Get the free Christmas Club Account Application

Get, Create, Make and Sign christmas club account application

Editing christmas club account application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out christmas club account application

How to fill out christmas club account application

Who needs christmas club account application?

Your Guide to the Christmas Club Account Application Form

Understanding Christmas Club Accounts

A Christmas Club Account is a specialized savings account designed to help individuals save money specifically for the holiday season. By setting aside funds throughout the year, account holders can avoid the financial stress that often accompanies holiday shopping. These accounts serve the dual purpose of encouraging disciplined savings and offering a means to budget for Christmas and other festive expenses.

The benefits are multifaceted, including setting aside funds steadily to cover gifts, travel, or holiday-related expenses without resorting to credit. Furthermore, many banks offer interest earnings on these accounts, which can add to the overall holiday budget when the funds are withdrawn.

How does interest work on a Christmas Club Account?

Interest on a Christmas Club Account varies by institution but typically accumulates over the duration of the account. This interest is usually compounded either monthly or quarterly, providing account holders with a small return on their savings. When comparing this to traditional savings accounts, Christmas Club Accounts often have lower interest rates. However, their focus on holiday savings helps individuals manage their finances more effectively during a typically expensive time of year.

Steps to apply for a Christmas Club Account

Applying for a Christmas Club Account is a straightforward process, designed to make it easy for everyone to get started with their holiday savings. The first step is ensuring you meet the eligibility requirements set by the financial institution of your choice.

Eligibility requirements

Most financial institutions require applicants to be at least 18 years old. Some may also allow accounts for minors with a parent or legal guardian's co-signature. Documentation typically includes proof of identity, such as a government-issued ID, and possibly proof of address.

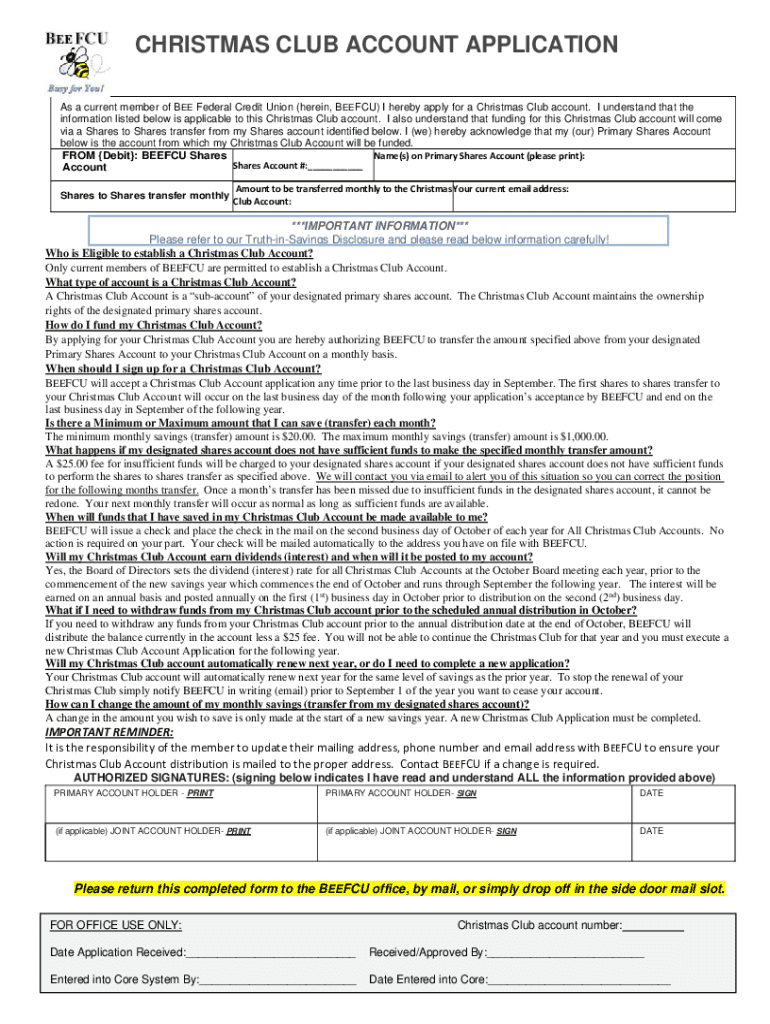

How to fill out the Christmas Club Account application form

Once eligibility is confirmed, you can proceed to fill out the application form. Here's a step-by-step guide:

Submitting your application

You can usually submit your application online through the bank's website, in person at a local branch, or by mailing in your completed form. Processing times may vary, but most applications are processed within a few business days.

Managing your Christmas Club Account

Once your Christmas Club Account is established, understanding the details of your account management is crucial. Most accounts come with a minimum balance requirement, which varies by institution. Additionally, some banks may impose account fees or charges if the balance falls below a certain threshold.

Account details overview

It’s essential to familiarize yourself with these fees as they can eat into your savings. Many banks provide online banking options, allowing you to monitor your account and track your progress toward your holiday savings goals. A mobile app can also add convenience, giving you access to your account anywhere and at any time.

Enjoy these services with every account

In addition to online access, many Christmas Club Accounts offer budgeting tools that can help you visualize your savings plan. These tools can assist you in staying on track and making the most of your holiday budget.

Frequently asked questions

Can withdraw funds early from my Christmas Club Account?

Generally, Christmas Club Accounts are designed to restrict early withdrawals until a predetermined date, often just before the holiday season. However, some institutions might allow exceptions, although early withdrawal fees may apply. This policy encourages disciplined saving and protects the purpose of the account.

How do get started if don’t have a community bank checking account?

If you are new to banking or don't have a checking account, you can still apply for a Christmas Club Account. Many institutions allow you to start with just a savings account. Just inquire during your application process about any specific requirements they may have.

What happens if don’t meet contribution goals?

Failure to meet your contribution goal may lead to penalties, which vary by bank. To avoid these penalties, ensure that you understand the account's terms when signing up and develop a realistic savings plan that works for your budget.

Helpful tools for account management

Budgeting tools

Many banks offer interactive budgeting tools that can help you effectively manage and visualize your savings. Utilizing resources from pdfFiller can enhance your planning experience, from formatting spreadsheets to tracking your expenses in digital format.

Support resources

Should you need further assistance, customer service options are often available through phone or online chat. Furthermore, pdfFiller provides access to user guides and FAQs that can help you navigate your account and any issues that arise.

Discover other savings options

Christmas Club Accounts are just one avenue for savings. Consumers should explore other banking products that might suit their financial needs. Many institutions offer savings accounts, loans, and even insurance options designed with customer satisfaction in mind.

Creating a personalized savings strategy

Optimizing your overall savings strategy means being aware of all your options. Consider setting short-term and long-term savings goals, understanding the best use of your funds, and selecting accounts that support your financial objectives.

Get in touch

If you have questions about your Christmas Club Account or need assistance with the application process, contacting customer service is a reliable option. Most banks provide dedicated customer service hours, along with contact numbers available both online and in branches. pdfFiller also offers online support features, including live chat for immediate help.

Privacy notice

Understanding your privacy rights is crucial when applying for any financial product. Banks, along with pdfFiller, implement data protection practices to secure your information during and after the application process. Familiarizing yourself with their policies on data protection ensures you know how your personal information is used and safeguarded.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify christmas club account application without leaving Google Drive?

How can I send christmas club account application to be eSigned by others?

How do I complete christmas club account application on an Android device?

What is christmas club account application?

Who is required to file christmas club account application?

How to fill out christmas club account application?

What is the purpose of christmas club account application?

What information must be reported on christmas club account application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.