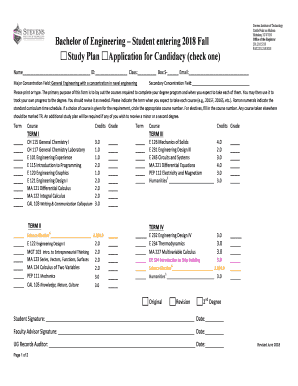

Get the free Ft 1120

Get, Create, Make and Sign ft 1120

How to edit ft 1120 online

Uncompromising security for your PDF editing and eSignature needs

How to fill out ft 1120

How to fill out ft 1120

Who needs ft 1120?

FT 1120 Form: A Comprehensive How-to Guide

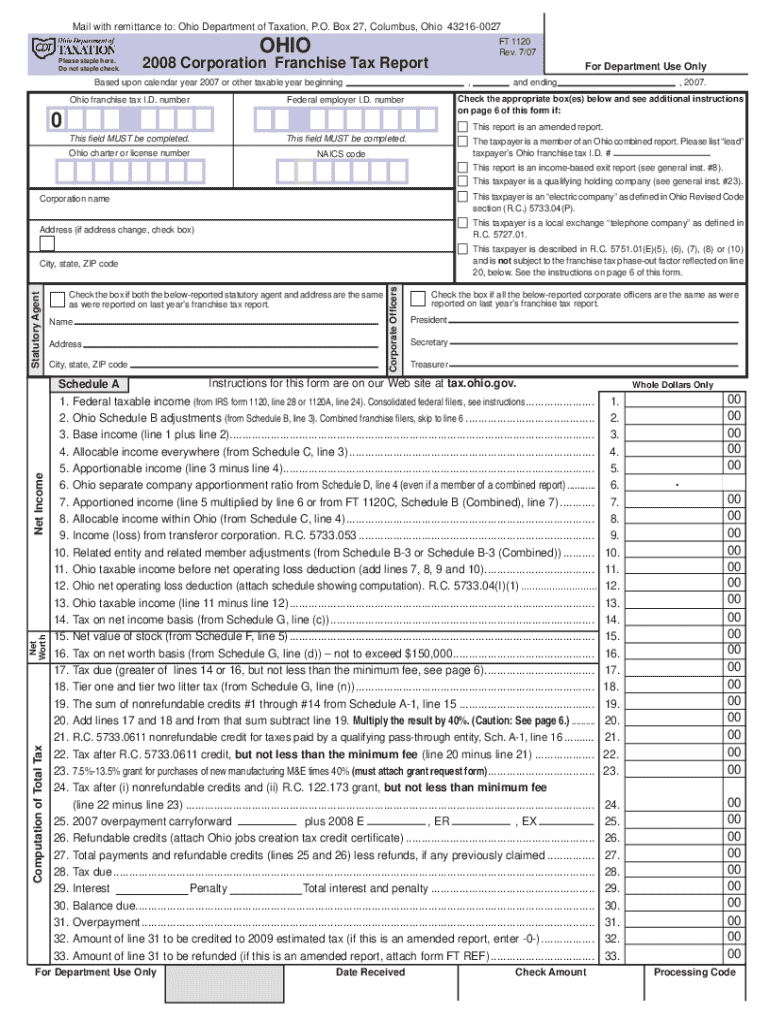

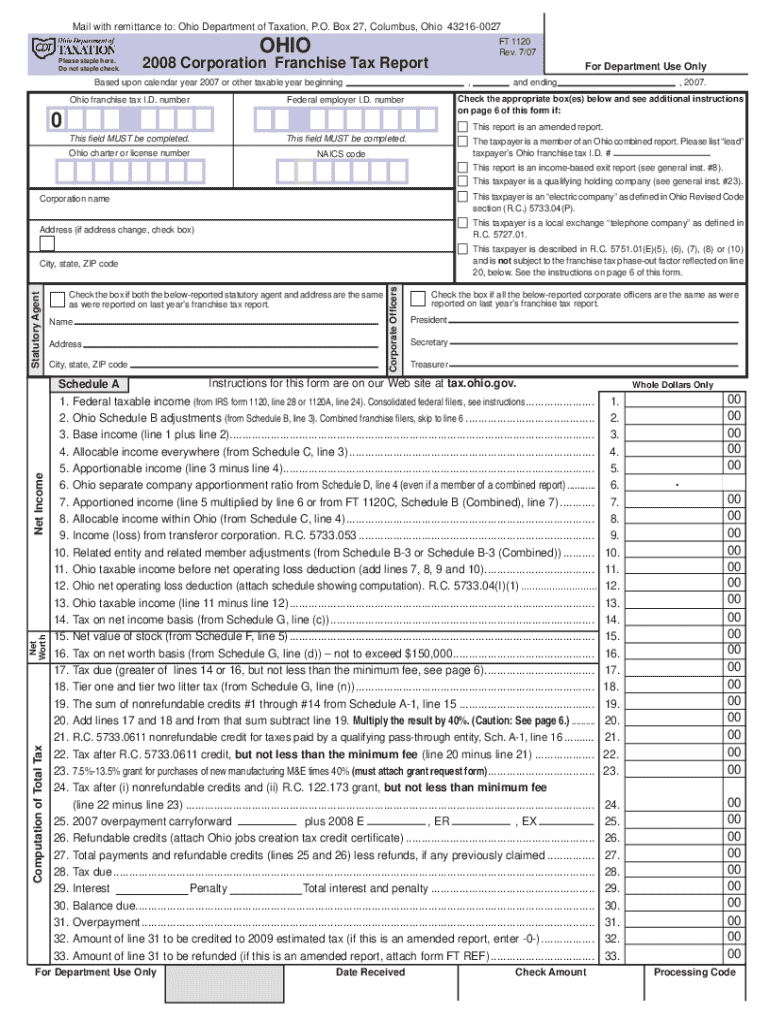

Understanding FT 1120 Form

The FT 1120 Form, often referred to simply as the '1120 Form,' is a critical tax document that corporations must file with the IRS to report their financial performance. It serves as the formal declaration of a corporation's income, deductions, and tax liability for the fiscal year. Properly filing the FT 1120 Form is essential, as it ensures that businesses comply with federal tax regulations.

Filing the FT 1120 is not just a bureaucratic formality; it is a legal obligation for corporations operating in the United States. This process enables the IRS to assess the company's profitability and ensure that appropriate taxes are collected. Failure to file can result in penalties, interest on unpaid taxes, and even audits.

Common misconceptions about the FT 1120 include the belief that only large corporations need to file it. In reality, any corporation, regardless of size, with income must complete this form. Additionally, some business owners may think they can delay filing without consequences; however, timely filing is crucial to avoid unnecessary penalties.

Key components of the FT 1120 Form

The FT 1120 Form consists of several distinct sections that gather information about a corporation’s financial activities. Each section must be accurately completed to ensure compliance and avoid any potential discrepancies.

Understanding the terminology used in the FT 1120 Form is key to accurate reporting. Terms like 'adjusted gross income,' 'net operating loss,' and 'tax credits' are essential for effective navigation of this form. Familiarity with these terms can reduce confusion and streamline the filing process.

Detailed instructions for completing the FT 1120 Form

Completing the FT 1120 Form may seem daunting, but breaking it down into manageable steps can simplify the process. Here’s a detailed step-by-step guide for accurately filling out the FT 1120 Form.

Tips for avoiding common mistakes include double-checking entries, staying organized throughout the filing process, and consulting a tax professional if needed. Errors, no matter how small, can lead to significant consequences, so diligence is key.

Interactive tools for FT 1120 Form management

Utilizing interactive tools like pdfFiller can enhance the efficiency of managing the FT 1120 Form considerably. pdfFiller allows users to edit and fill out the form digitally, making the process quicker and more streamlined.

Leveraging these tools ensures a smooth experience with the FT 1120 Form, allowing users to focus more on their business operations while streamlining their tax filing processes.

Frequently asked questions about FT 1120 Form

Many questions arise around the FT 1120 Form, particularly concerning how to handle mistakes or late filings. Understanding the options available can alleviate much of the stress associated with tax season.

Staying informed about these FAQ can save valuable time and resources, empowering businesses to handle their tax obligations with confidence.

Best practices for filing your FT 1120 Form

Implementing organizational strategies when preparing the FT 1120 Form is crucial for a smooth filing experience. To ensure you are filing effectively, consider the following best practices.

By adopting these best practices, businesses can ensure a more efficient tax filing experience while minimizing the risk of errors and penalties.

Alternative forms and when to use them

While the FT 1120 Form is comprehensive for C corporations, it is important to recognize that not all business structures utilize this form. Understanding the available alternatives empowers business owners to file accurately.

Choosing the correct business tax form is essential for compliance and can significantly impact how profits are taxed. Consulting with a tax professional can provide clarity on which form is appropriate for your business structure.

Leveraging pdfFiller for ongoing document management

Beyond the immediate filing of the FT 1120 Form, pdfFiller provides extensive tools that help businesses manage documents efficiently. This platform ensures that users can access their important documents anytime, anywhere.

The ongoing advantages of employing pdfFiller as your document management solution highlight the importance of having a centralized platform to handle business documentation effectively.

Keeping your FT 1120 Form and related documents secure

With the increasing reliance on digital formats, ensuring the security of your FT 1120 Form and other related documents is paramount. Implementing best practices for data protection can prevent unauthorized access and data breaches.

Prioritizing security not only protects your company data but also builds trust with clients and stakeholders, reinforcing your business's commitment to best practices in data management.

Testimonials and success stories

Real user experiences provide insight into the effectiveness of pdfFiller in managing the FT 1120 Form. Many businesses have transformed their filing processes, benefiting immensely from the platform’s features.

These testimonials illustrate not only the functionality of pdfFiller but also its impact on empowering corporations to file their FT 1120 Form confidently and accurately.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an eSignature for the ft 1120 in Gmail?

How can I fill out ft 1120 on an iOS device?

How do I fill out ft 1120 on an Android device?

What is ft 1120?

Who is required to file ft 1120?

How to fill out ft 1120?

What is the purpose of ft 1120?

What information must be reported on ft 1120?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.