Get the free 2022 Irs Tax Return Transcript (trt)

Get, Create, Make and Sign 2022 irs tax return

How to edit 2022 irs tax return online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2022 irs tax return

How to fill out 2022 irs tax return

Who needs 2022 irs tax return?

2022 IRS Tax Return Form: A Comprehensive How-To Guide

Understanding the 2022 IRS tax return form

The 2022 IRS tax return form is essential for individuals, families, and businesses to accurately report their income and claim deductions for the tax year 2022. Knowing the requirements for filing your return is crucial to avoid penalties and ensure you receive any eligible refunds.

Accurate filing is significant for various reasons. It not only ensures compliance with tax regulations but also impacts your eligibility for future loans, benefits, and programs. The IRS's tax laws can change frequently, so familiarity with the 2022 regulations is critical.

Who should file the 2022 tax return form?

Determining who must file the 2022 IRS tax return form involves understanding specific eligibility criteria. Generally, if your income exceeds a certain threshold, you are required to file. This threshold varies depending on your filing status (single, married filing jointly, head of household, etc.) and age.

Individual filers, such as employees, contractors, and self-employed individuals, need to consider their total income from all sources. Likewise, businesses, including sole proprietorships and partnerships, have their own requirements based on net income.

Gathering necessary documentation

Before you fill out the 2022 IRS tax return form, collecting the necessary documentation is vital. This preparation streamlines the filing process and minimizes errors.

Essential documents to gather include W-2 forms from employers, 1099 forms for other income sources like freelance work, and any other income documentation relevant to your financial situation. Together, these documents help accurately report total income.

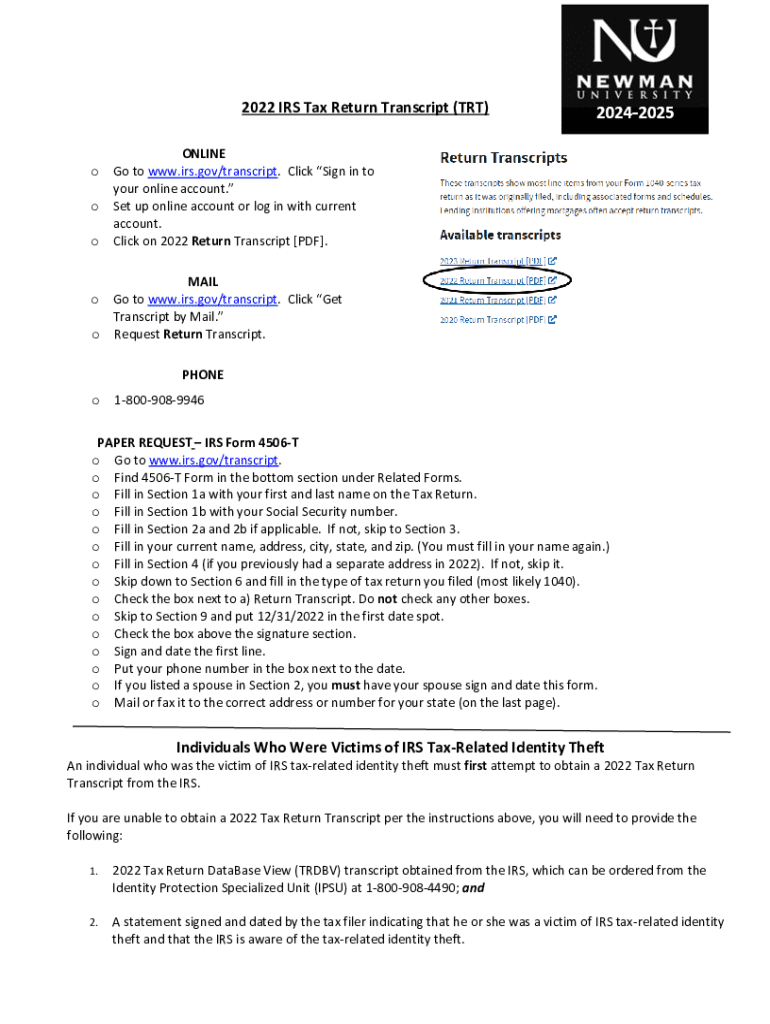

Where to access the 2022 IRS tax return form

Accessing the 2022 IRS tax return form is easier than ever. The IRS website offers a wealth of resources to support taxpayers in their filing processes.

You can download the forms directly from the IRS’s official website, but local offices and tax assistance centers are also available if you prefer in-person help. Utilize these resources to ensure you receive the correct forms based on your filing needs.

Step-by-step guide to filling out the 2022 IRS tax return form

Filling out the 2022 IRS tax return form requires careful navigation through its various sections. Starting with personal information, ensure details like your Social Security number and address are accurately filled.

Next, you will report your income. Be sure to include information from all relevant documents collected earlier. For deductions and credits, explore options related to student loans, mortgage interest, and childcare expenses to maximize your benefits.

While filling out the form, double-check entries to avoid common errors like miscalculating income or overlooking deductions. Utilize tools that allow for easier data verification.

Using technology for your tax return

Technology has significantly streamlined the 2022 tax filing process. eFiling has become a popular option, allowing you to submit your return quickly online. Modern tax preparation software offers user-friendly interfaces and guidance to navigate complex tax situations.

Using software tools for filing, especially pdfFiller, enhances accuracy and efficiency in managing your tax return form. With features that gracefully blend user interaction and system validation, filing is more manageable and less stressful.

Editing and managing your tax return with pdfFiller

Once you have completed the 2022 IRS tax return form, you may want to share it or make adjustments. pdfFiller provides an excellent platform for uploading and editing your completed forms while ensuring all changes are saved securely.

You can upload a scanned copy of your completed form to pdfFiller, allowing you to make necessary edits or corrections. Collaborating with team members or co-filers on a single platform helps avoid confusion associated with handling multiple versions of documents.

Filing your 2022 tax return: options and guidelines

After completing your 2022 IRS tax return form, consider the best practices for submission. Timely filing is paramount; late submissions can result in significant penalties. Knowing the submission options available to you means fewer headaches during tax season.

Understand if you need to file for an extension; this may be beneficial in specific situations. However, penalties can still apply if taxes owed are not paid by the due date.

Track the status of your 2022 tax return

After filing your 2022 IRS tax return form, you may wonder how to track its status. The IRS provides online tools that allow you to check the progress of your return, helping you monitor when you may receive your refund.

Utilize the 'Where's My Refund?' tool available on the IRS website to get real-time updates. If you encounter any issues or delays, knowing the next steps will be crucial for resolution.

Navigating potential tax audits

Tax audits can be daunting but understanding what triggers them helps prepare you for the possibility. Common triggers include large discrepancies between reported income and standard expenses, and claims for high deductions relative to income.

Training yourself on record-keeping can significantly reduce risks. Having organized documentation at the ready makes the audit process flow more smoothly.

Frequently asked questions about the 2022 IRS tax return form

Navigating through tax filing can generate numerous questions. Common queries include understanding your filing status, what to do if you need to amend a return, and how to handle missing documents.

It's essential to seek clarity on these issues and utilize IRS resources or consult with tax professionals for detailed answers that fit your specific situation.

Final checklist before submission

Before clicking submit on your 2022 IRS tax return form, take a moment for final checks. Confirming that all your information is accurate can save significant time if corrections are needed later.

Review deductions and credits you may be eligible for to ensure you're not leaving potential savings on the table. Finally, ensure that the completion acknowledgment is confirmed, marking the end of your filing journey.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the 2022 irs tax return in Chrome?

How do I edit 2022 irs tax return on an iOS device?

How do I complete 2022 irs tax return on an Android device?

What is irs tax return?

Who is required to file irs tax return?

How to fill out irs tax return?

What is the purpose of irs tax return?

What information must be reported on irs tax return?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.