Get the free Annual Earned Income Report - dcrb dc

Get, Create, Make and Sign annual earned income report

How to edit annual earned income report online

Uncompromising security for your PDF editing and eSignature needs

How to fill out annual earned income report

How to fill out annual earned income report

Who needs annual earned income report?

Your Complete Guide to the Annual Earned Income Report Form

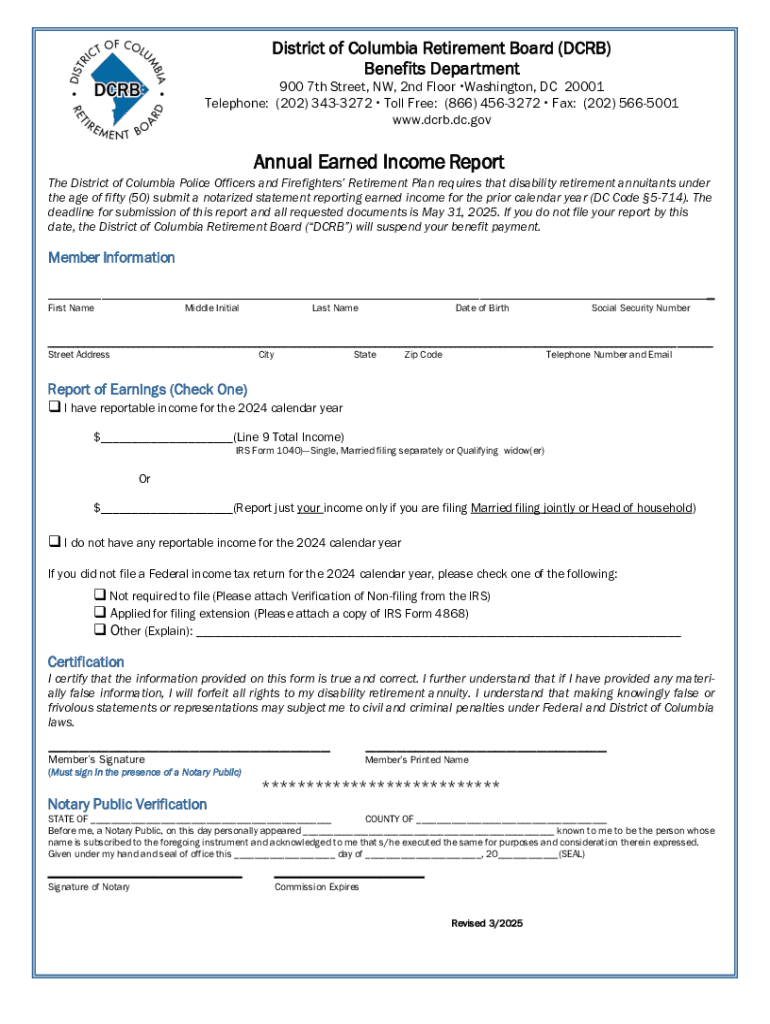

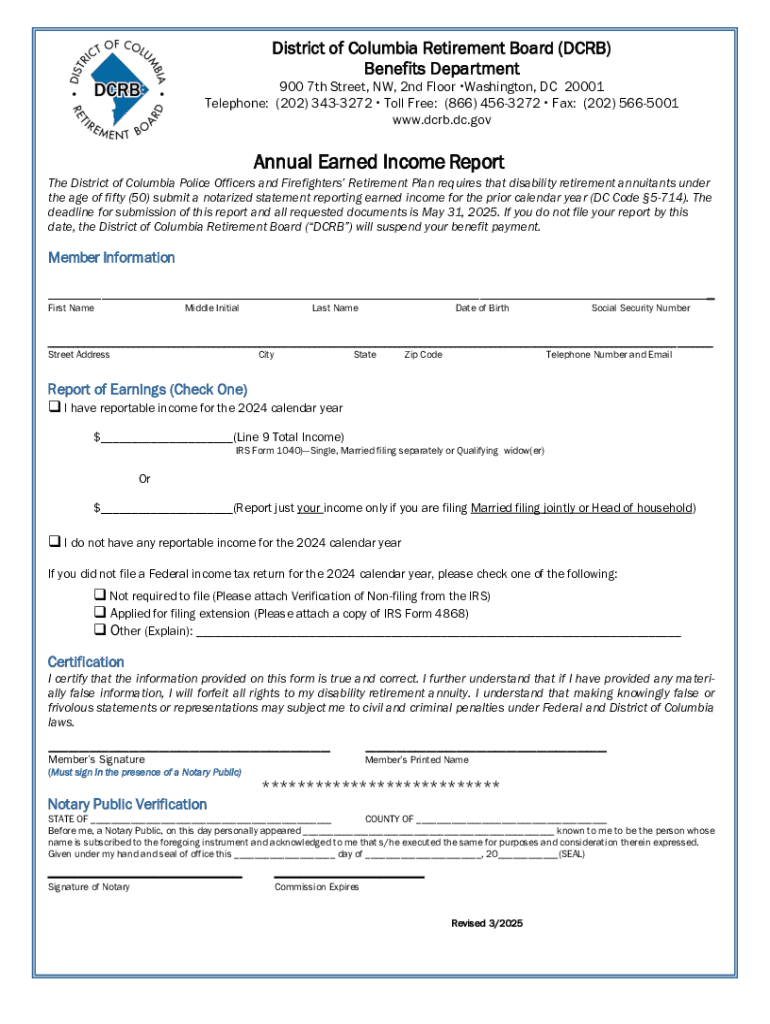

Understanding the annual earned income report form

The Annual Earned Income Report Form is a crucial document for both individual taxpayers and local authorities, designed to track earned income within a jurisdiction. This form serves to calculate the total earned income for the previous year, ensuring that local income taxes are assessed fairly and accurately.

For taxpayers, filing this form is essential to comply with local tax regulations. Local authorities rely on the information provided in these forms to plan budgets, allocate resources, and fund community services. Therefore, submitting a complete and accurate form is vital for both individual financial health and the well-being of the community.

Who needs to file this form?

Individuals with earned income, which encompasses wages, salaries, and tips, are typically required to file the Annual Earned Income Report Form. Additionally, employers and businesses that collect local earned income taxes must also be aware of their obligations regarding this reporting.

Preparation for completing the form

To successfully complete the Annual Earned Income Report Form, you must first gather all the necessary documentation. This includes W-2 forms from your employer(s), pay stubs, and potentially 1099 forms if you have income from freelance or contract work. Make a checklist of required records to streamline your preparation.

Understanding your tax obligations is also critical. Different jurisdictions may have varying local earned income tax rates, and knowing your specific rates is crucial for accurate reporting. It's essential to be aware of submission deadlines as late filings may incur penalties.

Detailed insights into the form sections

Filling out your personal information on the Annual Earned Income Report Form should be straightforward. Ensure all names, addresses, and social security numbers are entered correctly. A common pitfall is mistyping these critical details, which can cause significant delays in processing.

When reporting your income, you must accurately calculate your total earned income by summing all earnings from different sources—salaries, bonuses, and any taxable benefits. Accepted income sources should always be documented clearly, as they are scrutinized during audits.

Deductions and credits are also vital. Many individuals may qualify for local credits that reduce overall tax liability, such as credits for low-income workers or those supporting dependents. Familiarize yourself with these options to ensure you take full advantage of any tax relief for which you may qualify.

Interactive tools for easier form completion

Using pdfFiller's platform, you can easily access and edit the Annual Earned Income Report Form. Our intuitive interface allows users to fill out the form online, making it user-friendly for those who might find traditional paper forms cumbersome.

Our step-by-step filling and submission guide simplifies this process, allowing you to edit, sign, and submit your form entirely online. This not only saves time but also ensures your submission is secure and easily retrievable.

Common questions and FAQs

Mistakes can happen when filling out your form, and if you make an error, steps can be taken to correct it. You should contact the local tax office where you submitted the form to understand the best course of action.

Tracking the submission status can also be vital. Many local tax authorities provide online systems to monitor the status of your form after submission. Knowing your submission's progress can reduce anxiety and ensure that your filing meets deadlines.

Managing your earned income documentation

Keeping organized records of your earned income documentation is essential to make tax filing easier in the future. Establishing a consistent filing system, whether physical or digital, ensures that you can quickly locate necessary documents when it comes time to prepare your Annual Earned Income Report Form.

Cloud-based document management systems can store and retrieve documents efficiently, providing peace of mind in case of audits or inquiries.

Case studies and real-life scenarios

There are many success stories of individuals and businesses that have benefited from timely and accurate submissions of the Annual Earned Income Report Form. For example, a small business owner carefully tracked their employee compensation and managed to maximize deductions, significantly reducing their tax burden while ensuring compliance.

Additionally, accurate reporting helps local communities thrive as it ensures proper funding for vital services.

Engaging with us for support

For anyone needing assistance while completing their Annual Earned Income Report Form, our customer service team is readily available to help. Reaching out to us can clarify any questions or confusion about the process.

User testimonials reflect the impact pdfFiller's platform has had in simplifying the process of managing tax-related documentation and forms. Many have noted the stress relief that comes from using a comprehensive document management solution.

Additional features of pdfFiller

Aside from the Annual Earned Income Report Form, pdfFiller offers various templates and resources relevant to tax-related documentation. Whether you need to prepare 1099 forms, track expenses, or handle tax invoices, we facilitate a seamless experience.

We continually evolve based on user feedback. Your input is invaluable, allowing us to develop tools or features that enhance your document management journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I execute annual earned income report online?

How do I fill out the annual earned income report form on my smartphone?

How do I edit annual earned income report on an Android device?

What is annual earned income report?

Who is required to file annual earned income report?

How to fill out annual earned income report?

What is the purpose of annual earned income report?

What information must be reported on annual earned income report?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.