Get the free W-9

Get, Create, Make and Sign w-9

Editing w-9 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out w-9

How to fill out w-9

Who needs w-9?

Your Comprehensive Guide to the W-9 Form

Understanding the W-9 form

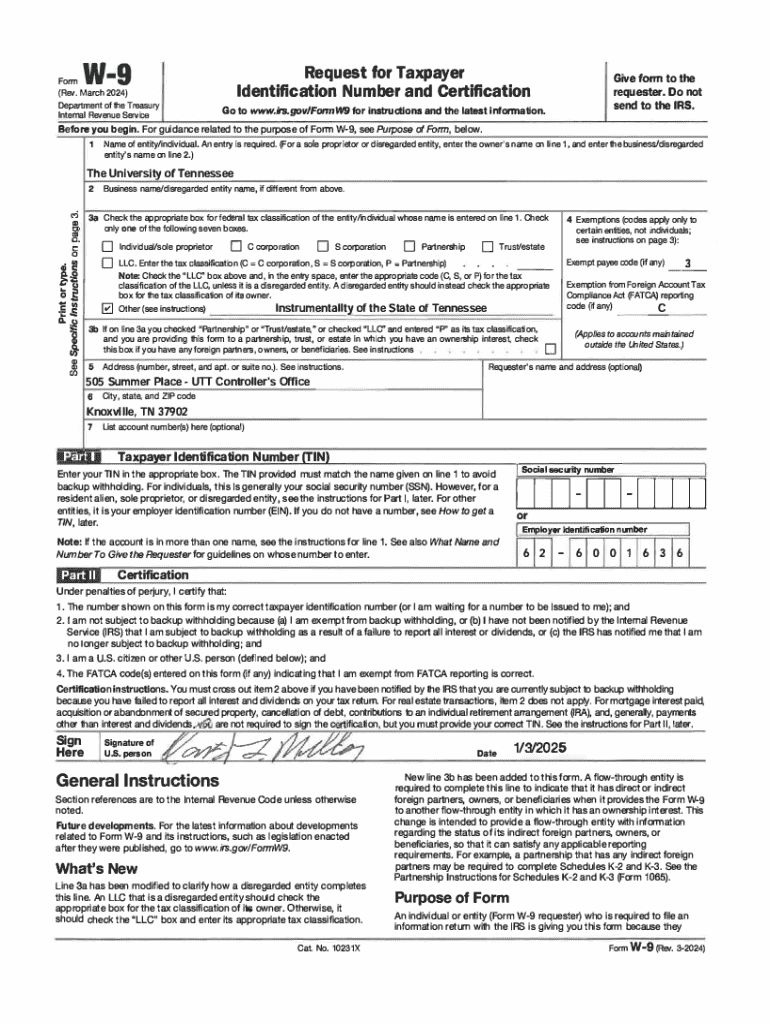

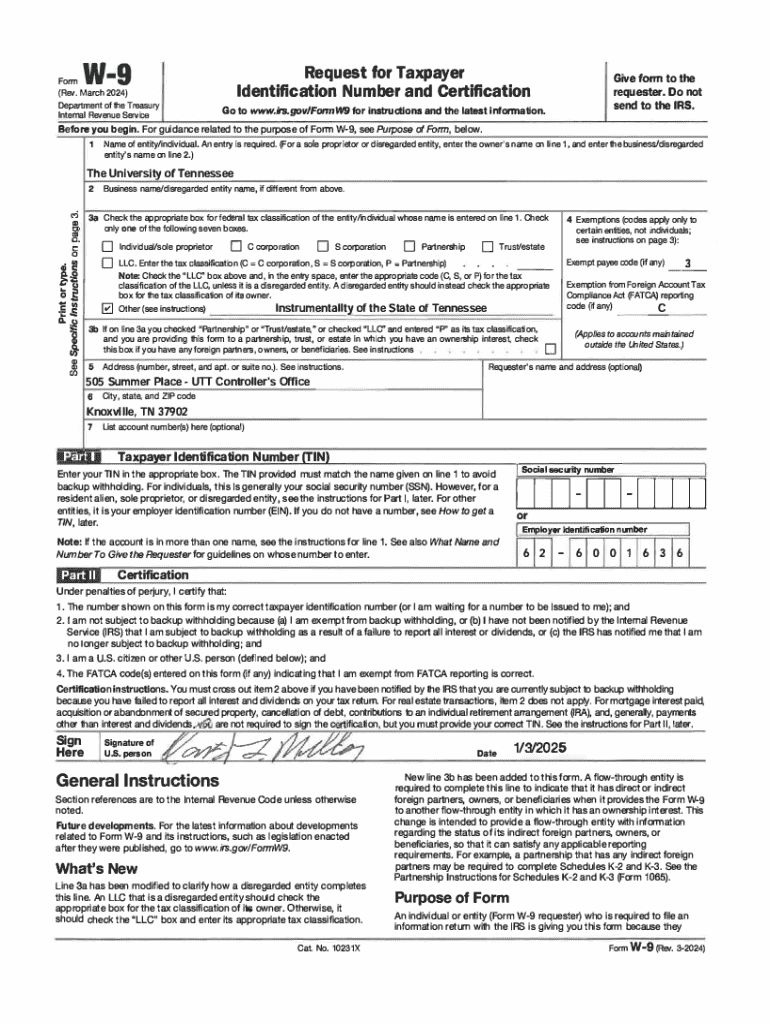

The W-9 form, officially known as the 'Request for Taxpayer Identification Number and Certification,' is a crucial document used primarily in the United States for tax purposes. It serves as a means for individuals and businesses to provide their taxpayer identification number (TIN) to parties that require this information for reporting income payments to the IRS. Without this form, entities may face challenges in accurately reporting payments, which can lead to complications during tax filing.

The importance of the W-9 form in tax reporting cannot be overstated. It helps ensure that income is reported accurately to the IRS, helping to prevent issues such as underreporting. A clear understanding of key terminology associated with the W-9 form is essential. For instance, a Taxpayer Identification Number (TIN) can refer to a Social Security Number (SSN) for individuals or an Employer Identification Number (EIN) for businesses. Certification on this form indicates that the taxpayer is confirming their TIN as accurate and is not subject to backup withholding.

When to use the W-9 form

Understanding when to fill out a W-9 form is vital for independent contractors, freelancers, and businesses. Independent contractors and freelancers are generally required to submit a W-9 form to clients who will be paying them, allowing these clients to accurately report the payments made during the year. Corporations and partnerships may also need to provide a W-9 when entering contractual agreements or receiving payments for services rendered.

Common situations requiring a W-9 submission include instances when an individual or business is receiving income payments from another entity. This applies across various scenarios such as freelance work, consultancy services, and contractual agreements with businesses. In each of these cases, having a completed W-9 enables the paying entity to properly report payments to the IRS, ensuring compliance with tax regulations.

How to fill out the W-9 form

Filling out the W-9 form might seem daunting, but it can be broken down into simple steps. Begin by providing your personal information, which includes your name and business name if applicable. Next, you will need to select your tax classification—be it an individual, corporation, partnership, or another entity type. This selection is crucial as it dictates how the IRS classifies the income reported.

One critical aspect to note is the difference between a Taxpayer Identification Number (TIN) and a Social Security Number (SSN). If you're an individual, your SSN serves as your TIN. However, businesses typically need to provide their EIN. Lastly, ensure to sign and date the form, as failing to do so could lead to its rejection or incorrect processing.

Digital and electronic completion of the W-9

Utilizing modern tools like pdfFiller simplifies the completion of the W-9 form. With pdfFiller, users can effortlessly upload PDFs and fill in interactive fields, allowing for the smooth entry of necessary information without the hassle of printing and scanning. This efficiency can save significant time, particularly for those managing multiple documents.

The eSignature functionality further enhances the digital process. An electronic signature not only streamlines the signature process but also holds legal validity in many situations. This means that once you’ve completed your W-9 form digitally and signed it via pdfFiller, you can confidently submit it, knowing that it meets all legal and compliance standards.

Managing your completed W-9 forms

After filling out your W-9 form, the next step is managing it securely. Effective storage and organization of your completed forms can help ensure that you can quickly retrieve them when needed. Cloud storage options are highly recommended as they provide easy access from anywhere while ensuring your documents remain secure.

When it comes to sharing your W-9, it's crucial to practice caution with sensitive information. Avoid sending the form via insecure methods such as unencrypted email. Instead, consider secure platforms that allow for encrypted file transfers. This will protect your personal information from unauthorized access while ensuring that your W-9 submission is both efficient and confidential.

Common use cases for the W-9 form

The W-9 form is widely used in different arrangements, especially in employer-employee and business-contractor relationships. In an employer-employee setup, the employer may request a W-9 from employees working under a 1099 arrangement to ensure proper tax reporting. Similarly, businesses often request a W-9 when hiring outside contractors for specific projects.

These use cases exemplify the versatility and necessity of the W-9 form in various financial agreements. Regardless of the specific arrangement, the W-9 form ensures clarity and compliance in income reporting.

Filing method and submitting your W-9

Once you have completed your W-9 form, you may wonder where to send it. Typically, you provide your W-9 to the company or individual requesting it, which could vary widely based on your situation. Some entities may request you to email the completed form, while others may require direct mail.

Several filing options are available depending on the requesting party's preference or operational structure. Ensure you follow any specific instructions provided to you regarding submission formatting or methods. Also, remember to consider timelines, as some organizations may require the W-9 to be processed within a certain frame, especially if financial transactions are contingent upon its receipt.

Frequency of W-9 requests

How often should you update your W-9? It is advisable to review your W-9 form every few years or whenever there is a change in your personal or business information, such as a change in your name or taxpayer identification. These changes may necessitate completing a new W-9 form to maintain accurate records.

Additionally, any indicators that a new W-9 is needed may include receiving a request from a client or a notice from the IRS pertaining to discrepancies in reporting. Being proactive about keeping your W-9 current ensures smooth interactions with clients and minimizes potential issues during tax filings.

Legal and compliance considerations

The W-9 form plays a critical role in tax compliance and understanding its implications is important. One key aspect is backup withholding, which may occur if your TIN is not provided or if the IRS notifies the payer of certain issues regarding your tax status. Backup withholding requires the payer to withhold a percentage of payments to you, which can lead to a reduction in your income.

To avoid backup withholding, ensure that you provide an accurate TIN when submitting your W-9 form. Additionally, staying informed about your tax status and resolving any discrepancies presented by the IRS quickly can help protect you from unnecessary withholdings during income reporting.

Insights on IRS regulations related to W-9

The IRS has established specific guidelines concerning the W-9 form that all users should be aware of. Regulations are subject to updates, and it is essential to keep abreast of these changes to ensure compliance. For example, administrative adjustments within the IRS procedures can impact the requirements for W-9 submissions, necessitating users to refer to the most current resources.

Regularly reviewing IRS publications and official announcements regarding Form W-9 can not only ensure proper compliance but also aid in understanding any new obligations you may have as a taxpayer or business entity. Utilizing platforms like pdfFiller also allows you to keep your W-9 compliant with the latest regulations.

Troubleshooting common W-9 issues

If you encounter issues with your W-9 form, such as it being rejected, the first step is to check for common mistakes. Incorrect TIN submissions are a frequent cause of rejection. Make sure the TIN provided matches the official documentation issued by the IRS. Errors can lead to significant complications in tax reporting.

In cases of receiving inquiries from the IRS regarding your W-9, responding promptly and accurately is crucial to avoid additional complications. Keeping copies of all communications and your submitted forms ensures that you have records available for any follow-up.

Helpful guides and quick reference links

For those seeking supplementary information regarding the W-9 form, there are numerous resources available. Frequently asked questions (FAQs) about W-9 forms provide valuable insights and clarifications. Additionally, templates and resources via pdfFiller can enhance your document management experience.

Links to IRS publications concerning the W-9 can also serve as a foundation for understanding tax obligations and changes in compliance requirements. Staying informed enables individuals and businesses to navigate their tax circumstances effectively.

Contact information for further support

If you require assistance with your W-9 form or any related questions, reaching out to pdfFiller can provide you with the support needed to streamline your document management. Customer service teams are available to assist with queries about using pdfFiller’s features for filling out, signing, and storing W-9 forms effectively.

Additionally, seeking resources for legal and tax consultation is important for individuals and businesses navigating filing requirements. Professional advice can help mitigate risks associated with tax compliance while ensuring all forms, including the W-9, are in proper order.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my w-9 in Gmail?

How can I get w-9?

Can I create an electronic signature for signing my w-9 in Gmail?

What is w-9?

Who is required to file w-9?

How to fill out w-9?

What is the purpose of w-9?

What information must be reported on w-9?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.