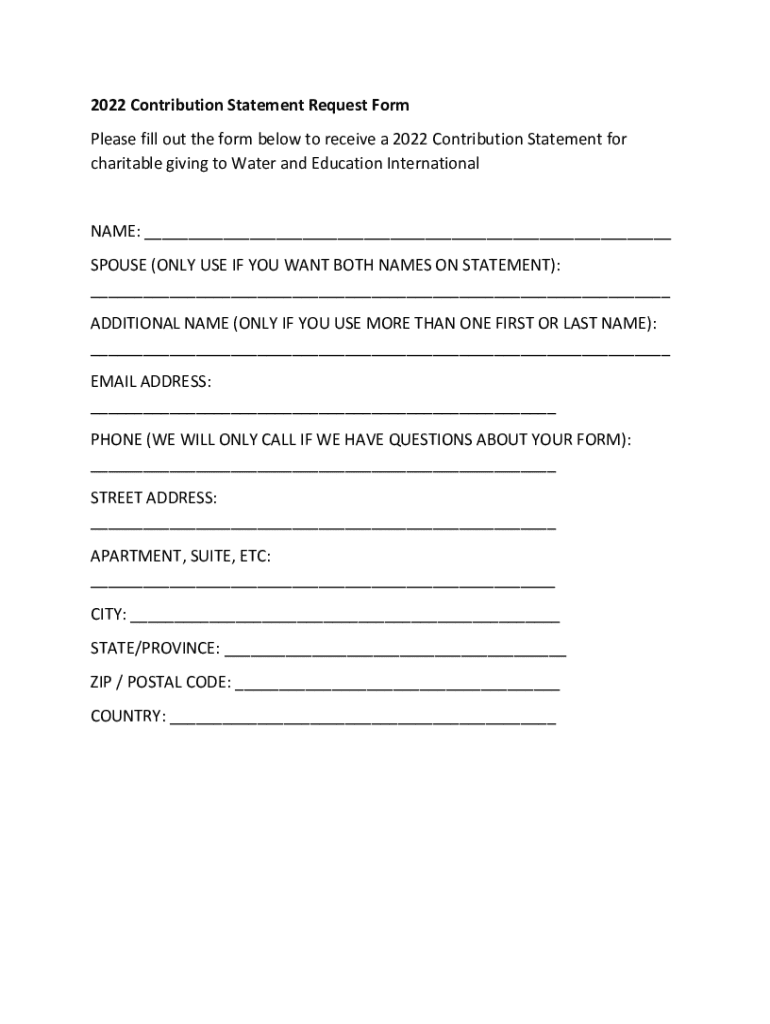

Get the free 2022 Contribution Statement Request Form

Get, Create, Make and Sign 2022 contribution statement request

Editing 2022 contribution statement request online

Uncompromising security for your PDF editing and eSignature needs

How to fill out 2022 contribution statement request

How to fill out 2022 contribution statement request

Who needs 2022 contribution statement request?

2022 Contribution Statement Request Form - How-to Guide

Understanding the contribution statement request process

A contribution statement is a vital document that outlines an individual’s or team's contributions over a specified period, typically utilized for review and reporting purposes. The main function of this statement is to provide a comprehensive record that can assist in financial reporting, tax filing, and even personal budgeting. For teams, it serves as a performance metric, demonstrating individual contributions towards team outcomes.

The importance of the contribution statement extends beyond mere documentation. It forms the foundation for transparency and accountability, highlighting key contributions which can support both individual recognition and professional growth opportunities. In 2022, ensuring you have a clear and precise contribution statement can significantly ease your financial planning, whether you're an individual taxpayer or part of an organizational team.

Who can request a contribution statement?

Eligibility to request a contribution statement generally depends on one's employment status and relationship with the organization or entity issuing the statement. Individuals typically eligible include employees, contractors, and self-employed individuals. Each of these groups may have unique requirements and processes for requesting their respective statements.

Specific demographics such as current employees of a company will have straightforward access compared to former employees or contractors who may need to follow alternative protocols. Additionally, organizations often establish their own internal guidelines for issuing these statements, which can affect the speed and process of your request.

Preparing to request the contribution statement

Before submitting your request for a 2022 contribution statement, it's crucial to gather all necessary information. This includes personal identification details such as your full name, current address, and possibly your Social Security number (SSN) or taxpayer identification number (TIN). Furthermore, understanding your employment history is vital, including the duration of your employment and types of contributions made within that time frame.

Preparing these details in advance can significantly speed up the request process. You should also have an understanding of the types of contributions you need documented—be they financial contributions to retirement plans, project contributions, or volunteer hours—so that your request is as comprehensive as possible.

Understanding necessary documentation

Submitting your request requires various documents to authenticate your identity and substantiate your contributions. This may include tax returns, pay stubs, or previous contributions records. Collecting these documents ahead of time can streamline your request process and minimize back-and-forth communication with your issuing agency.

Additionally, if you're retrieving documents from different entities, make sure to allow sufficient time for accessibility. It's advisable to secure electronic copies whenever possible, as they can simplify the submission process. Most organizations today offer digital access to employment records and contribution documentation, which is a tremendous advantage.

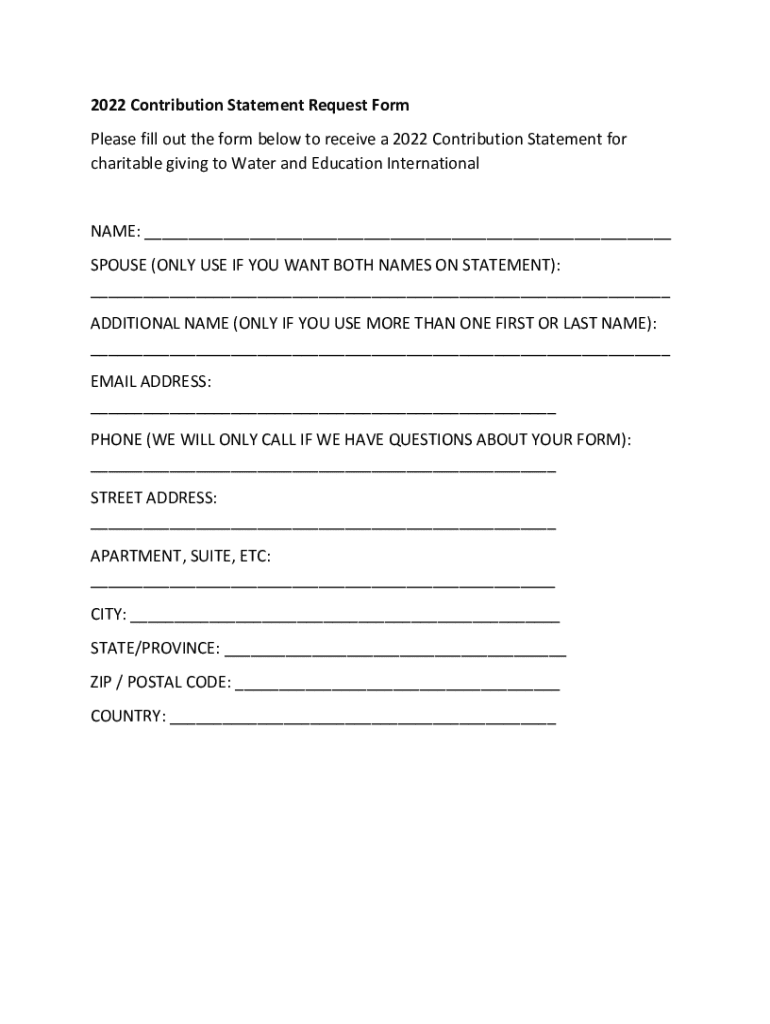

How to fill out the 2022 contribution statement request form

Completing the 2022 contribution statement request form accurately is key to ensuring you receive the documentation you need without delay. Start by filling out your personal information completely and correctly. It's essential to ensure that your name and address match exactly how they are recorded within the organization’s files.

When documenting your contributions, provide specific figures and descriptions where applicable. Additions or omissions of even minor details can lead to confusion or delays. Once you have filled out the form, review it thoroughly to verify there are no errors or missing information, utilizing a checklist where necessary to ensure you've included everything required.

Utilizing pdfFiller for easy form completion

To enhance your form completion experience, pdfFiller simplifies filling out the 2022 contribution statement request form through its intuitive online platform. With the added capability to edit PDFs, you can easily customize your documents without fear of miscommunication or error. The interactive tools available on pdfFiller allow you to include digital signatures, text, and other necessary components seamlessly.

Moreover, collaboration with team members becomes effortless due to cloud-based sharing features. You can invite colleagues to review or contribute to the form, reducing redundant efforts and ensuring everyone’s input is considered before submission. With tools like pdfFiller, your document management experience is significantly enhanced.

Submitting your request

After precisely completing the 2022 contribution statement request form, you need to select the submission method that best fits your needs. Online submission through pdfFiller is one of the most efficient ways to send your request. Simply follow the on-screen prompts to ensure that your form is submitted correctly and retains all its necessary components.

If you prefer mailing your request, print the completed form and package it correctly, following up with the appropriate organization by phone to confirm they received it. This serves as both a courtesy and a precaution against lost documentation. Additionally, once your request is submitted, tracking its status is critical – many organizations provide online portals for this purpose.

Tracking the status of your request

Once your 2022 contribution statement request is submitted, keeping track of its status is paramount. If you submitted online via pdfFiller, you can usually check your request status directly through the platform. Login to your account and navigate to the submissions section to view any updates or pending actions.

For mailed requests, consider contacting the customer support department of the organization to verify receipt and ask about processing times. This proactive approach ensures you’re in the loop and can act quickly if more information is needed or if there are delays.

Managing your contribution statement effectively

After receiving your contribution statement, it's essential to manage it effectively. Store the document securely in both physical and digital forms, ensuring it's easily accessible for future reference. Many individuals benefit from organizing such documents in a dedicated folder or using cloud storage to prevent loss.

Moreover, when it comes to collaborating with others or utilizing the document for official purposes, pdfFiller offers features that allow you to e-sign the statement electronically, enhancing its legitimacy and usefulness. This step ensures that your contribution statement remains a formal part of your financial documentation.

Common issues and FAQs

Despite meticulous efforts in the request process, various issues can arise. For instance, if your request for the 2022 contribution statement is denied, reach out to the corresponding department for clarification and details about what information may be lacking or what the next steps should be. Understand the criteria they used, and use this information to improve your future submissions.

Furthermore, questions about processing times are common. Generally, organizations will provide a timeframe for when you can expect to receive your statement, typically ranging from a week to several weeks. If your request is urgent, express that need upfront to potentially speed up the review process.

Additional tools and resources

In addition to the 2022 contribution statement request form itself, various other forms and templates may be required to complete your financial or organizational documentation. For example, tax forms, employment verification letters, and receipts may accompany your statement for a complete financial overview.

Utilizing pdfFiller’s platform can also connect you to various related forms you may need, ensuring that every aspect of your documentation is covered efficiently. Furthermore, numerous helpful links exist, leading to government resources or financial institutions that can provide additional assistance tailored to your specific situation.

Recent updates and changes

As 2022 came to pass, several changes in policies related to contribution statements were enacted. These adjustments could stem from new regulations enacted by governing authorities or significant shifts in how various organizations handle employee documentation. Understanding these changes is crucial as they can affect your submission processes and requirements.

Staying abreast of the latest news surrounding contribution statements is essential for those actively concerned about their financial documentation. With updates being periodically shared by trusted organizations, it’s advised to subscribe to relevant news feeds that can keep you informed of any changes that may affect your contributions or statement processing.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit 2022 contribution statement request straight from my smartphone?

How do I fill out the 2022 contribution statement request form on my smartphone?

How can I fill out 2022 contribution statement request on an iOS device?

What is contribution statement request?

Who is required to file contribution statement request?

How to fill out contribution statement request?

What is the purpose of contribution statement request?

What information must be reported on contribution statement request?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.