of intent form is a crucial document in the realm of estate planning, serving as a declaration of an individual's intentions regarding the distribution of their assets upon death. Unlike a will, which outlines the specifics of how one’s estate will be divided, the bequest statement provides insight into the individual’s wishes toward particular charitable organizations or causes. It acts as a formalized approach to communicate these desires, ensuring that the intentions of the donor are clear and respected.

For both individuals and charitable organizations, this form carries significant importance. For the donor, it provides peace of mind that their philanthropic goals will be honored after their passing. Charitable organizations benefit from knowing what potential gifts they can expect, allowing them to plan their future projects and contributions accordingly. Moreover, understanding the legal implications of a bequest statement is also essential. Although it does not hold the power to dictate the terms of an estate, it can influence the execution of a will and guide fiduciaries in adhering to the donor's wishes.

Key components of the bequest statement of intent form

A comprehensive bequest statement of intent form contains several key components, ensuring that all necessary details are captured efficiently. First and foremost, essential information includes the personal details of the donor—such as their full name, contact information, and possibly a brief biography if relevant. This personalization fosters a connection between the donor and the intended organization.

The next crucial element is the description of the bequest itself, detailing what assets or funds are being donated. This could range from a certain monetary amount to real estate or personal property. Furthermore, the purpose of the bequest should be clearly outlined. This section helps the organization understand how the funds will be utilized, whether for specific programs, scholarships, or general operational support.

Lastly, optional information can provide further clarity. This may include any special requests or conditions tied to the bequest, such as how the funds should be managed or used. Additionally, including contact information allows the organization to follow up with the donor for any clarifications or updates, creating an open line of communication that can strengthen the relationship.

Step-by-step instructions for completing the form

Completing a bequest statement of intent form may seem daunting, but it can be broken down into manageable steps. The first step involves gathering all necessary documents and records. This could include a list of assets, any previous wills, and information regarding the charitable organization you wish to support. Being organized at this stage can save time later and ensure all required details are accurately captured.

Next, fill out your personal details meticulously. Accuracy is crucial, as discrepancies can lead to misunderstandings later. It’s advisable to verify all provided information against official documents, such as your ID or social security card, ensuring compliance with legal standards.

When describing the bequest, clarity is vital. Examples of common bequests include monetary amounts, properties, stocks, or specific items that hold personal significance. Be precise about what you are leaving behind to help guide the organization’s future planning and implementation.

Once the form is filled out, reviewing and editing is essential. Utilize pdfFiller's editing tools to ensure everything is clear, concise, and free from errors. For additional security and verification, a second pair of eyes can provide crucial feedback before finalizing the document.

After reviewing, the form needs to be signed. Options for eSigning through pdfFiller are available, making it seamless to finalize your document without the need for physical printing. Lastly, you can choose how to submit the form—whether online for immediate acknowledgment or traditional mail if required by the organization; both have merits depending on your preference or the organization’s protocols.

Interactive tools available on pdfFiller

pdfFiller provides robust interactive tools designed to aid in the completion of forms like the bequest statement of intent. One key feature is the auto-fill option, which streamlines the information input process by automatically populating fields based on pre-existing data. This saves time and reduces the likelihood of errors.

Collaboration tools are also available, allowing users to share the document with family members, legal advisors, or organizational representatives. This feature encourages open dialogue and feedback regarding intentions and details, fostering a sense of community around important charitable contributions. Additionally, cloud storage benefits ensure your documents are accessible anytime, from anywhere, allowing you to manage your bequest statement effectively.

Managing your bequest statement of intent form

After completing the bequest statement of intent form, proper management is crucial for future reference. pdfFiller offers tools to store and organize your documents securely, ensuring you can retrieve your form with ease when needed. Consistent organization of documents not only aids in personal management but also prepares you for any discussions with beneficiaries or organizations.

Version control is another important aspect of document management. Tracking changes and updates can prevent any miscommunication about wishes as time progresses. If circumstances change, such as new relationships or changes in belonging assets, knowing how to revoke or modify your bequest is vital. Keeping your bequest statement updated ensures it accurately reflects your current desires regarding your estate.

Common questions about the bequest statement of intent form

Many individuals considering the bequest statement encounter questions along the way. One common query is about changing one's mind regarding a bequest. The good news is that donors can modify or even revoke their bequests at any time, provided they follow the proper legal steps. This flexibility allows individuals to adapt their philanthropic goals as their life circumstances evolve.

Another frequent concern involves the tax implications of making a bequest. Donors often wonder how a bequest affects estate taxes. In many instances, bequests to charitable organizations may not be taxable, providing potential financial benefits for the estate. Moreover, donors can designate multiple beneficiaries within their bequest statement, allowing them to support various causes or individuals simultaneously.

It's also essential to consider the future of the organization intended for support. Questions arise about what occurs if the organization no longer exists at the time of the donor's passing. Most bequest statements include contingencies or state alternate charities to ensure the funds are directed as closely as possible to the original intent.

Real-life examples of bequest statements of intent

Real-life examples of bequest statements of intent help illustrate the profound impact that such acts can have. One case study involved a retired educator who left a significant bequest to her local community college. Her intent was to establish scholarships for underprivileged students. The institution used her donation to create a dedicated fund, enabling hundreds of students to pursue higher education who otherwise would have faced financial barriers.

Another impactful story emerged from a philanthropist who directed his bequest toward environmental conservation. His estate funded vital research programs and conservation projects, leading to the protection of vulnerable ecosystems. Each of these cases showcases how a well-executed bequest statement of intent can generate significant positive ramifications for communities and causes long after the donor's passing.

Additional insights on bequests and philanthropy

Bequests play a pivotal role in the landscape of charitable giving, often comprising a crucial portion of the income for many nonprofit organizations. According to recent data, bequests can account for nearly a third of all charitable donations in the United States. This trend highlights the continuing need for individuals to think seriously about their legacy and the impact they wish to have on future generations through thoughtful bequest planning.

Organizations leverage the power of bequests to ensure their long-term sustainability. Many implement awareness campaigns that encourage supporters to consider leaving a legacy gift. Furthermore, with rising trends in generational wealth transfer, more individuals are advised to contemplate how their bequests can contribute to community wealth, address social issues, and bolster significant causes that resonate with them.

Media inquiries and updates

For those interested in staying informed about developments in bequest giving or for media inquiries, organizations typically provide a dedicated contact avenue. Individuals can reach out to designated representatives for press releases, updates, and further information regarding bequest statements and related philanthropic initiatives. Ensuring that you remain updated on these matters can foster stronger relationships with charitable organizations, helping to amplify your intended legacy.

Additionally, subscribing to newsletters or following related social media channels can serve as beneficial avenues for ongoing education about the nuances of bequests and the various ways individuals can contribute to causes they care about. These proactive steps reinforce one’s commitment to philanthropy and ensure that intentions remain aligned with actions throughout one’s life journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit bequest statement of intent from Google Drive?

How can I send bequest statement of intent for eSignature?

How do I complete bequest statement of intent online?

What is bequest statement of intent?

Who is required to file bequest statement of intent?

How to fill out bequest statement of intent?

What is the purpose of bequest statement of intent?

What information must be reported on bequest statement of intent?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.