Get the free Crs Individual Self-certification Form

Get, Create, Make and Sign crs individual self-certification form

Editing crs individual self-certification form online

Uncompromising security for your PDF editing and eSignature needs

How to fill out crs individual self-certification form

How to fill out crs individual self-certification form

Who needs crs individual self-certification form?

A Complete Guide to the CRS Individual Self-Certification Form

Understanding the CRS individual self-certification form

The CRS individual self-certification form is a crucial document designed to assist financial institutions in identifying the tax residency status of individuals for the purpose of meeting their obligations under the Common Reporting Standard (CRS). This form allows individuals to declare their country of tax residence, ensuring compliance with international tax regulations.

Self-certification is vital in the realm of global tax compliance because it aids in the accurate reporting of financial information to tax authorities. The CRS, initiated by the Organisation for Economic Co-operation and Development (OECD), facilitates the automatic exchange of financial account information across borders. The declaration made through this form contributes to enhanced transparency and deters tax evasion.

Understanding the Common Reporting Standard (CRS) is essential for individuals who hold financial accounts internationally. The CRS outlines the reporting requirements for financial institutions and encourages individuals to take a proactive stance in disclosing their tax information. This underscores the necessity for the CRS individual self-certification form in today’s interconnected financial landscape.

Who needs to complete the CRS individual self-certification form?

Typically, individuals who open a financial account at a participating financial institution are required to complete the CRS individual self-certification form. Specifically, this applies to account holders who are considered tax residents in one or more jurisdictions outside of the country in which their account is held. Essentially, if you have income or assets reporting obligations in more than one country, this form might be necessary.

However, there are certain exemptions. For instance, individuals who are not considered tax residents or whose accounts are held solely for personal, non-commercial purposes might not need to submit the form. These exemptions underline the importance of understanding your specific tax residency status.

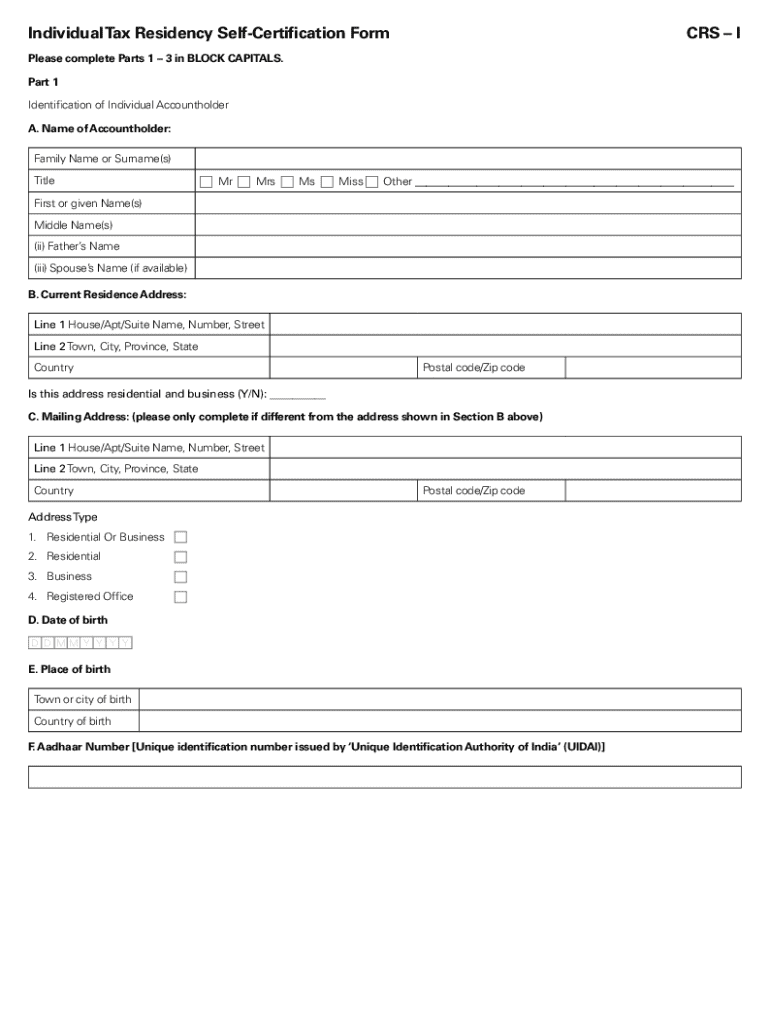

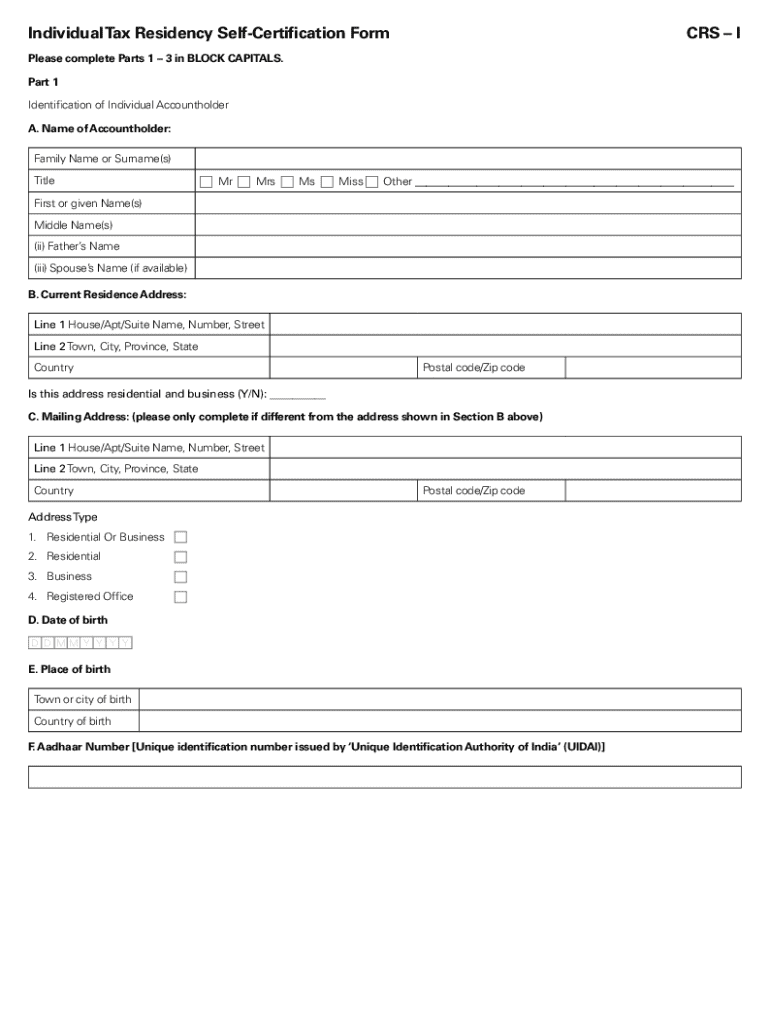

Key components of the CRS individual self-certification form

To properly understand how to fill out the CRS individual self-certification form, recognizing its main components is essential. The form is generally structured into three key sections: personal identification information, tax residency information, and certification details. Each section serves a distinct purpose in ensuring accurate and complete disclosure of tax information.

In the personal identification information section, you’ll typically provide details like your full name, date of birth, and address. Following this, the tax residency information section requires you to list all countries where you are a tax resident, along with your taxpayer identification number for each of those jurisdictions. Finally, the certification details section contains a declaration statement that asserts the authenticity of the information provided. This statement is critical as it confirms your awareness of the obligations under the CRS.

Step-by-step guide to filling out the CRS individual self-certification form

Filling out the CRS individual self-certification form may seem daunting, but a systematic approach can simplify the process. Follow these steps to maneuver through the form efficiently and accurately.

Common mistakes to avoid when completing the CRS form

It’s vital to be meticulous when completing the CRS individual self-certification form. Even small mistakes can lead to significant issues with tax compliance. Numerous individuals often encounter common pitfalls that can easily be avoided.

Managing and submitting your completed CRS individual self-certification form

After meticulously completing the CRS individual self-certification form, the next step involves managing and submitting the form correctly. Understanding your options for submission is crucial to ensure compliance.

Typically, the form can be submitted directly to your financial institution or through designated online platforms. Retaining copies of your submitted forms is an important practice; this supports any potential future inquiries or audits by tax authorities. Digital solutions such as pdfFiller enable secure document management, allowing you to easily store and retrieve forms whenever needed.

Furthermore, incorporating eSignature functionalities not only enhances the security of your submission but also adds a layer of convenience, allowing for quick validation without the need for physical signatures.

Resources for further assistance with CRS compliance

As the landscape of international tax laws continues to evolve, having access to resources for clarification and guidance is indispensable. For many individuals, numerous questions remain about the CRS individual self-certification form, its requirements, and potential implications of non-compliance.

How pdfFiller enhances your experience with the CRS form

pdfFiller stands out as a versatile platform that simplifies the entire process of creating, filling, and managing documents like the CRS individual self-certification form. Its user-friendly interface allows individuals and teams to navigate through the complexities of financial forms effortlessly.

With real-time collaboration features, teams can work together to complete forms efficiently, eliminating the challenges often associated with remote document editing. Security is paramount; therefore, pdfFiller provides secure cloud-based access to documents, ensuring they remain protected yet easily retrievable.

Testimonials and success stories from users of the CRS individual self-certification form on pdfFiller

Real user experiences provide insight into how pdfFiller effectively streamlines tax compliance processes. Numerous individuals have shared success stories detailing how they navigated through the complexities of the CRS individual self-certification form with the help of pdfFiller.

Continuous updates and changes related to CRS individual self-certification

Staying informed about developments pertaining to the CRS individual self-certification form is essential for all individuals involved in international finance. Tax laws are dynamic, and changes can significantly impact your obligations. Keeping abreast of legislative changes helps in adjusting your tax strategies and ensuring continuous compliance.

Make it a routine to regularly review the CRS individual self-certification form, especially after any significant tax rule changes. This diligence will help in maintaining compliance and avoiding the headache of penalties further down the line.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send crs individual self-certification form for eSignature?

How do I execute crs individual self-certification form online?

How do I edit crs individual self-certification form on an Android device?

What is crs individual self-certification form?

Who is required to file crs individual self-certification form?

How to fill out crs individual self-certification form?

What is the purpose of crs individual self-certification form?

What information must be reported on crs individual self-certification form?

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.