Get the free Utah Individual Income Tax Return

Get, Create, Make and Sign utah individual income tax

How to edit utah individual income tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out utah individual income tax

How to fill out utah individual income tax

Who needs utah individual income tax?

Understanding the Utah Individual Income Tax Form: A Comprehensive Guide

Overview of the Utah Individual Income Tax Form

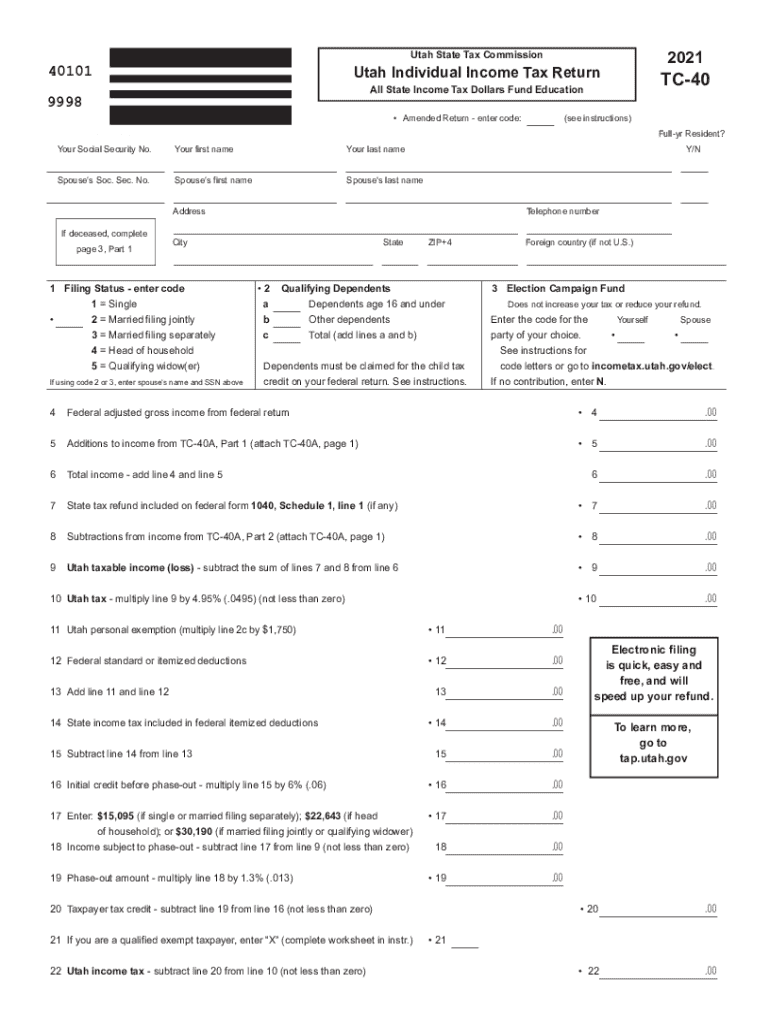

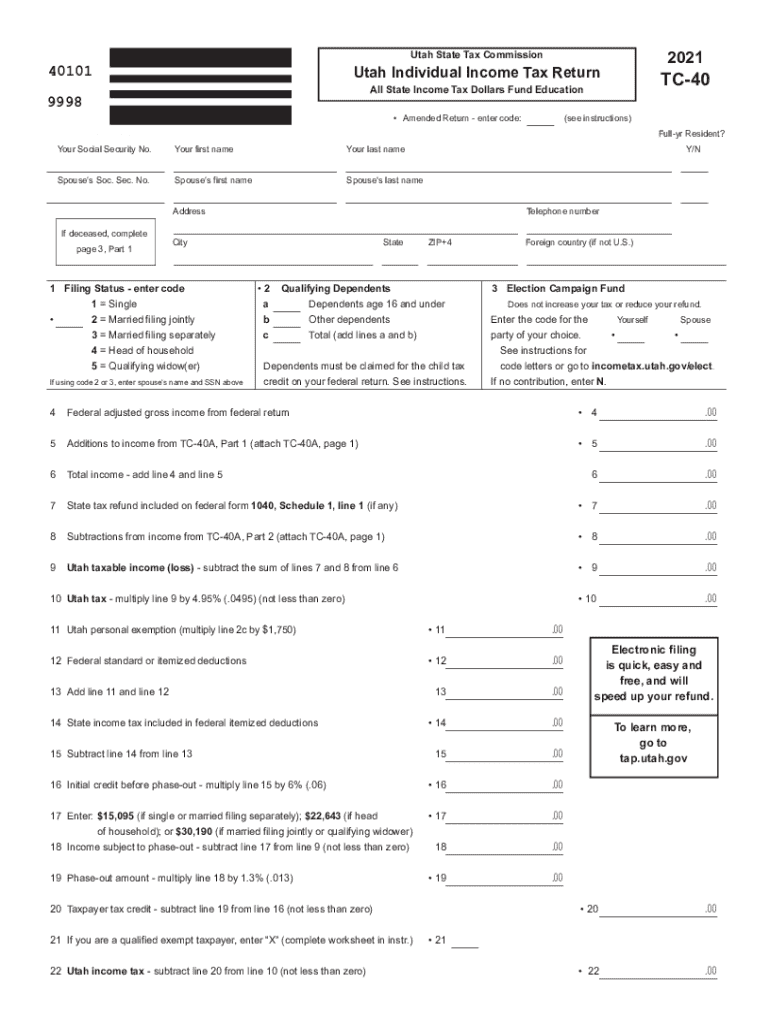

The Utah Individual Income Tax Form, known as the TC-40, is the official document that residents and non-residents must complete to report their income and calculate the tax owed to the state of Utah. It serves as a crucial tool for documenting financial information during the tax season, ensuring compliance with state tax laws. Filing the TC-40 accurately is essential, as it affects not only personal financial liabilities but also eligibility for various tax credits and deductions.

Both residents and non-residents of Utah have specific guidelines to follow when submitting this form. Utah residents generally file the TC-40 if they earn income or if their tax liability meets established thresholds, while non-residents must file if they have income sourced from Utah. Correctly handling the file is key to availing oneself of potential tax benefits and avoiding penalties.

Eligibility for filing the TC-40

Determining who needs to file the TC-40 is crucial for the taxpayers. Essentially, anyone earning income within or from Utah generally needs to file this form. Specific circumstances that obligate residents and non-residents to file may include various income levels and types. For instance, if an individual’s income exceeds the taxable threshold set by the Utah State Tax Commission, they are required to file.

Aging considerations can also affect filing responsibilities. Individuals below a certain age, typically those considered dependents, may not need to file if their income falls below the thresholds established for taxable income. Furthermore, part-year residents or individuals claiming dependents may have unique considerations when filing, requiring special attention to ensure compliance with state tax regulations.

Preparing to file the TC-40

Effective preparation is the backbone of filing the TC-40 form correctly. Taxpayers need to gather essential documentation prior to initiating the filing process. Key information includes a valid Social Security Number (SSN) or an Individual Taxpayer Identification Number (ITIN), necessary income statements such as W-2s and 1099s, and supporting documents for any deductions or credits claimed on the tax form.

Additionally, understanding the types of deductions and credits available is crucial. This can include deductions for mortgage interest, medical expenses, and contributions to retirement accounts. Utilizing organized methods for data collection can significantly streamline the filing process. Tools like spreadsheets or tax preparation software can help in gathering and reviewing the necessary financial information.

Where to find the TC-40 form and instructions

Locating the TC-40 form is a straightforward process. The form can be downloaded from the Utah State Tax Commission’s official website. For those who prefer a digital approach, pdfFiller offers an efficient way to access the TC-40 form, allowing users to fill it online and utilize cumulative editing features on the platform.

The instructions accompanying the TC-40 form provide critical guidance on how to complete each section effectively. It’s advisable to read through these guidelines thoroughly before starting. Familiarizing yourself with the information presented in these instructions can help avoid common errors and ensure compliance with all necessary requirements.

Filling out the TC-40 form

Filling out the TC-40 form involves several essential sections that must be completed accurately. The personal information section requires basic identification details, including your name, address, and SSN. Following this, the income reporting section is where you'll indicate all earned income, including wages, self-employment earnings, and other sources of income.

The deductions and credits section is equally vital. Taxpayers must ensure they are accurately reflecting any deductions or credits they are eligible for, as these can significantly alter the tax owed. Common mistakes to avoid include inaccurate reporting of income, failing to claim applicable deductions, and miscalculating the overall tax owed. Careful review of the filled form against the provided instructions is recommended for preventing errors.

Filing options for the TC-40

When it comes to submitting the TC-40, taxpayers have multiple options: e-filing or paper filing. E-filing offers a streamlined process, allowing faster processing times and reduced chances of errors. pdfFiller provides a user-friendly platform to e-file the TC-40, including features such as seamless PDF editing and e-signature capabilities, enhancing the overall filing experience.

For those interested in paper filing, completed forms should be mailed to the Utah State Tax Commission. However, opting for electronic submission not only speeds up the filing process but can also be an eco-friendly choice. Submitting electronically also enables real-time collaboration with tax advisors if needed, ensuring comprehensive assistance throughout the filing period.

Post-filing steps and considerations

Once the TC-40 has been submitted, several post-filing steps should be undertaken. One crucial action is to track the status of your tax return. The Utah State Tax Commission offers online resources where you can check the filing status and expected refund timelines. Monitoring your status helps in addressing any potential issues early in the process.

If errors arise post-submission, it’s key to address these promptly. The tax commission typically provides guidance on how to amend the TC-40 if necessary. Understanding the tax refund process is also essential; knowing the average timeframes for refunds can help manage expectations and assist in financial planning.

Frequently asked questions about the TC-40

When filing the TC-40, many taxpayers have similar queries regarding the filing process. Common questions revolve around eligibility, deadlines, and required documentation. Key insights can be gained from the Utah State Tax Commission, and additional resources are available online. Engaging with local tax professionals can also illuminate particular concerns based on individual situations.

A worthwhile approach for taxpayers is to compile a list of frequently asked questions that they can reference during the filing process. This proactive strategy aids in clarifying obligations and responsibilities, reducing confusion, and ensuring smoother navigation through tax season.

Additional forms and schedules related to the TC-40

Along with the TC-40, taxpayers may require additional forms and schedules depending on their individual tax situations. A notable example is the TC-69 form, which is often necessary for those claiming various tax credits and deductions. Understanding the context in which these supplementary forms are applicable can help ensure comprehensive filing.

Taxpayers should familiarize themselves with when these additional forms need to be submitted and why they are crucial for an accurate tax return. Resources for accessing these supplementary documents are readily available through the Utah State Tax Commission’s website, further enhancing the ability to comply with all tax obligations.

Utilizing pdfFiller for managing your Utah Individual Income Tax forms

pdfFiller stands out as an excellent platform for managing the TC-40 and other tax forms efficiently. The platform boasts features that simplify cloud-based document management, allowing users to edit PDF forms, e-sign, and collaborate with ease. The user-friendly interface enhances productivity and minimizes the time spent on document preparation.

The security measures in place for protecting personal information make pdfFiller a trustworthy choice for sensitive tax documents. User testimonials reflect high satisfaction levels, highlighting seamless experiences in tax filing and management through the platform. Such positive feedback underscores pdfFiller’s commitment to supporting users through their financial documentation needs.

Upcoming changes and notifications

Tax laws are subject to change, and it's essential for taxpayers to remain aware of any upcoming updates concerning the TC-40 form and related requirements. Regular checks with the Utah State Tax Commission’s website can help tax filers stay informed about future deadlines and any potential changes in tax legislation affecting their filing criteria.

Looking ahead, taxpayers may anticipate systematic enhancements in the filing processes that could impact submission methodologies. Engaging with email notifications or updates from reliable tax advocacy platforms can ensure individuals are prepared for any imminent regulations that may affect their tax obligations and deadlines.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my utah individual income tax in Gmail?

How do I execute utah individual income tax online?

How do I edit utah individual income tax online?

What is utah individual income tax?

Who is required to file utah individual income tax?

How to fill out utah individual income tax?

What is the purpose of utah individual income tax?

What information must be reported on utah individual income tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.