Get the free F399

Get, Create, Make and Sign f399

How to edit f399 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out f399

How to fill out f399

Who needs f399?

Understanding the F399 Form: A Comprehensive Guide

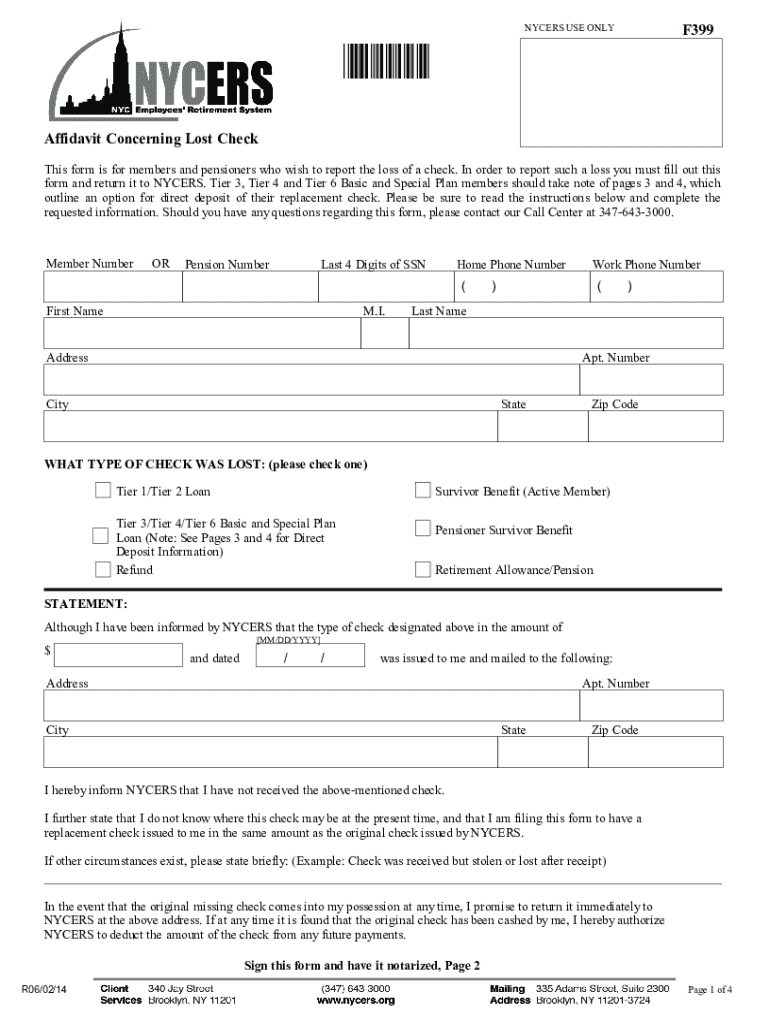

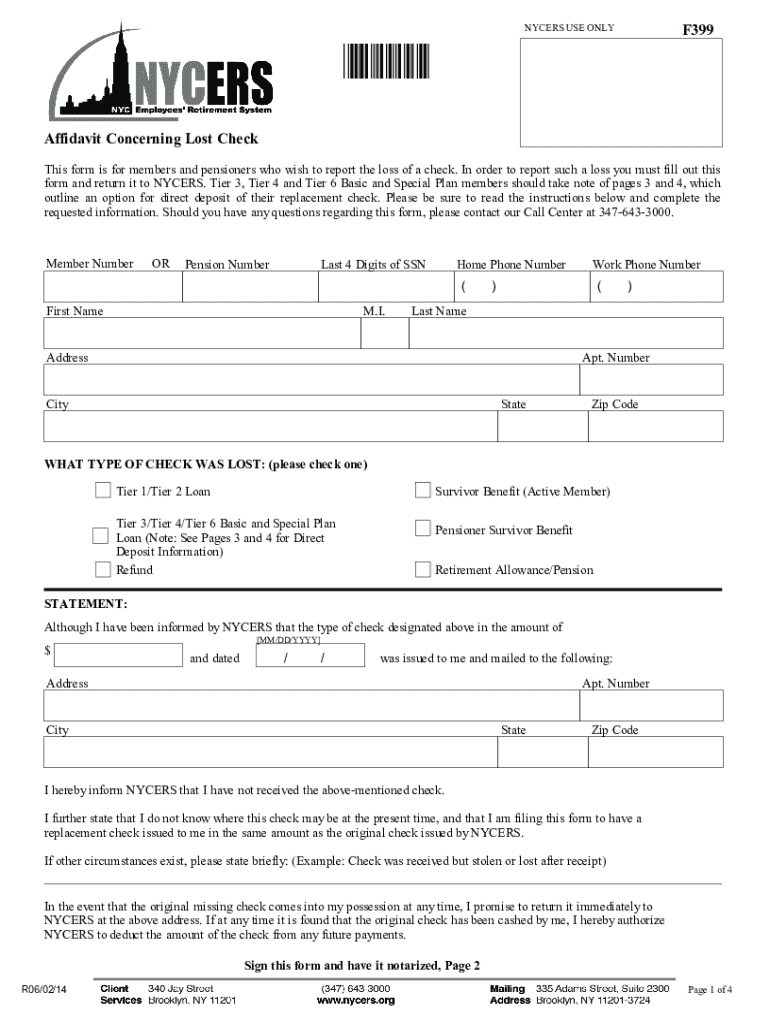

Overview of form F399

Form F399 is an important affidavit utilized in the context of lost checks. This document formally affirms that the individual signing the form has lost a check and is seeking to declare it void. The primary purpose of the F399 form is to assist individuals and businesses in resolving issues related to lost or disputed financial instruments, thereby providing a means of protection against fraudulent activities.

The filing of Form F399 often becomes necessary in situations where a check has been misplaced or potentially stolen. It plays a crucial role in ensuring that individuals or businesses do not suffer financial loss due to the misuse of lost checks. By filing this affidavit, the claimant formally declares the check as lost, effectively stopping any potential cashing or endorsement of the check by unauthorized persons.

Who should use form F399?

Form F399 caters primarily to individuals and organizations who have experienced the misplacement of a check. This includes employees who may have received a paycheck via check, freelancers who have issued personal checks, and companies that may need to declare payroll or vendor checks as lost. The versatility of this form makes it a critical resource for a wide range of users.

Common scenarios necessitating the use of Form F399 include losing a personal check while out and about, accidentally discarding a check with non-essential paperwork, or when a company fails to receive a salary check due to postal issues.

Detailed breakdown of form F399

The structure of Form F399 is straightforward yet comprehensive, consisting of several key sections that encapsulate critical information. First, users are required to provide identification details, ensuring that the affidavit can be traced back to the correct claimant. Next, the specifics regarding the lost check must be detailed, including important identifiers such as the check number and the total amount.

The final part of the form is the Affidavit Declaration, where the signer attests to the truthfulness of the information provided. Understanding the nuances of each section is essential for an effective filing process.

To ensure accurate filing, claimants should be aware of common pitfalls, such as providing incomplete information or failing to sign the document appropriately, which can cause delays in processing.

Step-by-step instructions for filling out form F399

Preparing to fill out the F399 form involves gathering pertinent documentation, such as a copy of the original check if available and any identification that confirms the claimant's identity. Understanding the necessary details beforehand can streamline the process and reduce errors.

Following these steps ensures that each aspect of the form is completed accurately, minimizing the chances of rejection or delay.

Editing and modifying your form F399

Utilizing pdfFiller tools makes editing and modifying Form F399 simple and efficient. The platform offers user-friendly features that allow users to adjust content seamlessly without the hassle of pen and paper.

By leveraging these capabilities, individuals can ensure that their form remains accurate and up-to-date, providing peace of mind during the filing process.

Options for signing form F399

When it comes to signing Form F399, users can choose between electronic signatures and handwritten signatures. Each method has its advantages, with electronic signing via pdfFiller being particularly efficient, reducing the time spent on document processing.

For those who opt to use pdfFiller for their electronic signature, a simple step-by-step guide is provided on the platform for adding a signature, ensuring ease of use for everyone.

Submitting your form F399

Once Form F399 is filled out and signed, the next step is submission. Depending on the requirements of your situation, there are multiple methods available for submission, including online, by mail, or in person.

It’s crucial to also keep track of submission deadlines and seek confirmation of receipt to ensure that the form was properly filed and acknowledged.

Frequently asked questions (FAQs) about form F399

Navigating through questions regarding Form F399 can be challenging, so addressing common inquiries is essential. One common concern is what to do if a lost check is found after filing the affidavit; usually, the finder should not cash the check as it is declared void.

Answers to these questions can save time and prevent unnecessary complications for claimants.

Troubleshooting common issues related to form F399

While filling out Form F399 is generally straightforward, users may occasionally face challenges. Common issues include accessing the form online or capturing a signature electronically. Having a set of troubleshooting strategies can alleviate these potential problems.

When problems arise, pdfFiller support resources are available to assist users, providing guidance and solutions quickly.

Related forms and documents

Filing Form F399 can sometimes prompt the need for additional documentation. Various related forms exist for lost checks, including state-specific variations that might be required depending on jurisdiction.

Being aware of the related documents can ensure comprehensive coverage of the topic, providing claimants all necessary tools to move forward.

Tips for effective document management with pdfFiller

Effective document management is crucial for anyone regularly handling forms like F399. Using pdfFiller offers several best practices for organizing and maintaining important papers.

Incorporating these practices into daily operations can greatly enhance user efficiency and make managing important documents a more seamless experience.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my f399 in Gmail?

How can I send f399 to be eSigned by others?

How do I fill out the f399 form on my smartphone?

What is f399?

Who is required to file f399?

How to fill out f399?

What is the purpose of f399?

What information must be reported on f399?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.