Get the free Form 8-k

Get, Create, Make and Sign form 8-k

Editing form 8-k online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8-k

How to fill out form 8-k

Who needs form 8-k?

Comprehensive Guide to Form 8-K: Understanding, Filing, and Management

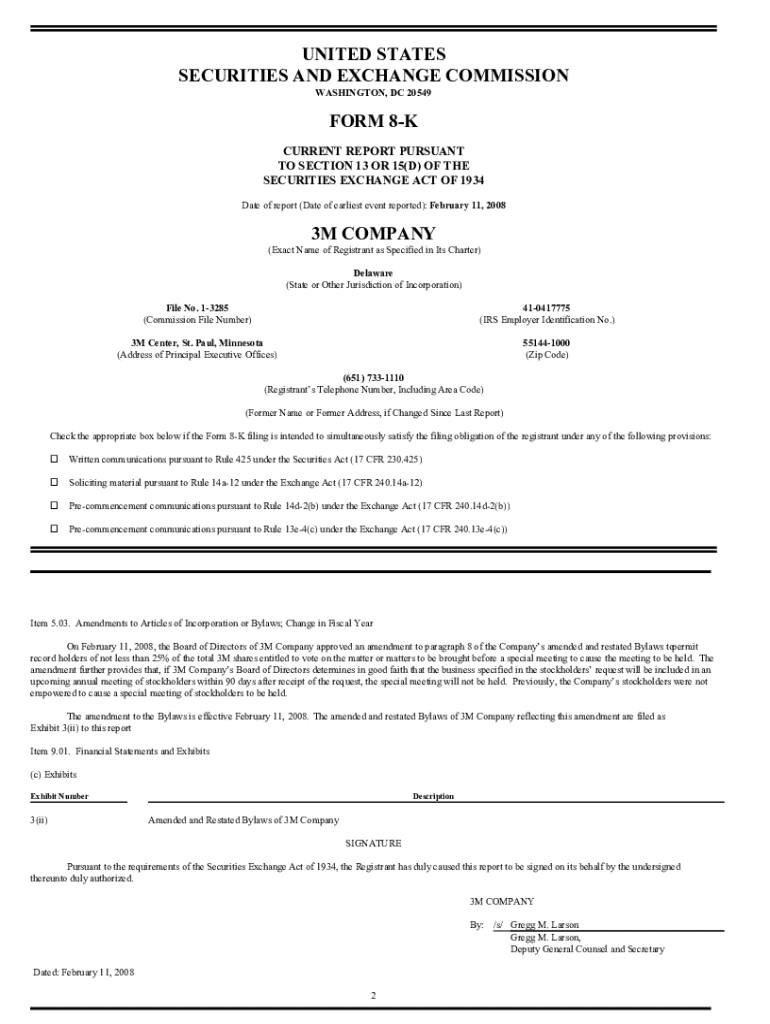

Overview of Form 8-K

Form 8-K is a crucial document that publicly traded companies must file with the Securities and Exchange Commission (SEC) to announce major events that shareholders should know about. This form, often referred to as a 'current report,' serves as a transparency tool, ensuring that investors receive timely information that may impact their investment decisions.

The importance of Form 8-K in corporate reporting cannot be overstated. It plays a vital role in promoting corporate accountability and transparency, providing stakeholders such as investors, analysts, and regulators the essential information regarding significant organizational events. By mandating timely disclosures, Form 8-K helps maintain market integrity.

When to file Form 8-K

Filing Form 8-K is triggered by specific events that are significant to shareholders. Companies must be vigilant about understanding these events to ensure compliance. Some common instances requiring a Form 8-K filing include mergers and acquisitions, financial restatements, and resignations of key officers or directors.

Additionally, exceptions may arise, and companies should be aware of particular cases that may not necessitate an immediate filing. Understanding deadlines is critical, as companies typically must file Form 8-K within four business days after the triggering event.

Understanding form 8-K structure

The structure of Form 8-K is straightforward but contains vital components that require careful attention. The form is divided into several key sections, starting with essential header information that includes the company’s name, SEC file number, and fiscal year end.

Following the header, the form presents itemized disclosures that allow companies to report the specifics of the event triggering the filing. Each item number corresponds to specific disclosures required by the SEC, ensuring clarity and consistency.

Detailed examination of specific items in form 8-K

Form 8-K contains various items, each relating to unique events that can affect a company's financial standing or governance. Understanding the implications of these items is crucial for timely and accurate reporting.

Filing form 8-K: Step-by-step process

Filing Form 8-K may seem daunting, but when broken down into manageable steps, it becomes a systematic process. By following a clear, structured approach, companies can ensure they meet all regulatory requirements.

Utilizing pdfFiller for form 8-K

pdfFiller provides an ideal solution for managing Form 8-K filings. With its robust set of features designed for document management, pdfFiller makes the process of filling out, editing, and submitting Form 8-K more efficient.

Interactive tools available within pdfFiller make it simple for users to create and customize their Form 8-K easily. The platform's eSigning capabilities allow for quick approvals and collaborations, which is essential given the time-sensitive nature of Form 8-K filings.

Common mistakes to avoid when filing form 8-K

While filing Form 8-K is essential, companies often make errors that can lead to serious repercussions. Understanding these common mistakes can prevent costly missteps.

FAQs about form 8-K

Addressing common questions regarding Form 8-K can alleviate concerns for companies new to the process. Questions often include topics such as filing requirements, deadlines, and the implications of disclosures.

Historical context of form 8-K

Understanding the historical context of Form 8-K offers insights into its significance in today’s corporate governance. Initially established to promote transparency post-Watergate era, the requirements have evolved to accommodate changes in market conditions and investor expectations.

Significant historical events, such as financial crises and technological advancements, have shaped contemporary reporting practices and regulatory requirements. These changes often influence how companies approach Form 8-K filings, ensuring they meet current disclosure standards.

Essential considerations for companies

For companies looking to enhance their compliance processes, several best practices emerge from effective Form 8-K filing procedures. Instituting robust internal controls for tracking material events can reduce risks significantly.

Additionally, consulting with legal advisors ensures that companies navigate the complexities of disclosure requirements. As the corporate landscape continues to evolve, being proactive in terms of compliance will safeguard against potential pitfalls and enhance overall transparency.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my form 8-k in Gmail?

How can I edit form 8-k from Google Drive?

How do I edit form 8-k online?

What is form 8-k?

Who is required to file form 8-k?

How to fill out form 8-k?

What is the purpose of form 8-k?

What information must be reported on form 8-k?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.