Get the free Brokerage Agreement in IndiaDownload Word Template ...

Get, Create, Make and Sign brokerage agreement in indiadownload

Editing brokerage agreement in indiadownload online

Uncompromising security for your PDF editing and eSignature needs

How to fill out brokerage agreement in indiadownload

How to fill out brokerage agreement in indiadownload

Who needs brokerage agreement in indiadownload?

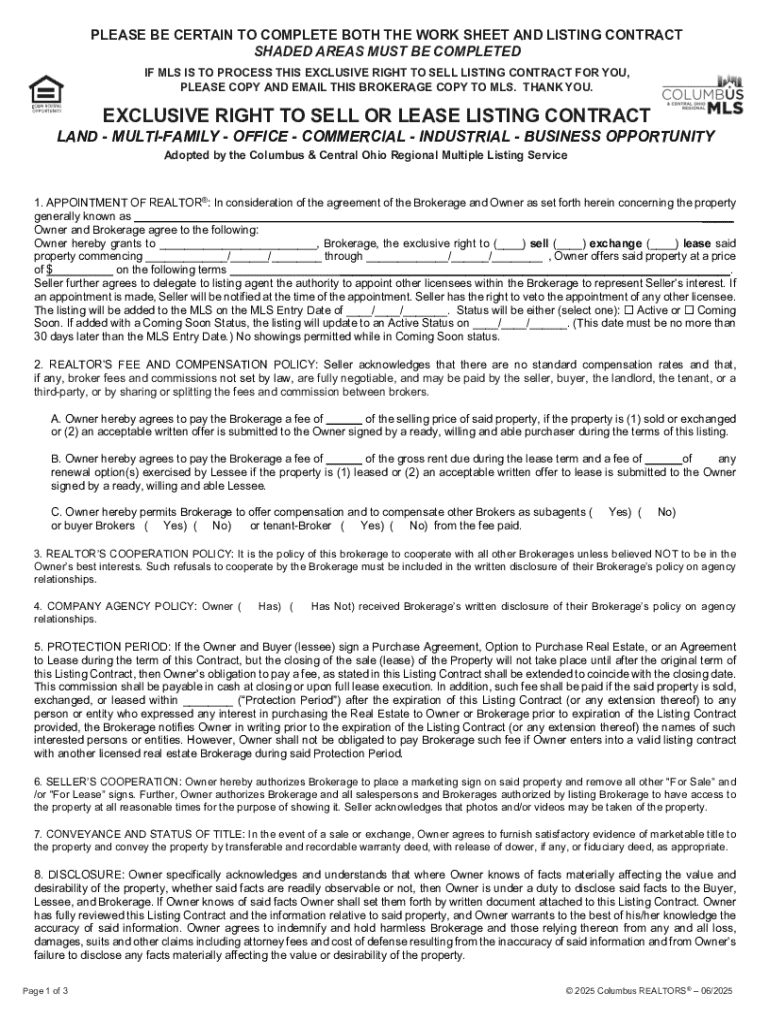

Brokerage Agreement in India Download Form

Understanding the brokerage agreement

A brokerage agreement is a legally binding contract between a broker and a client, establishing the terms under which a broker will provide services to the client. This document plays a crucial role in the financial ecosystem as it formalizes the relationship between involved parties and sets clear expectations regarding the services offered, commission structures, and other vital details. In India, the brokerage agreement is particularly significant in facilitating transactions across various sectors, including real estate and financial services.

The legal standing of brokerage agreements in India is underpinned by several regulatory frameworks, primarily governed by the Indian Contract Act, 1872, and specific regulations related to financial markets and real estate transactions. These laws ensure that both brokers and clients adhere to stipulated guidelines, thereby fostering trust and accountability.

Purpose of a brokerage agreement

A brokerage agreement is necessary in various scenarios, primarily when a party seeks to leverage the expertise and services of a broker for transactions involving property or financial assets. For instance, individuals engaging in real estate should formalize their relationship with real estate brokers through a brokerage agreement to outline the transaction process, ensure clarity on remuneration, and define the scope of services provided.

In addition to establishing the relationship, a brokerage agreement delineates the roles and responsibilities of each party. The broker typically handles aspects including marketing the client’s property, negotiating deals, and providing market insights. Conversely, the client's responsibilities may encompass providing accurate property details, agreeing to commission terms, and cooperating fully during the transaction process.

Key components of a brokerage agreement

A well-crafted brokerage agreement should include several essential elements to protect both the broker and the client. Key components include the parties involved in the agreement, a clear scope of services outlining what the broker will do, commission structures detailing the fees applicable, and the duration of the agreement specifying how long the contract will remain active.

Specific clauses are also crucial in brokerage agreements. For instance, termination rights enable either party to terminate the agreement under certain conditions. Additionally, dispute resolution clauses outline the methods for resolving any conflicts that may arise, which is fundamental in maintaining a professional relationship.

Types of brokerage agreements

In India, brokerage agreements can be classified into different types based on exclusivity and services offered. Exclusive agreements grant a single broker the rights to represent the client, while non-exclusive agreements allow multiple brokers to work simultaneously. This distinction can significantly impact the client's reach and engagement in the market.

Understanding the difference between full-service and discount brokerage agreements is also essential. Full-service brokers offer comprehensive services, including market analysis and personal consultations, whereas discount brokers specialize in providing minimal services for lower fees. The choice between these types often depends on the client's specific needs and budget.

How to create your brokerage agreement

Creating a brokerage agreement involves several key steps. First, clearly identify the parties involved, ensuring that all names and addresses are correct. Next, define the relationship and the specific services the broker will provide. This stage is critical, as it sets the tone for expectations and responsibilities.

Outlining terms and conditions is the next step, which should encompass commission rates, payment timelines, and the duration of the agreement. Utilizing templates can simplify this process significantly. pdfFiller offers customizable templates that allow users to create brokerage agreements tailored to their specific requirements easily.

Common pitfalls in brokerage agreements

When drafting a brokerage agreement, it’s vital to avoid common mistakes that could lead to disputes or legal complications. One frequent error is failing to provide clear definitions of services, leading to possible misunderstandings. Additionally, not addressing termination rights or not specifying commission structures can create problems later on.

Inadequate agreements can result in significant legal ramifications, including lawsuits or loss of commissions. Properly addressing these aspects in the brokerage agreement can mitigate risks and uphold the integrity of the transaction.

Downloading the brokerage agreement form

Accessing a brokerage agreement template is simplified through platforms like pdfFiller. Users can easily navigate to the website, search for the brokerage agreement template, and download it in various formats. This accessibility empowers individuals to create legally binding documents without extensive legal knowledge.

When filling out the brokerage agreement form, attention to detail is paramount. Key areas to focus on include the clear identification of the parties involved, specific terms regarding commission and services, and any clauses related to termination and dispute resolution. Accurate completion helps prevent future conflicts and ensures a smooth transaction.

Signing and managing your brokerage agreement

Electronic signing options have gained popularity for their convenience, especially in today’s remote working environment. pdfFiller provides tools for electronic signatures that adhere to legal standards, allowing users to finalize agreements efficiently without the need for physical meetings.

Once signed, managing the brokerage agreement is crucial for ensuring compliance and tracking responsibilities. Best practices include storing accessible digital copies in secure locations and periodically reviewing the agreements to remain up-to-date with any changes in terms or conditions.

Frequently asked questions (FAQs)

Operating without a brokerage agreement poses significant risks. Without formal documentation, buyers may face challenges in proving and enforcing terms, leading to potential disputes and losses. A brokerage agreement provides a structured path for buyers and brokers to navigate.

Dispute resolution mechanisms commonly included in brokerage agreements often specify arbitration or mediation processes. These pre-determined steps help streamline conflict resolution, enabling both parties to find amicable solutions without resorting to lengthy court battles.

It’s essential to understand that payment structures in brokerage agreements differ from trading. While trading often involves transactions without formal agreements, brokerage agreements are specific contracts detailing services offered in exchange for a commission, ensuring that both parties have clear expectations.

Connecting with legal experts

For individuals and businesses seeking further guidance, consulting with legal experts can provide invaluable insights into navigating brokerage agreements. Many professionals specialize in this area, offering tailored advice to ensure compliance with current laws and best practices.

Engaging with experts can also include attending workshops or reading resources curated by financial and legal professionals. These platforms often discuss aspects of brokerage agreements, enabling individuals to make informed decisions as they engage in significant transactions.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find brokerage agreement in indiadownload?

Can I create an electronic signature for signing my brokerage agreement in indiadownload in Gmail?

Can I edit brokerage agreement in indiadownload on an Android device?

What is brokerage agreement in indiadownload?

Who is required to file brokerage agreement in indiadownload?

How to fill out brokerage agreement in indiadownload?

What is the purpose of brokerage agreement in indiadownload?

What information must be reported on brokerage agreement in indiadownload?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.