Get the free Matching Gift Program Application Form

Get, Create, Make and Sign matching gift program application

Editing matching gift program application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out matching gift program application

How to fill out matching gift program application

Who needs matching gift program application?

A comprehensive guide to the matching gift program application form

Understanding matching gift programs

A matching gift program is a corporate initiative that enables employees to increase their charitable contributions through corporate sponsorship. Essentially, for every dollar an employee donates to a qualified nonprofit organization, their employer matches that amount, often dollar for dollar. The primary purpose of these programs is to encourage philanthropic efforts among employees while maximizing the nonprofit's fundraising potential.

Employers offer matching gifts for several reasons. Firstly, it enhances employee engagement by promoting participation in charitable activities. Additionally, these programs can serve as a tax-deductible expense for the company, aligning corporate social responsibility with financial incentives. It also offers an opportunity for companies to give back to the communities they operate in, fostering goodwill and enhancing their brand reputation.

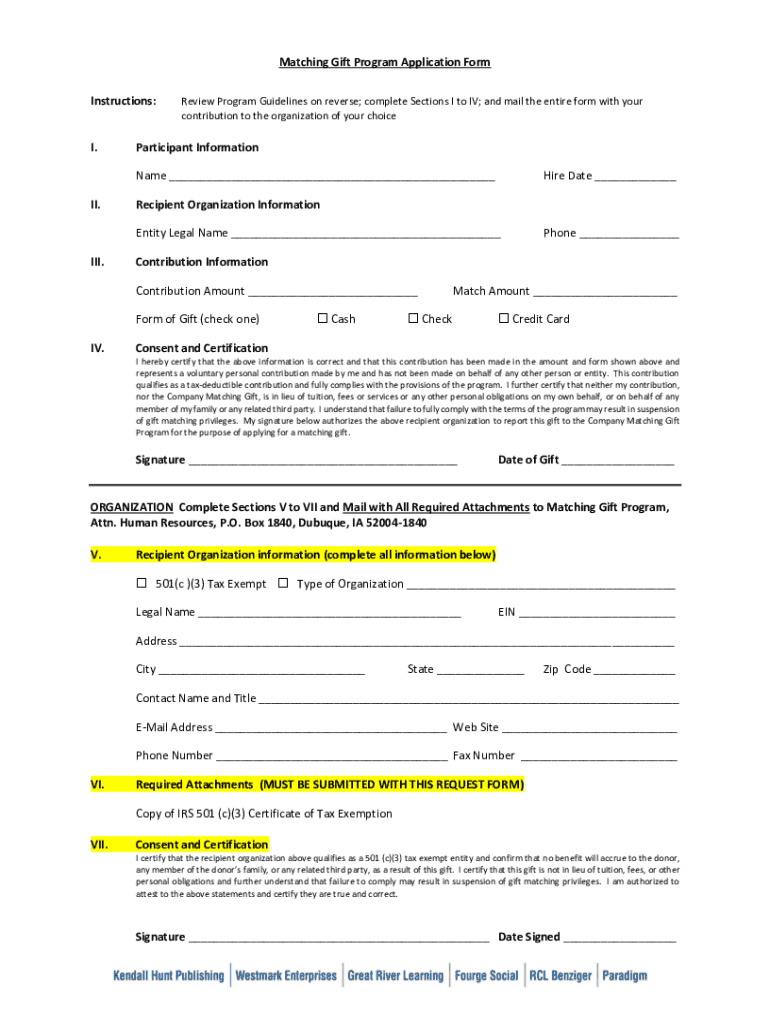

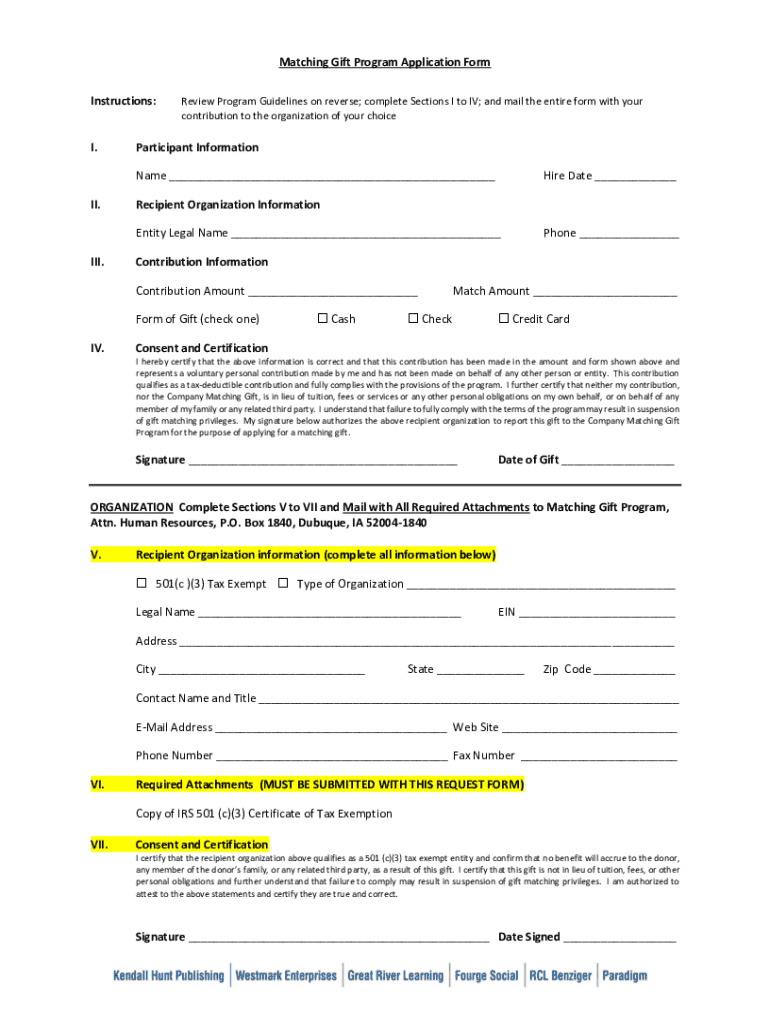

Overview of the matching gift program application form

The matching gift program application form is essential in initiating the matching process between an employee's donation and their employer's contribution. This form typically includes vital information about both the donor and the nonprofit organization. The accuracy and completeness of this form are paramount to ensure the matching gift is processed seamlessly.

Importance cannot be overstated; this form is the bridge between your charitable intent and the company's support. If the form is incomplete or incorrect, it could lead to delays or rejection of the matching gift. Common requirements for submission often include proof of donation, personal identification details, and a signature of authorization from the employee.

Types of matching gift program application forms

Corporate matching gift forms

Corporate matching gift forms are tailored specifically for organizations that provide matching gifts. These forms are straightforward and typically require basic personal information from the donor, as well as details about the donation made. Information often required includes the name of the charitable organization, the amount donated, and the donation date.

Many companies participate in these programs, including large corporations like Microsoft, Google, and Johnson & Johnson. Employees should check with their HR departments or corporate websites for specific details about their respective matching gift forms.

Electronic matching gift forms

With the growing digital landscape, many employers now offer electronic matching gift forms which streamline the submission process. The advantages of online submissions include faster processing times, ease of editing, and reduced paper waste.

To access electronic forms, employees typically need to log in to their human resources portal or the employer's matching gift program platform. After logging in, you can navigate to the matching gifts section, where electronic forms can be filled out and submitted directly.

Paper matching gift forms

While electronic forms are gaining popularity, paper matching gift forms remain an option, especially for those less familiar with digital technology. In instances where you prefer or require a paper form, it is crucial to obtain the correct version from your employer or nonprofit organization.

Completing and sending a paper form often involves printing the document, filling it in by hand, and mailing it to a designated address, which may delay the processing of the application. Ensuring accuracy and clarity in your handwriting can expedite the process.

Essential elements of a matching gift program application form

A well-structured matching gift program application form will typically contain several essential elements, which collectively facilitate the processing of the gift. Firstly, donor information is critical and includes the donor's name, contact information, employer's name, and employee ID.

Next, details about the nonprofit organization must be included, such as its official name, tax identification number, and contact details. Additionally, you must provide specifics about your donation, including the donation amount, date, and payment method. Finally, a clear area for signatures indicating authorization is necessary to complete the form, ensuring that the company can process the matching gift.

Step-by-step instructions for completing the matching gift program application form

Gathering required information

Before filling out the matching gift program application form, it is crucial to gather all required information. Start by compiling your personal information, including your full name, contact details, and employee ID. Next, collect relevant nonprofit organization information such as its official name, location, and tax ID to ensure accurate documentation.

Filling out the form

When filling out the form, take your time to ensure that every section is completed thoroughly. Begin with your donor information, followed by the details pertaining to the charitable organization. Fill in your donation details clearly, being careful to indicate the correct amount and date of your donation. Accuracy is critical in this step to prevent any complications during the matching gift processing.

Verification and signatures

Once the form is completed, review all information for accuracy. It is essential to verify that spellings are correct, especially for the nonprofit organization's name and your own information. Obtain necessary signatures from your supervisor if required, as some companies mandate managerial approval for matching gift submissions.

Common mistakes to avoid when submitting matching gift forms

When submitting your matching gift program application form, it’s easy to make small but significant errors. One of the most common mistakes is leaving information incomplete, which can lead to processing delays or even denial of the matching gift. Information such as names, amounts, and dates must be accurately provided to ensure compliance.

Another frequent oversight is misspelled names or incorrect details. This can happen when transcribing information, especially under time constraints. Finally, keeping an eye on submission deadlines is critical; missing these can jeopardize your eligibility for matching funds, so always check the guidelines provided by your employer.

Tracking your matching gift submission

After you submit your matching gift program application form, it’s crucial to track its status to ensure it’s being processed. Many companies will allow you to check the status via their HR portal or matching gift program website. Regularly logging in can keep you informed about the progress of your request and provide peace of mind.

In the event of a denied application, don’t hesitate to reach out to your employer’s HR department for clarification. They can offer insights into why the application was rejected and guide you on the steps needed for resubmission.

Frequently asked questions about the matching gift program application form

How long the approval process takes can vary based on the employer’s internal review process. Typically, many companies complete the process within four to six weeks, but it’s essential to consult your employer’s guidelines for specific timelines. Family members may also be able to participate in some matching gift programs, but this often depends on company policies, so checking the eligibility criteria is crucial.

If your employer does not have a matching gift program, you may want to explore other charitable initiatives they participate in or advocate for the establishment of a matching gift program within your organization. Engaging with leadership about the benefits of such programs can foster support for their implementation.

Additional tools and resources

Using tools like pdfFiller can significantly enhance your ability to manage and edit matching gift forms. This platform allows users to seamlessly edit PDFs, eSign documents, and collaborate with others to ensure that your matching gift application form is perfect before submission.

Accessing a matching gift database can also be beneficial in identifying companies that offer matching gifts, allowing you to maximize your charitable impact. A comprehensive online resources and community dedicated to matching gifts can provide support and guidance, helping you navigate any complexities with ease.

The role of nonprofits in facilitating matching gifts

Nonprofits play a crucial role in promoting matching gift programs and facilitating participation among donors. By educating their supporters about the benefits and processes involved in matching gifts, they can increase overall contributions significantly. Nonprofits may also provide resources such as pre-filled forms or dedicated instructions on how to navigate matching gift applications.

Furthermore, many nonprofits utilize platforms and tools that simplify the matching gift process, making it easier for donors to submit applications. Having dedicated staff or volunteers can also help address any questions or concerns that donors may have, further enhancing the experience for all parties involved.

Contact information for assistance

If you require assistance, the first point of contact should be your nonprofit organization. They are well-equipped to guide you through the matching gift process, addressing any specific questions you may have regarding the matching gift program application form. Additionally, reaching out to your employer's HR department can provide further clarity, especially regarding company-specific policies and submission processes.

Share your experience

Sharing your experiences with matching gift programs can not only offer valuable insights to fellow donors but also foster a sense of community. Engaging with others who have successfully navigated the matching gift process can help streamline their experiences and enhance their understanding of what to expect.

Consider using social media platforms or community forums dedicated to charitable giving to spread awareness about the impact of matching gifts. Encouraging others to share their stories can help emphasize the importance of these programs and inspire more individuals to participate, ultimately benefiting the nonprofits and communities they care about.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in matching gift program application without leaving Chrome?

Can I create an eSignature for the matching gift program application in Gmail?

How can I fill out matching gift program application on an iOS device?

What is matching gift program application?

Who is required to file matching gift program application?

How to fill out matching gift program application?

What is the purpose of matching gift program application?

What information must be reported on matching gift program application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.