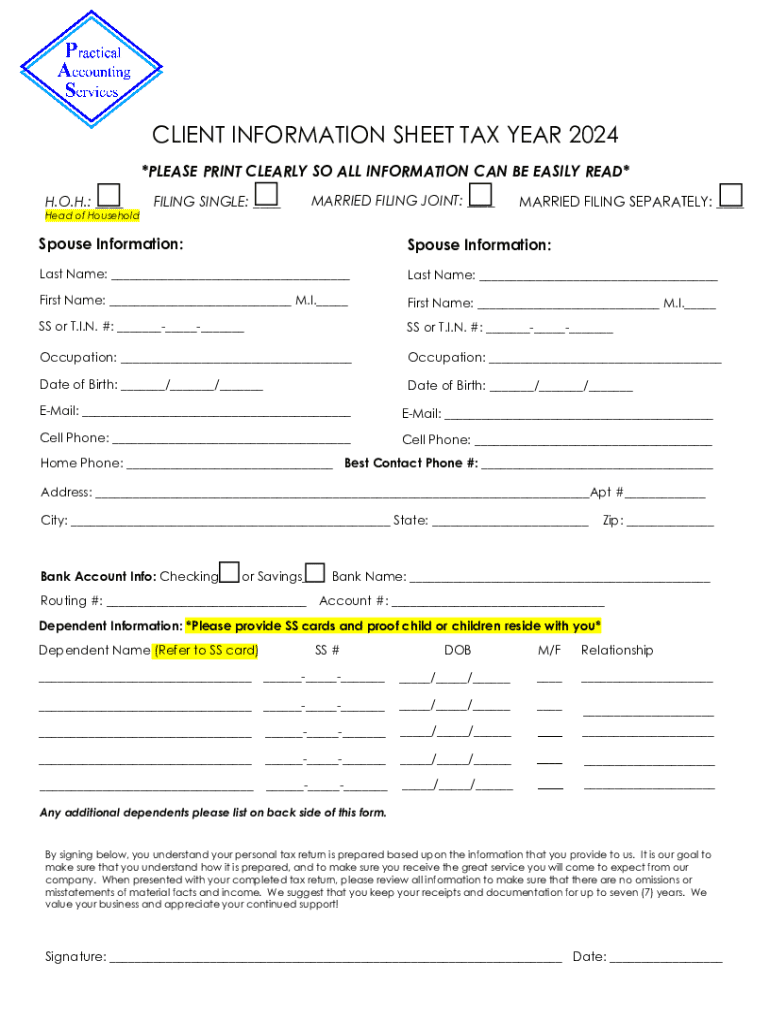

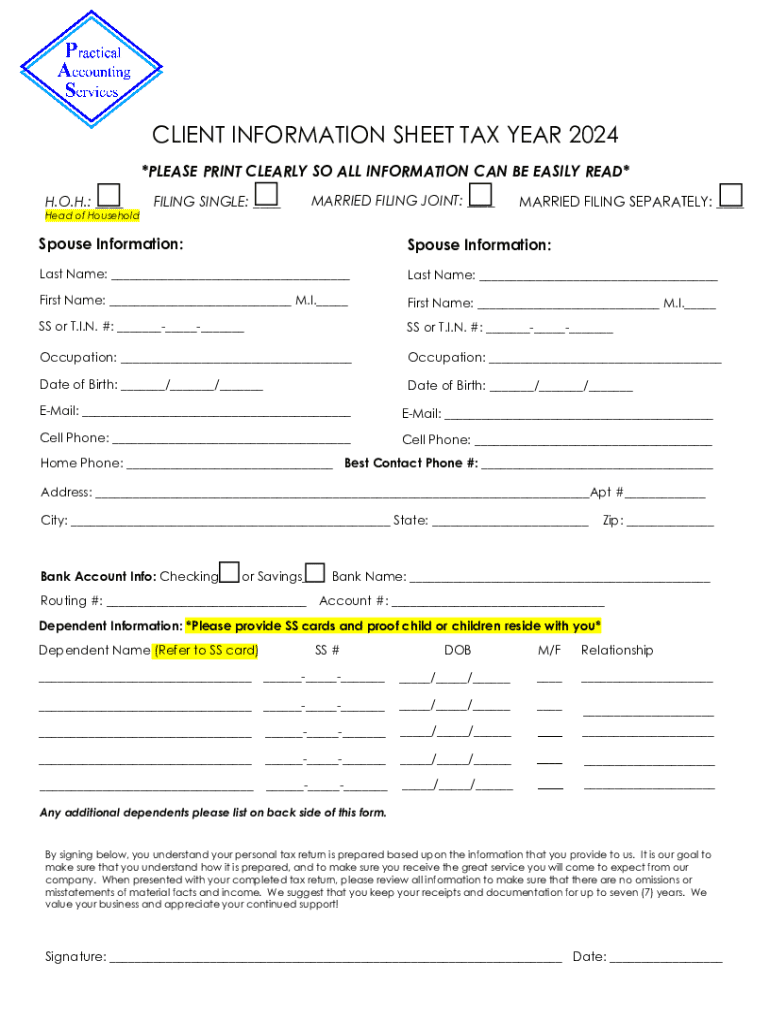

Get the free Client Information Sheet Tax Year 2024

Get, Create, Make and Sign client information sheet tax

How to edit client information sheet tax online

Uncompromising security for your PDF editing and eSignature needs

How to fill out client information sheet tax

How to fill out client information sheet tax

Who needs client information sheet tax?

Comprehensive Guide to the Client Information Sheet Tax Form

Understanding the client information sheet tax form

The client information sheet tax form serves as a crucial document in the tax preparation process, designed to collect essential information from clients. This form serves both as a tool for tax preparers and a means for clients to provide necessary data. Understanding its structure and importance is key to ensuring an accurate and efficient tax filing experience.

The primary purpose of this form is to gather all relevant client details that will influence their tax obligations and entitlements. From income types to potential deductions, the client information sheet acts as a roadmap for tax professionals to tailor their services to meet specific client needs. It's vital for both parties, as accurate information helps in minimizing potential errors during tax filing, thus reducing the risk of audits and penalties.

Key elements of the client information sheet tax form

A well-structured client information sheet tax form features several key elements that facilitate effective communication between tax preparers and clients. These elements help in ensuring that all crucial data is captured to maximize tax benefits and minimize liabilities for clients.

Personal information collection

The personal information section requires fundamental details, including:

Financial information overview

The financial section encapsulates comprehensive information on:

Additional relevant data

Lastly, clients are asked to detail their current employment status and any dependents as this can significantly influence their tax liabilities and benefits. This section may also include strategic questions about any significant life changes such as marriage, home purchases, or job changes.

Types of client information sheets for tax purposes

Various types of client information sheets cater to different client needs and scenarios. Each form is structured to gather specific information pertinent to the client’s situation, enhancing the effectiveness of tax preparation.

Filling out the client information sheet tax form

Completing the client information sheet tax form accurately is vital for a seamless tax preparation experience. Here’s a step-by-step guide to ensure that you fill it out correctly.

Step-by-step instructions

Common mistakes to avoid

Editing and managing the client information sheet tax form

Once you have filled out the client information sheet tax form, managing it effectively is equally essential. Utilizing tools for editing and version control can streamline the process, especially for tax teams handling multiple clients.

Using pdfFiller’s editing tools

Saving and organizing your forms

eSigning the client information sheet tax form

In an increasingly digital world, electronic signatures have become an essential part of the tax preparation process. They not only save time but also offer security and legal validity.

The importance of electronic signatures

Utilizing eSignatures simplifies the process, allowing clients to sign documents without the need for physical presence or mailing. When implemented correctly, eSignatures provide the same legal standing as traditional handwritten signatures, expediting the overall workflow.

How to add signatures with pdfFiller

Frequently asked questions (FAQs)

Navigating the client information sheet tax form can lead to several questions. Here we address some frequently asked queries to smooth the process.

Sources and further reading

For those looking to dive deeper into the specifics of tax preparation, consider consulting official IRS resources and other quality guides.

Popular related forms and templates

To complement your client information sheet tax form, consider these related documents that may also be beneficial for tax preparation.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get client information sheet tax?

Can I sign the client information sheet tax electronically in Chrome?

How do I fill out client information sheet tax on an Android device?

What is client information sheet tax?

Who is required to file client information sheet tax?

How to fill out client information sheet tax?

What is the purpose of client information sheet tax?

What information must be reported on client information sheet tax?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.