Get the free Franchise Business Loan Application

Get, Create, Make and Sign franchise business loan application

How to edit franchise business loan application online

Uncompromising security for your PDF editing and eSignature needs

How to fill out franchise business loan application

How to fill out franchise business loan application

Who needs franchise business loan application?

Franchise business loan application form: A comprehensive guide

Understanding franchise business loans

Franchise business loans are specialized loans designed specifically for entrepreneurs looking to own and operate a franchise. Such funding is crucial for various aspects of the franchise operation, including initial startup costs, purchasing equipment, and even marketing strategies. Securing funding is often a pivotal step for franchisees aiming to grow their business and maximize profitability.

The importance of financing cannot be overstated. It provides franchisees the necessary capital to invest in essential resources that can set the foundation for a successful business. One of the key benefits of franchise business loans is the tailored support that comes with them, as many lenders understand the franchise model and the specific challenges you may face.

Types of franchise financing options

Several financing options are available for potential franchise owners, each catering to different needs and qualifications. Understanding these can help you choose the right funding path.

Traditional bank loans

Traditional bank loans are a well-known funding source for many franchisees. They typically offer lower interest rates and require solid personal credit histories. However, they may have stringent qualification criteria.

SBA loans

SBA loans, backed by the Small Business Administration, are a popular choice for franchisees looking for long-term financing solutions. They typically offer lower down payments and longer repayment terms.

Alternative financing

Alternative financing solutions, such as crowdfunding, online lenders, and franchisee support programs, have gained popularity. These options can often be less cumbersome in terms of paperwork and quicker to obtain.

Evaluating the various financing options based on your specific situation will help ensure you choose wisely, maximizing your chances for success as a franchisee.

Preparing your franchise business loan application

Preparation is key when applying for a franchise business loan. Lenders require specific documentation that demonstrates your financial health and the viability of your franchise.

Essential documents needed

Having these documents prepared can streamline your application process significantly. Most loan applications follow a standard process involving several key steps.

Overview of the application process

The application process typically includes submitting the necessary documentation, waiting for lender review, and possibly undergoing interviews. Expect a timeline of several weeks, especially with traditional lenders.

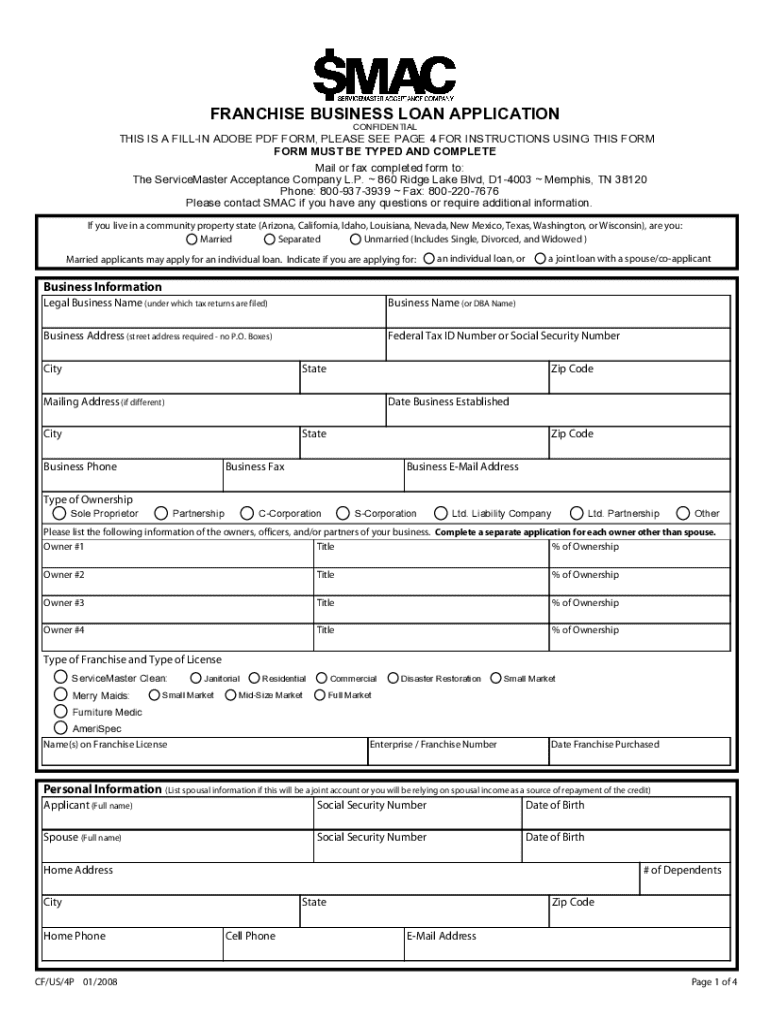

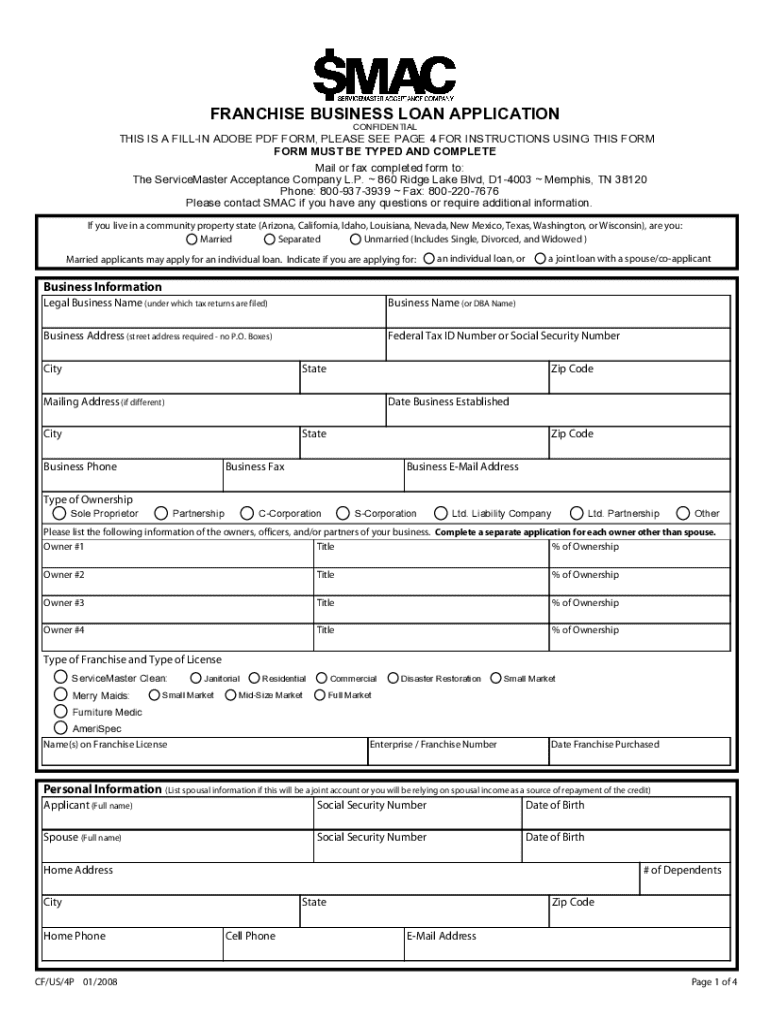

Filling out the franchise business loan application form

Completing the franchise business loan application form diligently is crucial for a successful outcome. This document usually contains several key sections that require careful attention.

Sections of the application form explained

Many applicants make common mistakes that can jeopardize their chances. It's crucial to ensure all information provided is accurate and complete.

Common mistakes to avoid

Presenting your case to lenders

When you present your application to lenders, it’s essential to communicate effectively why your franchise is a sound investment. This involves crafting an impactful business plan that clearly outlines the potential for success.

Crafting a compelling business plan

Additionally, showing proof of your franchise’s success can solidify your argument. Present testimonials and examples of franchise performance in your application.

Preparing for interviews with lenders

Interviews with lenders can be nerve-wracking, but being prepared is essential. Practicing common questions can help you communicate confidently.

Managing your loan once approved

Once your franchise business loan is approved, you’ll need to manage it responsibly. Understanding the terms of repayment and budgeting effectively will set you up for success.

Understanding loan repayment terms

Financial management goes beyond just tracking expenses. It also involves planning for the future.

What to do if you encounter financial difficulties

Interactive tools and resources

Utilizing the right tools can simplify the application process significantly. Online platforms like pdfFiller not only offer access to essential documents but provide interactive features to help you throughout your journey.

FAQs about franchise business loans

When considering a franchise business loan, several questions frequently arise that can help clarify the process and expectations.

Leveraging pdfFiller for your application needs

pdfFiller delivers a robust platform that empowers users to create, edit, sign, and manage their application documents seamlessly. Utilizing pdfFiller ensures that your franchise business loan application form is completed accurately and submitted efficiently.

Why choose pdfFiller for your franchise business loan application

Listening to real customers can also offer insights into how effectively pdfFiller streamlines the loan application process. Users frequently highlight the platform's efficiency and ease of use.

Customer testimonials: Real experiences with pdfFiller

Many users praise pdfFiller for transforming their document management experience, providing them with the tools necessary for successful loan applications.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get franchise business loan application?

How do I make edits in franchise business loan application without leaving Chrome?

Can I edit franchise business loan application on an Android device?

What is franchise business loan application?

Who is required to file franchise business loan application?

How to fill out franchise business loan application?

What is the purpose of franchise business loan application?

What information must be reported on franchise business loan application?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.