Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Form 990: A Comprehensive How-to Guide

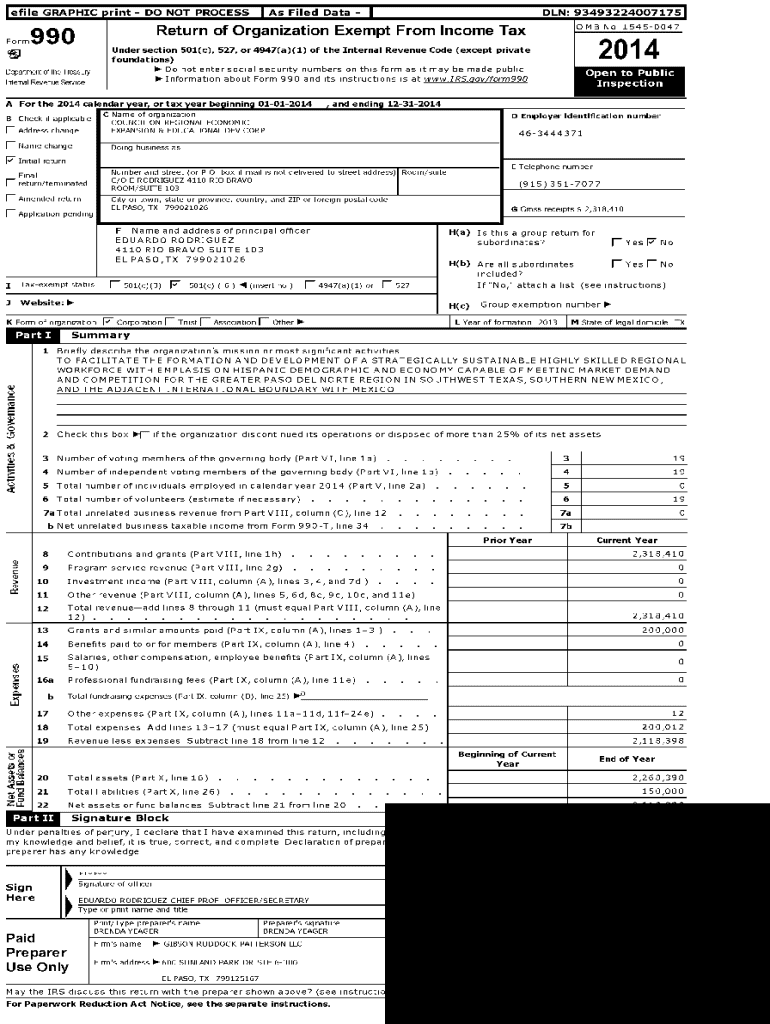

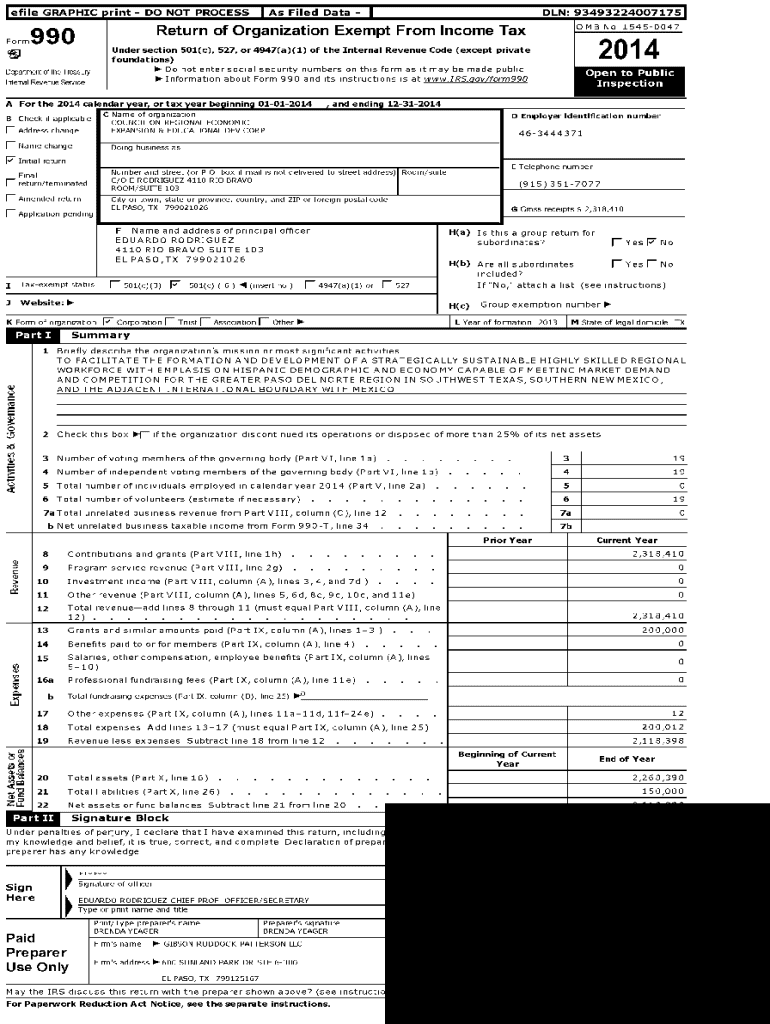

Understanding Form 990

Form 990 is a crucial document that nonprofit organizations must file annually with the IRS. This form serves as a public disclosure document, detailing the organization’s financial activities, governance, and compliance with regulations. It's not only a tool for maintaining transparency but also an essential means for the IRS to monitor charitable organizations and ensure they adhere to tax-exempt requirements.

The necessity of Form 990 cannot be overstated. By providing detailed financial data and operational information, nonprofits foster trust among donors and the public. Furthermore, it assists in ensuring that organizations remain compliant with federal regulations, maintaining their tax-exempt status and overall financial health.

Who must file Form 990?

Understanding who must file Form 990 is vital for nonprofits. Generally, this applies to tax-exempt organizations, including charitable organizations, private foundations, and certain other types of nonprofits. Each of these categories faces specific filing obligations, which may differ based on the organization’s size, revenue, and type.

However, not every organization is mandated to file. There are exceptions based on annual revenue and activities. For instance, very small nonprofits, those with annual gross receipts of $50,000 or less, can file Form 990-N, also known as the e-Postcard, while other organizations meeting certain criteria may be exempt altogether.

Preparing to file Form 990

Before filing Form 990, organizations need to gather various types of documentation and information. This includes financial statements, lists of board members, and details about the organization’s programs and funding.

Choosing the correct version of Form 990 is also critical. Organizations can typically select from: Form 990, Form 990-EZ, and Form 990-N, each tailored to the size and complexity of the organization’s operations.

Step-by-step instructions for completing Form 990

Filling out Form 990 involves multiple sections that require precise information. The first section is the Basic Information section, wherein organizations enter their name, address, and Employer Identification Number (EIN). Ensuring accuracy here is fundamental, as errors can delay the processing of the form.

The next key section pertains to financial data reporting. Organizations must report total revenue, expenses, and net assets. Understanding how to differentiate between various income sources, such as program fees, donations, and grants, is critical for transparency and compliance.

Additional sections include Governance and Management, which outline board composition and practices, and Functional Expenses, where organizations report costs based on functional classification. Finally, some nonprofits might need to complete additional schedules depending on their specific circumstances, like Schedule B for donor disclosure.

Filing modalities for Form 990

Nonprofits have options when it comes to filing Form 990. Electronic filing is highly encouraged due to its efficiency. Filing online through platforms like pdfFiller provides many benefits, including instant confirmation of receipt and saves time by reducing paperwork.

For those opting for paper filing, it’s essential to ensure the forms are sent well ahead of the deadline to avoid late fees and complications.

Deadlines and penalties for late filing

Staying compliant with Form 990 deadlines is non-negotiable for tax-exempt organizations. The annual filing deadline is typically the 15th day of the 5th month after the end of the organization’s fiscal year. For nonprofits operating on a calendar year, this means the deadline is May 15.

Setting reminders and utilizing calendar tools to track these deadlines can significantly reduce the risk of late or non-filing.

Public inspection regulations

Transparency is a key pillar for nonprofits, and Form 990 plays a central role in this. Nonprofits must make their Form 990 filings available for public inspection. This is vital not only for compliance but also to foster trust and accountability amongst stakeholders.

Form 990 filings from other organizations can be accessed via the IRS website or third-party databases, allowing stakeholders to perform due diligence on potential charitable contributions.

Utilizing Form 990 for research and evaluation

Form 990 is not just a compliance tool; it can be a powerful resource for stakeholders evaluating nonprofits. Donors can analyze Form 990 data to understand an organization’s financial health, funding sources, and operational transparency.

Interpreting Form 990 data allows stakeholders not only to select organizations that align with their values but also to push for improved practices within the nonprofit sector.

Frequently asked questions about Form 990

Common questions arise around the specifics of filing Form 990. Many misconstrue this form’s requirements, thinking all organizations face the same obligations. However, given the variety in types and sizes of nonprofits, understanding specific nuances is critical.

By addressing these inquiries, organizations can ensure compliance and optimize their transparency initiatives.

Additional tips for a smooth filing process

For nonprofits, maintaining organized records throughout the fiscal year is vital. A systematic approach to document management will streamline the preparation for Form 990. Utilizing tools such as pdfFiller for ongoing documentation needs can save time and reduce stress when tax season approaches.

By embracing a proactive mindset and using available resources, nonprofits can ensure a smoother, more efficient filing process, allowing them to focus on their mission-driven work.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my form 990 directly from Gmail?

Can I create an electronic signature for the form 990 in Chrome?

Can I edit form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.