Get the free Overdraft Privilege Opt-out Form

Get, Create, Make and Sign overdraft privilege opt-out form

How to edit overdraft privilege opt-out form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out overdraft privilege opt-out form

How to fill out overdraft privilege opt-out form

Who needs overdraft privilege opt-out form?

Understanding and Managing Overdraft Privilege: The Opt-Out Form Guide

Understanding overdraft privilege

Overdraft privilege is a service offered by many banks that allows customers to withdraw more money than they have in their checking accounts. This potentially prevents declined transactions and bounced checks that can incur fees and affect credit ratings.

When you make a transaction that exceeds your account balance, instead of declining the transaction, the bank covers the overdraft up to a certain limit. This limit varies between institutions, often ranging between $200 to $1,000. While overdraft privilege can be a financial lifesaver in emergencies, it comes with its unique set of benefits and drawbacks.

The importance of opting out

Opting out of overdraft privilege is a decision that can lead to better financial health for many individuals. The reasons for opting out vary, but significant financial benefits often drive the choice.

First and foremost, opting out can help individuals manage their finances more effectively. Without the safety net of overdraft protection, users are more likely to monitor their accounts actively to prevent overdrafts. This practice fosters better budgeting and financial planning habits.

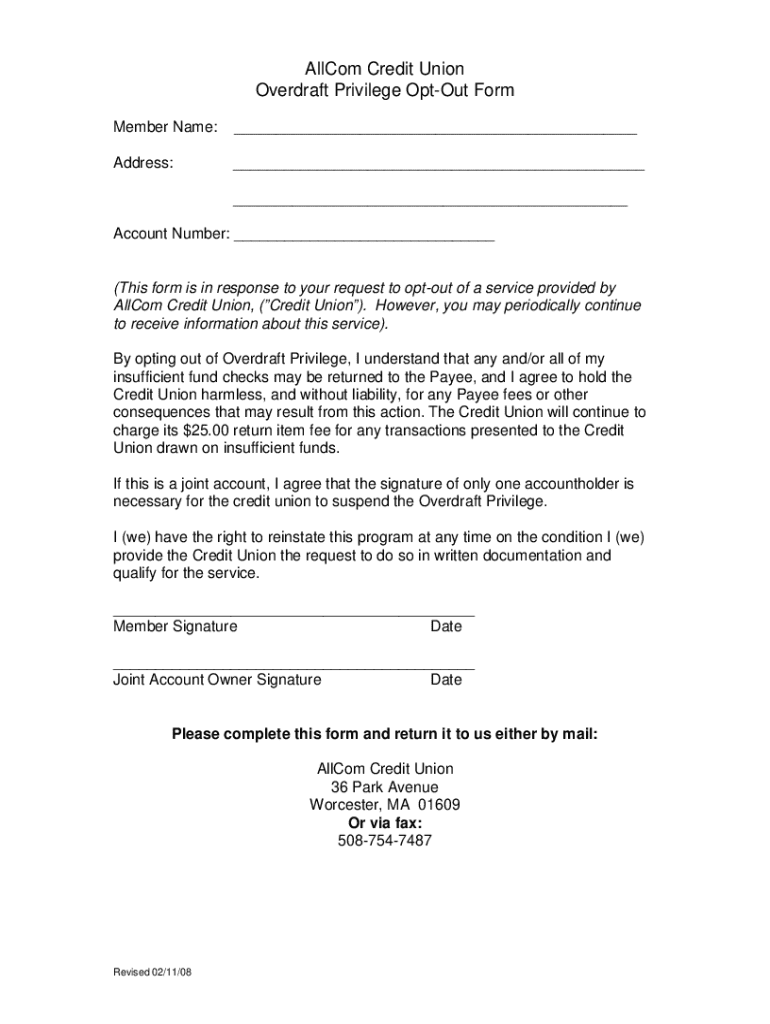

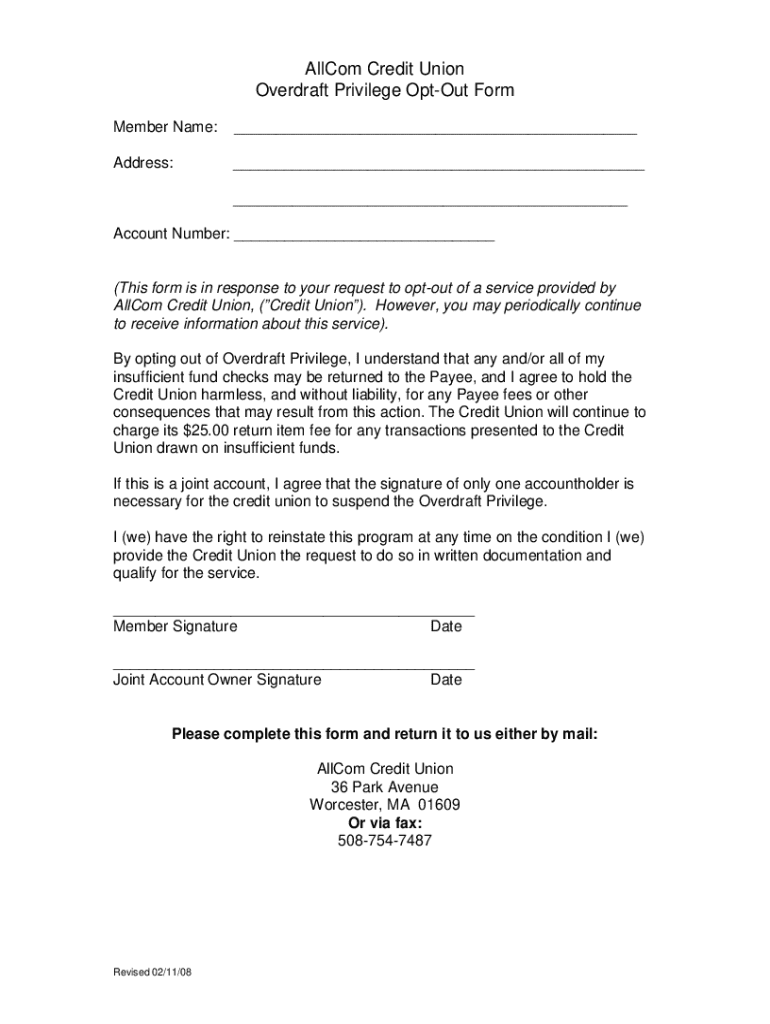

Overview of the overdraft privilege opt-out form

The overdraft privilege opt-out form is a crucial document for any individual wishing to halt their participation in overdraft services. This form serves as an official request to your bank to remove your account from any overdraft programs.

The legal significance of opting out cannot be understated; it acts as a formal directive to your bank, ensuring that they cannot automatically cover any future overdrafts, which can protect you from unforeseen financial pitfalls.

Step-by-step guide to completing the overdraft privilege opt-out form

Completing the overdraft privilege opt-out form is a straightforward process, but it's crucial to fill it out accurately to avoid delays or complications.

Step 1: Gathering necessary information

Before accessing the form, gather all necessary details, such as your full name, social security number, and account details. Confirm identification requirements will ensure your request is processed without issues.

Step 2: Accessing the form online

You can conveniently locate and access the opt-out form online through pdfFiller. Forms are available in various formats like PDF, DOCX, or as editable documents to best suit your needs.

Step 3: Filling out the form accurately

Filling out the form accurately is crucial. Ensure that each section is completed correctly to avoid any processing delays. Common mistakes include missing signatures or incorrect account numbers.

Step 4: Reviewing your submission

Once your form is filled out, it’s critical to review your submission. This ensures that everything is correct and complete.

Step 5: Submitting the form

After reviewing the form, you can submit it via various methods such as online through your banking portal, mailing a physical copy to your bank’s address, or even delivering it in person at a local branch.

Incorporating a method to confirm receipt—the bank will typically provide a confirmation number or email—ensures your request is on record.

Managing your banking preferences post opt-out

Once you've opted out of overdraft services, managing your finances effectively becomes paramount. Monitor your account for any unauthorized charges or unexpected changes in balance.

Employ tools that help streamline this process, such as budgeting apps and alerts for low balances. These not only help prevent overdrafts but encourage proactive financial management.

Frequently asked questions (FAQ)

Additional insights on overdraft policies

Understanding federal regulations surrounding overdraft services is essential for informed decision-making. Many laws guide how banks can implement these services, ensuring transparency and protecting consumers.

It's worth comparing overdraft policies from different banks. These offerings can vary significantly, influencing both the limits and fees associated with overdraft privilege.

Conclusion on opting for financial wellness

Opting out of overdraft privilege is a proactive step toward managing your finances more effectively. It encourages discipline in tracking spending and limits unnecessary fees.

Regularly reviewing your banking policies and your financial strategy can enhance your financial wellbeing, providing a sustainable approach to personal and/or team financial management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit overdraft privilege opt-out form from Google Drive?

How can I get overdraft privilege opt-out form?

How do I edit overdraft privilege opt-out form on an iOS device?

What is overdraft privilege opt-out form?

Who is required to file overdraft privilege opt-out form?

How to fill out overdraft privilege opt-out form?

What is the purpose of overdraft privilege opt-out form?

What information must be reported on overdraft privilege opt-out form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.