Get the free Correspondent Lending Application

Get, Create, Make and Sign correspondent lending application

Editing correspondent lending application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out correspondent lending application

How to fill out correspondent lending application

Who needs correspondent lending application?

Correspondent Lending Application Form - How-to Guide

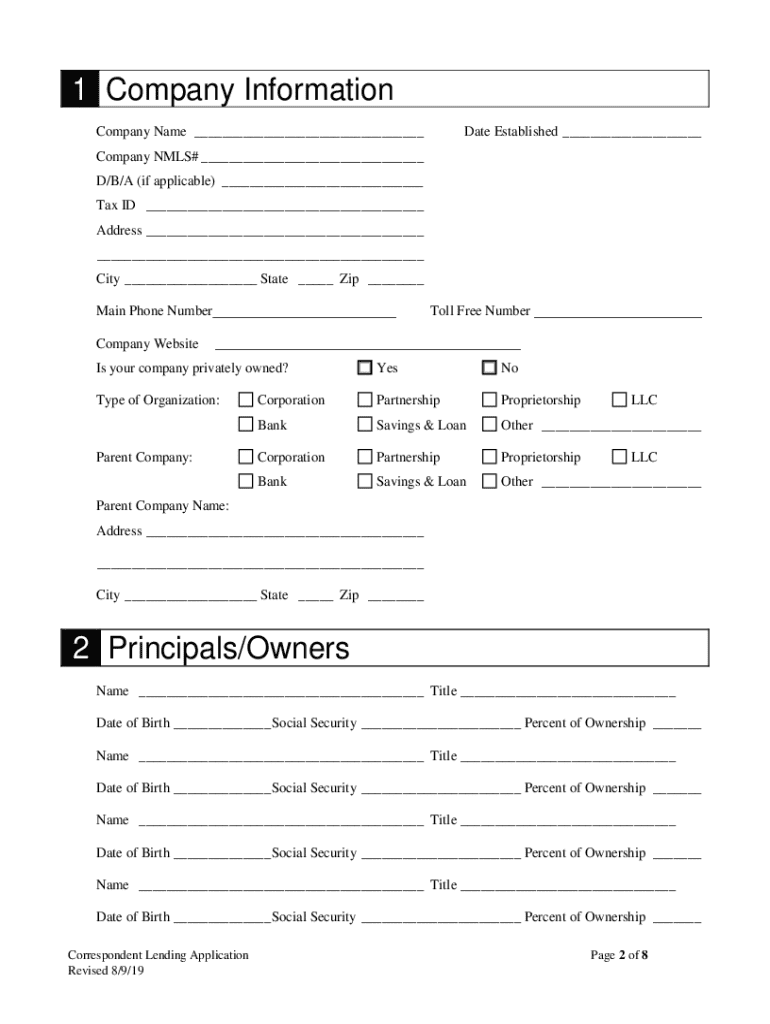

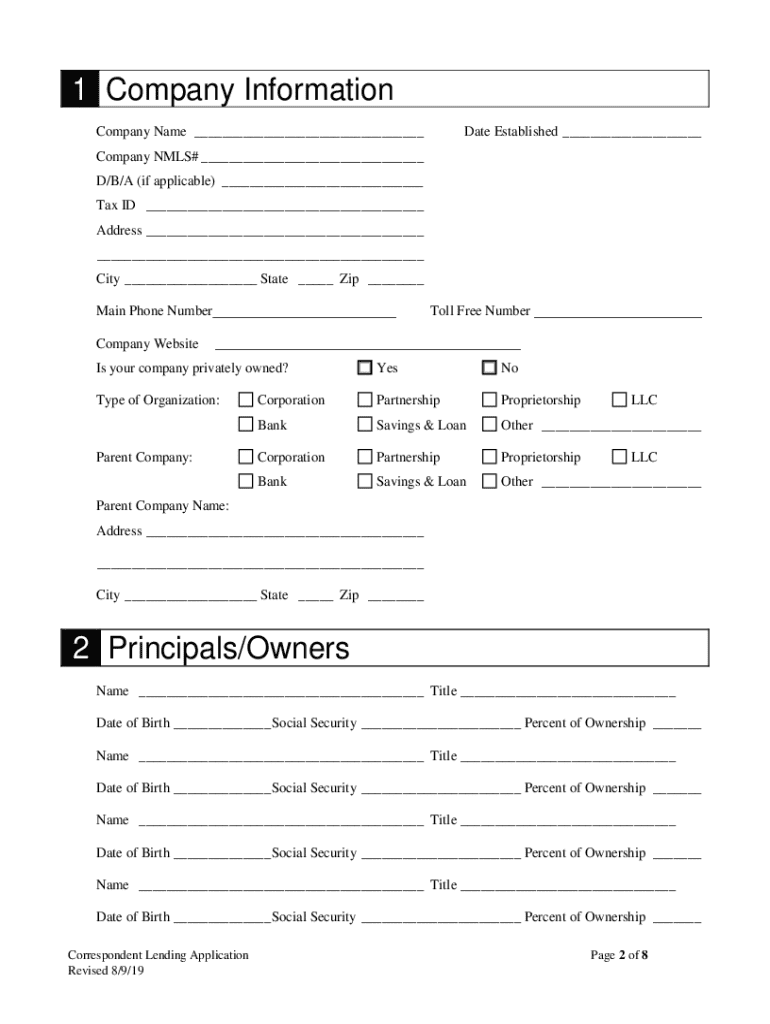

Understanding the correspondent lending application form

The correspondent lending application form serves as a crucial tool in the loan origination process, acting as the gateway for borrowers to secure financing through correspondent lenders. This form simplifies the application process by consolidating essential information required by lending institutions. The primary purpose of the form is to gather accurate data about the borrower, their financial background, and the specifics of the loan being sought. Accurate submission of this application is vital; it not only defines the efficiency of the loan approval process but also ensures compliance with regulatory standards.

Key stakeholders involved in the application process include the borrower, correspondent lenders, and the eventual investors who will fund the loan. Each party plays an important role in ensuring that the loan application is completed correctly and processed in a timely manner, showcasing the importance of clear communication and thorough documentation throughout.

Overview of the correspondent lending process

The correspondent lending process is structured to facilitate efficient funding for borrowers. It consists of several key steps, which include:

Understanding common terminology in correspondent lending is also essential. Terms like 'underwriting,' 'loan-to-value ratio (LTV),' and 'closing costs' frequently arise, impacting the borrower’s understanding of the application process and their obligations.

Key components of the correspondent lending application form

The correspondent lending application form comprises several key components designed to collect comprehensive information about each applicant. Let's break it down:

Tips for completing the correspondent lending application form

Completing the correspondent lending application form accurately is essential to avoid delays. Here are detailed tips to help fill each section effectively:

Interactive tools for form completion

Leveraging technology can streamline the lending application process significantly. Online tools offered by pdfFiller enhance the experience by providing key features that enable users to complete forms efficiently. Here are some notable benefits:

Managing your correspondent lending application

Post-submission, tracking your application status becomes crucial. Users can manage their correspondent lending application through pdfFiller, which offers comprehensive tracking features. Here's how:

Legal considerations and compliance

Navigating the legal landscape of correspondent lending requires awareness of regulatory requirements that may vary by state or federal law. Understanding these is imperative for compliance. Key considerations include:

Become our partner: Collaborating with pdfFiller

Partnering with pdfFiller presents several advantages for lending institutions. By integrating our platform, institutions can enhance their service offerings and streamline processes. Benefits include:

Starting the partnership is straightforward. Institutions can easily reach out to our partnership team to learn more about the process and expected benefits.

Helpful resources and further learning

For those looking to deepen their understanding of correspondent lending and document management, numerous resources are available. Below are valuable tools and materials:

Connecting with pdfFiller

Stay engaged and informed by connecting with pdfFiller through various channels. Keeping updates in sight will help users maximize their document handling capabilities.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get correspondent lending application?

How do I make changes in correspondent lending application?

How do I fill out the correspondent lending application form on my smartphone?

What is correspondent lending application?

Who is required to file correspondent lending application?

How to fill out correspondent lending application?

What is the purpose of correspondent lending application?

What information must be reported on correspondent lending application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.