Get the free Overdraft Privilege (odp) Opt Out Request

Get, Create, Make and Sign overdraft privilege odp opt

How to edit overdraft privilege odp opt online

Uncompromising security for your PDF editing and eSignature needs

How to fill out overdraft privilege odp opt

How to fill out overdraft privilege odp opt

Who needs overdraft privilege odp opt?

Overdraft Privilege ODP Opt Form Guide

Understanding Overdraft Privilege (ODP)

Overdraft privilege (ODP) is a service offered by banks that allows account holders to withdraw more money than they have available in their checking accounts. This feature aims to prevent declined transactions and bounced checks, thereby providing a safety net for account holders during financial emergencies.

The main purpose of ODP is to add a layer of security and convenience for customers, allowing them to cover any unexpected expenses without the embarrassment of declined transactions. This can be particularly helpful when paying bills, making purchases, or handling urgent financial matters.

Pros and cons of using ODP

Having access to overdraft privilege can lead to enhanced financial flexibility. For many individuals, the comfort of knowing that they won’t face declined transactions can mitigate stress in managing day-to-day expenses. Additionally, it can preserve your credit rating by avoiding overdraft fees from billers who may report late or declined payments.

However, the use of overdraft privilege is not without drawbacks. The fees associated with ODP can be quite high. Banks typically charge per transaction that triggers the overdraft, which can quickly add up. Moreover, relying on such a feature might encourage overspending, leading to a cycle of debt.

Navigating the overdraft privilege opt-in and opt-out process

Understanding the opt-in and opt-out process is critical for effectively managing your overdraft privilege. Opting in means you agree to allow your bank to cover overdrafts on transactions like checks and electronic payments, while opting out means you will not receive this service, and transactions will be declined if you don’t have sufficient funds.

It's essential to consider your financial habits when deciding. If you tend to keep a close watch on your balance, opting out may save you from unnecessary fees. However, if unexpected expenses arise often, opting in could provide necessary protection.

Eligibility requirements for ODP

To qualify for overdraft privilege, account holders typically need to meet certain bank-specific criteria. These may include maintaining an active checking account for a set period, having a positive account balance over a certain timeframe, and not having excessive overdraft occurrences.

Documentation may also be required when opting in or out, such as proof of identification and account details. Clarifying these requirements with your bank before beginning the process can save you time and ensure a smoother experience.

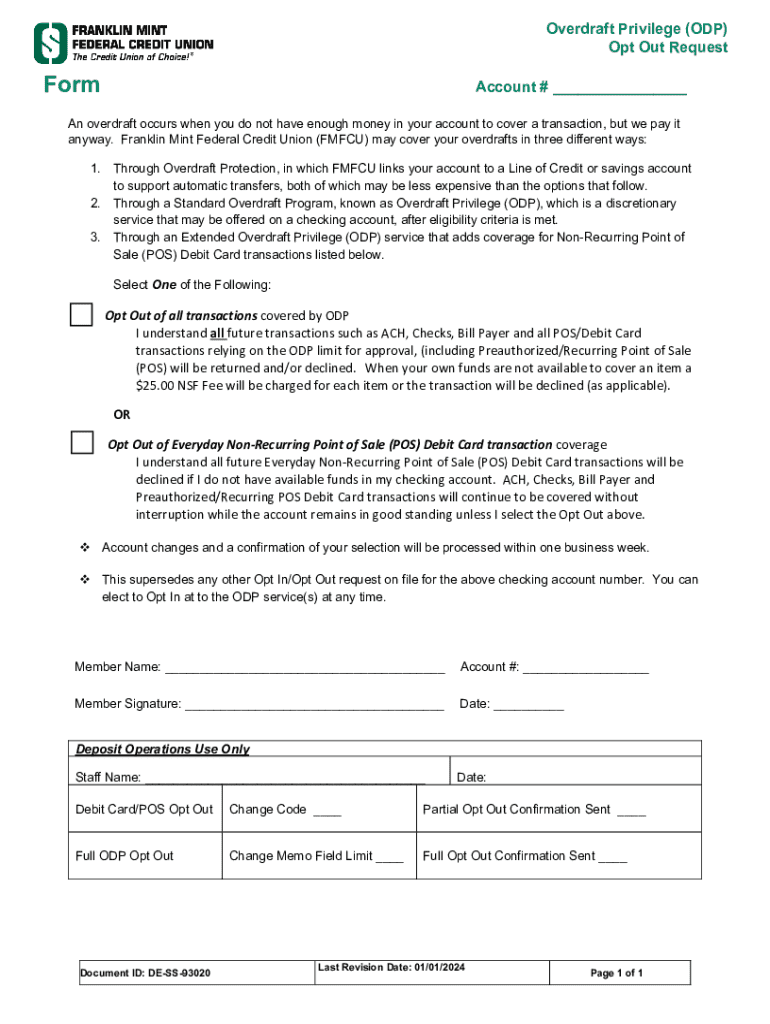

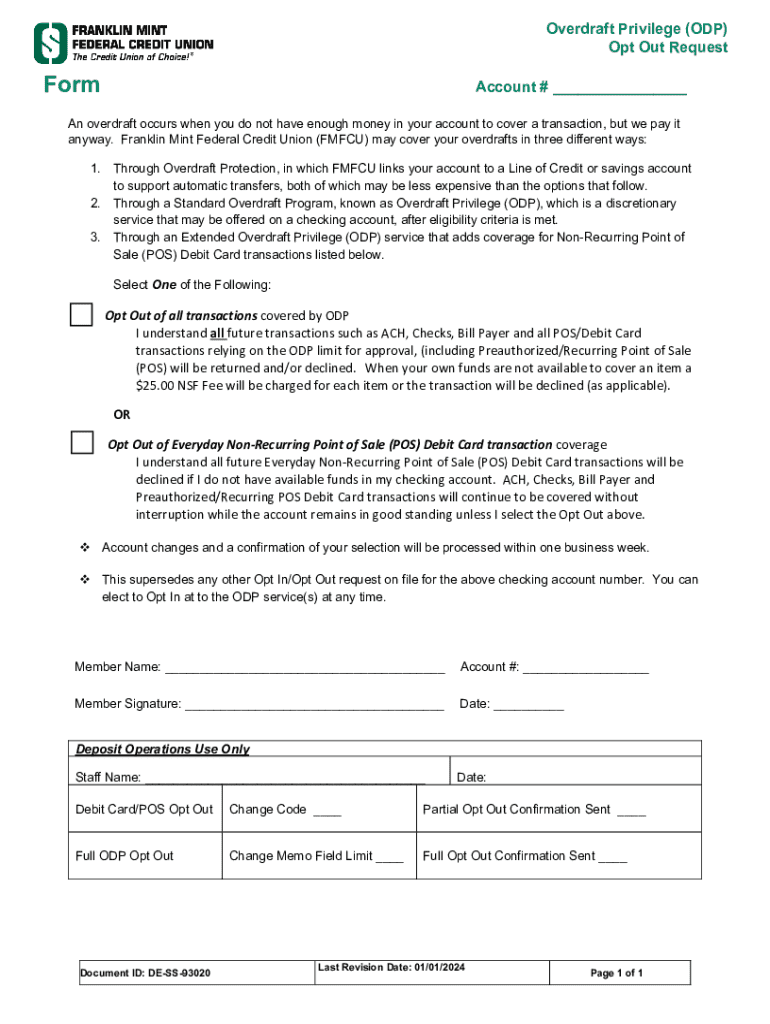

Detailed steps to complete the ODP opt form

Completing the overdraft privilege ODP opt form can seem daunting, but it can be straightforward with the right steps. Here is your guide to efficiently fill out the ODP opt form using pdfFiller.

Step 1: Accessing the overdraft privilege ODP opt form

To start, access the ODP opt form directly on pdfFiller. The platform offers an intuitive user experience, allowing you to find your desired document quickly. Ensuring that you’re using a reliable document service like pdfFiller guarantees that your form will maintain its necessary formatting and compliance.

Step 2: Filling out the ODP opt form

The next step involves filling out the form. Make sure you provide accurate personal information, including your name, address, and account number. You will also need to indicate whether you opt in or opt out of the overdraft privilege service.

Step 3: Editing your ODP opt form

Using pdfFiller’s editing tools can make necessary adjustments to your ODP opt form seamless. If you find any errors or regions that require modification, pdfFiller allows you to edit the text, ensuring that all the information you submit is accurate and complete.

Step 4: eSigning the ODP opt form

Signing the document is crucial for the process to be valid. With pdfFiller, you can easily eSign your ODP opt form, giving it the necessary authenticity without the need for printing and scanning. E-signatures are legally binding, simplifying the submission process.

Step 5: Submitting your ODP opt form

After completing and signing your form, you have the choice of submission options. You can submit electronically through the platform or choose to send it physically to your bank. Tracking your submission status can help ensure that everything is processed on time.

Frequently asked questions about ODP forms

Many customers have questions when dealing with ODP forms. Addressing common concerns can assist others in navigating this process effectively. One frequent query is what to do if your submitted ODP opt form is rejected, which usually means there may be inaccuracies that need addressing.

In addition, processing times for ODP forms can vary depending on the bank’s operations. It's wise to follow up with your bank if significant time has passed without communication about your form.

Understanding fees associated with ODP changes

Bank fees associated with overdrawn accounts can be substantial. Understanding these fees can alleviate the financial stress that comes with using ODP. Banks typically charge per transaction; hence knowing your bank’s fee structure is crucial.

To avoid unnecessary fees, using overdraft services judiciously is vital. Monitor your account closely and keep balances above your overdraft limit to remain in control.

Tips for managing your overdraft privilege

Monitoring your account activity is a fundamental part of effectively managing your overdraft privilege. Regularly checking your account balance can help you stay ahead of potential overdrafts and fees. Setting alerts for low balances via your bank’s mobile application can also be a proactive approach.

Additionally, it’s wise to review your ODP preferences periodically. Life circumstances and financial needs change, so revisiting your opt-in or opt-out status ensures that your banking services align with your current situation.

Conclusion: Streamlining your overdraft privilege management

Efficiently managing your overdraft privilege is crucial for financial stability. Utilizing tools from pdfFiller enhances your experience in handling all relevant documents, including forms required for ODP management. The platform's capabilities allow users to access, edit, and sign forms, thus streamlining the entire process.

By taking advantage of pdfFiller features, you're not only ensuring that your ODP opt form is completed accurately but also staying organized and informed about your banking practices. This commitment to proactive management can lead to improved financial health.

Contact information

If you need assistance with your overdraft privilege ODP opt form, pdfFiller support is readily available to help. They offer various resources through their platform, designed to guide you through any challenges you may encounter.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my overdraft privilege odp opt in Gmail?

How do I execute overdraft privilege odp opt online?

How do I fill out overdraft privilege odp opt on an Android device?

What is overdraft privilege odp opt?

Who is required to file overdraft privilege odp opt?

How to fill out overdraft privilege odp opt?

What is the purpose of overdraft privilege odp opt?

What information must be reported on overdraft privilege odp opt?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.