Get the free Streamlined Sales Tax Certificate of Exemption

Get, Create, Make and Sign streamlined sales tax certificate

Editing streamlined sales tax certificate online

Uncompromising security for your PDF editing and eSignature needs

How to fill out streamlined sales tax certificate

How to fill out streamlined sales tax certificate

Who needs streamlined sales tax certificate?

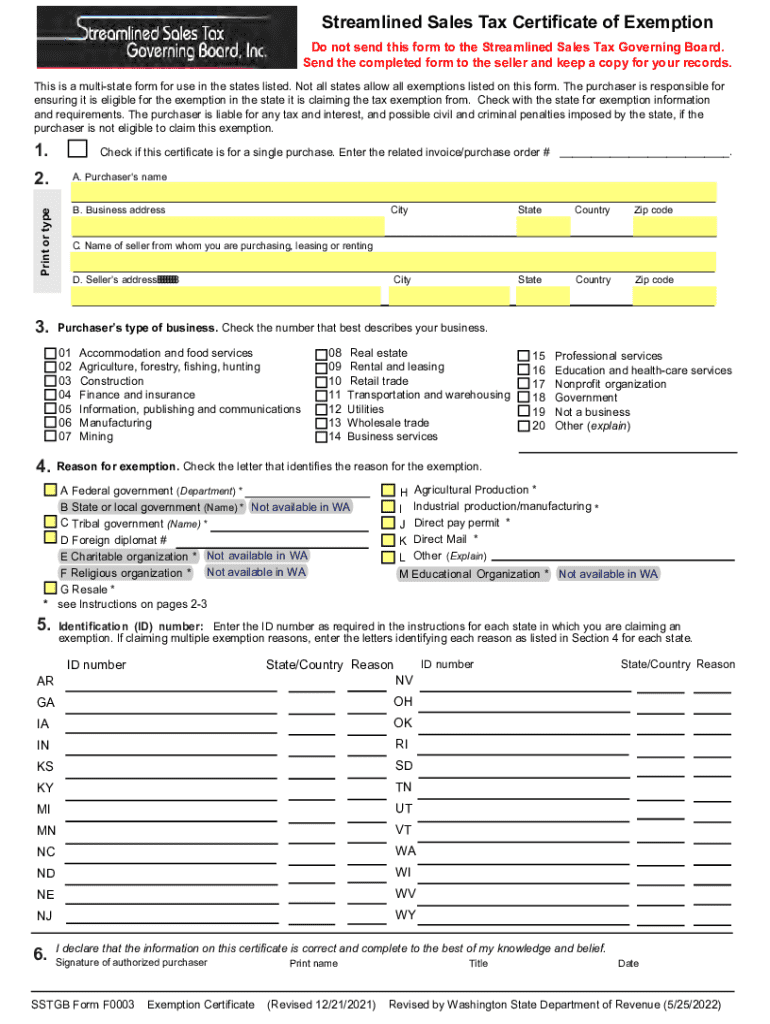

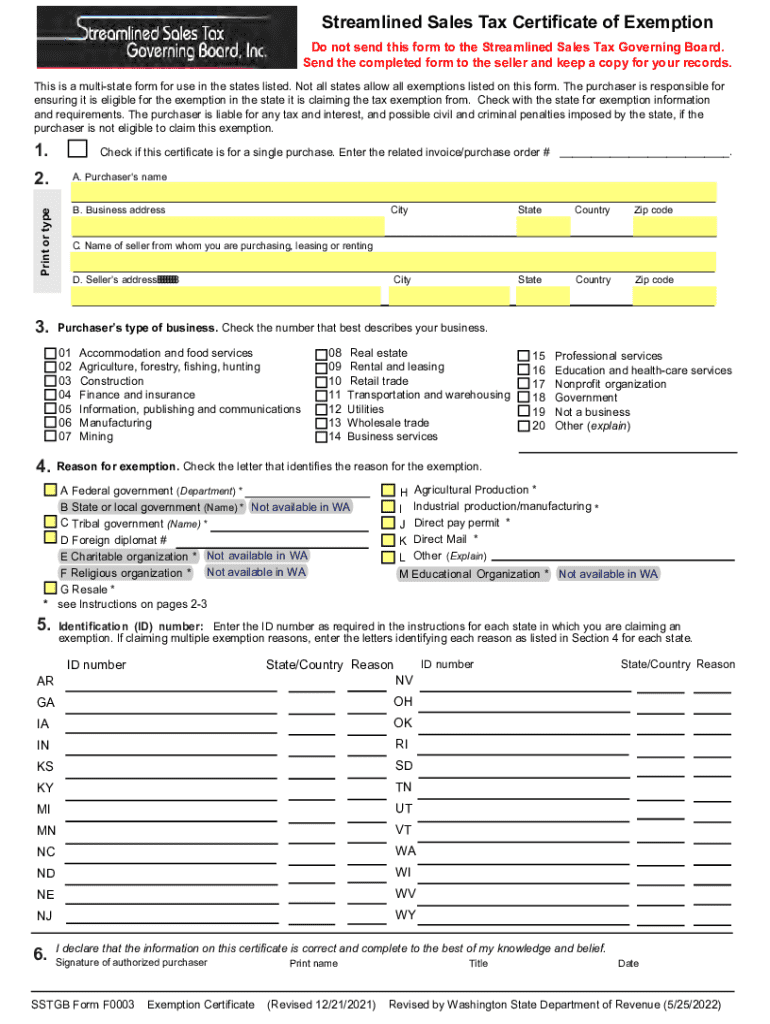

Understanding the Streamlined Sales Tax Certificate Form

Understanding the streamlined sales tax certificate

The streamlined sales tax certificate is a crucial document designed for purchasers intending to claim tax exemptions on specific purchases across the participating states. It facilitates businesses and individuals in ensuring compliance with state sales tax regulations while simplifying the process of submitting exemption claims. By providing a standardized form, the streamlined sales tax certificate alleviates the confusion that can arise from varied state tax laws, ultimately promoting straightforward compliance.

For businesses and consumers alike, the significance of this certificate cannot be understated. It acts as a safeguard against state sales taxes on qualifying purchases, which can result in substantial savings over time. Understanding who needs this certificate is the first step toward effective sales tax management.

Key benefits of using the streamlined sales tax certificate

Utilizing the streamlined sales tax certificate offers various advantages primarily focused on efficiency and compliance. Notably, the simplified process for filing exemption claims enables users to navigate state tax systems without confusion. With a single, unified form accepted across multiple states, the burden of managing divergent requirements diminishes significantly.

Financially, businesses and individuals can benefit from potential cost savings. By accurately using this certificate, purchasers can eliminate unnecessary tax expenses on qualified items, ultimately affecting their bottom lines positively. Furthermore, employing the streamlined sales tax certificate greatly enhances compliance with state regulations. Reducing the constant worry about tax audits and enduring liabilities becomes far more manageable, as all transactions backed by the certificate are clearly documented.

Overview of participating states

The streamlined sales tax certificate is only available in states that participate in the Streamlined Sales and Use Tax Agreement (SSTGA). Currently, a select number of states across the U.S. have adopted this cooperative approach to sales tax administration. Familiarizing yourself with these states and understanding their specific requirements is vital for effective usage of the certificate.

Although the general principles of the streamlined sales tax certificate are consistent, there may be unique requirements in each participating state regarding acceptance and usage. Users must stay informed about these nuances to ensure compliance and maximize the benefits of the certificate.

Filling out the streamlined sales tax certificate form

Successfully completing the streamlined sales tax certificate form necessitates familiarity with its various sections. Each portion of the form holds unique significance and understanding how to navigate it ensures that purchasers can accurately represent their exemption claims. Comprehensive knowledge of the form enables users to avoid common pitfalls during submission.

Here’s a detailed breakdown of the primary sections and some step-by-step instructions:

Editing and managing your completed form

Once the streamlined sales tax certificate form has been completed, users often find it beneficial to ensure accuracy and clarity of the information provided. Utilizing tools such as pdfFiller enables users to edit the form digitally, allowing corrections to be made swiftly before submission. The capability for electronic signatures further enhances the convenience, as users can now sign documents securely without the need for paper.

In addition, collaborative tools within pdfFiller facilitate teamwork, enabling users to invite colleagues to review the form before it is finalized and submitted. These features contribute to overall document management efficiency, ensuring that errors are minimized, and compliance is enhanced.

Submitting the streamlined sales tax certificate

After completing the streamlined sales tax certificate form, knowing where and how to submit it is essential. Users often have multiple options for submitting their forms, ranging from electronic submissions via state tax agency websites to traditional paper mail. Understanding the specific submission channels allows users to choose the most efficient method based on their needs.

Tracking the status of the submission is another vital aspect of the process. Many states provide avenues for users to monitor their submissions' progress, helping them follow up if required. Being proactive in managing submissions can significantly reduce uncertainty regarding the approval of tax-exempt purchases.

Common pitfalls and how to avoid them

Completing the streamlined sales tax certificate form can seem straightforward, but it is crucial to be aware of common errors that can derail an otherwise successful submission. Mistakes, such as providing incorrect personal information or selecting the wrong exemption category, can lead to significant delays or denials.

To ensure accuracy, users should employ best practices for double-checking their work. A systematic approach to reviewing each section of the completed form helps mitigate the risk of errors and promotes successful acceptance by state tax agencies.

Supporting documentation required

As part of the streamlined sales tax certification process, additional documentation may be necessary to substantiate exemption claims. By providing supporting documentation such as invoices, purchase orders, or prior correspondence with state tax agencies, users can present a robust case for their exemption requests.

Proper documentation not only pleases state agencies but also fortifies the overall integrity of the purchase exemption. Ensuring that all required attachments accompany the submitted certificate is essential for a seamless process.

Special scenarios

Certain scenarios may necessitate additional considerations when using the streamlined sales tax certificate. Understanding how different purchaser types—be it individuals, businesses, or tax-exempt entities—identify with exemption rules is crucial for compliant transactions. Each entity may encounter unique requirements or processes in utilizing the certificate effectively.

Additionally, drop shipments present a special case where the purchasing party might be different from the delivery party. Clear guidelines exist to handle such situations, ensuring that all parties involved can navigate compliance accurately while benefiting from tax exemptions.

FAQs about the streamlined sales tax certificate

To address uncertainties surrounding the streamlined sales tax certificate, many individuals and businesses often have common questions. Frequently asked questions include inquiries about eligibility, the timely submission of forms, and the implications of incorrect information supplied. An understanding of typical queries can help demystify the process and promote compliance.

Resources are also available for further help. Each participating state's tax agency typically provides guidance and support regarding the streamlined sales tax certificate, ensuring users can reach out for assistance when needed.

Accessing templates and tools

Individuals and businesses can significantly benefit from the interactive tools readily available on pdfFiller for handling the streamlined sales tax certificate. These templates are designed for immediate use, drastically reducing the time spent on document preparation. By accessing ready-to-use forms, users can eliminate redundancy and focus on ensuring the accuracy of their specific information.

Moreover, personalizing these templates is straightforward with pdfFiller’s user-friendly interface. Users can easily customize the certificate to their individual needs by inputting pertinent information, thereby streamlining their workflow.

Customer experience: testimonials and use cases

Many users have shared their positive experiences when leveraging pdfFiller to manage their streamlined sales tax certificate needs. Real-life success stories illustrate how businesses and individuals increased their efficiency by adopting the digital document management platform. Users have reported reduced errors, increased compliance, and significant time savings in handling their sales tax certifications through pdfFiller.

Moreover, feedback on user experience emphasizes the intuitive design of pdfFiller, facilitating easier navigation and use for all individuals and teams. Whether a first-time user or a seasoned professional, the positive reception of the tools speaks volumes about the capability of pdfFiller in expertly streamlining certificate management.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit streamlined sales tax certificate online?

Can I sign the streamlined sales tax certificate electronically in Chrome?

How do I complete streamlined sales tax certificate on an iOS device?

What is streamlined sales tax certificate?

Who is required to file streamlined sales tax certificate?

How to fill out streamlined sales tax certificate?

What is the purpose of streamlined sales tax certificate?

What information must be reported on streamlined sales tax certificate?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.