Get the free Form 5500-sf

Get, Create, Make and Sign form 5500-sf

Editing form 5500-sf online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 5500-sf

How to fill out form 5500-sf

Who needs form 5500-sf?

Comprehensive Guide to Form 5500-SF

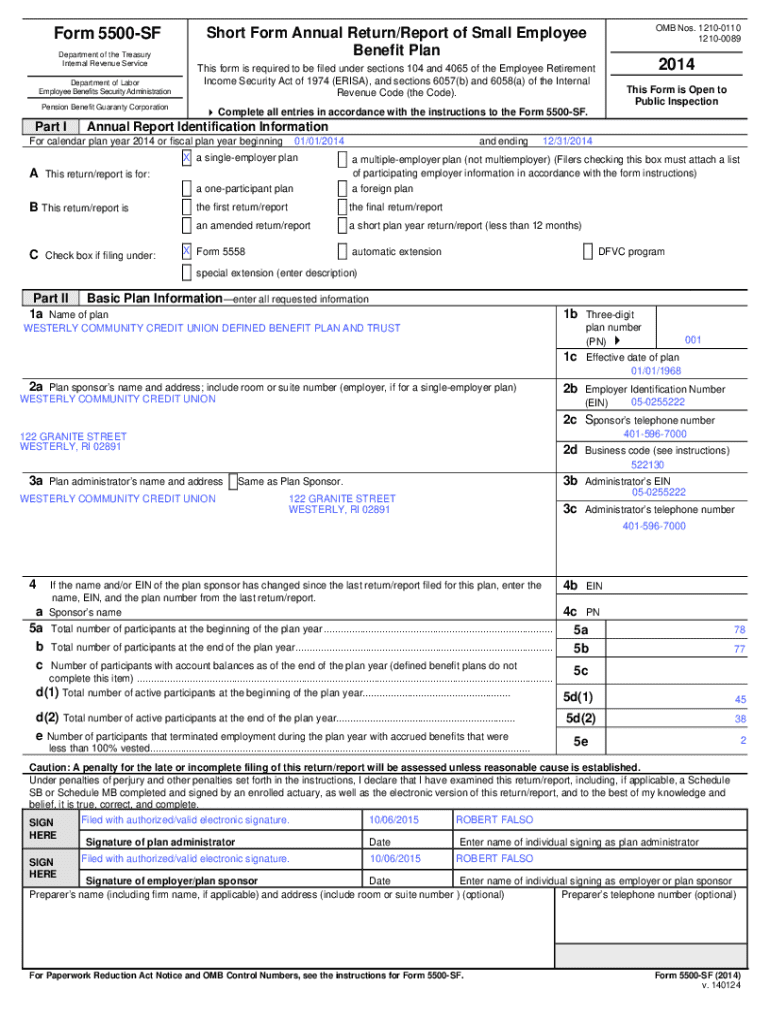

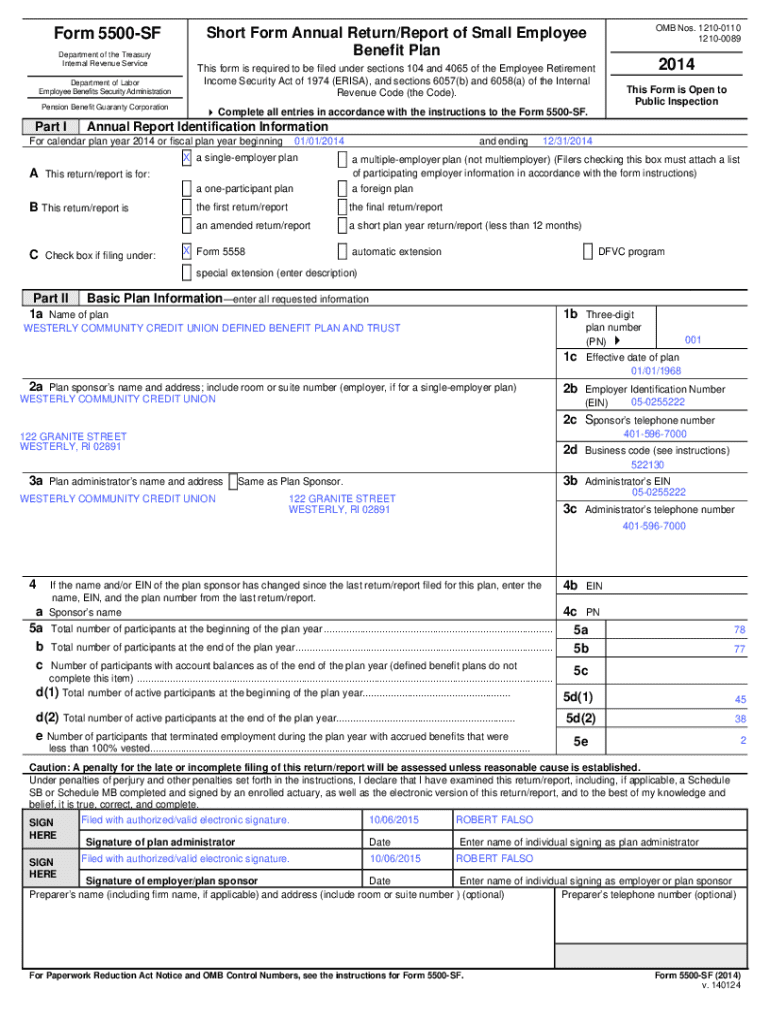

Overview of Form 5500-SF

Form 5500-SF is an important document that simplifies annual reporting requirements for certain retirement plans. Understanding its purpose is vital for employers and plan administrators to ensure compliance with federal regulations. The form plays a critical role in providing the federal government with necessary information regarding the operations of retirement plans, ensuring transparency and accountability in plan management.

The primary difference between Form 5500 and Form 5500-SF lies in eligibility and complexity. While Form 5500 caters to larger plans with more intricate reporting needs, Form 5500-SF is designed specifically for small plans, allowing them a streamlined reporting process. Accurate reporting through these forms is crucial, as it not only fulfills legal obligations but also supports participants in making informed decisions regarding their retirement savings.

Who should file Form 5500-SF?

Employers that sponsor small retirement plans may find Form 5500-SF useful. To determine eligibility, a plan must generally have fewer than 100 participants at the beginning of the plan year. Additionally, plans that meet criteria under ERISA (Employee Retirement Income Security Act) and are not covered by certain exemptions must file this form. It's essential for employers and administrators to know their roles; they are responsible for timely and accurate filing.

Interactive tools for Form 5500-SF

Utilizing interactive tools can significantly simplify the process of filling out Form 5500-SF. A comprehensive document preparation checklist can guide you through the required information needed for completion. These tools help identify common pitfalls, such as missing details or incorrect financial data, which can delay filings or result in penalties.

Accessing the PDF tool on pdfFiller offers multiple features to enhance your filing process. Users can edit and highlight important sections within the document, ensuring clarity and focus. Additionally, the platform provides collaboration features that allow team members to review and suggest edits in real-time, facilitating a smoother workflow.

Step-by-step instructions for filling out Form 5500-SF

Filling out Form 5500-SF involves several clear steps, essential to ensure compliance with federal regulations. Starting with 'Basic Plan Information,' you’ll need to provide details such as the plan’s name, number, and year of operation. Next, include the ‘Plan Administrator Details’ to identify who is responsible for managing the plan. Finally, move on to 'Financial Information and Schedule Information' to offer financial statements and disclosures.

One tip for ensuring compliance is to double-check every entry on the form. Inaccuracies can lead to fines or additional audits. Pay attention to required signatures, as missing signatures can also cause delays.

Filing Form 5500-SF: electronic submission requirements

The electronic filing process for Form 5500-SF is essential, as paper submissions are phased out. To comply, you must file using the EFAST2 system, which was designed to simplify this process. Ensuring that your filings are submitted electronically not only speeds up processing times but also facilitates better tracking and management of your submissions.

Keeping track of key deadlines is vital; typically, the Form must be filed no later than the last day of the seventh month after the plan year ends. Failing to meet this deadline could lead to hefty penalties, underscoring the importance of proactive planning and scheduling.

Common mistakes and how to avoid them

When filing Form 5500-SF, many submitters encounter common pitfalls. One frequent error is submitting incomplete information; each section must be thoroughly completed to avoid delays. Additionally, incorrect financial data, such as miscalculating contributions or benefits paid, can lead to serious compliance issues.

Establishing best practices, such as creating a checklist or schedule for preparation, can help mitigate these mistakes. Furthermore, utilizing tools available at pdfFiller can streamline the process and minimize errors.

Addressing delinquent filings for Form 5500-SF

If your organization finds itself facing delinquency concerning Form 5500-SF, understanding the Delinquency Filing Program is essential. This program offers a mechanism for plan administrators to correct voluntary compliance failures. Filing a delinquent Form 5500 is possible, but it must be done in accordance with the regulations set forth by the Department of Labor.

To avoid penalties, it's critical to act quickly. Engage legal or compliance professionals to ensure that the filing is completed correctly and prepare for any corrective actions that may be necessary.

Supplementary requirements related to Form 5500-SF

Filing Form 5500-SF is often just one component of compliance for retirement plans. Understanding supplementary requirements is essential. For instance, a completed Summary Annual Report is mandatory for participants, providing an overview of plan activities. Adhering to fidelity bond requirements is also critical, as these protect plan assets and ensure their safeguarding.

Paying attention to these requirements fortifies your compliance framework and supports plan participants in maintaining trust in their retirement savings.

Real-world examples and case studies

Studying real-world examples of proper filing can illuminate best practices. Organizations with a proactive approach often succeed in maintaining compliance without issues, benefiting from the diligent management of Form 5500-SF. For instance, a medium-sized company that utilized pdfFiller effectively managed their filing and avoided penalties by ensuring timely submissions and accurate data.

On the flip side, analyzing common pitfalls reveals the consequence of neglect. Various case studies show organizations facing audits and penalties due to incomplete filings or inaccurate data. These findings underscore the importance of using reliable tools and procedures to navigate the complexities of retirement plan reporting.

Keeping current: changes and updates in filing requirements

Federal regulations dynamically change, impacting the requirements for Form 5500-SF. Staying informed about new regulations is crucial for employers and administrators to remain compliant. Regularly reviewing updates from the Department of Labor and utilizing resources from pdfFiller can enhance your compliance strategy.

Engaging with industry webinars and professional organizations can also keep you abreast of significant changes, ensuring your organization adapts to new guidelines swiftly.

FAQs about Form 5500-SF

Frequently asked questions about Form 5500-SF often revolve around eligibility, filing deadlines, and common concerns regarding financial data accuracy. Clarifying these misconceptions can significantly reduce anxiety surrounding the filing process.

Addressing these questions upfront can provide peace of mind to employers and enhance overall compliance rates.

Resources for further assistance

For those navigating the complexities of Form 5500-SF, accessing support options through pdfFiller can provide invaluable assistance. The platform offers additional tools and templates aimed at aiding the filing process, ensuring every submission meets regulatory standards.

Utilizing these resources not only empowers individuals and teams but also streamlines the workflow, making the entire process of managing retirement plan filings simpler and more efficient.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit form 5500-sf from Google Drive?

How can I get form 5500-sf?

How do I edit form 5500-sf online?

What is form 5500-sf?

Who is required to file form 5500-sf?

How to fill out form 5500-sf?

What is the purpose of form 5500-sf?

What information must be reported on form 5500-sf?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.