Get the free Form 8868 and Form 990

Get, Create, Make and Sign form 8868 and form

How to edit form 8868 and form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out form 8868 and form

How to fill out form 8868 and form

Who needs form 8868 and form?

A Comprehensive Guide to IRS Form 8868 and Related Forms

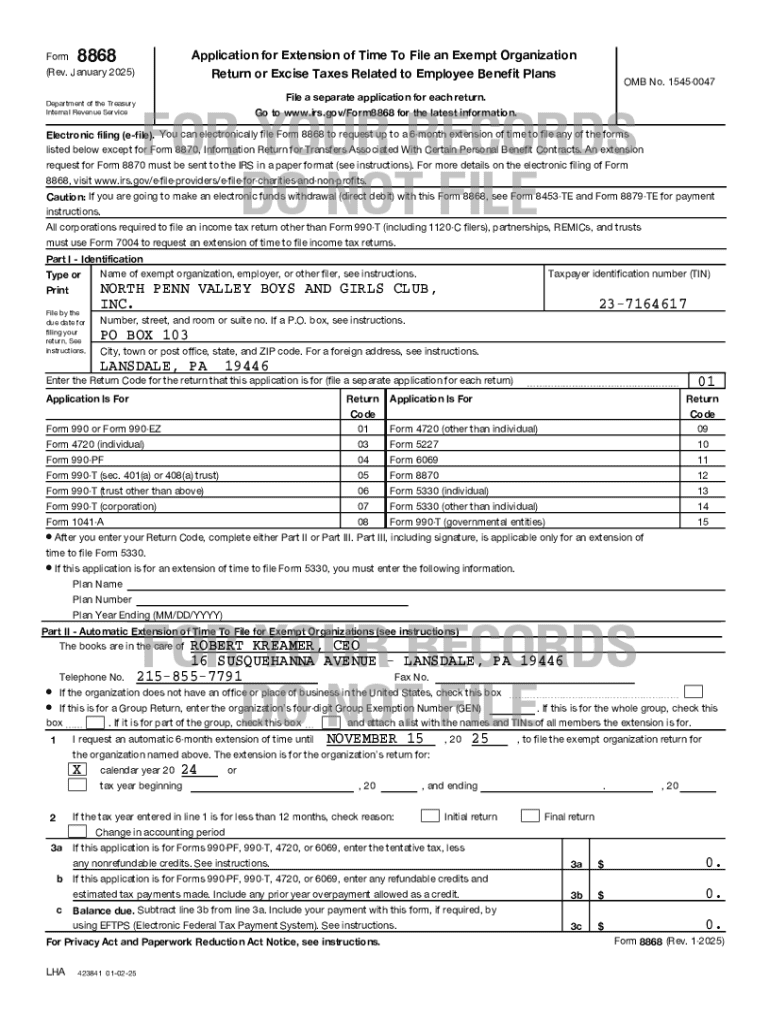

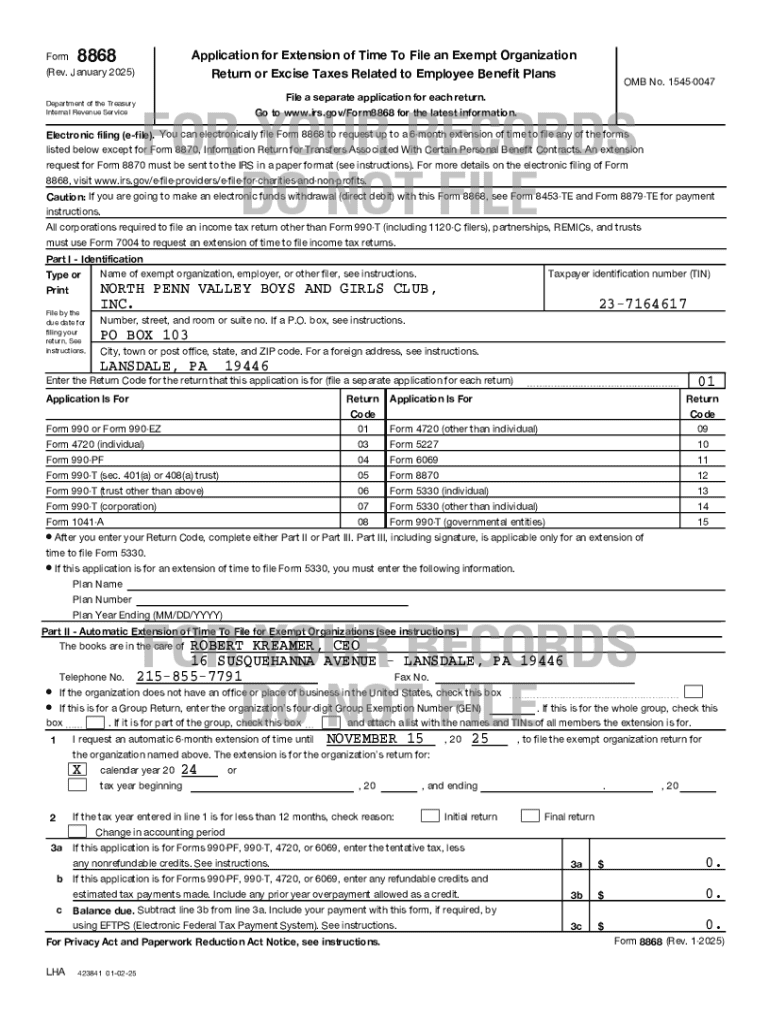

Understanding IRS Form 8868

Form 8868 is an essential document for tax-exempt organizations looking to request an extension of time to file their annual information returns (Form 990-series forms). This form is crucial for ensuring that these organizations remain compliant with federal tax regulations while requiring additional time to finalize their returns.

The primary purpose of Form 8868 is to provide a mechanism through which tax-exempt entities can avoid late filing penalties, granted they meet specified criteria. Understanding Form 8868 is paramount for any organization wishing to adhere to IRS guidelines and maintain its tax-exempt status.

Key changes for 2024 tax year

For the 2024 tax year, new developments regarding Form 8868 have emerged that organizations must be aware of to ensure compliance. The IRS has recently outlined adjustments to the deadlines and filing processes for this form, aiming to streamline the experience for organizations seeking extensions.

Changes applicable for the upcoming filing may include updated guidelines on electronic submissions and any modifications to the criteria for obtaining extensions. Organizations should stay updated about these changes to prepare their submissions effectively.

Who can use Form 8868?

Form 8868 can be utilized by a broad range of tax-exempt entities, including those classified under IRC Section 501(c)(3) as well as other applicable tax-exempt organizations. This flexibility allows a multitude of organizations to leverage this form to manage their filing status efficiently.

The types of returns that can be extended using Form 8868 include:

When and how to file Form 8868

Filing deadlines for the 2024 tax year generally align with the due dates of the specific returns being extended. For most organizations, the standard deadline falls on the 15th day of the 5th month after the end of their tax year. Therefore, it is critical to familiarize yourself with these deadlines for accurate and timely submissions.

Form 8868 can be filed electronically, which is often the most efficient method. Submissions are made directly through the IRS website or by utilizing platforms that support tax filings, such as pdfFiller.

To file Form 8868 online, follow this step-by-step guide:

Detailed instructions for filling out Form 8868

When filling out Form 8868, it is essential to follow each section meticulously to avoid errors that could result in processing delays or complications.

Part : Identification

In Part I, you need to report important identification information about your organization, including the legal name, address, and Employer Identification Number (EIN). Ensure this information is accurate, as it directly correlates with your entity's tax records.

Part : Automatic extension details

This section outlines the criteria for automatic extension eligibility. Organizations with a valid tax-exempt status can automatically extend their filing deadline for six months with Form 8868, provided they submit this request on time.

Part : Additional extensions (e.g., Form 5330)

In this part, you can request additional extensions beyond the automatic six-month period. Be aware that specific conditions apply, such as additional filings (like Form 5330) which may necessitate further documentation.

Filing information and requirements

When preparing to file Form 8868, it’s imperative to gather all necessary documentation in advance. This includes prior tax returns, financial statements, and any correspondence from the IRS that may impact your filing.

Common mistakes to avoid when filing include:

Additionally, be mindful of any tax payment obligations related to Form 8868, as organizations must remain compliant with IRS requirements to avoid losing their tax-exempt status.

Privacy and compliance considerations

When handling sensitive information through Form 8868, it's essential to understand the Privacy Act Notice and adhere to the guidelines set forth under the Paperwork Reduction Act. This ensures organizations protect sensitive data while fulfilling their legal obligations.

Every exempt organization must also maintain compliance with all laws concerning the handling and submission of their tax documentation, ensuring that privacy and security remain a priority.

Frequently asked questions about Form 8868

After filing Form 8868, organizations often wonder what the next steps are. The IRS generally processes submissions within six to eight weeks, and you should monitor for any communication or additional requirements from the IRS.

Solutions to common filing issues include:

Keeping track of your submission can be easily managed through tools provided on the pdfFiller platform, ensuring that you always have access to records when needed.

Helpful tools and resources

To enhance document management and submission efficiency, pdfFiller offers a range of tools designed to assist users with Form 8868. From easy-to-use templates to eSignature capabilities, users can streamline the entire process to stay compliant effortlessly.

Resources for understanding related forms, such as Form 990 and Form 990-N, are also crucial for comprehensive compliance. Additionally, links to governmental guidelines and forms can be invaluable for staying current on any congressional adjustments or proposals affecting tax-exempt organizations.

Navigating extensions and related forms

Understanding the connection between Form 8868 and Form 990 is critical for tax-exempt organizations, as filing inaccuracies can lead to complications regarding extensions. The interrelationship enables better management of multiple returns and clarifies how various forms interact regarding deadlines.

Grasping extension options for other tax-exempt returns reinforces compliance and streamlines the overall filing process, particularly for organizations that file multiple forms annually.

Essentials and key takeaways

To summarize critical points regarding Form 8868, organizations must recognize its role in facilitating extensions for tax filings, thus providing a safety net against penalties related to late submissions. The automatic extension allows additional flexibility, underscoring the importance of timely filing.

Implementing best practices for compliance and filing can be the difference between maintaining tax-exempt status and incurring penalties. Engaging reliable tools such as pdfFiller reinforces the filing experience effectively.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send form 8868 and form to be eSigned by others?

How do I execute form 8868 and form online?

Can I edit form 8868 and form on an Android device?

What is form 8868 and form?

Who is required to file form 8868 and form?

How to fill out form 8868 and form?

What is the purpose of form 8868 and form?

What information must be reported on form 8868 and form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.