Get the free Boe-502-a (p1)

Get, Create, Make and Sign boe-502-a p1

Editing boe-502-a p1 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out boe-502-a p1

How to fill out boe-502-a p1

Who needs boe-502-a p1?

A Comprehensive Guide to the BOE-502-A P1 Form

Overview of the BOE-502-A P1 Form

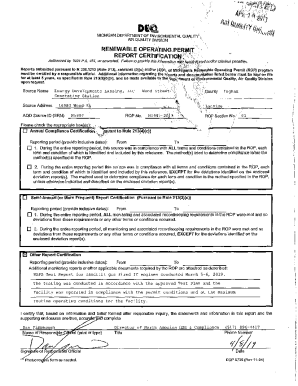

The BOE-502-A P1 form is a critical document used for reporting changes in ownership or service of any property in California. This form provides crucial information that informs the state's assessment of property tax. Understanding the nuances of this form is essential for ensuring compliance with local tax regulations.

The primary purpose of the BOE-502-A P1 form is to declare the value of newly transferred properties to the California Board of Equalization. It serves as a tool for property owners to accurately convey details about their properties and respective owners to local assessing agencies.

This form is typically required for new property purchases, as well as for transferred or inherited properties. Basically, if you're involved in real estate transactions within California, it's likely that you'll need to use the BOE-502-A P1 form.

Accessing the BOE-502-A P1 Form

To obtain the BOE-502-A P1 form, individuals can easily access it online. The California Board of Equalization provides a straightforward way for users to download the form directly from their website.

Additionally, users can take advantage of pdfFiller to find and download the form in a PDF format. This is particularly beneficial for those who prefer a quick fillable option without unnecessary bureaucracy.

For optimal accessibility, the form can be downloaded on various devices, such as desktops, tablets, and smartphones. This multifunctional capability allows you to fill out the form at your convenience, regardless of location.

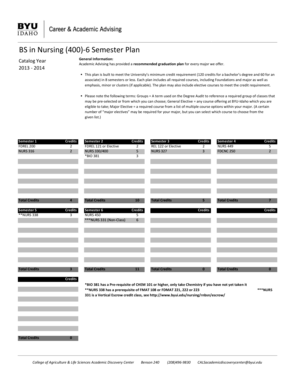

Detailed breakdown of form sections

The BOE-502-A P1 form consists of several sections, each requiring specific information. Understanding what to fill in each section will simplify the process and minimize the risk of errors.

Section 1: Property information

In this section, you need to provide essential details about the property. This includes the property's address, the type of property (residential, commercial, etc.), and any improvements made. Accurate reporting is crucial here, as any discrepancies can result in assessment delays or even penalties.

Commonly asked questions in this section include inquiries about property zoning and any changes to the land. Reviewing local zoning laws can be beneficial before filling in this section.

Section 2: Owner information

This section requests identifying information about the current property owners. This typically includes names, addresses, and contact information. Ensure the details are accurate and consistent with legal documents, as errors may lead to issues in ownership verification.

Section 3: Declaration of value

In this final section, you will declare the monetary value of the property. This is a critical area since it directly impacts property tax calculations. You must accurately assess the fair market value based on current real estate conditions, typically done through market analysis or the assistance of a qualified appraiser.

The declared value of the property could significantly alter your tax obligations. Therefore, it's imperative to perform thorough research and consult professionals if unsure about the assessment process.

Instructions for completing the BOE-502-A P1 form

Filling out the BOE-502-A P1 form may seem daunting, but following a step-by-step approach can simplify the task significantly. Start by accessing the form on pdfFiller, which provides user-friendly features to assist in the process.

Common mistakes to avoid include overlooking fields, incorrect valuations, and mismatched information. To ensure compliance, familiarize yourself with local regulations regarding property declarations and consult resources available on pdfFiller.

Editing and customizing the BOE-502-A P1 form with pdfFiller

pdfFiller provides a robust editing platform that allows users to customize the BOE-502-A P1 form as needed. Beyond simple text entry, users can employ various functionalities to make their process smoother.

Utilizing these features can gauge effectiveness in managing your documents, ensuring nothing is overlooked, and allowing for easy adjustments as new information arises.

E-signing the BOE-502-A P1 form

The process of e-signing the BOE-502-A P1 form is designed to streamline the signing process while adhering to legal standards. With pdfFiller, users can add their e-signature directly to the document without the hassle of printing and signing.

E-signatures are legally valid in California, so there's no need for additional paperwork. This digital method not only saves time but also helps maintain the form's integrity.

Submitting the BOE-502-A P1 form

After completing and signing the BOE-502-A P1 form, the next step is submission. Depending on your preference and the requirements of your local county, there are several methods for submitting the completed form.

It’s advisable to follow up after submission to ensure the form was received. You can typically expect a notification regarding any further actions required or verification of your claims.

Managing your BOE-502-A P1 form post-submission

Once you've submitted your BOE-502-A P1 form, it's important to manage your documentation effectively. Thankful for pdfFiller, users have the capability to track submission statuses, giving them peace of mind.

Staying organized in this phase ensures you won't miss critical communication from assessing agencies that could impact your tax obligations.

Common FAQs about the BOE-502-A P1 form

Questions often arise regarding the BOE-502-A P1 form, especially for first-time users. Here are some frequently asked questions to aid your understanding.

For any additional queries or grievances, utilizing the resources available at pdfFiller can provide essential guidance as you navigate through common issues associated with completing and submitting this pivotal form.

Other related forms and resources

The BOE-502-A P1 form interacts with a variety of other property-related forms that may be necessary depending on your circumstances. Understanding complementary forms is beneficial for comprehensive property tax management.

Utilizing pdfFiller allows seamless integration of multiple forms, which can be extremely useful when dealing with complex property tax situations.

Important legal considerations

Filling out the BOE-502-A P1 form with incorrect information can lead to serious legal implications. Depending on the severity of the discrepancy, penalties can range from fines to further action by tax authorities.

Ensuring that your form is correct and timely is essential to avoid complications with property taxes that could hinder long-term financial plans.

Connecting with professional help

Given the complexity of property assessments and tax regulations, there may be times when consulting a professional is necessary. Lawyers or accountants can offer insights that ensure compliance and strategic planning.

By leveraging professional insights along with pdfFiller's features, you can navigate the complexities of document management while ensuring complete compliance.

Share your experience

Engaging with the community around the BOE-502-A P1 form can lead to valuable insights. Sharing your experiences, challenges, and tips on social media can foster dialogue that benefits many.

User-generated content often leads to improved processes, making it easier for future form users. Encouraging open communication within the community can help everyone navigate the complexities of the BOE-502-A P1 form more efficiently.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit boe-502-a p1 online?

Can I create an eSignature for the boe-502-a p1 in Gmail?

How do I fill out boe-502-a p1 using my mobile device?

What is boe-502-a p1?

Who is required to file boe-502-a p1?

How to fill out boe-502-a p1?

What is the purpose of boe-502-a p1?

What information must be reported on boe-502-a p1?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.