Get the free Form 990

Get, Create, Make and Sign form 990

How to edit form 990 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 990

How to fill out form 990

Who needs form 990?

Comprehensive Guide to Form 990: Essential Insights for Non-Profit Organizations

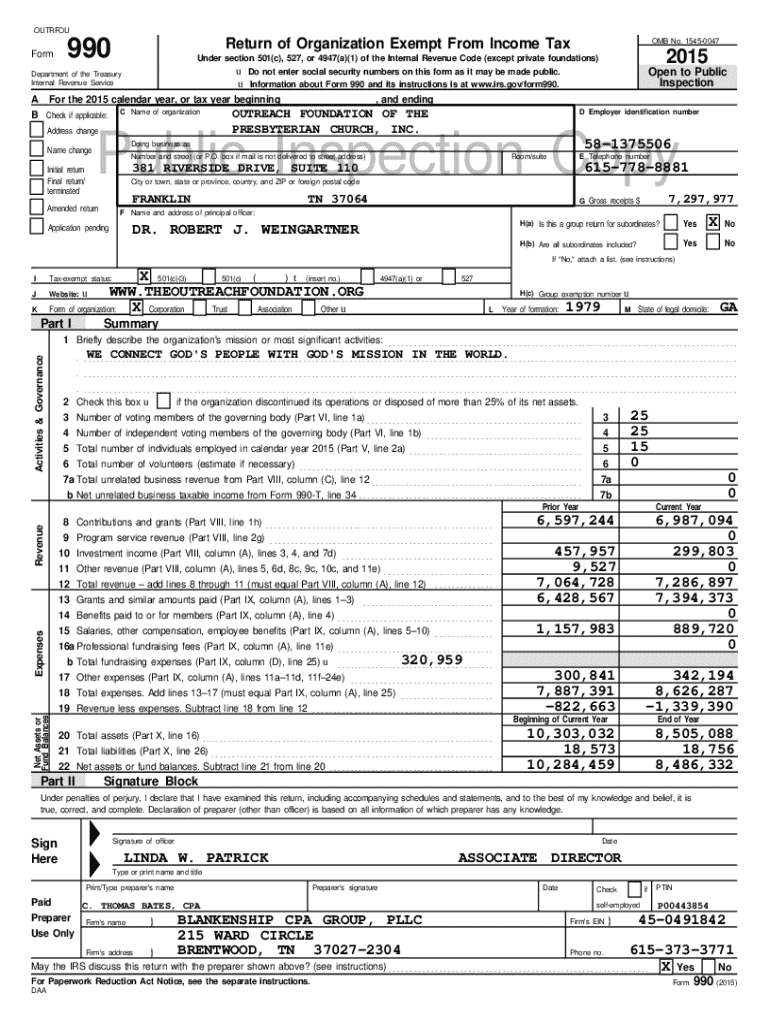

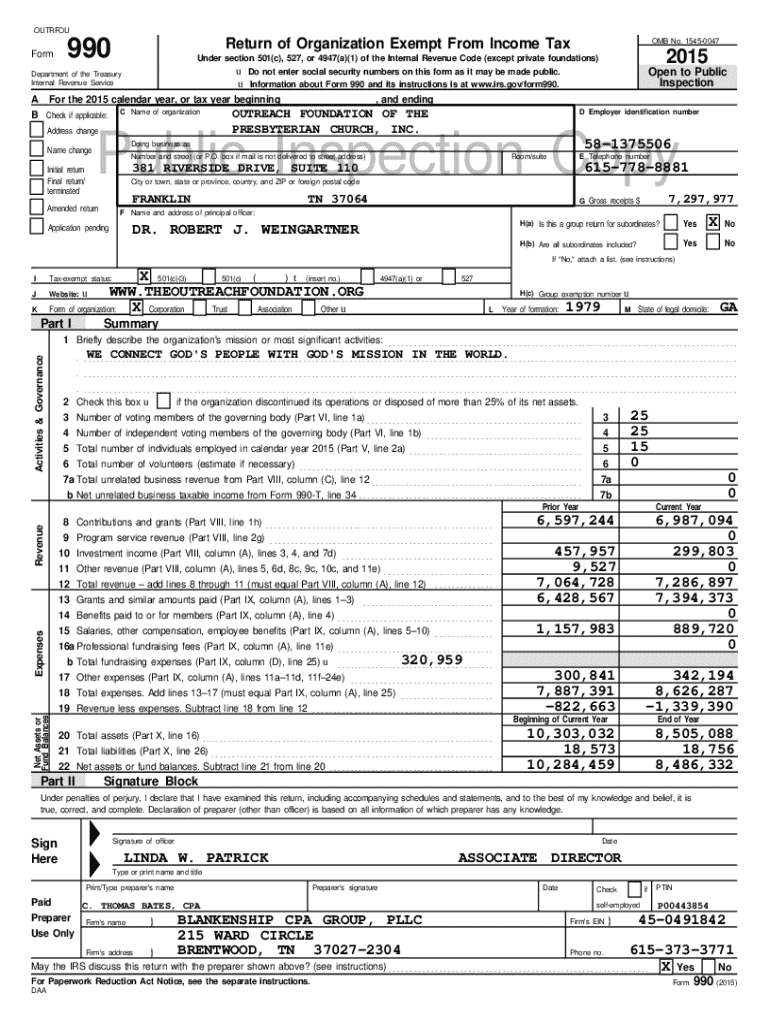

Overview of Form 990

Form 990 is the IRS form used by tax-exempt organizations, including non-profits, to provide the IRS with detailed information about their financial activities, governance, and programs. The purpose of Form 990 is multifaceted; it not only facilitates transparency regarding the operations and financial health of non-profits but also helps the IRS ensure compliance with tax regulations.

Understanding the significance of Form 990 is essential for any non-profit organization, as failing to file it can result in losing tax-exempt status. Moreover, stakeholders such as donors, board members, and the general public often rely on this form to assess the organization’s accountability and efficiency.

Understanding the types of Form 990

There are several variants of Form 990 that cater to different types of tax-exempt organizations. The most common forms include Form 990-N (e-Postcard), Form 990-EZ (Short Form), the Full Form 990, and Form 990-PF for private foundations. Each form serves a specific purpose based on the size and complexity of the organization.

Selecting the appropriate form is crucial. For small organizations with gross receipts of less than $50,000, Form 990-N is sufficient. Larger organizations with gross receipts between $50,000 and $200,000 may opt for Form 990-EZ, while those with gross receipts exceeding $200,000 or total assets over $500,000 must file the full Form 990 or Form 990-PF.

Filing requirements

To maintain tax-exempt status, non-profit organizations must understand who needs to file Form 990. Generally, all tax-exempt non-profits, including 501(c)(3) organizations, are required to file annually, unless they qualify for an exemption based on their income or organization type.

Organizations should also be aware of the annual filing deadline, typically the 15th day of the 5th month after the end of their fiscal year. For example, if a non-profit’s fiscal year ends on December 31, its Form 990 is due by May 15. To check filing status, organizations can use the IRS website or consult the Form 990 database.

Key components of Form 990

Form 990 consists of multiple sections designed to provide a comprehensive view of a non-profit's finances, governance, and accomplishments. It begins with a summary of the organization in Part I, followed by governance details in Part II, which includes the board composition and conflict-of-interest policies.

In Part III, organizations are required to report program service accomplishments, detailing how they achieved their mission. Detailed financial statements form a critical section of the form, which breaks down income, expenses, assets, and liabilities, providing stakeholders a clear picture of the organization’s financial health.

How to fill out Form 990

Filling out Form 990 can seem daunting, but following a structured approach can simplify the process significantly. Firstly, gather all necessary documentation such as financial statements, IRS determination letters, and board meeting minutes. This forms the backbone of your filing.

Next, accurately input financial information, ensuring to reconcile figures with your organization's accounting records. Report executive compensation and disclose any related party transactions, as this information is critical for transparency. Lastly, review the form to catch common pitfalls, such as missing signatures or incorrect financial data.

Tools for managing Form 990

Managing Form 990 can be a streamlined process thanks to various tools available to organizations. pdfFiller, for instance, offers an efficient platform for completing and managing Form 990. Through its intuitive interface, users can fill in forms, edit content directly, and manage document versions without hassle.

Additionally, an interactive checklist can guide organizations through filing requirements, ensuring that no necessary components are overlooked. Using templates specifically designed for Form 990 can further simplify documentation, providing a consistent format that can be adapted year-on-year.

eSigning and collaboration features

The digital age allows non-profits to take advantage of eSigning capabilities, making the signing process for Form 990 much more accessible. pdfFiller enables users to eSign documents easily, making it possible for multiple stakeholders to review and sign forms without needing physical meetings or mail.

Moreover, collaborative tools offered by pdfFiller facilitate team editing and review, ensuring all necessary stakeholders have input before submission. This feature secures document sharing, ensuring that sensitive information is only accessed by authorized personnel.

Understanding filing modalities

When it comes to filing Form 990, organizations have options. The most efficient method is electronic filing, which is recommended by the IRS. Electronic filing is straightforward; it involves using approved tax software or platforms like pdfFiller that guide you through the process with prompts and checklists. Users can file directly online, reducing processing times and ensuring prompt submissions.

For organizations opting for paper filing, it is crucial to follow the IRS instructions meticulously, as errors could lead to delays in processing. Paper files must be mailed to the address stated in the instructions based on the organization's location. Regardless of the method chosen, organizations should adopt best practices for maintaining filing records to streamline future submissions.

Penalties for non-compliance

Failing to file Form 990 accurately and on time can lead to significant penalties. Organizations may incur late filing fees, with the IRS imposing fines for each month a return is overdue, up to a maximum amount. Additionally, persistent non-compliance may trigger audits, further complicating the organization's financial standing and relationship with the IRS.

To mitigate risks associated with potential penalties, non-profits must ensure accurate filings by conducting regular reviews and audits of their financials. Engaging with experienced tax professionals can provide invaluable support in navigating these regulations.

Public inspection regulations

Form 990 is subject to public inspection, meaning that non-profits are required to make their filings available to the public, ensuring accountability and transparency in operations. Organizations must provide copies of their Form 990 if requested, making it vital to prepare the form accurately and maintain documentation for easy access.

Individuals can locate Form 990 filings through IRS resources or various websites hosting non-profit information. The public availability of these forms plays a critical role in fostering trust with donors and the community by demonstrating the non-profit’s financial health and mission impact.

A historical perspective

Form 990 has undergone several transformations since its inception, reflecting the evolving landscape of non-profit regulation and reporting standards. Originally, the form was designed primarily to ensure that non-profits remained accountable to the IRS; however, its purpose has expanded over the years to include greater transparency and detailed financial reporting requirements.

Key amendments and changes in filing requirements have included adjustments to information disclosures, shifts towards electronic filing, and stricter penalties for non-compliance. Understanding this historical context can provide organizations with insights into why accurate Form 990 completion is essential for maintaining public trust and official compliance.

Using Form 990 for charity evaluation research

Form 990 is not just a compliance document; it serves as a valuable resource for analyzing and evaluating the health of non-profit organizations. Researchers, potential donors, and other stakeholders can review these forms to glean insights into an organization’s efficiency, effectiveness, and overall mission achievement. By analyzing metrics such as revenue generation, program expenses, and fundraising efficiency, interested parties can make informed decisions about their involvement with specific organizations.

Moreover, various platforms aggregate Form 990 data, providing easy access to standardized information. This streamlines research efforts and helps in comparing organizations across similar sectors, ultimately promoting better decision-making.

Additional considerations

The complexities surrounding Form 990 necessitate vigilance in compliance, prompting many organizations to seek professional assistance. Consulting with a tax professional can yield beneficial insights into best practices for filing, ensuring compliance with regulations. Keeping abreast of changes to tax laws that impact Form 990 is also vital for organizational leadership.

Organizations should actively engage with IRS updates while considering leveraging resources within their networks for support. and developing a direct line of communication with a tax professional can address specific questions and concerns related to Form 990.

Troubleshooting common issues

Common issues can arise post-submission of Form 990, including the need to amend filed documents. If a mistake is discovered after submission, organizations can file Form 990-X to correct errors. It is critical to address mistakes promptly to avoid penalties and to maintain accurate records.

Should organizations need assistance at any point, they can reach out to the IRS for clarification or guidance on resolving specific issues. Being proactive about rectifying errors can significantly enhance trust and confidence in a non-profit’s governance practices.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify form 990 without leaving Google Drive?

How can I edit form 990 on a smartphone?

How do I edit form 990 on an Android device?

What is form 990?

Who is required to file form 990?

How to fill out form 990?

What is the purpose of form 990?

What information must be reported on form 990?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.