Get the free Kyc - Self Declaration

Get, Create, Make and Sign kyc - self declaration

Editing kyc - self declaration online

Uncompromising security for your PDF editing and eSignature needs

How to fill out kyc - self declaration

How to fill out kyc - self declaration

Who needs kyc - self declaration?

Understanding the KYC - Self Declaration Form: A Comprehensive Guide

Understanding KYC - Self Declaration Form

Know Your Customer (KYC) refers to the process of a business verifying the identity of its clients. The KYC process involves several steps, including the collection of specific information through a Self Declaration Form. This form captures critical client information that helps verify their identity and assess any potential risks.

The significance of a KYC Self Declaration Form lies in its multifaceted role in today's compliance landscape. It assists organizations in maintaining regulatory compliance by ensuring they have sufficient information about their clients' identities. Additionally, it plays a crucial role in risk management, allowing organizations to detect and prevent fraudulent activities by validating customers' backgrounds.

KYC requirements are prevalent across various sectors, including banking, insurance, and investment firms. The banking sector, for instance, utilizes these forms to confirm the identities of clients wishing to open accounts, while insurance companies apply KYC to verify policyholders' identities and risks. Investment firms also rely on KYC processes to ensure they are acting in accordance with regulatory standards when accepting clients.

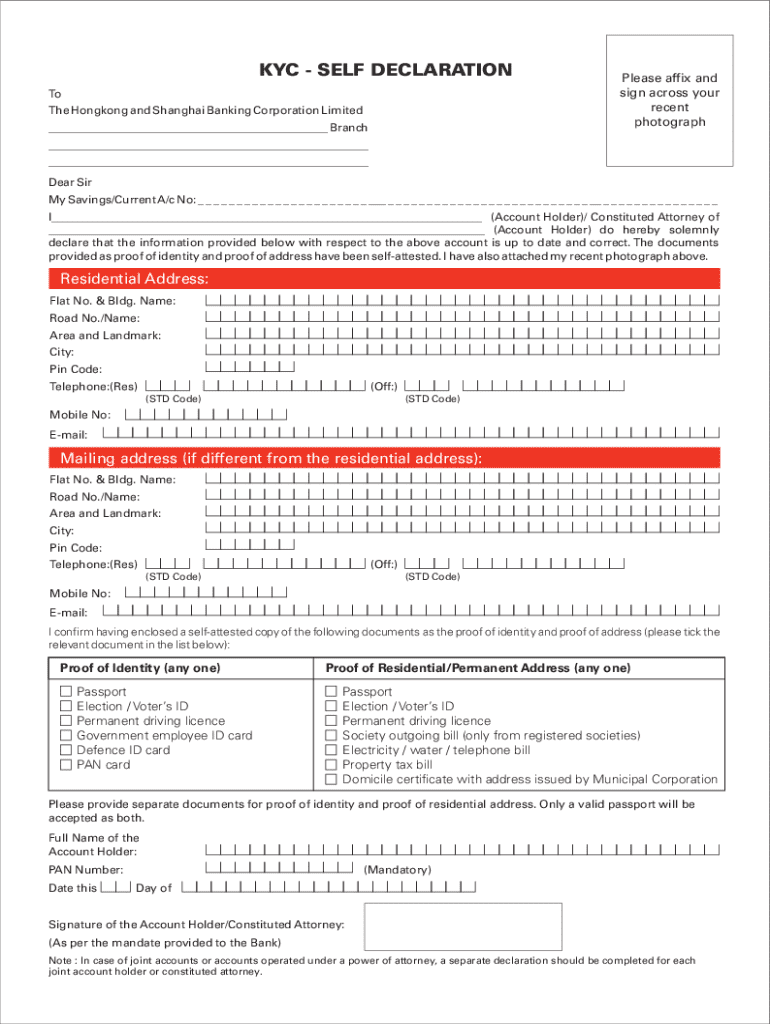

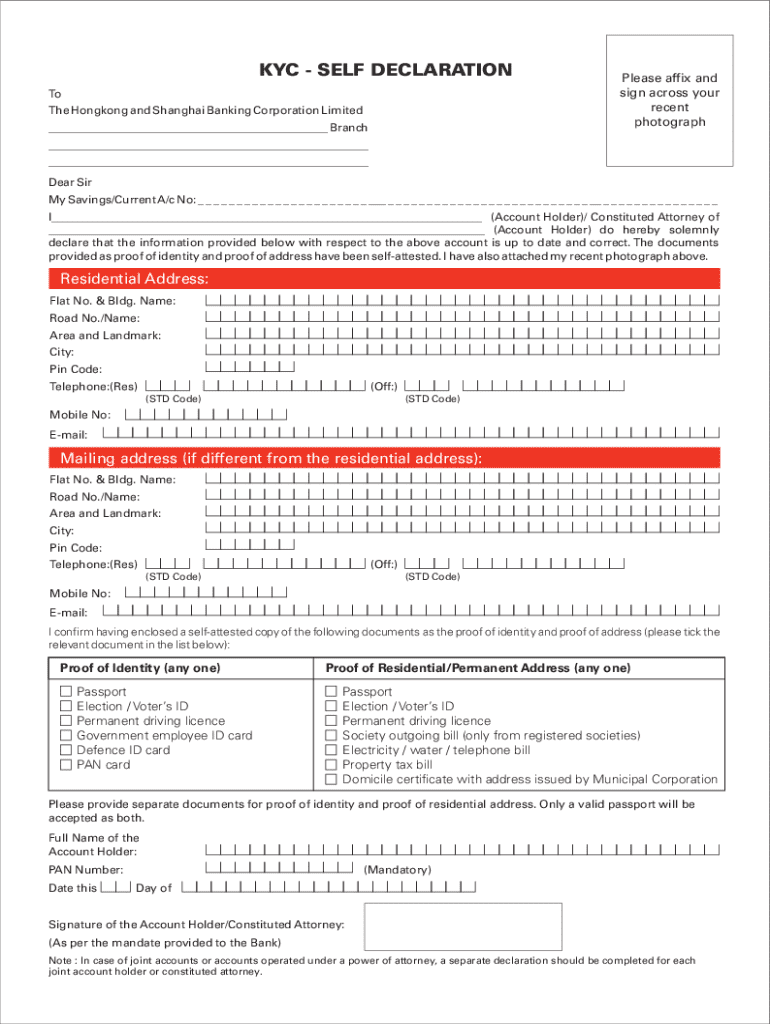

Key components of the KYC - Self Declaration Form

The KYC Self Declaration Form typically encompasses several critical components. The first section covers personal information. This includes essential data points such as the individual's name, address, and date of birth, which must align with identification documents like a passport or driver's license.

The second section focuses on the financial background of the individual or business. This area allows organizations to gather insights into the individual's source of income or, in the case of businesses, their operational nature and relevant financial details. This information is crucial for conducting a comprehensive risk assessment.

A declaration statement is also prominently featured in the form, where individuals confirm that the information they provided is true and complete. This section may include an acknowledgment of legal compliance, emphasizing the importance of accuracy in the submission.

Lastly, individuals must provide consent for how their data will be processed. This section typically includes statements about the organization’s data usage policies, ensuring clients are aware of how their personal information will be handled.

Steps to fill out the KYC - Self Declaration Form

Filling out the KYC Self Declaration Form requires attention to detail and preparation. Before you begin, it’s crucial to prepare necessary documents to support your application. This includes forms of identification and address verification documents. Have a valid ID such as your passport or national ID card and a utility bill that reflects your current residential address ready.

Start by completing the personal information section accurately. Ensure that all names, addresses, and dates of birth are entered correctly to match your identification documents. Inconsistencies in this section can lead to delays and might raise red flags during the verification process.

Next, provide detailed financial background information. Outline your source of income clearly, mentioning your current employment status or, if self-employed, describe the nature of your business. This will help mitigate any compliance risks by ensuring your financial activities align with your declared identity.

Before submitting, thoroughly review and verify all submitted information. Mistakes can lead to unsatisfactory verification or, worse, legal complications. It’s advised to create a checklist to ensure completeness and accuracy before moving forward with your submission.

Common mistakes to avoid when filling out the KYC form

While filling out the KYC Self Declaration Form, there are several common pitfalls to be aware of. One of the most frequent errors involves inaccuracies in personal information. Double-check that all names, addresses, and identification numbers are correct to avoid complications.

Another common mistake is providing incomplete information in the financial section. It is essential to be thorough when detailing the source of income or business activities. Leaving out vital information may jeopardize the verification process.

Additionally, omitting your signature or date can hinder processing. Always ensure that the form is signed and dated properly. A frequently overlooked aspect is failing to acknowledge data processing consent. Be sure you understand and agree to how your data will be utilized, as forms without this acknowledgment might be considered incomplete.

Tips for successfully managing your KYC - self declaration form

To facilitate an efficient KYC process, utilizing digital tools can significantly enhance your experience. Platforms like pdfFiller simplify document management by allowing users to create, edit, and store forms online. With such tools, you can keep your personal information organized and accessible.

Maintaining document security is paramount. It’s crucial to safeguard your personal information, especially when sharing it online. Always use secure platforms and understand their privacy policies thoroughly. Good security practices involve using strong passwords and enabling two-factor authentication whenever possible.

Staying up-to-date with regulatory changes is equally vital. KYC regulations can evolve, making it essential for individuals and organizations to remain informed about the latest compliance requirements. Regularly check for amendments in applicable laws or change in organizational policies to adapt accordingly.

Benefits of using pdfFiller for your KYC documentation

Utilizing a service like pdfFiller brings numerous advantages when managing your KYC documentation. One of the most compelling features is the streamlined document editing capability. Users can swiftly fill out forms using an intuitive interface, making the KYC process less daunting.

The pdfFiller platform also offers eSigning and collaboration features, allowing users to share documents effortlessly with others for review or approval. This capability is particularly beneficial for teams needing to collaborate on KYC forms and ensures that all involved parties can access and contribute to the documents.

Moreover, accessing forms from anywhere is a significant advantage of using a cloud-based solution like pdfFiller. With the flexibility of cloud access, individuals can work on their KYC Self Declaration Forms from different devices and locations, making it a convenient choice for busy professionals.

Use cases for KYC - self declaration form

The application of the KYC Self Declaration Form extends across a variety of scenarios. For individual users, one of the most common use cases is during the process of opening a new bank account. Banks require this form to verify a customer’s identity, helping them remain compliant with financial regulations.

Business owners also frequently encounter this form when registering a new company. Ensuring that the owners are properly identified helps mitigate risks and establish a trustworthy business environment. Furthermore, financial institutions must adhere to compliance standards, which often lead them to use KYC self-declaration forms extensively in their operations.

Interactive tools to enhance your KYC experience

To further streamline your experience with the KYC Self Declaration Form, interactive tools can be incredibly beneficial. A template customizer allows you to modify the form to meet your specific needs, ensuring you capture all relevant information precisely.

Additionally, step-by-step fillable forms with guiding prompts help enhance accuracy and reduce errors during completion. These tools focus on user-friendliness, making the KYC process easier for everyone involved, regardless of their familiarity with such forms.

Lastly, employing tips for effective document management within pdfFiller ensures you can track your KYC documentation. This includes maintaining versions of documents, setting reminders for renewals, and organizing your files efficiently to avoid any last-minute scrambles.

Frequently asked questions (FAQs)

KYC compliance stands for the measures used to verify consumer identities, ensuring financial institutions meet regulatory requirements. This verification process aims to prevent identity theft, fraud, and money laundering.

The significance of the self-declaration form cannot be understated. It serves as a primary tool for verifying the identity of customers in various sectors, creating a safer environment for both organizations and clients.

Once you submit your KYC form, you typically cannot edit it. However, if you discover a mistake post-submission, contact the institution promptly for guidance on correcting your information.

If you make a mistake on your KYC form, it's important to address it as soon as possible. Contact the relevant authority or institution to understand the procedure for rectifying any inaccuracies.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit kyc - self declaration from Google Drive?

Can I create an electronic signature for the kyc - self declaration in Chrome?

How do I complete kyc - self declaration on an iOS device?

What is kyc - self declaration?

Who is required to file kyc - self declaration?

How to fill out kyc - self declaration?

What is the purpose of kyc - self declaration?

What information must be reported on kyc - self declaration?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.